Originally posted by homie1975

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

YoY inflation = 2.8% now.

stocks, bitcoin, ethereum, set up beautifully.

Leave a comment:

-

The job market is showing signs of stress. If you look at the Establishment Survey and the average hours worked, job equivalents (my term for hours worked + total jobs) have fallen since September. March 8 non farm payrolls will be important, if that trend continues, I think it's safe to say we're in the early signs of a recession. If March rebounds we probably just had a soft period.Originally posted by d2betsThat's the normal course of things. And new jobs are being created. The job market is good. If you aren't lazy and have some skill, you can get a good job easy. There are some people invested in wanting to make the economy and everything else seem terrible, but it most certainly is not.Leave a comment:

-

Another week and another week dominated by a few stocks in the market. I know it all looks good now, but the breadth isn't what I would like. Will it broaden out? who knows. I had my chance to buy NVDA this week right before the earnings but I didn't because of my discipline wont allow me to buy a stock and hold over the earnings report. This one was a tough one to overlook as at $663 coming into the last hour of trading was at my low number for a scalp, it closed today at $788. That's 18% since which was just Wednesday for Christ sake, and I could of had it for just overnight and sold for $775.

Oh well, I've been burnt so many times before trying that trade that I just couldn't pull the trigger on it. Gotta shake that off and look for other trades.

Congrats to all that own the NVDA, but remember the high flyers from 2001.Leave a comment:

-

Congrats, however "What have you done for me lately".Originally posted by homie1975coming up on the 6 year anniversary of this thread starting (03/06/2018).

I spend endless hours with older friends who are fixated dwelling on "Glory Days' trying to focus them. What was was!!, Personally, I can't change the past so I try endlessly to focus on tomorrow and thereafter. Maybe it's just getting old?

All my best!!Leave a comment:

-

coming up on the 6 year anniversary of this thread starting (03/06/2018).

Leave a comment:

-

they can root all they want against #46 but the truth is the POTUS has very little do w how the stock market does, even #45.Originally posted by d2betsI've grown to hate politics. Completely unnecessarily divisive and corrosive. Of course it's largely the fault of one person, but if I say that then I'm getting political. It's not even politics though, it's personal politics. People used to be able to disagree, yet still have shared values and get along. Maybe someday it'll return. /rant

but i can see through them.

they pipe up when the market tanks, but are nowhere to be found when the market soars.

it is pretty obvious.

Leave a comment:

-

I've grown to hate politics. Completely unnecessarily divisive and corrosive. Of course it's largely the fault of one person, but if I say that then I'm getting political. It's not even politics though, it's personal politics. People used to be able to disagree, yet still have shared values and get along. Maybe someday it'll return. /rantOriginally posted by homie1975yep, and 98% of their commentary is POLITICALLY motivated.Leave a comment:

-

yep, and 98% of their commentary is POLITICALLY motivated.Originally posted by d2betsThat's the normal course of things. And new jobs are being created. The job market is good. If you aren't lazy and have some skill, you can get a good job easy. There are some people invested in wanting to make the economy and everything else seem terrible, but it most certainly is not.Leave a comment:

-

That's the normal course of things. And new jobs are being created. The job market is good. If you aren't lazy and have some skill, you can get a good job easy. There are some people invested in wanting to make the economy and everything else seem terrible, but it most certainly is not.Originally posted by MadisonAnd so where are these people going such that they sure don't seem to be affecting the govmt #'s.

In stark contrast to the official numbers from the U.S. Bureau of LaborStatistics, the experience on the ground is disheartening.

Since January 1, 2023, more than 5,487 companies have announced massivelayoffs.

According to news reports, the number of layoffs in the U.S. increased 98% from2022 to 2023. A whopping 721,677 people received pink slips last year.

And clearly, things aren’t looking much better this year. It seems newheadlines appear weekly about the latest wave of restructuring andretrenchments.Leave a comment:

-

And so where are these people going such that they sure don't seem to be affecting the govmt #'s.

In stark contrast to the official numbers from the U.S. Bureau of LaborStatistics, the experience on the ground is disheartening.

Since January 1, 2023, more than 5,487 companies have announced massivelayoffs.

According to news reports, the number of layoffs in the U.S. increased 98% from2022 to 2023. A whopping 721,677 people received pink slips last year.

And clearly, things aren’t looking much better this year. It seems newheadlines appear weekly about the latest wave of restructuring andretrenchments.Leave a comment:

-

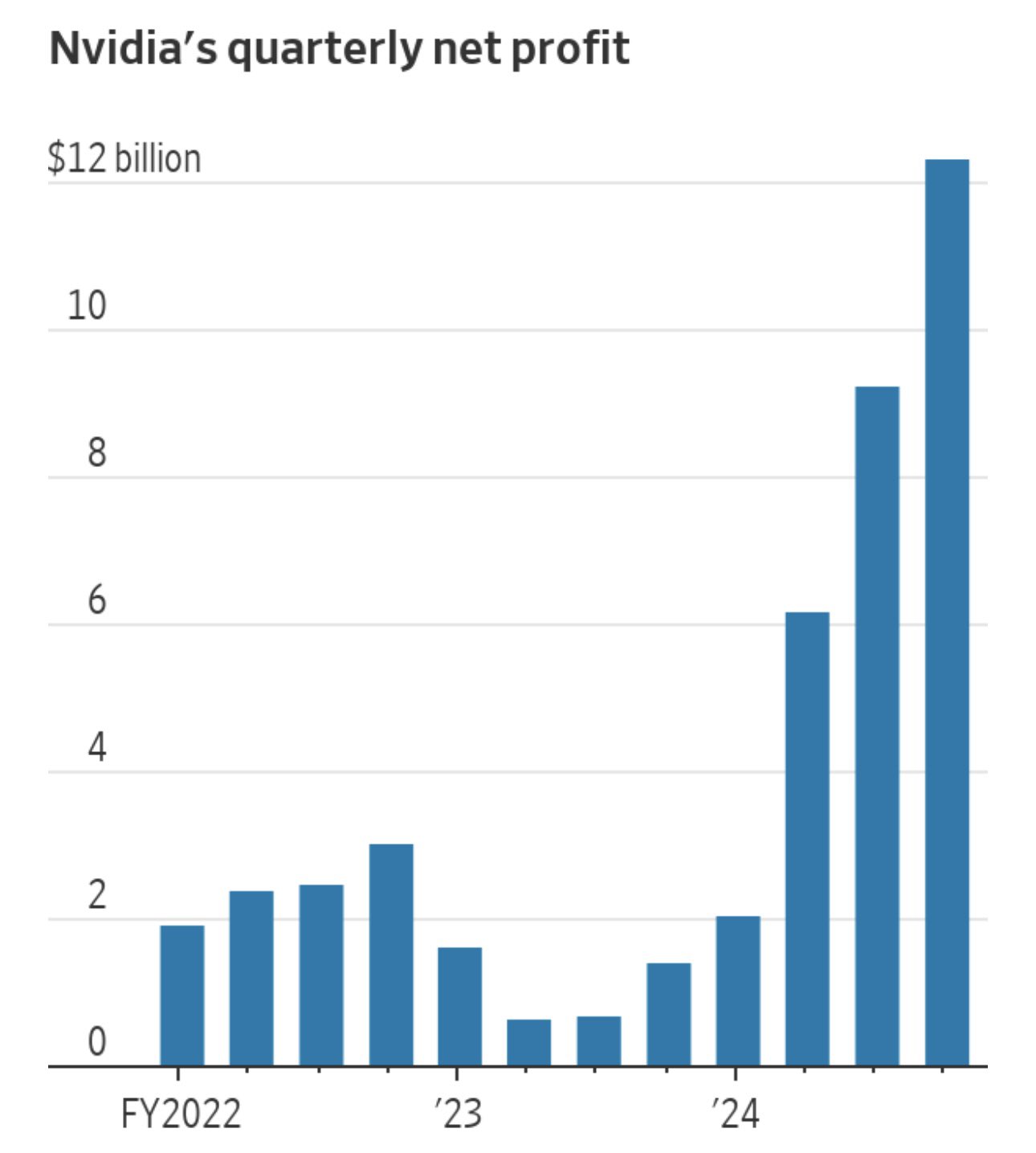

NVDA up only like 15%. Ho hum.

Over 250 billion increase in market cap today.

Leave a comment:

-

Nice post-drop rebound from NVDA. Up over 6% AH.

Edit: now up $55 (over 8%). Basically back where it was a couple days ago, if it holds.

4q revenue/profit:

2022: 6.06 billion/1.41 billion

2023: 22.1 billion/12.29 billionLeave a comment:

-

I screwed that one up, AAPL didn't make it to 180, and I put the trade in wrong as it picked it up off the open on a open market order due to me effing up the advanced trade parameters. Still got luck and got a buck out of it before it started to go south.

Sometimes I get lucky and don't lose money too. As my parameters were not met, but I accidentally got in anyway, and rode it a little way to make some lunch money.Leave a comment:

-

OK, NVDA didn't make it down to the $671 spot and is hovering at the $680 spot after falling this morning. So it fell didn't bounce and is hanging on to a spot just above my stated buying price. That means no trade even if it comes into the price later today. Too risky, it has a good probability of cutting right through that price to a spot that is lower.

AAPL came right to the $180 spot on the nose and I jump on it and got out at $182.50. A quick 1% scalp trade for about an hour or so worth of work.

SPY is hanging out just above my bounce leve for this morning so no more scalp action for the same reasons NVDA is off the board.

Work is done for today, and I'll rack them up again tomorrow and see what the market brings. 1 out of 3 calls right today is pretty good believe it or not, and not getting into losing trades is half the battle.Leave a comment:

-

Yeah, wth is going on there last couple days. I guess it was inevitable. No clue what happens later.Originally posted by homie1975D2er waiting for NVDA earnings with baited breath.

the eyes of the market world all on JensenLeave a comment:

-

Looking to see if the SPY can hold $494 this morning out of the gate. Morning trade looking for a bounce to $499 gap from yesterday to start.

Hey I'm a day trading buyer of NVDA if it runs down to the $671 and $663.50ish spots for 2 possible bites at that apple this morning as well.

and how about that AAPL? I'll play that as well this morning at about the $180ish level. All day trades for a few minutes to hours only. Just looking for a bounce.

Forgot to mention that any gap open below my trading level will take that trade off the table and leave me searching elsewhere.Leave a comment:

-

D2er waiting for NVDA earnings with baited breath.

the eyes of the market world all on JensenLeave a comment:

-

OK day 2 of my bet of a pullback, and it looks like we will open in the money for those calls I touted and showed you how to generate a emotionless trade. Now, its all about keeping the W. I will just watch it to make sure it stays in the money. There is still a few day left to hang out and wait.Leave a comment:

-

Dude, how fast do youtype? I failed 3 times. I have trouble posting one or two sentences.Originally posted by Slurry PumperI'm not disagreeing with you. I'm just highlighting another way to extract wealth out of the markets. I think we are getting a pullback here in the markets. That doesn't mean I just dive in and say F it is time and I deem it so. We have to wait for a market signal for that. In the mean time, I can use the market behavior to get some seed money for some side bets. Below is my technique I use for bets of this nature. Do I know the markets are going down next week? No of course not, but the bet is that it will so I buy PUTS that expire next Friday. The money I use is the money I make today.

OK this is a chart from today's action with 1 minute candles on the SPY. As you can see the SPY just plotted along for the most part until around the 11:15 spot (arrow 1), when it took a pause and turned around. I didn't buy PUTS why? Well the price pulled back to support but didn't break through as shown (arrow 2). How do I know that was an area of support? The chart shows me this as price paused at about the same level starting at around 10 and staying there until 10:20 or so. So after the typical pivot happens on a daily basis, I have to wait until the price gets back to support and break down lower to buy PUTS. As it turned out it bounced off of support today and went straight back to the 100 period moving average (blue line) then came back down almost to the level of support before taking off back to the blue line again. Once it broke through that blue line, if you wanted, it could have been bought for a long position on a break out Friday creeper move. That would have been the big winning play of the day which I didn't do why? I felt that there was a greater chance the market would come back down at some point and that it wouldn't float up as high as it did. I was wrong and if floated up pretty good today. What can I say, I can't catch all the opportunities and I'm wrong more than I'm right about my prognostications. That is why I liek to gather a full stack of information to support my case before I buy anything.

Now on the same chart but zoomed in a little bit, we will see what I did do, and give an explanation on why. For reference the high of the day is marked (arrow 1), I waited for the pullback to come and bounce off of the 100 period moving average (blue line). It didn't really bounce it kind of came in punched through hung out for minute or 2 or 5 before taking back off north. Price came up to resistance as marked by the horizontal yellow line. MACD was in the max'd out condition, stochastic lines were also overbought, it took another pause for about 3 to 5 minutes, so I bought PUTS that expire at the end of the day expecting that it was at a pivot point. These puts have literally about an hour left in their life span so the premium is lost and I can pick them up for less than a dollar a piece, then I wait the half hour or so for the price to creep down to the 200 period moving average. A total movement of just around $0.75 on the SPY, and around $0.30 on the actual PUTS cost so it wasn't a blockbuster trade by any means. Typically there is a reaction at the 200 period moving average when price approaches for the 1st time, so I sold those and collected the $0.30 per, and waited until the very end of the day for the "jam session" which happens everyday in the last 10 minutes of trading. Then right before the close, I use all my profits to buy those Puts at the $500 strike that expire next Friday. Now I have an emotionless trade going using just the profits from a small trade I made today. If it goes to shyt, who cares it was a gamble anyway really, but it could also be a big winner.

The trade was a full stack of probabilities that the market was going to go down at that point, or as the gamblers say a positive EV, so we make the trade. Now at 30 cent a share, you need some volume to make the numbers pop, but it really is just a scaling issue for smaller trade account sizes. The technique remains the same for all time scales and all stocks. I like to use the SPY because it has daily expiration times, strikes at the every dollar amount and the liquidity to get in and out at any time you want.

Leave a comment:

-

I'm not disagreeing with you. I'm just highlighting another way to extract wealth out of the markets. I think we are getting a pullback here in the markets. That doesn't mean I just dive in and say F it is time and I deem it so. We have to wait for a market signal for that. In the mean time, I can use the market behavior to get some seed money for some side bets. Below is my technique I use for bets of this nature. Do I know the markets are going down next week? No of course not, but the bet is that it will so I buy PUTS that expire next Friday. The money I use is the money I make today.Originally posted by d2betsThe SPY chart since the October lows is astoundingly impressive. I still contend we see another ~ 10% upward before any meaningful correction, probably summer.

Meanwhile, the NVDA monster keeps gaining steam.

OK this is a chart from today's action with 1 minute candles on the SPY. As you can see the SPY just plotted along for the most part until around the 11:15 spot (arrow 1), when it took a pause and turned around. I didn't buy PUTS why? Well the price pulled back to support but didn't break through as shown (arrow 2). How do I know that was an area of support? The chart shows me this as price paused at about the same level starting at around 10 and staying there until 10:20 or so. So after the typical pivot happens on a daily basis, I have to wait until the price gets back to support and break down lower to buy PUTS. As it turned out it bounced off of support today and went straight back to the 100 period moving average (blue line) then came back down almost to the level of support before taking off back to the blue line again. Once it broke through that blue line, if you wanted, it could have been bought for a long position on a break out Friday creeper move. That would have been the big winning play of the day which I didn't do why? I felt that there was a greater chance the market would come back down at some point and that it wouldn't float up as high as it did. I was wrong and if floated up pretty good today. What can I say, I can't catch all the opportunities and I'm wrong more than I'm right about my prognostications. That is why I liek to gather a full stack of information to support my case before I buy anything.

Now on the same chart but zoomed in a little bit, we will see what I did do, and give an explanation on why. For reference the high of the day is marked (arrow 1), I waited for the pullback to come and bounce off of the 100 period moving average (blue line). It didn't really bounce it kind of came in punched through hung out for minute or 2 or 5 before taking back off north. Price came up to resistance as marked by the horizontal yellow line. MACD was in the max'd out condition, stochastic lines were also overbought, it took another pause for about 3 to 5 minutes, so I bought PUTS that expire at the end of the day expecting that it was at a pivot point. These puts have literally about an hour left in their life span so the premium is lost and I can pick them up for less than a dollar a piece, then I wait the half hour or so for the price to creep down to the 200 period moving average. A total movement of just around $0.75 on the SPY, and around $0.30 on the actual PUTS cost so it wasn't a blockbuster trade by any means. Typically there is a reaction at the 200 period moving average when price approaches for the 1st time, so I sold those and collected the $0.30 per, and waited until the very end of the day for the "jam session" which happens everyday in the last 10 minutes of trading. Then right before the close, I use all my profits to buy those Puts at the $500 strike that expire next Friday. Now I have an emotionless trade going using just the profits from a small trade I made today. If it goes to shyt, who cares it was a gamble anyway really, but it could also be a big winner.

The trade was a full stack of probabilities that the market was going to go down at that point, or as the gamblers say a positive EV, so we make the trade. Now at 30 cent a share, you need some volume to make the numbers pop, but it really is just a scaling issue for smaller trade account sizes. The technique remains the same for all time scales and all stocks. I like to use the SPY because it has daily expiration times, strikes at the every dollar amount and the liquidity to get in and out at any time you want.Leave a comment:

-

The SPY chart since the October lows is astoundingly impressive. I still contend we see another ~ 10% upward before any meaningful correction, probably summer.Originally posted by Slurry PumperWell as I mentioned previously, when the SPY gets to 500 which it did briefly yesterday, I'm buying puts. I was away yesterday so I didn't get a chance to do so, and today being Friday, I will probably wait all day long to see if we get a Friday floater. If that happens, I'm coming in at the end of the dayish (3-4 time frame depending on the action). Light play to start the balls rolling. There is also a chance things start well and go to shyt around the typically daily pivot time of 11:30ish, in that case, I'm buying puts that expire today and will try that day trade for some superbowl seed money going into the weekend.

Meanwhile, the NVDA monster keeps gaining steam.Leave a comment:

-

Well as I mentioned previously, when the SPY gets to 500 which it did briefly yesterday, I'm buying puts. I was away yesterday so I didn't get a chance to do so, and today being Friday, I will probably wait all day long to see if we get a Friday floater. If that happens, I'm coming in at the end of the dayish (3-4 time frame depending on the action). Light play to start the balls rolling. There is also a chance things start well and go to shyt around the typically daily pivot time of 11:30ish, in that case, I'm buying puts that expire today and will try that day trade for some superbowl seed money going into the weekend.Leave a comment:

-

Credit card delinquency rates jumped across the board, the New York Fed and TransUnion found. Credit card delinquencies surged more than 50% in 2023, the New York Fed reported. According to TransUnion’s research, “serious delinquencies,” or those 90 days or more past due, reached the highest level since 2009.Leave a comment:

-

I was here for 1987. Barring unbridled inflation, which is poison in its own right, this just doesn't smell right to me.

BOL to all. I'm burying my nuts. LOL.Leave a comment:

-

Few snippets:

US. households are carrying a record amount of credit card debt, according to a new Federal Reserve Bank of New York report released Tuesday. The bank said the data indicates financial distress is on the rise, particularly among younger and lower-income Americans.

Credit card delinquencies have also soared more than 50% in the past year, with the Fed's report finding that about 6.4% of all accounts are now 90 days past due, up from 4% at the end of 2022.Leave a comment:

-

This one kills me. I bought SM motherboard computers in the 80's. I hovered all over this one at circa 250. Another failure lately by me.Originally posted by homie1975

and SMCI tearing too !!!

Leave a comment:

-

This.Originally posted by Slurry PumperNVDA is certainly on a run. At this point I would have to wait until it hits 500 on a pullback to get in, or wait until it levels out for a while before I can jump in. You all those who own it, I would ride that play for all its worth. Its only been 5 weeks since it last saw $500, and since then it has gone parabolic, which is what you want, but at the same time you just can't keep it forever. There will be a day when it takes a rest for a while. I don't know when, but it will eventually.Leave a comment:

-

This is a more narrow AI burst. But AI is as real as the internet was and there will be huge winners. NVDA just has such a head start and visionary leadership that it's just so hard to see them losing their dominant position for the deep foreseeable future. I said awhile ago, and still believe, they will be the market cap leader within 3-5 years. At this rate, it might be sooner.Originally posted by homie1975for certain stocks yes, but nowhere near the breadth of spiking stocks preceding the dot.com burst.Leave a comment:

-

for certain stocks yes, but nowhere near the breadth of spiking stocks preceding the dot.com burst.Originally posted by guitarjoshIt's 1999 all over againLeave a comment:

-

Originally posted by d2betsStop me if you've heard this one before...

NVDA shares surge 5% to another record high.

5% APR CD's? NVDA goes up 5% per day. It's 1999 all over againOriginally posted by homie1975

It's 1999 all over againOriginally posted by homie1975

and SMCI tearing too !!!

Leave a comment:

-

yes, but "when" is the key thing.Originally posted by Slurry PumperNVDA is certainly on a run. At this point I would have to wait until it hits 500 on a pullback to get in, or wait until it levels out for a while before I can jump in. You all those who own it, I would ride that play for all its worth. Its only been 5 weeks since it last saw $500, and since then it has gone parabolic, which is what you want, but at the same time you just can't keep it forever. There will be a day when it takes a rest for a while. I don't know when, but it will eventually.

those who are waiting for a "better" entry point might be waiting for $850 after it hits $900 and retreats.Leave a comment:

-

Good PLTR move after-hours too. Lots of potential there IMO.Originally posted by homie1975

and SMCI tearing too !!!

Leave a comment:

-

Well that's for sure. But who knows, it might shoot to $900 before it rests. I suspect they are going to 4-1 split at Feb 21 earnings.Originally posted by Slurry PumperNVDA is certainly on a run. At this point I would have to wait until it hits 500 on a pullback to get in, or wait until it levels out for a while before I can jump in. You all those who own it, I would ride that play for all its worth. Its only been 5 weeks since it last saw $500, and since then it has gone parabolic, which is what you want, but at the same time you just can't keep it forever. There will be a day when it takes a rest for a while. I don't know when, but it will eventually.Leave a comment:

Search

Collapse

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code

Leave a comment: