Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4026Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#4027I can see what you mean but I think the market is a little ahead of itself. It looks like today we will probably move into the next trading range between the 50 and 200 day moving average for the S&P. Took a little bath today with Tesla, but I've made so much cash with them over the last 4 years so I'm going to stick with it until they blast me out of the water with earnings a little later on in the week.Slurry

a month ago i would have agreed with you but now i am feeling a different tune which is i started building positions in Best of Breed companies over the past two to three weeks. i have sensed a major shift. the market is ignoring most of the bad news now.

CMG drops 35% in same store sales but the stock flies up DD % after earnings

so many other examples

i believe the COVID shock to the market is basically over now. trust me, i want to build my positions more but i have to go with what i see not what i want.

BTW i did not buy CMG. i refuse to chase stocks that are on ATH or have run too far. i might begin a position on a pullback but i am not chasing. no way jose

I still think things will come back down and test the lows from March. All of this ignoring of reality will eventually catch up and all at once the market will realize how bad it is and whamo one day we will see another downturn. They usually happen fast and I just can't believe that this irrational exuberance will continue much longer. As always I let the charts make my opinion so I can lose the opinion before I lose my money.Comment -

MinnesotaFatsSBR Posting Legend

- 12-18-10

- 14758

#4028I've never seen a market more removed from reality in my life.I can see what you mean but I think the market is a little ahead of itself. It looks like today we will probably move into the next trading range between the 50 and 200 day moving average for the S&P. Took a little bath today with Tesla, but I've made so much cash with them over the last 4 years so I'm going to stick with it until they blast me out of the water with earnings a little later on in the week.

I still think things will come back down and test the lows from March. All of this ignoring of reality will eventually catch up and all at once the market will realize how bad it is and whamo one day we will see another downturn. They usually happen fast and I just can't believe that this irrational exuberance will continue much longer. As always I let the charts make my opinion so I can lose the opinion before I lose my money.

Fukkin oil is going to zero, AGAIN, and there's still bulls out there. I have 0 idea what they're reading into.

Brink and motar retail is FINISHED

I'd say 30% of restaraunts and bars are FINISHED

unemployment will be 10% for the foreseeable future, probably 15-20% for next 6 months

Wages are flat, inflation must be coming, manufacturing is dead, consumer demand and confidence is all time low, debt all time high

Noone has any cash and all banks care about is a credit score that's worthless when you don't have a job.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#4029Yeah good times ahead for sure.I've never seen a market more removed from reality in my life.

Fukkin oil is going to zero, AGAIN, and there's still bulls out there. I have 0 idea what they're reading into.

Brink and motar retail is FINISHED

I'd say 30% of restaraunts and bars are FINISHED

unemployment will be 10% for the foreseeable future, probably 15-20% for next 6 months

Wages are flat, inflation must be coming, manufacturing is dead, consumer demand and confidence is all time low, debt all time high

Noone has any cash and all banks care about is a credit score that's worthless when you don't have a job.Comment -

SBR_Guest_ProSBR MVP

- 02-10-15

- 3955

#4030crazy day today. everything up except united and americanComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4031there was just a major shift in the wind about three weeks ago. it was palpable. i could not ignore it. so i started buying Best of Breed American companies. very happy i did. here's to the beginning of the next BULLComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4032SLURRY and MINNY FATS

we disagree but i have a lot of respect for your views and enjoy reading them so please keep posting.

if you end up being correct that we have a strong pullback, then i simply buy more and lower cost basis.

if not, then at least i am over 75% of my portfolio in the market and it is full steam ahead

win either way. prefer to have the strong pullback though as I want to invest more.

Cheers EveryoneComment -

SBR_Guest_ProSBR MVP

- 02-10-15

- 3955

#4033I bought last week. Today was good. up $50 today. Unfortunately Sold Disney Friday at $101 because i got nervous reading that they weren't opening the parks until next year. Would've been a lot better day if i kept themComment -

guitarjoshSBR Hall of Famer

- 12-25-07

- 5797

#4034The Federal Reserve and the Federal Government will just keep pumping money into the pockets of the American people, which is why stocks are going higher.I've never seen a market more removed from reality in my life.

