Originally posted by KVB

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

Slurry PumperSBR MVP

- 06-18-18

- 2814

#13126Yeah the last half hour of the day yesterday was the SPY realizing that it needed to close about the trend line. I jumped off when it started to move past $389. That was a bullish sign. I think you got lucky today as nothing has happened since the gap although we do have a bear flag going on in the hourly chartComment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#13127Pretty much took the day off yesterday until the very end when another money making opportunity came across my desk late in the day, and since the trend line trade has been working pretty well for me lately, I think I'll share this one with you just because I rarely give out actual stock plays even though I do play individual stocks almost as much as I play the index funds. It's my Slurry Pumping Falling Knife trade.

Look at this set up, we have a rising trend line that has been tagged 3 times in the last year and held. With once before being the exact scenario we have set up for today (circled). Oil fell of the map a little bit yesterday and ET fell off the table with it spiked through the 200 DMA, then bounced right off the trend line to close just above the 200DMA.

I bought my first half of the position yesterday of ET at the $12 Strike for the 4/21 termination. After we see the shake out this morning, I'll be picking up the second half. If we get lucky there may be another dip to start the morning to perhaps the 200DMA again for another intra-day test or even another trend line test but maybe not. I figure I'm wrong if it closes the week below the trend, and definitely below the $11.50 support spot.

Looking for this to pop in the coming week or so to $13 as a minimum.

Comment

Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30089

#13128ET...broke under lower bollinger band, but filled candlestick gaps, meanwhile broke also under the 100 EMA

and that trendline support is what helped it stay over the 200 MA for now at least. As more trading days pass,

the 200 MA will either break, or it will creep to meet the trendline providing a double-support.

The upside appears limited as the lower bollie and the 100 EMA meet at 12.18-12.20 which is immediate resistance. The action will be neutral in the 11.50s-12.20 area, until one of those sides converts. The Money Flow is undecided at .001. The 200 SMA is 11.39, further butressing the trendline that held. Although upside appears limited at 12.18/12.20 resistance, watch for buy volumes on the CMF to stay green. If they turn red, the TL breaks, it will fall to the 200 EMA and DMA and if those break it try December candle supports in the 11.20-11.25 area, then it's actually a long way down to the weekly moving averages that are far lower than the dailies on this. That is because ET spend a LOT of time last year in the 9-11 range.

A truly bullish move would convert 12.20 to support. There is extreme correlation to oil, for example OIL and USO have RSI's @ 30 and ET has 31 which is baseline bottom so some would be worried go lower.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#13129Thanks for the break down, this is a oil rebound play for me and if I'm in this in a week, I would be surprised. I expect a further run down or a spring dampener style chart here going forward. I guess it could consolidate for a while before making another leg up or down, but that to would be a signal for me to cut and run. Actually if it breaks the TL, I may turn around with the Put options for a monthly time period as it looks like a little ways down to the next area of support.Originally posted by SnowballET...broke under lower bollinger band, but filled candlestick gaps, meanwhile broke also under the 100 EMA

and that trendline support is what helped it stay over the 200 MA for now at least. As more trading days pass,

the 200 MA will either break, or it will creep to meet the trendline providing a double-support.

The upside appears limited as the lower bollie and the 100 EMA meet at 12.18-12.20 which is immediate resistance. The action will be neutral in the 11.50s-12.20 area, until one of those sides converts. The Money Flow is undecided at .001. The 200 SMA is 11.39, further butressing the trendline that held. Although upside appears limited at 12.18/12.20 resistance, watch for buy volumes on the CMF to stay green. If they turn red, the TL breaks, it will fall to the 200 EMA and DMA and if those break it try December candle supports in the 11.20-11.25 area, then it's actually a long way down to the weekly moving averages that are far lower than the dailies on this. That is because ET spend a LOT of time last year in the 9-11 range.

