Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1961Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#1962ROYer I think that's a bad number. About 350 worldwide in service and about 35 of those w southwest airlines and another 25 or so w American airlines. No other us carrier that I know of flying the max 8 but there are some max 9s out there that were also groundedComment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1963OK. I'm not following it closely. Great company and no doubt this will blow over. I just came to the opinion there was too much short term downside in the mix.

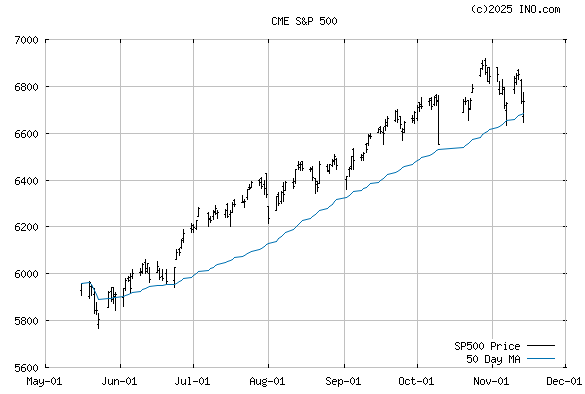

It's interesting that this latest power surge up has not been correlated with China as has been the case in Jan and Feb.

My opinion is the selloff LY simply did not correctly price in the tax cuts or China deal potential. And over priced in a natural global slowdown.

Speaking of correlation. If you are investing in stocks you should really watch the crude market. The crude market forsaw both the big dip LY and big gain this year.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#1964Great info ROYerComment -

freeVICKSBR Hall of Famer

freeVICKSBR Hall of Famer- 01-21-08

- 7114

#1965Just downloaded Robinhood so I can play around with short term trading. What’s good fellasComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#1966if the FED says anything construed as bad news for the near future, then the market is going to tank because it is already jittery about Trump's statement regarding China tariffsComment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

-

freeVICKSBR Hall of Famer

freeVICKSBR Hall of Famer- 01-21-08

- 7114

#1968Like it a lot. I highly recommend it. Free trades can’t beat it. They even give you a free stock like groupon for signing up. And they also have a referral program that can get you more free stocks. PM me for my link Comment

Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1969OK I will when and IF.

I couldn't find a phone number on their website and that kindof bothers me.

Do you know what their deal is with options? Is there a commission if I sell 300 options at .01?Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#1970Josher where are you?

yield curve looks invertedComment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#1971Schwab lets us close out options for free if it's less than a nickel.

Currently short a ton of LNG 4/12/19 70.50 calls, just sold them on the 20th. Today's drop was helpful, don't really want to get called away.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#1972Here are the top 20 Decliners so far today with last trade over 5 and avg 5 day trading volume over 250k

Not sure we can glean much from this list today.

Symbol Last Trade Change % Change Description BKNG 1,715.05 -59.32 -3.34 BOOKING HOLDINGS INC AMZN 1,778.91 -40.35 -2.22 AMAZON.COM INC GOOGL 1,210.00 -26.13 -2.11 ALPHABET INC GOOG 1,206.46 -25.08 -2.04 ALPHABET INC AZO 982.34 -18.76 -1.87 AUTOZONE INC SIVB 210.61 -17.70 -7.75 SVB FINANCIAL GROUP CTAS 194.77 -13.36 -6.42 CINTAS CORP NFLX 364.53 -13.34 -3.53 NETFLIX INC ISRG 564.80 -13.18 -2.28 INTUITIVE SURGICAL INC DXCM 129.04 -13.12 -9.23 DEXCOM INC ANET 302.52 -12.50 -3.97 ARISTA NETWORKS INC ABMD 325.72 -11.71 -3.47 ABIOMED INC SOXL 140.84 -11.60 -7.61 DIREXION DAILY SEMI BULL W 159.90 -11.47 -6.69 WAYFAIR INC BLK 419.17 -11.19 -2.60 BLACKROCK INC SHW 422.96 -10.68 -2.46 SHERWIN-WILLIAMS CO TTD 203.10 -10.47 -4.90 TRADE DESK INC ALGN 271.09 -9.64 -3.43 ALIGN TECHNOLOGY INC GWW 295.94 -9.04 -2.96 GRAINGER (W W) INC COUP 90.34 -8.95 -9.01 COUPA SOFTWARE INC Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1973Etrade is $0 on close outs less than .10.

But I like to at times sell 300 at .02 to open which nets $600 but the etrade commission on that trade is like $127.Comment -

freeVICKSBR Hall of Famer

freeVICKSBR Hall of Famer- 01-21-08

- 7114

#1974Ouch horrible day. Any buy low recommendations?Comment -

BigJaySBR MVP

- 01-14-12

- 3485

#1975Pork Bellie prices have been dropping all morning. Everybody’s sitting in their office waiting for them to hit rock bottom so they can buy cheap and go long. The people who own the Pork Bellie contracts are going batshit. They think they’re losing all their money and they won’t be able to buy their son the GI Joe with the Kung Fu grip.

They thinking my wife ain’t going to want to make love to me because I don’t have any money. They’re panicking. They’re screaming sell, sell because they don’t want to lose all their money. I can feel it. They’re out there. They’re panicking.

I’d wait until you get to about 64 then I’d buy. You’ll have cleared out all the suckers by then.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1977Let's let it play out. Too many cross currents to draw any conclusions. We had the same thing happen what a year ago or was it two?

The global downdraft of trade, Brexit, rates needs to settle and we need some more economic data. I personally think the US economy is stronger than the bond market is leading us to believe.

There is fear of weakness gaining momentum. By the 4th of July we will be worrying about overheating. I'm using this bond strength to sell longer maturities. They will be cheaper later in the year.Comment -

guitarjoshSBR Hall of Famer

- 12-25-07

- 5797

#1978The 10 year hasn't been inverted with anything since 2007.Let's let it play out. Too many cross currents to draw any conclusions. We had the same thing happen what a year ago or was it two?

The global downdraft of trade, Brexit, rates needs to settle and we need some more economic data. I personally think the US economy is stronger than the bond market is leading us to believe.

There is fear of weakness gaining momentum. By the 4th of July we will be worrying about overheating. I'm using this bond strength to sell longer maturities. They will be cheaper later in the year.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1979It came close with the 30 or maybe it was the 5 and 2? Germany went negative today and that was suppose to signal a bear market except it started a rally up to new highs.

If folks want to cue the inversion and go short in here, I have no problem with that. Probably do fine for a month or two. I'm profit taking on long maturities. They have run too far too fast and they will be cheaper in a few months imho.Comment -

guitarjoshSBR Hall of Famer

- 12-25-07

- 5797

#1980Close isn't an inversion. The fed shouldn't have hiked in December and needs a cut or we're going to have a recession in the next couple years.It came close with the 30 or maybe it was the 5 and 2? Germany went negative today and that was suppose to signal a bear market except it started a rally up to new highs.

If folks want to cue the inversion and go short in here, I have no problem with that. Probably do fine for a month or two. I'm profit taking on long maturities. They have run too far too fast and they will be cheaper in a few months imho.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#1981The last 6 times the yield curve inverted and it lasted 10 days or longer,a recession followed within 2 years. Avg 311 days afterComment -

dustyySBR MVP

- 12-08-17

- 2459

#1982Bad move by the fed but looks like they are done for awhile. Slight chance they may have to move them downward before a hike.

I'm afraid the chance of the "R" word within the next 18 months with the inversion being the signal. May not be deep and long but let's get it over with.

Be interesting to see how this plays out in an election yearComment -

guitarjoshSBR Hall of Famer

- 12-25-07

- 5797

#1983After looking at charts today, I wouldn't be surprised to see the spreads steepen over the next few days, but I don't know how long until another inversion

If a recession starts in the last third of 2020, it won't affect the election at all. Little if any economic data from October 2020 will be out by election day, and it will take around 6 months to know a recession has started.Bad move by the fed but looks like they are done for awhile. Slight chance they may have to move them downward before a hike.

I'm afraid the chance of the "R" word within the next 18 months with the inversion being the signal. May not be deep and long but let's get it over with.

Be interesting to see how this plays out in an election yearComment -

kidcudi92SBR Posting Legend

- 12-14-11

- 15434

#1984TSLA

The SEC is about to drop the fukkin hammer, Musk's lawyers are idiotsComment -

guitarjoshSBR Hall of Famer

- 12-25-07

- 5797

#1985After looking at the charts even more tonight, I think we're quite a way from a recession. The treasury has been selling 30 year bonds since 1977, except during 2002-2006. Every recession during that period had the 1 year - 30 year spread invert at least 10 months before a recession, and the only inversion that was less than a year was the 1981 double dip recession caused by record high interest rates and high oil prices. All of the other inversions were at least a year, and some closer to two years before the recession started.

I still think we need the Fed to do something like lower rates .25% - .50% or have a reverse Operation Twist where the Fed buys short term treasuries and sells long term treasuries to steepen the curve. The longer term treasuries aren't inverted with anything right now so I hope the people at the Eccles Building and Wall Street don't start pushing bad mortgages again since longer dated loans are still profitable for the banks.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1986That's actually really nice thinking. Love it.After looking at the charts even more tonight, I think we're quite a way from a recession. The treasury has been selling 30 year bonds since 1977, except during 2002-2006. Every recession during that period had the 1 year - 30 year spread invert at least 10 months before a recession, and the only inversion that was less than a year was the 1981 double dip recession caused by record high interest rates and high oil prices. All of the other inversions were at least a year, and some closer to two years before the recession started.

I still think we need the Fed to do something like lower rates .25% - .50% or have a reverse Operation Twist where the Fed buys short term treasuries and sells long term treasuries to steepen the curve. The longer term treasuries aren't inverted with anything right now so I hope the people at the Eccles Building and Wall Street don't start pushing bad mortgages again since longer dated loans are still profitable for the banks.

Have to be careful not to diagnose a hiccup as a heart attack...and vicea versa.

I think finally the Fed's neutral position is perfect. The QE bleeding off is almost done. If the fed lowers and starts some type of QE manipulation of the curve that's just more painful unwinding down a too short of road.

No need to panic. Let the markets trade freely and figure things out. The underlying economic numbers are there. There is massive growth churning under the headlines.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#1987ROYer I'm a bull like u. We cannot ignore that the global economy is slowing and we'll be affected in the USA. we don't live and operate in a vacuum. U know this much better than I do. At some point in the next 18 mos the fear index will reach a high and it will sit there for a while. Guys like u and me will load up on stocks on sale. But if you're not an options player (i.am not), you'll have to hold those positions for years potentially to turn a profit. Prosperity will favor the patient onesThat's actually really nice thinking. Love it.

Have to be careful not to diagnose a hiccup as a heart attack...and vicea versa.

I think finally the Fed's neutral position is perfect. The QE bleeding off is almost done. If the fed lowers and starts some type of QE manipulation of the curve that's just more painful unwinding down a too short of road.

No need to panic. Let the markets trade freely and figure things out. The underlying economic numbers are there. There is massive growth churning under the headlines.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1988I love Josh and I want to be there if there is a recession. Downward markets can be the easiest to profit from. Not the flash crashes, I mean the death by a thousand pin prick types.ROYer I'm a bull like u. We cannot ignore that the global economy is slowing and we'll be affected in the USA. we don't live and operate in a vacuum. U know this much better than I do. At some point in the next 18 mos the fear index will reach a high and it will sit there for a while. Guys like u and me will load up on stocks on sale. But if you're not an options player (i.am not), you'll have to hold those positions for years potentially to turn a profit. Prosperity will favor the patient ones

The global issue is beset by basically two complicated but not catastrophic situations. Trade and Brexit. The US, on the other hand, is far more vulnerable to overheating. We had a soft manufacturing report and a soft labor report from a terrible weather month. Sandwiched in there we had an explosive homes report & new job listings report.

A guy will get killed trying to read tea leaves on such shallow evidence. The real play here is to short the 30 year. There is no way the yield stays at 2.87. I will say it's 3.5 by the start of football.Comment -

guitarjoshSBR Hall of Famer

- 12-25-07

- 5797

#1989The 1 month bond out to the 10 year bond being inverted isn't a hiccup, it's a major warning. When the T-bill yields are above the 30 year we have about 12-18 months. Back in late 1995 the curve from the 3 month to the 5 year was inverted, and the Fed reacted by cutting rates from 5.75% to 5.25%. The curve steepened over the next few months and we ended up having another 5 years of strong growth. Here's an article about how an inverted curve can cause liquidity to tighten up and cause a recession.That's actually really nice thinking. Love it.

Have to be careful not to diagnose a hiccup as a heart attack...and vicea versa.

I think finally the Fed's neutral position is perfect. The QE bleeding off is almost done. If the fed lowers and starts some type of QE manipulation of the curve that's just more painful unwinding down a too short of road.

No need to panic. Let the markets trade freely and figure things out. The underlying economic numbers are there. There is massive growth churning under the headlines.

Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#1990Only time will tell if it's a hiccup or a heart attack.The 1 month bond out to the 10 year bond being inverted isn't a hiccup, it's a major warning. When the T-bill yields are above the 30 year we have about 12-18 months. Back in late 1995 the curve from the 3 month to the 5 year was inverted, and the Fed reacted by cutting rates from 5.75% to 5.25%. The curve steepened over the next few months and we ended up having another 5 years of strong growth. Here's an article about how an inverted curve can cause liquidity to tighten up and cause a recession.

https://www.stlouisfed.org/on-the-ec...ause-recession

Are you going balls to the wall short and buying bonds? I sort of doubt it.

If you trade based on inversions that happen say 10 times in a century you are trading on incredibly limited data. Each would have to be studied independently and compared to current events before you can even think of a trading strategy.

We just came off of a gov shutdown, a blizzard, political turmoil and we have Brexit and China trade cluttering things up.

I'm not talking you out of your position. I am saying that you ignore a growing economy and short this market based on a rare technical event at your own peril. For myself, this is a great opportunity to sell everything with a maturity over 6 years at a nice profit. Rates may be in a vacuum down for now but in a few months they will be higher. The only real threat to this market is the pricing in of a far left wave and that ain't happening.Comment -

guitarjoshSBR Hall of Famer

- 12-25-07

- 5797

#1991The problem is that by the time we find out it can be too late.Only time will tell if it's a hiccup or a heart attack.

Are you going balls to the wall short and buying bonds? I sort of doubt it.

If you trade based on inversions that happen say 10 times in a century you are trading on incredibly limited data. Each would have to be studied independently and compared to current events before you can even think of a trading strategy.

We just came off of a gov shutdown, a blizzard, political turmoil and we have Brexit and China trade cluttering things up.

I'm not talking you out of your position. I am saying that you ignore a growing economy and short this market based on a rare technical event at your own peril. For myself, this is a great opportunity to sell everything with a maturity over 6 years at a nice profit. Rates may be in a vacuum down for now but in a few months they will be higher. The only real threat to this market is the pricing in of a far left wave and that ain't happening.

No, I'm not shorting anything, as I said until the t-bills yield more than the 30 year we have at least 1 year until a recession. The fact is that it has a perfect track record since inception of the 30 year.

I'm not ignoring the current economy, as I'm currently only holding long positions. The fact is that with an inversion of the 1Y/10Y has always led to a recession. Like the article I posted says, inversions make it not profitable for banks to loan money, so the economy sputters. Yes, I think they need to cut rates, even if it is just to raise them again if inflation picks up.

The only good news regarding the curve at this point is that the 30 year hasn't inverted with anything yet and the Fed has decided to stop hiking, whereas in previous cycles the Fed kept hiking well after an inversion.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#1992Josh and Roy making tremendous points here.Comment -

pavyracerSBR Aristocracy

- 04-12-07

- 82839

#1993This is the beginning of another 20% drop. Get ready for the bumpy ride. Smart money has aborted the market. Now the sharks are in to take the little guys out.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

Search

Collapse

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code