Fukkin oil is going to zero, AGAIN, and there's still bulls out there. I have 0 idea what they're reading into.

Brink and motar retail is FINISHED

I'd say 30% of restaraunts and bars are FINISHED

unemployment will be 10% for the foreseeable future, probably 15-20% for next 6 months

Wages are flat, inflation must be coming, manufacturing is dead, consumer demand and confidence is all time low, debt all time high

Noone has any cash and all banks care about is a credit score that's worthless when you don't have a job.Comment -

MinnesotaFatsSBR Posting Legend

- 12-18-10

- 14758

#4035I understand that the 3 trillion will eventually flow into the pockets of big business. However, what is the value of trying to determine 20xs earnings for money that really has half the value it had last month? I mean, at some point there has to be inflation here....and oil indicates 0 consumer or manufacturing demand.

It's not making any sense other than McConnell suggesting States file bankruptcy ignited a flood of repositioning from bonds to equities....

IDK .... such a bizzare 60 days. I still see a 10 % pullback by June 1Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#403610% from here isn't anywhere near the March lows. We're now over 30% off the March lows. Truly incredible, and bizarre.I understand that the 3 trillion will eventually flow into the pockets of big business. However, what is the value of trying to determine 20xs earnings for money that really has half the value it had last month? I mean, at some point there has to be inflation here....and oil indicates 0 consumer or manufacturing demand.

It's not making any sense other than McConnell suggesting States file bankruptcy ignited a flood of repositioning from bonds to equities....

IDK .... such a bizzare 60 days. I still see a 10 % pullback by June 1Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4037none of this is really as crazy as some of you think

let's say we lose a whole year's worth of earnings (ain't happening, but let's say that for arguments sake).

what should be the haircut? if stocks trade at 20x earnings, and you take away a year's worth of earnings, you really only took away 5% of the earnings they were going to make over the next 20 years... and with interest rates at close to 0, you could have a p/e of 80 and that stock would still look better as an investment than buying a treasury bond or cd with a rate of 0.5%Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4038that is just not trueThat's because the main stream media pushed a Hillary victory and many Americans bought into the idea. She was a heavy favorite in the betting market.

But when the world realised Donald Trump was going to be president, not only did the betting markets flip, but the stock futures as well.

The fact is, by the end of the night, stock futures actually way UP on election night.

With a few blips along the way, stocks have nothing but soared under Trump. That all started on election NIGHT.

they were still limit down at midnight on election night, and even the next morning/day the market was down until the final hour of trading

november 8, 2016 close (dia) 183.38

nov 9 open 181.93 close 185.96Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#4039Why is 20 years' earnings a magic number? Not trying to be a smartass, I'm actually curious.none of this is really as crazy as some of you think

let's say we lose a whole year's worth of earnings (ain't happening, but let's say that for arguments sake).

what should be the haircut? if stocks trade at 20x earnings, and you take away a year's worth of earnings, you really only took away 5% of the earnings they were going to make over the next 20 years... and with interest rates at close to 0, you could have a p/e of 80 and that stock would still look better as an investment than buying a treasury bond or cd with a rate of 0.5%Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#4041OK, I see what you're saying. Still > 20 is on the high side, and it takes a lot of "faith" to assume the S&P 500 earnings a year from now will be back to where it had been. It will for some but it won't for many others.p/e of the s&p 500 has averaged roughly 20 over the past 30 years

https://www.multpl.com/s-p-500-pe-ratioComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4042Mike is a contrarian. I am with him. i have learned a lot from many of you in this thread the past two-plus years and am so grateful for it. you have helped my family and continue to. God bless you all for that!!

What i am learning now is how to dial out the noise. what is very clear is what Josher said earlier. the Govt and the Fed are willing to throw all the money humanly possible at this to support the market.

the support point on the SPX *feels like* 2640. it is currently 8.25% down from where we are now. it will create some buying opportunities for folks who missed the boat on stocks they like.

however, i do not see it this week nor next...............Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4044the one thing that has helped me over the years is quick action... if you waited a couple weeks until things were better you missed a huge rally, and if someone is just buying the averages now might turn out to be a pretty dumb time.Mike is a contrarian. I am with him. i have learned a lot from many of you in this thread the past two-plus years and am so grateful for it. you have helped my family and continue to. God bless you all for that!!

What i am learning now is how to dial out the noise. what is very clear is what Josher said earlier. the Govt and the Fed are willing to throw all the money humanly possible at this to support the market.

the support point on the SPX *feels like* 2640. it is currently 8.25% down from where we are now. it will create some buying opportunities for folks who missed the boat on stocks they like.

however, i do not see it this week nor next...............

but there are still huge opportunities in individual stocks/bonds if bill gates loses... if gates wins (let's remember he called this "pandemic 1" and said nobody could ever have a gathering again unless we all get jabbed with his vaccine, so he's planning on an endless stream of fearmongering) we're all dead anyway so what's the difference?Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4045Mike I didnt begin buying again until about 8 or 10 sessions post 3/23. I didn't feel comfortable until I felt there was some real teeth to the rally. Better to get into the water a little late than never.

I have intelligent friends who sold everything or stopped buying 3 weeks ago. They keep telling me another sell off is forthcoming soon so they are waiting.

Meanwhile we are up over 350 again in the Pre.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4046the problem with that strategy is what happens if you never get back in? what do you do with the cash? buy 10-year treasuries for 0.5% lolololMike I didnt begin buying again until about 8 or 10 sessions post 3/23. I didn't feel comfortable until I felt there was some real teeth to the rally. Better to get into the water a little late than never.

I have intelligent friends who sold everything or stopped buying 3 weeks ago. They keep telling me another sell off is forthcoming soon so they are waiting.

Meanwhile we are up over 350 again in the Pre.

i'd rather lose 40% and try to get it back than have to take 1/2 a percent interest for the next 10 years

for fixed income there are still some opportunities, home run stuff like preferreds in pei/bhr, or safer stuff like the vno/bsa preferreds that still pay 7-10% or so

how can anyone dislike @home (home) down here at $2/share? pretty good chance that goes back to 10... their inventory didn't get stale while they were closed like clothing retailersComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4047Mike since you mentioned stock symbol HOME take a look at that downtrend since mid 2018 on that guy, even before COVID-19 he was at $7. i realize that is nearly 3x on current price $2.40 but let's just say he doubles to $5 or even $5.50, how long are you willing to wait for that to happen? and what are the chances it does not?

i am just asking, not because i intend to buy, i just want to know your time horizon on a position like this.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4048normally i could kind of lock in a time horizon by selling covered calls... in this case though i wouldn't sell anything less than 5s and those don't go for muchMike since you mentioned stock symbol HOME take a look at that downtrend since mid 2018 on that guy, even before COVID-19 he was at $7. i realize that is nearly 3x on current price $2.40 but let's just say he doubles to $5 or even $5.50, how long are you willing to wait for that to happen? and what are the chances it does not?

i am just asking, not because i intend to buy, i just want to know your time horizon on a position like this.

someone could buy the stock for $2.40 and get 15 cents for the may 3s... that's a 6% return in 2 weeks with the top end being a 30% gain in 2 weeks ... rinse and repeat

or sell the $2 puts for 20 cents, then worst case scenario you have to buy it for $1.80 in 2 weeksComment -

IonaSBR MVP

- 01-08-10

- 4244

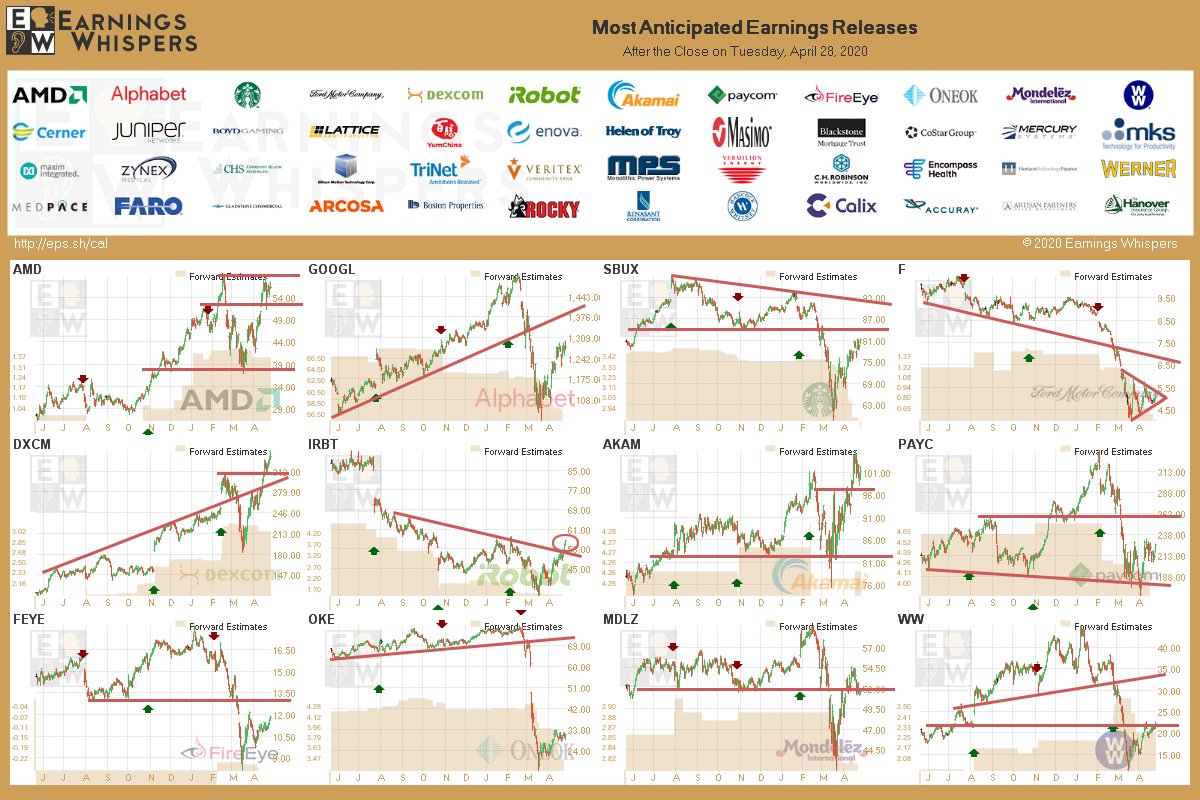

#4049After the close:

Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4050awful lot of V shapes in those charts!

energy/transport still in the toilet with oke/fComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4051I've got Google thru qqq and TQQQ and am direct owner of starbucks.