A truly bullish move would convert 12.20 to support. There is extreme correlation to oil, for example OIL and USO have RSI's @ 30 and ET has 31 which is baseline bottom so some would be worried go lower.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#13130Well we'll see how this goes. Off the open ET price tagged the TL again so I pick up the other half of the position at $.34 for the same Calls.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30089

#13131The ECB hiked rates .50 ... that's not good for oil, and the USD is not dropping to move into Euro..

what this suggests is that the Fed is not done hiking, either. The UUP has flipped green already.

What's going on here is so much geopolitical problems that the governments and banks are defending

their currencies and financial infrastructures. Equities will be sacrificed. Commodities will deflate in face of rising rates and slowing economic activity. Oil could boom in May but doesn't appear likely to have immediate-term bids due to the central banks currency defense schemes. PM's are not likely to go much higher either until a crisis happens which they are fighting against hard, so strengths is in short positions on equities and in long currencies and yield intensive safe havens. Many are just choosing cash.Comment -

ChuckyTheGoatBARRELED IN @ SBR!

ChuckyTheGoatBARRELED IN @ SBR!- 04-04-11

- 38801

#13132Props to all the input in this thread.

I'll ask a question and feel like I'm speaking to people more knowledgable than me on Stk Market investing:

*Anything wrong with a portfolio that holds 30% of investment in Vanguard funds (VO/VOT/VV/VB etc)?

I've watched a lot of the old Bogel videos. Honest guy, loved the idea of diversification and low Expense ratio.

When I talk about Expense ratio and $$ that's going to a broker, I think in terms of the long-term horizon. 0.80% doesn't sound like much for one year. Try compounding that expense over 30+ years and note the difference.Where's the fuckin power box, Carol?Comment -

KVBSBR Aristocracy

- 05-29-14

- 74866

#13133Still rolling here. I think we’re gonna make it till Friday with these puts.Originally posted by Slurry PumperYeah the last half hour of the day yesterday was the SPY realizing that it needed to close about the trend line. I jumped off when it started to move past $389. That was a bullish sign. I think you got lucky today as nothing has happened since the gap although we do have a bear flag going on in the hourly chart

Comment

Comment -

JIBBBYSBR Aristocracy

- 12-10-09

- 83479

#13134Bank panic is going away. Money moving has stopped. Stocks going back up now.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30089

#13135ET 12.03 and market rallying on economists survey expectations that Fed will "only" raise rates by 25 bp next week.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#13136Well we are starting to get to that resistance area. A smarter me would take my $.10 for the 1st half and the $.21 for the second half of the position for a $.45 and $.34 cent CALL and have that be a pretty good days work, but since this is bought off of house money this week, I think I'll hang onto it until tomorrow at least to watch what happens. I do this knowing that resistance is right there. Maybe I should get eh start money out and let the rest run wherever.Originally posted by SnowballET 12.03 and market rallying on economists survey expectations that Fed will "only" raise rates by 25 bp next week.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#13137I haven't been doing anything this week as the FED will trout on out and ignite either a continuation of a rally, or a rug pull to the markets tomorrow. I'll wait to hear from Powell before I start playing the markets again here on Thursday or maybe even late Wednesday.

My ET trade is flopping around and hasn't really lost or gained anything just yet. Kind of like KVB stated. From my perspective it is making a bear flag bouncing above the 200DMA, and in another day or 2 and we will see the convergence of the 200DMA and an upward trend line, again as told as a possible occurrence so it isn't a surprise. It all hinges on oil and how that goes in the next little while.

Still like gold people and I buy more of it every month. I think it and other stuff grabbed out of the ground are getting ready for a sustained run up da charts here for the next few years. The old favorites for this old man, but I do applaud the Bitcoiners as some of my kids are wrapped up in that stuff even though they are still a little upside down. My kids are new so I don't think they have been cost averaging down when the stuff was under 20K. They are all running on hopium for now. Hey they're young, I'll continue to teach when I can and see if they get they're shit together by the time they get to run through my property on a gold bar hunt with the metal meter thing after I take the dirt nap.Comment -

navyblue81SBR MVP

- 11-29-13

- 4142

#13138Cardano ran me into the ground, all the way from $1.50 to .30. Of course now that I’m out, it’s exploding and I have no clue why. Ugh. Fml.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30089

#13139Seems like the anticipated 1/4 bp Fed hike is already priced-in.

However long the rally lasts post-Fed talk, I would hop on the reversal or sell long positions

...but wait for the que first. That's what everyone does now. Just play follow the leader.

Concerning oil, the traditional season for long positions is getting closer but still weeks away..

so if you own ET or oil related positions, make sure your expiration dates extend into, say July or longer, so that you are buffeted with premium.Comment -

ChuckyTheGoatBARRELED IN @ SBR!

ChuckyTheGoatBARRELED IN @ SBR!- 04-04-11

- 38801

#13140Props to all for the opinions in this thread:

*Any opinions on Silver vs Gold?

I've been heavy on Silver but not so much Gold. Mostly b/c the Ag/Au ratio seems off.

Does anyone buy into the "Pound of Gold" thinking? IE, one way to have a security plan is to hold 16 ounces of Gold. Hard to imagine any scenario where Gold de-values.Where's the fuckin power box, Carol?Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6709

#13142I played it perfectly until the bank crisis, thus the current gains. I bought all fall and sold all Jan/23. GLD and SLV. I'm holding on GLD at this level as I think they got overbought with the banking. Seeming like buy GLD under 170 and sell over 180. BOL.Originally posted by ChuckyTheGoatProps to all for the opinions in this thread:

*Any opinions on Silver vs Gold?

I've been heavy on Silver but not so much Gold. Mostly b/c the Ag/Au ratio seems off.

Does anyone buy into the "Pound of Gold" thinking? IE, one way to have a security plan is to hold 16 ounces of Gold. Hard to imagine any scenario where Gold de-values.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74866

#13143Did you see that where JP MOrgan has about 1.3 million in nickel in storage and then found out it was jsut rocks.

These things happen. One firm thought they had a bunch of pohysical copper, and it turned out it was spray painted rocks.

Mind your commodities fellas, if you're taking physical possession.

