Originally posted by rake922

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

JMobileSBR Posting Legend

- 08-21-10

- 19078

#6511I should have bought more NVAXComment -

navyblue81SBR MVP

- 11-29-13

- 4142

#6512Somewhere way back in this thread you'll see it, but I was a MRNA shareholder when it went up 20% and had major promise to go up over $100. Next thing you know, the executives dumped all the shares and sold. Stock plummeted 25% the next day two days. That was the end of me ever buying MRNA again. Hell no. I'll go with AZN who I have faith doesn't have the slime executives like MRNA has. At least I hope.Originally posted by antifoilhttps://www.secform4.com/insider-trading/1682852.htm

MRNA executives are dumping shares, some as soon as they exercise their options. The chief medical officer and the director, who today sold 73,000 shares, currently have sold down to zero shares. the company is pumping and dumping using press releases.Comment -

shadymcgradySBR Posting Legend

- 02-27-12

- 10036

#6513I have family members in the biotech and pharma industries. They all say AZN is a powerhouse company so regardless of the vaccine it is a good long term hold in their opinionsComment -

IonaSBR MVP

- 01-08-10

- 4244

#6514Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6717

#6515Novavax WTF

Was suggested to me a couple weeks ago by a novice investor who uses others advice.

Was $4 a year ago. Closed $140 Friday. Was $96 a week ago.

Vaccine-maker Novavax (NVAX) is a $6.5 billion company with only $18 million in trailing sales and no profits whatsoever.Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6717

#6516Satellites

Sputnik in 1957. 9K satellites since. 5K remain in Orbit. 2K still operational.

46,000 more expected in the next few years. Predominantly by Space X.

Who's manufacturing these and associated suppliers? I believe Lockheed LMT is a player. Any other thoughts?Comment -

rake922SBR Posting Legend

- 12-23-07

- 11692

#6517Roku is not going down long term.Originally posted by JMobileI should have bought more NVAXComment -

kyhawkSBR MVP

- 06-21-08

- 1012

#6518Invest in the vxx etfs or gtfo

Follow Search Results

Web results

Cryptopolis (@cryptopolis_x) | Twitter

Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6519Bro don't ever invest in a company that was 4 dollars a year ago and is at 100 dollars today. Never ever.Originally posted by MadisonWas suggested to me a couple weeks ago by a novice investor who uses others advice.

Was $4 a year ago. Closed $140 Friday. Was $96 a week ago.

Vaccine-maker Novavax (NVAX) is a $6.5 billion company with only $18 million in trailing sales and no profits whatsoever.Cause Sleep is the Cousin of DeathComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#6520Are you sure you are interpreting this correctly? Looks like the CMO is exercising options, and has history of always selling his options, he has owned zero shares for a long time. Correct me if I’m wrong. Also, pretty sure moderna news was public info when the other insiders sold, New England journal piece was announced Monday, so, unless they bought shares before the news hits, why the fook would they sell knowing there was good PR? That is literally the opposite of beneficial insider trading.Originally posted by antifoilhttps://www.secform4.com/insider-trading/1682852.htm

MRNA executives are dumping shares, some as soon as they exercise their options. The chief medical officer and the director, who today sold 73,000 shares, currently have sold down to zero shares. the company is pumping and dumping using press releases.Comment -

navyblue81SBR MVP

- 11-29-13

- 4142

#6521I personally think AZN is the best investment of the big 3 (MRNA, AZN, NVX). I’m hoping for a huge week from then next week when the big news comes out on their vaccine. Was already starting to take off Friday afternoon. It could hit $100 by the end of July.Originally posted by MadisonWas suggested to me a couple weeks ago by a novice investor who uses others advice.

Was $4 a year ago. Closed $140 Friday. Was $96 a week ago.

Vaccine-maker Novavax (NVAX) is a $6.5 billion company with only $18 million in trailing sales and no profits whatsoever.