Will be interestingComment -

IonaSBR MVP

- 01-08-10

- 4244

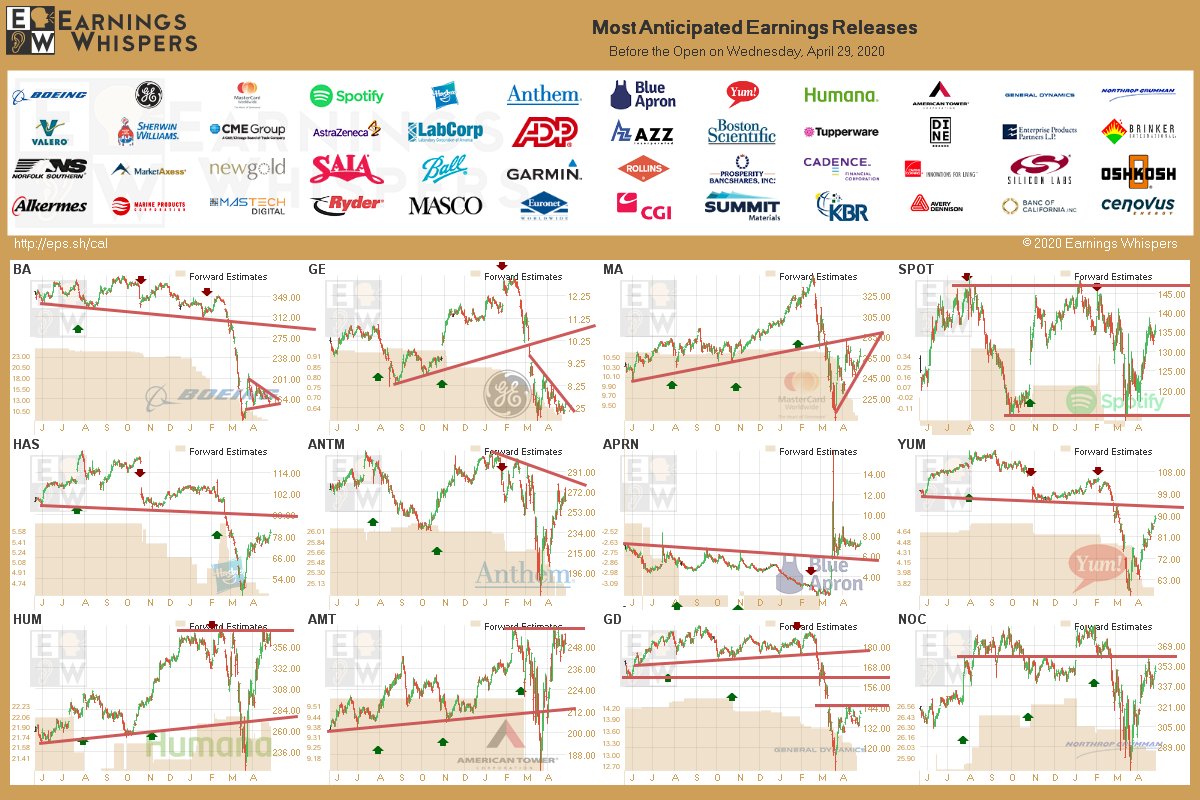

#4052Before the open tomorrow:

Should be interesting to hear what Boeing (BA) has to say.

Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#4053Guidance will certainly be more interesting than actual earnings since that's only through March. I expect we'll see some really good ones and some really bad ones.Comment -

POTVINSUXSBR MVP

- 10-14-08

- 2423

#4055Guys, I'm fairly new to the market scene. I have a few hundred to invest, what's the current best buy? I'm interested in MGM long term. Thoughts? Thanks in advance.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4056The headline of your link...

Although it appears they remained negative.US stock futures slash losses

Nov. 8, 2016 close...18,332

Nov 9, 2016 open...18,317, close 18,589

Trump was good for the markets, despite the MSM attempt to paint it otherwise.

The markets were up a few days in a row and continued on a steady ride upward since, with a few blips.

Perhaps my remembering the up night was really in other indices and I may just be remembering the massive surge once it was recognized that Trump would win.

Traders didn't want Hillary, that's for sure.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4057yeah i hate to correct someone's memory but the surge pretty much started in the final hour of trading THE NEXT DAYThe headline of your link...

Although it appears they remained negative.

Nov. 8, 2016 close...18,332

Nov 9, 2016 open...18,317, close 18,589

Trump was good for the markets, despite the MSM attempt to paint it otherwise.

The markets were up a few days in a row and continued on a steady ride upward since, with a few blips.

Perhaps my remembering the up night was really in other indices and I may just be remembering the massive surge once it was recognized that Trump would win.

Traders didn't want Hillary, that's for sure.

i know it well because i was watching the futures closely all night/morningComment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4058i actually like mgp better than mgm (same company but mgp holds the real estate and pays nice 8% dividend)

with that small of an amount i would look for a 5-bagger or 10-bagger (since you're only risking a few hundred bucks)... in that case i would go with HOME or MIKComment -

POTVINSUXSBR MVP

- 10-14-08

- 2423

#4059Thanks for your input mike.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4060I think I might also remembering the Futures the next night, on the 9th. When reality set in...lol.

Comment

Comment

Search

Collapse

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code