Comment

Comment -

KVBSBR Aristocracy

- 05-29-14

- 74866

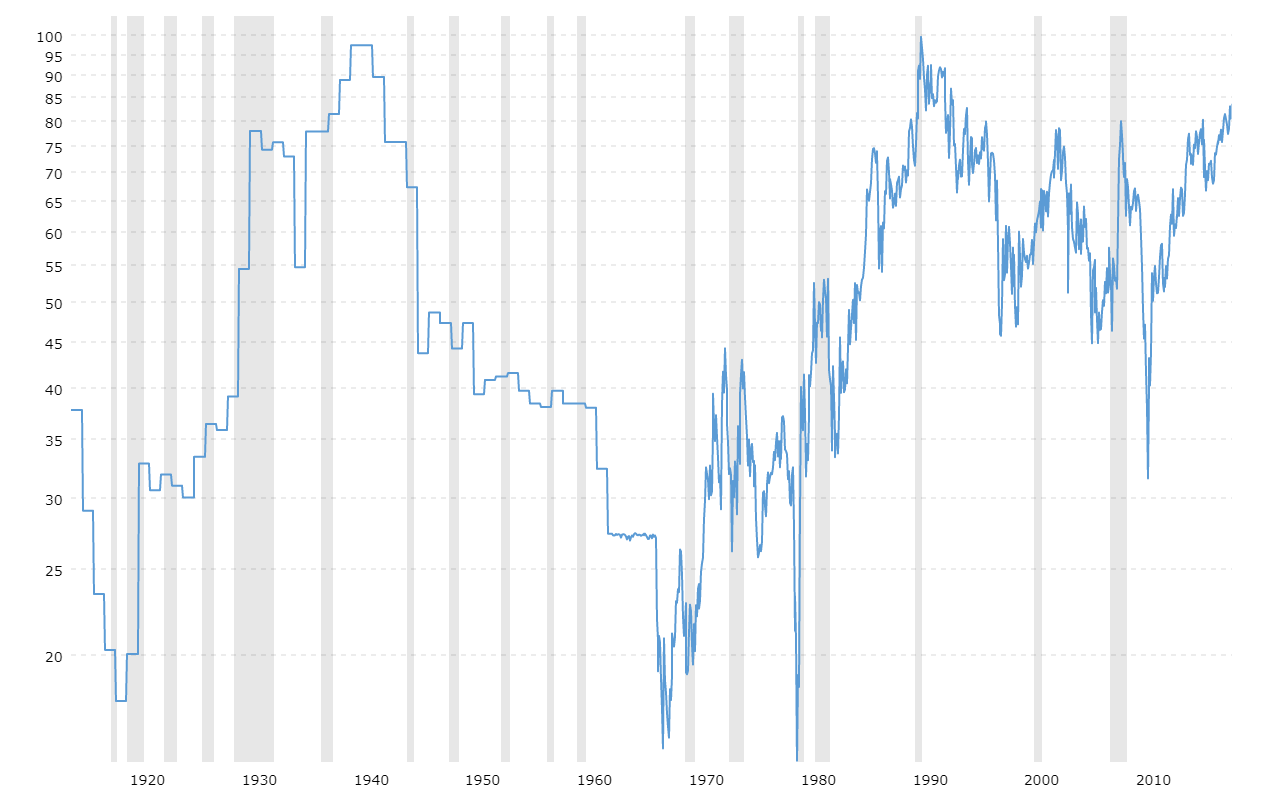

#13144You can trade the fluctuations between gold and silver and basically accumulate themetals on the side.Originally posted by ChuckyTheGoatProps to all for the opinions in this thread:

*Any opinions on Silver vs Gold?

I've been heavy on Silver but not so much Gold. Mostly b/c the Ag/Au ratio seems off.

Does anyone buy into the "Pound of Gold" thinking? IE, one way to have a security plan is to hold 16 ounces of Gold. Hard to imagine any scenario where Gold de-values.

This interactive chart tracks the current and historical ratio of gold prices to silver prices. Historical data goes back to 1915.

This interactive chart tracks the current and historical ratio of gold prices to silver prices. Historical data goes back to 1915.

I was talking about this at SBR a couple of years ago...

Hope this makes sense.Originally posted by KVB...Think about it. If you were a trader or even holder or accumulator of gold and and futures, deliverd and not, etc. Yesterday you could sell 1 ounce of gold and use it to buy 75 ounces of silver.

Today it's 71 ounces of silver, see why? You could now keep 4 ounces of silver and get your ounce of gold back. By trading at the fluctuation of the ratio you can accumulate both metals. In March, at the start of the pandemic, that chart has the ratio at 113....Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39847

#13145As usual, the initial move after the decision was wrong. Not exactly sure why. Seems like the Fed certainly is foreshadowing the end. Maybe one more .25 hike at most, or maybe not. I just think the Fed also does not want the market to be too happy. They want the markets to rise more gradually over time. If it moves up too fast it risks overheating things again. Market has been rangebound for awhile and will probably continue to bounce between 3,800-4,200 for the foreseeable future, probably most of the rest of the year. Just my guess. Next year will likely be better.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74866

#13146I agree, sideway like trading for a while.

I firmly believe they will be talking "recession" in July or August of this year.

So I am framing my outlook with that in mind. There might be some good trading in the meantime though. Maybe even just trade the range and try not get caught naked on a breakout either way.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30089

#13147I didn't know until you just told me. Btw, today was the first day of trading for NIKL.Originally posted by KVBDid you see that where JP MOrgan has about 1.3 million in nickel in storage and then found out it was jsut rocks.

These things happen. One firm thought they had a bunch of pohysical copper, and it turned out it was spray painted rocks.

Mind your commodities fellas, if you're taking physical possession.

Sprott launches nickel mining ETF to capture growing EV, green energy demand

Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#13148It seems as though the financial world needs to discover the XRF analyzer. https://elvatech.com/products/geo/ Its a tool used at manufacturing facilities for years to determine if the fancy steel we bought parts to be made out of is indeed the metal we want it to be.

I've been saying to get everything that comes out of the ground for a few years now and every month I just keep buying more of it. With the coming recession sometime this year, I would expect some of the more used elements in industry will slow and stall for a little while, but in the long run over the next decade returns should be grand. Also the mining industry that extracts all of this good stuff has been under invested in for the last couple of decades. This will change soon enough as the 1st world discovers that the green deal they are pushing will run on stuff that comes out of the ground.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15310

#13150Powell's dovish comments were taken very well by the market. It was all good. but at the same time he was speaking, Janet Yellen was talking about possibly not insuring all deposits unilaterally and that was what caused the selloff.Originally posted by d2betsAs usual, the initial move after the decision was wrong. Not exactly sure why. Seems like the Fed certainly is foreshadowing the end. Maybe one more .25 hike at most, or maybe not. I just think the Fed also does not want the market to be too happy. They want the markets to rise more gradually over time. If it moves up too fast it risks overheating things again. Market has been rangebound for awhile and will probably continue to bounce between 3,800-4,200 for the foreseeable future, probably most of the rest of the year. Just my guess. Next year will likely be better.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 27271

#13151unreal how you can stay so positiveOriginally posted by d2betsAs usual, the initial move after the decision was wrong. Not exactly sure why. Seems like the Fed certainly is foreshadowing the end. Maybe one more .25 hike at most, or maybe not. I just think the Fed also does not want the market to be too happy. They want the markets to rise more gradually over time. If it moves up too fast it risks overheating things again. Market has been rangebound for awhile and will probably continue to bounce between 3,800-4,200 for the foreseeable future, probably most of the rest of the year. Just my guess. Next year will likely be better.

this country is falling apart at the seams... no common culture, everyone hates "the other half", potholes all over the place, crime/garbage in every major city, people shooting up on the sidewalk and robbing walgreens, 2nd/3rd largest bank failures in history in the same week, largest commercial real estate crash in history, housing has never been more unaffordable ... and yet everything is gonna be OK and we'll all sing fukking kumbaya next year while sitting on piles of phony cash lololComment -

flyingilliniSBR Aristocracy

- 12-06-06

- 41222

#13152Best post I have seen in a very long time, 100% accurate .Originally posted by milwaukee mikeunreal how you can stay so positive

this country is falling apart at the seams... no common culture, everyone hates "the other half", potholes all over the place, crime/garbage in every major city, people shooting up on the sidewalk and robbing walgreens, 2nd/3rd largest bank failures in history in the same week, largest commercial real estate crash in history, housing has never been more unaffordable ... and yet everything is gonna be OK and we'll all sing fukking kumbaya next year while sitting on piles of phony cash lololהמוסד

המוסד למודיעין ולתפקידים מיוחדים

Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 27271

#13153we've disagreed on a lot of things, but i definitely think you were smart in getting the heck out of hereOriginally posted by flyingilliniBest post I have seen in a very long time, 100% accurate .

i imagine people during the fall of the roman empire said "everything will be better next year" too... people don't realize that less than 100 years ago, the british empire had 20% of the world's population, things changeComment -

flyingilliniSBR Aristocracy

- 12-06-06

- 41222

#13154I live in Paradise, banks are giving 9-11% on deposits now. I was one of those people that always thought America America the best etc etc, the only thing I can say that at least for me is music and sports - soccer. It is amazing to me that people don't see what is happening in America and people just think to seem everything is ok, it is very strange to be honest.Originally posted by milwaukee mikewe've disagreed on a lot of things, but i definitely think you were smart in getting the heck out of here

i imagine people during the fall of the roman empire said "everything will be better next year" too... people don't realize that less than 100 years ago, the british empire had 20% of the world's population, things changeהמוסד

המוסד למודיעין ולתפקידים מיוחדים

Comment -

ChuckyTheGoatBARRELED IN @ SBR!