Also there’s a lot of hype building on NOVN. Could be just rumors but there’s word they could merge with a big pharma company.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 27271

#6522well nvax is backed by gates/fauci and they just got a free 1.6 billion from the governmentOriginally posted by MadisonWas suggested to me a couple weeks ago by a novice investor who uses others advice.

Was $4 a year ago. Closed $140 Friday. Was $96 a week ago.

Vaccine-maker Novavax (NVAX) is a $6.5 billion company with only $18 million in trailing sales and no profits whatsoever.

so it's worth at least 1.6 billion right now

one of the easiest investments ever... when gates put in 300 million you knew damn well he would sucker the government to at least give him (and everyone else tailing) 500% returnComment -

MadisonSBR Hall of Famer

- 09-16-11

- 6717

#6523Understood here. Just posting facts. I get it.Originally posted by Goat MilkBro don't ever invest in a company that was 4 dollars a year ago and is at 100 dollars today. Never ever.

FKN unbelievable though no??Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6717

#6524Just disappointed I didn't realize some of the gains. Read today that if you would have put 1K in Berk 50 years ago you'd be worth 12M today. Why didn't I have a rich intelligent relative who wanted to seed his grandson's future. LOLOriginally posted by milwaukee mikewell nvax is backed by gates/fauci and they just got a free 1.6 billion from the government

so it's worth at least 1.6 billion right now

one of the easiest investments ever... when gates put in 300 million you knew damn well he would sucker the government to at least give him (and everyone else tailing) 500% return

Yeah, I know there's plenty more but just saying.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#6525

see the asterisks and skip to the end for foot stompsComment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#6526A couple of weeks ago I said that their was still some down side to LMT and to hold off on buying it. I was wrong, the sentiment has turned around with LMT and I will be looking to get in a long position this week when it moves above $369.03 which it is just about there as we speak. I'm only worried about the market sell off which seems almost imminently about to happen even though it just doesn't. So when I get in on Monday's rally off of the AZN news that everyone already knows about but they will tout it as a kung flu break through; I will put in a stop price of $358.63, which at 10 bucks doesn't allow for much downside movement. If I get stopped out, I will wait for another chance to enter when overall market forces are in my favor.Originally posted by MadisonSputnik in 1957. 9K satellites since. 5K remain in Orbit. 2K still operational.

46,000 more expected in the next few years. Predominantly by Space X.

Who's manufacturing these and associated suppliers? I believe Lockheed LMT is a player. Any other thoughts?Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15310

#6527Every starbucks I drive by in southern California has tons of cars in the drive through. It doesn't matter what day or what time, even at lunch time or early afternoon same thing.

Earnings on 7/28. I have to think it will pop but then again I'm holding a small position and focused on the drive through traffic not what they lost in the sit down piece of the business.

I'll continue to hold long for three reasons:

- well managed

- branded

- caffeine (it's an addiction and tough for folks to shake)Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#6528OK lets how how my positions did for the week starting with the ones that I closed or I got stopped out in.

CLOSED POSITIONS:

XLF Financial Select Sector SPDR Fund: Got stopped out on this short play and in the meantime it moved up above all of the moving averages then didn't do shit once I bought it back. If this market is going to eek out more gains, I have to believe the financial sector will have to participate now that the FANGMAN group is getting the rotation out. I was also looking at buying some actual banks like GS, or JPM but didn't pull the trigger. I'll take my $2 grand loss and go long again with fewer shares for the time being until the market can prove that it will move higher. The stop price will be $22.47 which is just lower than the recent support it has seen.

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 14.15.51 XLF -500 23.06 500 24.12 -529.00 -4.59% -529.00 -4.59% 06/26/20 11.10.22 XLF -1000 22.79 1000 24.12 -1,330.00 -5.84% -1,330.00 -5.84% 07/16/20 15.35.59 XLF 250 24.12 6,030.00 22.47 -412.50 -6.84% 23.95 -42.50

KBE SPDR S&P Bank ETF: Got stopped out and I'm leaving it alone for now if the banks start moving the market up I may jump in long here. Once again I'm choking down another $900 in losses.

LLNW Limelight Networks INC: Was doing alright but then it had a break down candle that swooped right down and triggered my stop loss trade at $7.01. Now it is hanging out at the $7.13 level, so I'll leave this one alone for now and just eat my $54 loss while waiting to see how the overall market acts in the near future before deciding to jump back in.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/26/20 11.11.58 KBE -500 29.75 500 30.51 -380.00 -2.55% -380.00 -2.55% 07/09/20 15.06.05 KBE -250 28.46 250 30.51 -512.50 -7.20% -512.50 -7.20%

LMT Lockheed Martin: Moved against me a little so I sold half of the shares and the next day it continued so I sold the rest mainly because I need to show a winner this month and they just haven't been coming my way I'll take my $1450 and as it turns out if the overall market has some gains I want to buy this one back and go long with it, so I may jump in if Monday's futures don't do a gap and crap, or gap down with follow thru.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/02/20 07.45.52 LLNW 100 7.55 100 7.01 -54.00 -7.15% -54.00 -7.15%

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 14.14.54 LMT -100 360.10 100 353.27 683.00 1.90% 683.00 1.90% 07/08/20 11.06.01 LMT -100 350.23 100 342.48 775.00 2.21% 775.00 2.21%

MCD. McDonalds: 'Ole Ronald McDonald gave me the finger and didn't go down like I thought it would so the stop price hit and I'm out. I'm getting back in if it can take out the $202.99 price resistance but for now this trip to Mickey D cost me about $350.

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 10.44.59 MCD -50 182.00 50 188.67 -333.50 -3.66% -333.50 -3.66%

SLB Schlumberger NV: Is another stock that showed some promise but just like all the other short plays petered out. This one was a fairly large play but I managed to lose just under $2 grand in the end. I'm jumping in long if it cab get above $19.29, and the stock market is moving up overall with good volume in the next couple of weeks.

DRIP Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares: Fell right outta bed one of these day during the week and I got stopped out at 5.73. I think oil will come down again once everyone is locked into their houses again and demand goes in the crapper again soon, can I say again a few more times please. I placed a Trailing Stop Buy on this baby and bought it back at $5.21. Since it has been moving back up for me so as of right now it is a no harm no foul play. My new stop is right at $5.00 so we'll see if it starts to move up if the price of oil sinks measurably.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 11.00.59 SLB -500 18.60 500 18.97 -185.00 -1.99% -185.00 -1.99% 06/26/20 14.00.39 SLB -500 17.58 500 18.97 -695.00 -7.91% -695.00 -7.91% 07/10/20 09.30.37 SLB -500 17.00 500 18.97 -985.00 -11.59% -985.00 -11.59%

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/10/20 10.57.15 DRIP 100 6.06 100 5.73 -33.00 -5.45% -33.00 -5.45% 07/16/20 12.17.12 DRIP 100 5.21 521.00 5.00 -21.00 -4.03% 5.57 36.00

NEW POSITIONS:

CAG Conagra Brands Inc: is one that I trade allot and it showed signs of life this week until I bought it then it hasn't done squat. I'm setting a tight stop with this one at $36.23, and will add if it can manage to make new highs in the $38.00 range.

F Ford Motor Company: Did show some signs of life also this week, and this one actually moved up a little so i'm placing the stock just below where I bought it at $6.49. If it can take out the resistance at $7.75, I'll buy some more.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/15/20 09.30.03 CAG 250 36.81 9,202.50 36.23 -145.00 -1.58% 36.58 -57.50

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/15/20 09.30.07 F 2000 6.53 13,060.00 6.49 -80.00 -0.61% 6.80 540.00

AZN Astrazeneca PLC Sponsored ADR: Someone on SBR mentioned a Phase III announcement coming on Monday when I just happened to check the thread, so I figured what the hell jump in now and see where it is at the end of the day. Well son of a bitch, I took right off within 20 minutes of buying it and now sits right at a level that even I should be able to get a profit out of it. I'm setting the stop price at $60.45 for now, and I may have a trailing stop on this one on Monday's action for a generous $1 or so if it hits big for the day. I'd like to thank the poster who put the tip in. Thanks.

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/17/20 10.48.47 AZN 200 58.00 11,600.00 60.45 490.00 4.22% 61.10 620.00

SO HOW ARE MY CONTINUING PLAYS DOING?

AU AngloGold Ashanti Limited Sponsored ADR: It was a rough week for Gold to start with, but it looks like it has bounced back, so I bought some more of it. I'm gonna be buying this for the foreseeable future. I move up the stop loss a little bit so that I can get some profits if the market craps out, but I'll be right back in it for a long term trade as soon as it stabilizes again.

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.18.46 AU 100 28.17 2,817.00 30.71 254.00 9.02% 32.37 420.00 06/30/20 11.09.53 AU 200 29.41 5,882.00 30.71 260.00 4.42% 32.37 592.00 07/08/20 09.30.22 AU 200 31.77 6,354.00 30.71 -212.00 -3.34% 32.37 120.00 07/17/20 11.59.56 AU 100 32.31 3,231.00 30.71 -160.00 -4.95% 32.37 6.00

AUY Yamana Gold Inc: Is another gold play which saw some recent pressure, but now looks like it is ready to move for me. I haven't bough more of it yet, but if it can get to $5.85 I'll start to add slowly. The stop price is moved up at just below the recent low price of $5.25 which is pretty tight for now. If I get stopped out I'll be looking to get another chance to buy it back at a lower rate. So maybe a trailing stop buy for this one is in the works.

GDX VanEck Vectors Gold Miners ETF: Same story here. Stop price is moved to $36.83, and I'll buy more at around $40.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.16.25 AUY 500 5.11 2,555.00 5.25 70.00 2.74% 5.41 150.00 07/08/20 09.31.15 AUY 200 5.67 1,134.00 5.25 -84.00 -7.41% 5.41 -52.00

GLD SPDR Gold Trust: All these gold plays have the same story, but I bought another 5 shares of these on Friday, stop at $168.53, and I'll add at $173. Stops are tight and if that happens like I stated earlier, I'll be looking to jump back in fully with the same amount of shares I have now when things are stabilized.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.57.34 GDX 70 34.70 2,429.00 36.83 149.10 6.14% 39.31 322.70 07/07/20 11.54.02 GDX 100 37.57 3,757.00 36.83 -74.00 -1.97% 39.31 174.00 07/08/20 09.30.25 GDX 100 38.44 3,844.00 36.83 -161.00 -4.19% 39.31 87.00

KL Kirkland Lake Gold Ltd: This gold stock hasn't rebounded at all yet so I'll leave it alone for now and see what happens. I'm moving up the stop loss to $43.41. I'm a buyer of more at $48.27.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.23.14 GLD 15 166.09 2,491.35 168.53 36.60 1.47% 170.12 60.45 07/08/20 09.54.37 GLD 10 170.11 1,701.10 168.53 -15.80 -0.93% 170.12 0.10 07/17/20 10.00.00 GLD 5 169.84 849.20 168.53 -6.55 -0.77% 170.12 1.40

AXP American Excess: For some reason when I type in the correct name this site changes the name to AMX, so here is the next best thing. This is one short that I still have going that didn't get stopped out. I moved my stop price down a little bit and I'll add at just below $89.45 for a few shares.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/02/20 11.14.12 KL 50 41.81 2,090.50 43.41 80.00 3.83% 44.71 145.00 07/08/20 09.30.05 KL 100 45.05 4,505.00 43.41 -164.00 -3.64% 44.71 -34.00

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 10.55.15 AXP -100 96.93 9,693.00 97.99 -106.00 -1.09% 95.18 175.00 07/08/20 09.30.11 AXP -100 91.82 9,182.00 97.99 -617.00 -6.72% 95.18 -336.00

Another stock I'll be looking to enter for a long position on Monday is PFE.

So far for the month, I'm down $7464, and I have positions worth $2927.65, so I have a little work to do before the close of the month next week.Comment -

JMobileSBR Posting Legend

- 08-21-10

- 19078

#6529Selling when the time is rightOriginally posted by rake922Roku is not going down long term.Comment -

daneault23SBR MVP

- 09-08-09

- 3877

#6530Interesting vid about LCA or soon to be GNOG. The owner is basically going all in and using this acquisition to hopefully resurrect his other businesses...Originally posted by navyblue81Agree, they have a lot to gain. I also think DKNG does, too, though. A lot of states are using them for their online gambling and that's only going to pump their stock. LCA another good one after their merger with Golden Nugget. I'll prolly buy both GAN and DKNG next week. Want to hold my $$$ for AZN through Monday and then I will jump on the sportsbooks.

Comment -

navyblue81SBR MVP

- 11-29-13

- 4142

#6531LCA merger with The Golden Nugget definitely puts them in the conversation with the other big boys as far as investing.Originally posted by daneault23Interesting vid about LCA or soon to be GNOG. The owner is basically going all in and using this acquisition to hopefully resurrect his other businesses...

https://www.youtube.com/watch?v=TDSQ25fbq9c

I’m looking at them as possibly the safest play. I don’t feel like it has anywhere to go but up.Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6717

#6532I just don't see XLF and banks in the next 18 months. Interest rates, forebearance, and loan loss provisions on the rise. Don't see the upside??Originally posted by Slurry PumperOK lets how how my positions did for the week starting with the ones that I closed or I got stopped out in.

CLOSED POSITIONS:

XLF Financial Select Sector SPDR Fund: Got stopped out on this short play and in the meantime it moved up above all of the moving averages then didn't do shit once I bought it back. If this market is going to eek out more gains, I have to believe the financial sector will have to participate now that the FANGMAN group is getting the rotation out. I was also looking at buying some actual banks like GS, or JPM but didn't pull the trigger. I'll take my $2 grand loss and go long again with fewer shares for the time being until the market can prove that it will move higher. The stop price will be $22.47 which is just lower than the recent support it has seen.

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 14.15.51 XLF -500 23.06 500 24.12 -529.00 -4.59% -529.00 -4.59% 06/26/20 11.10.22 XLF -1000 22.79 1000 24.12 -1,330.00 -5.84% -1,330.00 -5.84% 07/16/20 15.35.59 XLF 250 24.12 6,030.00 22.47 -412.50 -6.84% 23.95 -42.50

KBE SPDR S&P Bank ETF: Got stopped out and I'm leaving it alone for now if the banks start moving the market up I may jump in long here. Once again I'm choking down another $900 in losses.

LLNW Limelight Networks INC: Was doing alright but then it had a break down candle that swooped right down and triggered my stop loss trade at $7.01. Now it is hanging out at the $7.13 level, so I'll leave this one alone for now and just eat my $54 loss while waiting to see how the overall market acts in the near future before deciding to jump back in.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/26/20 11.11.58 KBE -500 29.75 500 30.51 -380.00 -2.55% -380.00 -2.55% 07/09/20 15.06.05 KBE -250 28.46 250 30.51 -512.50 -7.20% -512.50 -7.20%

LMT Lockheed Martin: Moved against me a little so I sold half of the shares and the next day it continued so I sold the rest mainly because I need to show a winner this month and they just haven't been coming my way I'll take my $1450 and as it turns out if the overall market has some gains I want to buy this one back and go long with it, so I may jump in if Monday's futures don't do a gap and crap, or gap down with follow thru.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/02/20 07.45.52 LLNW 100 7.55 100 7.01 -54.00 -7.15% -54.00 -7.15%

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 14.14.54 LMT -100 360.10 100 353.27 683.00 1.90% 683.00 1.90% 07/08/20 11.06.01 LMT -100 350.23 100 342.48 775.00 2.21% 775.00 2.21%

MCD. McDonalds: 'Ole Ronald McDonald gave me the finger and didn't go down like I thought it would so the stop price hit and I'm out. I'm getting back in if it can take out the $202.99 price resistance but for now this trip to Mickey D cost me about $350.

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 10.44.59 MCD -50 182.00 50 188.67 -333.50 -3.66% -333.50 -3.66%

SLB Schlumberger NV: Is another stock that showed some promise but just like all the other short plays petered out. This one was a fairly large play but I managed to lose just under $2 grand in the end. I'm jumping in long if it cab get above $19.29, and the stock market is moving up overall with good volume in the next couple of weeks.

DRIP Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares: Fell right outta bed one of these day during the week and I got stopped out at 5.73. I think oil will come down again once everyone is locked into their houses again and demand goes in the crapper again soon, can I say again a few more times please. I placed a Trailing Stop Buy on this baby and bought it back at $5.21. Since it has been moving back up for me so as of right now it is a no harm no foul play. My new stop is right at $5.00 so we'll see if it starts to move up if the price of oil sinks measurably.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 11.00.59 SLB -500 18.60 500 18.97 -185.00 -1.99% -185.00 -1.99% 06/26/20 14.00.39 SLB -500 17.58 500 18.97 -695.00 -7.91% -695.00 -7.91% 07/10/20 09.30.37 SLB -500 17.00 500 18.97 -985.00 -11.59% -985.00 -11.59%

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/10/20 10.57.15 DRIP 100 6.06 100 5.73 -33.00 -5.45% -33.00 -5.45% 07/16/20 12.17.12 DRIP 100 5.21 521.00 5.00 -21.00 -4.03% 5.57 36.00

NEW POSITIONS:

CAG Conagra Brands Inc: is one that I trade allot and it showed signs of life this week until I bought it then it hasn't done squat. I'm setting a tight stop with this one at $36.23, and will add if it can manage to make new highs in the $38.00 range.

F Ford Motor Company: Did show some signs of life also this week, and this one actually moved up a little so i'm placing the stock just below where I bought it at $6.49. If it can take out the resistance at $7.75, I'll buy some more.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/15/20 09.30.03 CAG 250 36.81 9,202.50 36.23 -145.00 -1.58% 36.58 -57.50

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/15/20 09.30.07 F 2000 6.53 13,060.00 6.49 -80.00 -0.61% 6.80 540.00

AZN Astrazeneca PLC Sponsored ADR: Someone on SBR mentioned a Phase III announcement coming on Monday when I just happened to check the thread, so I figured what the hell jump in now and see where it is at the end of the day. Well son of a bitch, I took right off within 20 minutes of buying it and now sits right at a level that even I should be able to get a profit out of it. I'm setting the stop price at $60.45 for now, and I may have a trailing stop on this one on Monday's action for a generous $1 or so if it hits big for the day. I'd like to thank the poster who put the tip in. Thanks.

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/17/20 10.48.47 AZN 200 58.00 11,600.00 60.45 490.00 4.22% 61.10 620.00

SO HOW ARE MY CONTINUING PLAYS DOING?

AU AngloGold Ashanti Limited Sponsored ADR: It was a rough week for Gold to start with, but it looks like it has bounced back, so I bought some more of it. I'm gonna be buying this for the foreseeable future. I move up the stop loss a little bit so that I can get some profits if the market craps out, but I'll be right back in it for a long term trade as soon as it stabilizes again.

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.18.46 AU 100 28.17 2,817.00 30.71 254.00 9.02% 32.37 420.00 06/30/20 11.09.53 AU 200 29.41 5,882.00 30.71 260.00 4.42% 32.37 592.00 07/08/20 09.30.22 AU 200 31.77 6,354.00 30.71 -212.00 -3.34% 32.37 120.00 07/17/20 11.59.56 AU 100 32.31 3,231.00 30.71 -160.00 -4.95% 32.37 6.00

AUY Yamana Gold Inc: Is another gold play which saw some recent pressure, but now looks like it is ready to move for me. I haven't bough more of it yet, but if it can get to $5.85 I'll start to add slowly. The stop price is moved up at just below the recent low price of $5.25 which is pretty tight for now. If I get stopped out I'll be looking to get another chance to buy it back at a lower rate. So maybe a trailing stop buy for this one is in the works.

GDX VanEck Vectors Gold Miners ETF: Same story here. Stop price is moved to $36.83, and I'll buy more at around $40.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.16.25 AUY 500 5.11 2,555.00 5.25 70.00 2.74% 5.41 150.00 07/08/20 09.31.15 AUY 200 5.67 1,134.00 5.25 -84.00 -7.41% 5.41 -52.00

GLD SPDR Gold Trust: All these gold plays have the same story, but I bought another 5 shares of these on Friday, stop at $168.53, and I'll add at $173. Stops are tight and if that happens like I stated earlier, I'll be looking to jump back in fully with the same amount of shares I have now when things are stabilized.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.57.34 GDX 70 34.70 2,429.00 36.83 149.10 6.14% 39.31 322.70 07/07/20 11.54.02 GDX 100 37.57 3,757.00 36.83 -74.00 -1.97% 39.31 174.00 07/08/20 09.30.25 GDX 100 38.44 3,844.00 36.83 -161.00 -4.19% 39.31 87.00

KL Kirkland Lake Gold Ltd: This gold stock hasn't rebounded at all yet so I'll leave it alone for now and see what happens. I'm moving up the stop loss to $43.41. I'm a buyer of more at $48.27.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.23.14 GLD 15 166.09 2,491.35 168.53 36.60 1.47% 170.12 60.45 07/08/20 09.54.37 GLD 10 170.11 1,701.10 168.53 -15.80 -0.93% 170.12 0.10 07/17/20 10.00.00 GLD 5 169.84 849.20 168.53 -6.55 -0.77% 170.12 1.40

AXP American Excess: For some reason when I type in the correct name this site changes the name to AMX, so here is the next best thing. This is one short that I still have going that didn't get stopped out. I moved my stop price down a little bit and I'll add at just below $89.45 for a few shares.DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/02/20 11.14.12 KL 50 41.81 2,090.50 43.41 80.00 3.83% 44.71 145.00 07/08/20 09.30.05 KL 100 45.05 4,505.00 43.41 -164.00 -3.64% 44.71 -34.00

DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 10.55.15 AXP -100 96.93 9,693.00 97.99 -106.00 -1.09% 95.18 175.00 07/08/20 09.30.11 AXP -100 91.82 9,182.00 97.99 -617.00 -6.72% 95.18 -336.00

Another stock I'll be looking to enter for a long position on Monday is PFE.

So far for the month, I'm down $7464, and I have positions worth $2927.65, so I have a little work to do before the close of the month next week.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

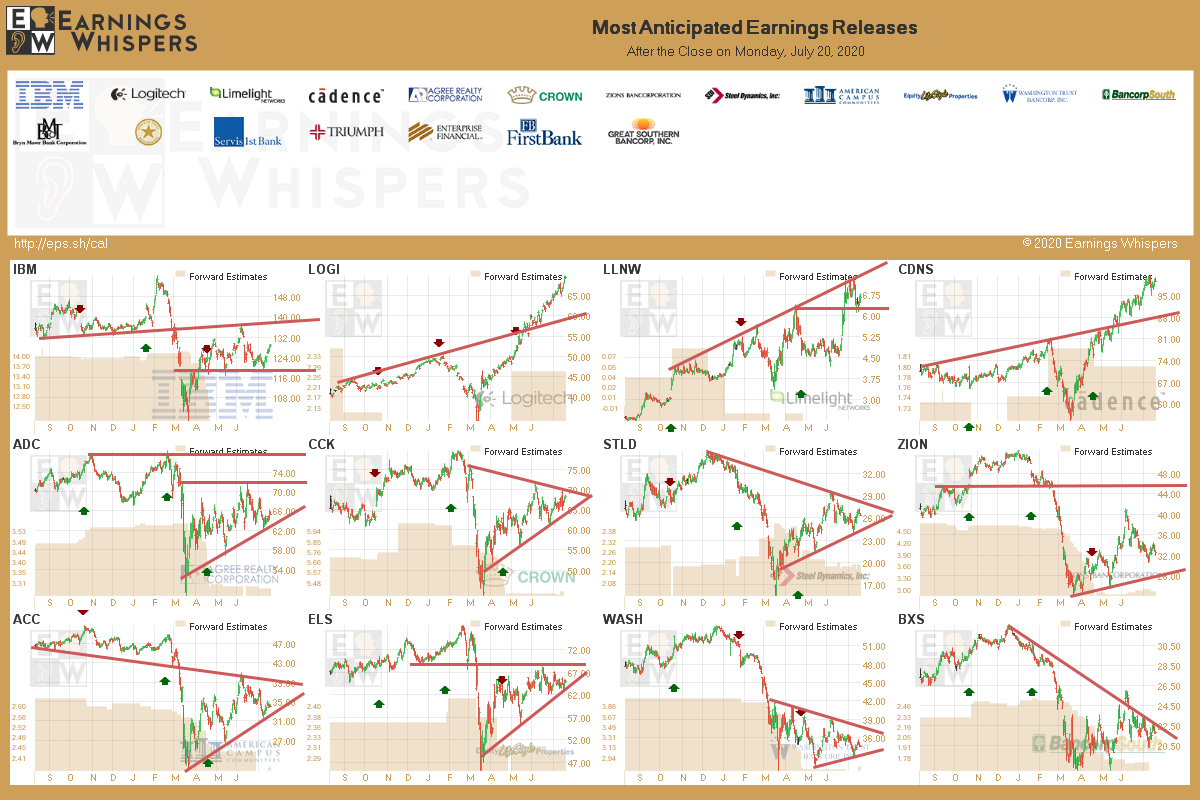

#6533What are you looking at for earnings

keeping an eye on

Logitech, limelight

Intuitive Surgical-> I buy dips whenever possible

Tesla, Microsoft

Citrix

Probably loading up in Microsoft pre-market, between the software needed to do stuff from home and many businesses moving to Microsoft teams for video and instant messaging, I think Microsoft could be in for a ginormous run.

i think Tesla will beat earnings again, lots of talk of S&P could drive price to 1800-2k, battery day looking as well in September. I still have my monthly allotment to buy into Tesla and have hesitated waiting for pullback this month, so hard to time Tesla and this is why I’d rather just DCA without worrying about it, it’s gonna be irrelevant next year or a few years when it’s 3-5kComment -

MadisonSBR Hall of Famer

- 09-16-11

- 6717

#6534Plumber,

FWIW, LMT reports Tuesday.Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6717

#6535TSLA reports Wed

Help me understand what they could possibly report that would power this even further? Granted I've been a non-believer but this seems like a nice short play??

Just trying to understand the momentum. don't get it. Up 100% in a couple months??

Mr TRobin?? Help please.Comment -

rake922SBR Posting Legend

- 12-23-07

- 11692

#6536big day for SWBIComment -

Slurry PumperSBR MVP

- 06-18-18

- 2814

#6537XLF being the financial ETF for all the big banks like Goldman Stacks, J.P. Morgan, Citibank, etc... are absolutely needed if this market is to continue upward and onward. It is also the most rigged sector going. In fact you can't believe a f'ing word they say. It is all about the FED and how the FED will secretly funnel money to them. My play was a short, then in one day the ETF was able to jump above all the moving averages. Now it is taking time off the clock waiting to do something. If the market tanks, I'll hit the stop and get out, but if the market is to continue the banks will need to participate. So far the FANG stocks have carried this market and they are starting to rotate out.Originally posted by MadisonI just don't see XLF and banks in the next 18 months. Interest rates, forebearance, and loan loss provisions on the rise. