Originally posted by Goat Milk

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39847

#10221Seems impossible. Mid-2016 to mid-2021 you could throw darts and double your money.Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39847

#10222Just keep buying Nvidia. 4:1 split tomorrow so it's going to be 75% cheaper.Originally posted by Goat MilkDo you have any stocks you think can 50% or more over the next year? I'd like to just put 20k in one thing and just sit on it, I'm sick of "diversifying" as it has gotten me no where to this point. Comment

Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15310

#10223the only way this is possible is if you are on penny stocks and/or speculative plays.Originally posted by Goat MilkAppreciate the advice, but 1% at the amounts I'm putting in will be worthless. Even if I put 10,000 bucks, which is a lot for me, what do I stand to gain on a 1% flip? 100 bucks? Definitely not worth the risk and the stress.

I like long term investments like roy said, but the reality is I have held every single one of my stocks for 5 years, and I am at even or slightly below. I've had no return on investment in 5 years. That's sad.

3 large ETF's for each index fund, with nothing more than an initial investment 5Y ago and no buying/selling in that time:

QQQ alone has more than tripled the L5Y

SPY almost twice as high in the L5Y ($217 to $425)

DIA 1.8x what it was 5Y ago ($185 to $340)Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#10224To see the effects of inflation on stocks consider this.

At the start of 1966 the market hit an all time record high of 8200.

15 years later the market stood just under 2500.

Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15310

#10225ROYer that was The Great Inflation and it does not appear we have even 5% of the total catalysts that caused that devastation, does it........Comment -

MinnesotaFatsSBR Posting Legend

- 12-18-10

- 14781

#10226Well those 70s Fed policies were Keynesian much like today's.Originally posted by homie1975ROYer that was The Great Inflation and it does not appear we have even 5% of the total catalysts that caused that devastation, does it........

Friedman followers can see the future here, it's a matter of history repeating itself is it not?Comment -

EnkhbatSBR MVP

- 04-18-11

- 3175

#10227What happened in the 70s Minny?Comment -

MinnesotaFatsSBR Posting Legend

- 12-18-10

- 14781

#10228Printed money. Fund the war, expansion of SS benefits, great society. Literally increased the money supply by 11% in fiscal 1972.Originally posted by EnkhbatWhat happened in the 70s Minny?

By comparison, between July 2019 and July 2021 we have increased our money supply by 19%.

So it's not a matter of if, it's a matter of when. The inflation is not transitory it's here to stay until the Fed reigns it in, by about 25%....which will basically reset the entire economic situation from top down.Comment -

Sanity CheckSBR Posting Legend

- 03-30-13

- 10973

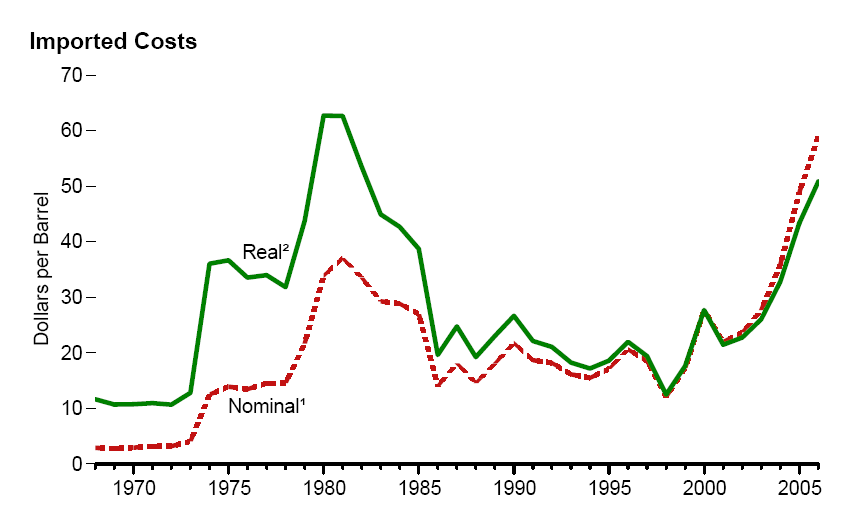

#10229Don't forget:Originally posted by EnkhbatWhat happened in the 70s Minny?

1970s energy crisis

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages, real and perceived, as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.[2]

The crisis began to unfold as petroleum production in the United States and some other parts of the world peaked in the late 1960s and early 1970s.[3] World oil production per capita began a long-term decline after 1979.[4]

The major industrial centers of the world were forced to contend with escalating issues related to petroleum supply. Western countries relied on the resources of countries in the Middle East and other parts of the world.

The crisis led to stagnant economic growth in many countries as oil prices surged.[5] Although there were genuine concerns with supply, part of the run-up in prices resulted from the perception of a crisis. The combination of stagnant growth and price inflation during this era led to the coinage of the term stagflation.[6]

Version 2.0 of this crisis could repeat (to some degree) via killing keystone pipeline et al.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#10230It doesn't matter what started the inflation; WWI, WWII, Korea, Oil embargo, Vietnam, political decisions, banking crisis or maybe a global pandemic???Originally posted by RoyBaconTo see the effects of inflation on stocks consider this.

At the start of 1966 the market hit an all time record high of 8200.

15 years later the market stood just under 2500.

The net effect is always the same.

I'm going to pick up some Pfizer stock today. With a nice little 3.5% dividend it could be a nice hedge.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#10231Just bought some SPY PUTS ($2.76), for expiration on Friday with a strike price of 429.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74866

#10232 Comment

Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#10233There could be a Big Short II developing but I think one needs to look at 6 months to 2 year plays. It may not be developing. Goldman Sachs may know but the rest of us mere mortals will have to wait for more pieces of the puzzle.Originally posted by Slurry PumperJust bought some SPY PUTS ($2.76), for expiration on Friday with a strike price of 429.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#10234Look at this run. You're up in no mans land now with no chart references of resistance or support. Kind of like the Nasdaq a week or so ago.Originally posted by KVB

In these situations, I keep my stops just below a SMA and let it run. It's pretty parabolic, but enjoy the rocket ride while its happening.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#10235I was actually thinking of buying more at the gap from yesterday at 431, this is obviously just a very short term position and a play on a turn around later in the week, probably tomorrow or Thursday. Its pretty high risk actually, but just a 20 contracts at each level so it boils down to about $10K gamble on the price not being above 429 by Friday.Originally posted by RoyBaconThere could be a Big Short II developing but I think one needs to look at 6 months to 2 year plays. It may not be developing. Goldman Sachs may know but the rest of us mere mortals will have to wait for more pieces of the puzzle.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#10236Well they filed the gap from yesterday, but we all knew they were going to do that from the fake candle wick they put on yesterday's daily candle. Anyway, adding to my short put play on the SPY for another 20 contracts ($1.66).Originally posted by Slurry PumperI was actually thinking of buying more at the gap from yesterday at 431, this is obviously just a very short term position and a play on a turn around later in the week, probably tomorrow or Thursday. Its pretty high risk actually, but just a 20 contracts at each level so it boils down to about $10K gamble on the price not being above 429 by Friday.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#10237You got balls Slurry I'll give you that.Originally posted by Slurry PumperWell they filed the gap from yesterday, but we all knew they were going to do that from the fake candle wick they put on yesterday's daily candle. Anyway, adding to my short put play on the SPY for another 20 contracts ($1.66).

I've been shorting GME and AMC calls since late Jan. Got nipped a couple of times but it's been the best trades of my career. But option premiums are coming back down to earth.

I sold this one today;

Sell to Open

30 Contracts AMC Jul 30 2021 125 Calls Limit at $0.16 (Day) Filled at $0.16

Imagine paying .16 for a $125 strike when your stock is at $40 and there are only 8 trading days left on it? Fugging insanity.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#10238I'm only $3 away from being in the money, who bought calls that are 80 bucks away on a 40 dollar stock. That is some serious movement in price there.Originally posted by RoyBaconYou got balls Slurry I'll give you that.

I've been shorting GME and AMC calls since late Jan. Got nipped a couple of times but it's been the best trades of my career. But option premiums are coming back down to earth.

I sold this one today;

Sell to Open

30 Contracts AMC Jul 30 2021 125 Calls Limit at $0.16 (Day) Filled at $0.16

Imagine paying .16 for a $125 strike when your stock is at $40 and there are only 8 trading days left on it? Fugging insanity.Comment -

Sanity CheckSBR Posting Legend

- 03-30-13

- 10973

#10239Anyone trade crypto.

Its a different format. You can trade it 24/7.

And there are strategies that are possible in crypto, that are only available to banks and hedge funds in equities/stocks trading.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#10241Literally only way you are not up on any investment over 5 years right now is you are in an energy company losing market share to solar or you have a predilection for speculative, non growing, unprofitable companies....I’m going to venture to say it’s the laterOriginally posted by Goat MilkAppreciate the advice, but 1% at the amounts I'm putting in will be worthless. Even if I put 10,000 bucks, which is a lot for me, what do I stand to gain on a 1% flip? 100 bucks? Definitely not worth the risk and the stress.

I like long term investments like roy said, but the reality is I have held every single one of my stocks for 5 years, and I am at even or slightly below. I've had no return on investment in 5 years. That's sad.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#10242Been buying COIN on the way down. Picked up some today.Originally posted by Sanity CheckAnyone trade crypto.

Its a different format. You can trade it 24/7.

And there are strategies that are possible in crypto, that are only available to banks and hedge funds in equities/stocks trading.

It’s arguably the best way to play crypt. They have a license to print money.Comment -

Sanity CheckSBR Posting Legend

- 03-30-13

- 10973

#10243Originally posted by RoyBaconBeen buying COIN on the way down. Picked up some today.

It’s arguably the best way to play crypt. They have a license to print money.

Back in the MTGOX days.

It was common for bitcoin to trade 20% or higher on different exchanges.

Cross platform arbitrage plays were common.

They might have closed paths which allowed for ARB. Or some could still be open.

Have not bothered to check. That was good stuff when it was available.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#10244Made a small fortune arbing BTC but I went through 15 banks at least. Biffinex and Bitstamp and of course when GDAX came along were my personal gold mines.Originally posted by Sanity CheckBack in the MTGOX days.

It was common for bitcoin to trade 20% or higher on different exchanges.

Cross platform arbitrage plays were common.

They might have closed paths which allowed for ARB. Or some could still be open.

Have not bothered to check. That was good stuff when it was available.

But sending large wires to Serbia and getting large wires from Hong Kong was hard to stomach for US banks. Plus I got audited by the IRS...took a little fun out of it.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#10245I agree, also get a great growing business along with it, eventually stocks and credit lines will be offered. Also they are in a great position for a future in which people are exchanging equities or crypto as payments vs fiat currency.Originally posted by RoyBaconBeen buying COIN on the way down. Picked up some today.

It’s arguably the best way to play crypt. They have a license to print money.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#10246But COIN is tied a bit unfairly to the price of BTC, both up and down.

Keep an eye on their quarterly's. They make money no matter what the price does as long as volume is there. The street seems to not quite understand their position. They don't make money holding crypto, they make money brokering it and through margin interest.Comment -

EnkhbatSBR MVP

- 04-18-11

- 3175

#10247I would start trading if they create an ETF, or if you can sell options on cryptos.Originally posted by Sanity CheckAnyone trade crypto.

Its a different format. You can trade it 24/7.

And there are strategies that are possible in crypto, that are only available to banks and hedge funds in equities/stocks trading.Comment -

Sanity CheckSBR Posting Legend

- 03-30-13

- 10973

#10248Crypto & Blockchain Exchange-Traded Funds (ETFs) Launching in EuropeOriginally posted by EnkhbatI would start trading if they create an ETF, or if you can sell options on cryptos.

MARCH 12, 2019

There are no signs a crypto exchange-traded fund (ETF) will drop in America any time soon. But if the U.S.A. ever embraces crypto ETFs, they’ll undoubtedly have to play catch up with Europe, where willingness to embrace these products is building up steam more quickly.

Such embraces have come into focus once more on the news that Swiss company Amun AG and U.S. investment firm Invesco are bringing new crypto and blockchain-centric exchange-traded products to market at Switzerland’s SIX stock exchange and the London Stock Exchange, respectively.

If the U.S.A. ever embraces crypto ETFs, they'll undoubtedly have to play catch up with Europe who are launching Crypto ETFs soon.

If the U.S.A. ever embraces crypto ETFs, they'll undoubtedly have to play catch up with Europe who are launching Crypto ETFs soon.

There are crypto ETFs.

Just not for SEC life americans.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#10249OK cost averaging down here with another Purchase of Puts for 429 strike at .65 for 20 more contracts. Might be sweating this one tomorrow if things continue to go against me.Originally posted by Slurry PumperWell they filed the gap from yesterday, but we all knew they were going to do that from the fake candle wick they put on yesterday's daily candle. Anyway, adding to my short put play on the SPY for another 20 contracts ($1.66).Comment -

dlowillySBR Posting Legend

- 11-09-16

- 13870

#10250Yesterday and especially today pretty bafflingComment -

rm18SBR Posting Legend

- 09-20-05

- 22292

#10251Allegiant site has been crashing for a week and still up 10%Originally posted by dlowillyYesterday and especially today pretty bafflingComment -

Poker_BeastSBR Hall of Famer

- 09-14-06

- 6547

#10252Yeah crazy 3 days. Day traders creating wealth.Comment -

Sanity CheckSBR Posting Legend

- 03-30-13

- 10973

#10253All QE.Originally posted by dlowillyYesterday and especially today pretty baffling

As the past 10 years were.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15310

#10254the last two days should not surprise anyone here.Originally posted by homie1975it will be nothing like 2000 dot.com burst or 2020 covid annihilation. nothing close to it. those were the two generational opportunities the last 20Y. i am not counting the 08 correction and eventual crash into march 09 because the market did not fall off a cliff like it did in 2000 and 2020.

right now we have record low credit card debt per capita and record high savings per capita means anything ~5% on a broad index correction snaps back in no time.

FANG stocks down ~10% will snap back right away. growth plays get to ~13% down they will do the same.

there is still WAY TOO much money out there on the sidelines always waiting these days so a full on crash simply is not happening. full 10% correction doubtful as well.

look what I posted back on July 18, three short days ago.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#10255Jobless claims unexpectedly rose to 419,000 last week, higher than the 350,000 Dow Jones estimate and more than the upwardly revised 368,000 from the previous period, the Labor Department reported Thursday.

~~~~~~~~~~~~~~~~

To be honest this doesn't bother me. With inflation going wild this is a reminder that the real economy is still slow. Futures immediately sold off but no big deal.Comment

Search

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code