ChuckyTheGoatBARRELED IN @ SBR!- 04-04-11

- 38801

#13155Don't need to listen to me. Think I'm going to buy an Ounce of gold this weekend.Originally posted by ChuckyTheGoatProps to all for the opinions in this thread:

*Any opinions on Silver vs Gold?

I've been heavy on Silver but not so much Gold. Mostly b/c the Ag/Au ratio seems off.

Does anyone buy into the "Pound of Gold" thinking? IE, one way to have a security plan is to hold 16 ounces of Gold. Hard to imagine any scenario where Gold de-values.

Yellen's response to the banking crisis was embarrassing. I expect the fallout to hit the news again this week.

Where's the fuckin power box, Carol?Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 27271

#13156chucky where are you these days? for places like milwaukee, it's better to drive to illinois and buy gold, save 5% sales tax which is $100/ounce

for stocks, the banking crisis has created some real opportunities... i bought a ton more vno-o at around $10 yesterday... that preferred is either worth 0 or 25, and it's not worth 0, their $13 billion in property would have to be only worth $5 billion for those preferreds to be as tainted as some people think

sometime in the next year if the world doesn't come to an end it will be back up to 15, and pays big dividends in the meantimeComment -

ChuckyTheGoatBARRELED IN @ SBR!

ChuckyTheGoatBARRELED IN @ SBR!- 04-04-11

- 38801

#13157Good morning, guys. Same old shit, just a new week:

1) Let's see what the news feed is on the Banking demise this week.

...I'd argue that Yellen's lying skills need to be sharpened. George Carlin might call it "not even a good lie."

...You don't want to play a game where the official is "moving the target." The FDIC protection against balances of $250,000 has been in place for a while. Where did Yellen get the idea that she would throw that out?

...The numbers don't add up. The prospect of a bank run is a real thing. Physical dollars would hold (temporary) value if credit dries up.

2) Silver prices going up:

Get the best deals for 1942-1945 Silver Wartime Nickels Wtn Roll WWII Lot 40 at eBay.com. We have a great online selection at the lowest prices with Fast & Free shipping on many items!

Get the best deals for 1942-1945 Silver Wartime Nickels Wtn Roll WWII Lot 40 at eBay.com. We have a great online selection at the lowest prices with Fast & Free shipping on many items!

...Let's see if that continues this week.

3) BTC price did a pullback. Currently around 28,000.

...Movement this week?Where's the fuckin power box, Carol?Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#13158It's not just Yellen, the entire government has been coming up with lies that a 5 year would dream up. When I hear anything now from anyone in a position of power, I can rest assured that what they said was bullshit.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 27271

#13159and it's not just our government, it's worldwide... started with unified covid rules, and now continues with "climate change" "trans rights" "racism"... world economic forum/WHO/other globalists pulling the strings to ruin societies all over the worldOriginally posted by Slurry PumperIt's not just Yellen, the entire government has been coming up with lies that a 5 year would dream up. When I hear anything now from anyone in a position of power, I can rest assured that what they said was bullshit.

not enough people jabbed themselves to death with fake vaccines, so it's on to the next scamsComment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30089

#13160Banks are certainly not done falling. There is no reason to buy any of them now.

Syria, Iraq, Iran heating up with attacks against US troops. US committed to Ukraine War

and confronting China in the Pacific. US Gov needs huge budget to pass and debt on way to high 30 trills.

Stephen Leeb speculates not without reason that JPM gold/silver short positions may be mathematically larger in derivatives exposure than their entire balance sheet. If gold shot up 1,000 it could trigger catastrophe. (link)Comment

Search

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code