need kmb to move little more so i don't get burnt to bad

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7246Comment -

Mac4LyfeSBR Aristocracy

- 01-04-09

- 48883

#7247Sorry to hear of your losses. I know a bunch of people who have died of this virus. I was also in the hospital and saw people get carried to the morgue, dead from this virus. I can only think that the people who think it’s a hoax, don’t know a lot of people or are so scared shitless that they try to minimize the virus as a coping mechanism. We will never know how many people have died not because of Covid but because they refused to go to the hospital for fear of Covid? A nurse in the ER here in Houston said that people with heart attacks and strokes refused to come in until it was too late.Originally posted by chico2663also my aunt who lived spent 12 days in hospital with that shit. She kept saying it was a fake. They were spreading this to get rid of trump. She retired from post office 3 years ago as did her husband. Now she has 0 blood and walked in marathons since she was 30. Now she has to take oxygen with her. Just because it hasn't hit anyone you know don't make it fake. Maybe you don't know but odds are against you being bit by a snake if you live in the city!Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7248Originally posted by Mac4LyfeSorry to hear of your losses. I know a bunch of people who have died of this virus. I was also in the hospital and saw people get carried to the morgue, dead from this virus. I can only think that the people who think it’s a hoax, don’t know a lot of people or are so scared shitless that they try to minimize the virus as a coping mechanism. We will never know how many people have died not because of Covid but because they refused to go to the hospital for fear of Covid? A nurse in the ER here in Houston said that people with heart attacks and strokes refused to come in until it was too late.

thank you. i live in n w houston. My neighbors kid...just found out she was made to back to work at methodist downtown and now she has it.Comment -

Mac4LyfeSBR Aristocracy

- 01-04-09

- 48883

#7249One of my nurses at Memorial Hermann got it a few months ago. She’s not sure if she got it working in the Covid ward or out in public. It lasted 31 says. She could barely move. Just laid in bed the entire time. She’s 28, in great shape but Covid knocked her out. I saw a dad and his daughter both come in and both died from Covid 2 days apart. She was only 33 years old. Sad.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15310

#7250great question.Originally posted by ex50warriorCurious whether the Bears in this thread are shorting stocks, buying puts, buying metals, or sitting on cash waiting for lower entry points.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74866

#7251I'm honestly a perennial bear, always getting burned for it. Shit, I talk myself out of winning bets all the time because they seem to good to be true...haha.

I took some cash, needed it...lol, and then concentrated down to aapl and msft, apple's split helping increase the shares.

Seems like these two will be strong relative to price and whether whatever we have next even if I do predict a bit of a tech pullback.Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7252Originally posted by milwaukee mikethat is the definition of cowardice

they didn't have cases of a virus, they had positive tests of genetic material, and people with no symptoms whatsoever

we're now on about day 175 of "15 days to slow the spread" with no end in sight... nobody is dying, nobody is even being hospitalized yet the fear mongering keeps on

Comment -

KVBSBR Aristocracy

- 05-29-14

- 74866

#7253Why would you post that link? Seems awfully misleading in an attempt to get someone to listen to a podcast especially since the casue of death in that case is not confirmed and both the high school and newspaper retracted the COVID statements.Originally posted by chico2663

Let's be better for this thread at least.Comment -

ERBtheGREATSBR Rookie

- 06-03-13

- 46

#7254stonks only go upComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7255I trade leveraged ETFs that short if I’m feeling bearish. UVXY and sqqq are my personal faves.Originally posted by ex50warriorCurious whether the Bears in this thread are shorting stocks, buying puts, buying metals, or sitting on cash waiting for lower entry points.Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7256Originally posted by KVBWhy would you post that link? Seems awfully misleading in an attempt to get someone to listen to a podcast especially since the casue of death in that case is not confirmed and both the high school and newspaper retracted the COVID statements.

Let's be better for this thread at least.

didn't realize it had a link to podcast. Just knew it stated a football player in pennsyvania died from covid,Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#7257Today I was day trading S&P, and sold when it turned bad at the end of the day. Trimmed all positions down to just gold and gold miners along with my scanner stock that still hasn't met the criteria for selling yet DKS. Also my wife's selection of CHEF took right off today after showing relative strength over the sell off in the NASDAQ.

I expect some more selling to come, and a rare occurrence of Gold and the Dollar moving up simultaneously.

Also like to jump in on some Bitcoin. The chart is drawing me in even though I've never had bitcoin in the past. What the hell, I've been dealing in a fantasy with dollars for 50+ years now so I might as well buy into another currency that at this point is less of a fantasy than any of the others.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#7258Yeah, love the SQQQ.Originally posted by trobin31I trade leveraged ETFs that short if I’m feeling bearish. UVXY and sqqq are my personal faves.

Also been hitting the SDS, and SPXU for the S&P

I know I'm up to my nards in gold, but every once in a bit when the price gets to resistance, I buy some DUST.

Also like the possibility of getting some DRIP this week also.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7259Any chance we see the gambling stocks pop more tomorrow with NFL starting? Draftkings had a fat lil candle before after hours closing, I’d look at a break out leading into the weekend if it passes 41.5Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7260Between the jobless report being higher than expected and latest political talking point of Trump downplaying virus and I think a very good chance of posturing back into tech and gold.Comment -

Mac4LyfeSBR Aristocracy

- 01-04-09

- 48883

#7261PENN gaming was $3 in March. It’s up to $65 today. Wow!Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7262As expected, betting stocks like Penn & DKNG Are popping on NFL starting, should be great for day trading over the next week for quick in and out profitsComment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#7263I have already been in and out of PENN, BETZ and MGM this morning.

Also shorted a little bit of LL at $22.17 for a small starter play of 65 shares.

I think the lumber industry has run up and topped with all the almost peaceful protesters getting out of favor lately and with the people who could move doing the move slowing down over the rest of the year. Looking for LL to come down pretty sharply here to around $13.Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39847

#7264Unsurprising weakness, but honestly could be bullish IF Tuesday's lows at the 50-day moving average holds. If not, then look out below. Hasn't traded below 50-day support since early April.Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7265got 22000 ready to pounce. kimberly clark is downComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7266What kind of time line are you looking at?Originally posted by chico2663got 22000 ready to pounce. kimberly clark is downComment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7267for a drop like it did during covid season would like to buy back into fb at 160 or so.pg at 90.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 27271

#7268sorry to hearOriginally posted by chico2663Tell that shit to my mom who lost 5 cousins. The youngest was 33. Their only mistake in life was becoming nurses!

please post their death notices (or pm me) and i'll contribute to the charities of their choiceComment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39847

#7269Futures up solid, but I wonder if it will hold? Won't be surprised to see late selling into the weekend turning red.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7270Sold CLOU, SSSS, AYX & only bought more Tesla and GRWG this week. Along with some day trading of DKNG and SQQQ

Holding cash for upcoming IPOs, SNOW & PalantirComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7271Nevermind, nasdaq turned around to test the 50MA again so BTFD on:

Sea Limited 138

Roku 153

JD 73

DOCU 194Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7272a-seeing they are dead than how would they choseOriginally posted by milwaukee mikesorry to hear

please post their death notices (or pm me) and i'll contribute to the charities of their choice

b-my family is rich. Came over on the sante teresa land grant from spain. Ergo don't need or want charity.

c- are you calling me a liar?Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7273i have been trying to buy warrants on eyeg-w. They show they are selling but t.d. ameritrade and e trade both say they see them but they aren't on the market. Do you have a way or know someone that has them?Originally posted by trobin31Sold CLOU, SSSS, AYX & only bought more Tesla and GRWG this week. Along with some day trading of DKNG and SQQQ

Holding cash for upcoming IPOs, SNOW & PalantirComment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7274thanks for the condolences.Originally posted by milwaukee mikesorry to hear

please post their death notices (or pm me) and i'll contribute to the charities of their choiceComment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7275But if you are wanting to give money away. My neighbors kid who caught it and has lung damage. She is trying to get disability but it takes 6 months. Well big boy I can ask her if she wants a donation.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7276The only warrants I see were a private offering and expired in AugustOriginally posted by chico2663i have been trying to buy warrants on eyeg-w. They show they are selling but t.d. ameritrade and e trade both say they see them but they aren't on the market. Do you have a way or know someone that has them?Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#7277Originally posted by trobin31The only warrants I see were a private offering and expired in August

thanksComment -

IonaSBR MVP

- 01-08-10

- 4244

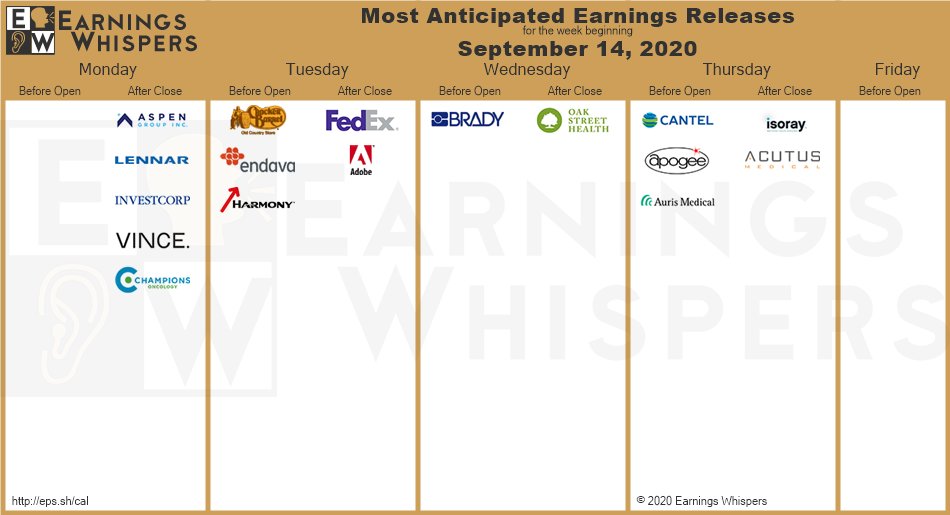

#7278Quiet week on the earnings front. Nevertheless, I would expect the high volatility to continue.

Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#7279O.K. lets see how this week went for my positions.

AU: AngloGold Ashanti

A lot of nothing going on here, just waiting for gold to consolidate and get going again. If it dips to $27.92, that is the sign to buy more as this level has been a line in the sand. It would take a real collapse for me to move out, I would need to see the price of Gold fall down to the $1800 level, and even then I would probably just buy more as the overall bet is that there will be inflation coming in the next couple of years.

TOTALS ALL STOCKS 2020 IN

PLAY41,129.90 ALLOWED

LOSS-1,697.55 GAIN

SO FAR180.82 TOTAL

GAIN-1,684.61 MONTH SEP 25,264.15 -1,417.10 -306.23 83.48 TOTALS PER STOCK AU 2,801.00 -9.00 83.00 1,763.98 MONTH SEP 2,801.00 -9.00 83.00 83.48 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS09/02/20 11.27.15 AU 300 28.01 2,801.00 27.92 -9.00 -0.32% 28.84 83.00 85 28.51 42.50 1.79% 115 28.57 64.40 2.00%

CHEF: Chef's Warehouse Inc.

The wife's choice is holding up here as a NASDAQ stock that is actually moving up although it did come back on Friday. I move the stop to $15.75 which represents a small profit if reached, and depending on the next week, I will probably move the stop up if the price comes back and moves higher than Thursday's close of $17.38.

TOTALS ALL STOCKS 2020 IN

PLAY41,129.90 ALLOWED

LOSS-1,697.55 GAIN

SO FAR180.82 TOTAL

GAIN-1,684.61 MONTH SEP 25,264.15 -1,417.10 -306.23 83.48 TOTALS PER STOCK CHEF 1,480.00 95.00 180.00 216.00 MONTH SEP 0.00 0.00 0.00 0.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS08/31/20 14.04.38 CHEF 100 14.80 1,480.00 15.75 95.00 6.42% 16.60 180.00

GDX: VanEck Vectors ETF Trust Gold Miners

This stock has been consolidating for the last month and a half in a wedge pattern. I'll wait to see if it breaks out to higher levels or plummets in a mining disaster. I'm a buyer at $39.61 which has been the line in the sand for this stock, and just like AU, it will be hard for me to sell if it dips lower. I just don't see the long term prospect for the precious metals staying down for long if it does fall another 10 to 20%. If it does, I'll probably be buying even more of it.

TOTALS ALL STOCKS 2020 IN

PLAY41,129.90 ALLOWED

LOSS-1,697.55 GAIN

SO FAR180.82 TOTAL

GAIN-1,684.61 MONTH SEP 25,264.15 -1,417.10 -306.23 83.48 TOTALS PER STOCK GDX 4,042.25 -442.25 73.75 1,733.20 MONTH SEP 1,995.50 -195.50 62.50 0.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS08/10/20 14.23.05 GDX 25 42.62 1,065.50 36.00 -165.50 -15.53% 41.16 -36.50 08/11/20 13.17.50 GDX 25 39.25 981.25 36.00 -81.25 -8.28% 41.16 47.75 09/04/20 10.29.46 GDX 50 39.91 1,995.50 36.00 -195.50 -9.80% 41.16 62.50

GLD: SPDR Gold Trust Gold SHS ETF

Same gold story as the other gold plays here. Just waiting for the breakout, and the line in the sand is at around $178.83 where I will buy some more. I'm a even bigger buyer if gold comes down another 10 to 20%, but I just don't see that happening, and if it does it would be a short term event and probably rally off of those levels pretty quickly.

TOTALS ALL STOCKS 2020 IN

PLAY41,129.90 ALLOWED

LOSS-1,697.55 GAIN

SO FAR180.82 TOTAL

GAIN-1,684.61 MONTH SEP 25,264.15 -1,417.10 -306.23 83.48 TOTALS PER STOCK GLD 14,522.10 -460.50 73.90 1,172.13 MONTH SEP 3,605.40 -90.00 43.60 0.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS08/11/20 9.30.02 GLD 30 183.54 5,506.20 175.77 -233.10 -4.23% 182.45 -32.70 08/25/20 10.00.44 GLD 30 180.35 5,410.50 175.77 -137.40 -2.54% 182.45 63.00 09/04/20 10.44.02 GLD 20 180.27 3,605.40 175.77 -90.00 -2.50% 182.45 43.60

LL: Lumber Liquidators Holdings Inc.

I shorted this one on Thursday and it moved down pretty good that day only to return on Friday during a down day. We'll see how it works out this week. I set my stop loss at $23.17.

TOTALS ALL STOCKS 2020 IN

PLAY41,129.90 ALLOWED

LOSS-1,697.55 GAIN

SO FAR180.82 TOTAL

GAIN-1,684.61 MONTH SEP 25,264.15 -1,417.10 -306.23 83.48 TOTALS PER STOCK LL 1,454.05 -52.00 4.55 0.00 MONTH SEP 1,454.05 -52.00 4.55 0.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS09/10/20 10.35.22 LL -65 22.37 1,454.05 23.17 -52.00 -3.58% 22.30 4.55

NKLA: Nikola Corporation

Now for the ugly. Every day I set up day trades that trigger automatically so I don't even need to be there for them to happen. It has been working out pretty well for the last 2 weeks as I am now back to being employed and once again engineering slurry pumping technology. Well Friday I wanted to do a day trade of the open with 2 entry points. $35.80, and $34.50. Well when I put in the prices in excel I used $32.80 as my second entry point. Well the day went on and I check around 10:30 in the morning and realized my mistake but it was too late. As a side note NKLA did indeed have a bounce off of the second entry point and would have produced a 2% quick gain. I waited all day and there was no movement in the stock so given the news about this stock it is gambling time, so before the close I bought another 150 shares and on Monday, we will see if GM comes to the rescue and this stock rebounds a little so I can get out at a break even price of $33.21, or even eventually get my target of 1% out of the deal at $33.54. If not I'm probably out either way by the end of the day.

TOTALS ALL STOCKS 2020 IN

PLAY41,129.90 ALLOWED

LOSS-1,697.55 GAIN

SO FAR180.82 TOTAL

GAIN-1,684.61 MONTH SEP 25,264.15 -1,417.10 -306.23 83.48 TOTALS PER STOCK NKLA 15,408.20 -1,070.60 -499.88 0.00 MONTH SEP 15,408.20 -1,070.60 -499.88 0.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS09/11/20 9.30.05 NKLA 150 35.56 5,334.00 30.90 -699.00 -13.10% 32.13 -514.50 09/11/20 10.23.12 NKLA 164 32.80 5,379.20 30.90 -311.60 -5.79% 32.13 -109.88 09/11/20 15.21.31 NKLA 150 31.30 4,695.00 30.90 -60.00 -1.28% 32.13 124.50

SCANNER STOCKS.

DKS: Dicks Sporting Goods Inc.

This scanner stock just keeps on meeting the criteria for holding, although the 9 DMA has moved up to right around the price. We'll see how it goes this week, but so far so good.

This week on Friday the scanner has picked up another stock to try. NUAN: Nuance Communications Inc.TOTALS ALL STOCKS 2020 IN

PLAY41,129.90 ALLOWED

LOSS-1,697.55 GAIN

SO FAR180.82 TOTAL

GAIN-1,684.61 MONTH SEP 25,264.15 -1,417.10 -306.23 83.48 TOTALS PER STOCK DKS 1,422.30 241.80 265.50 0.00 MONTH SEP 0.00 0.00 0.00 0.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS08/24/20 15.22.09 DKS 30 47.41 1,422.30 55.47 241.80 17.00% 56.26 265.50

To review the criteria for a scanner stock is:

- Stock price close (Friday) is between $10 and $100

- Volume (Everyday) must be at least 1,000,000 shares a day traded

- The closing price of the stock (Thursday) must be 0.1% above the 200 day simple moving average

- The closing price of the stock (Thursday) must be 0.1% above the 9 day simple moving average

- The day's open (Friday) must be 0.1% above the 9 day simple moving average

- The price from Thursday must cross above the 9 day simple moving average

- The 9 day simple moving average on Friday's close must be above the 9 day simple moving average close from Thursday

- The 9 day simple moving average on Thursday's close must be above the 9 day simple moving average close from Wednesday

- The average 9 day simple moving average to price ratio must be greater than 0.5% while removing from scrutiny from any closing price with upward movement greater than 5% and disqualifying stock if a 5% downward movement is detected at the close of the day. Further the 9 day simple moving average to price ratio is weighted as 3 separate 3 day simple moving averages as 16.6%, 33.3%, 50%. Any removal of a closing price extends the 9 day period back another day to meet the requirements of 9 closing prices for the formula

- The MACD difference from Friday must be greater than the MACD difference from Thursday

- The MACD difference (fast length of 12, slow length of 26, with an average type of simple) must be lower than .25

Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#7280So Oracle has won the TikTok bid...which it’s probably gonna go jolly green giant gap up tomorrow. Personally I’m staying away and looking at Microsoft to dip and add more below 200.Comment

Search

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code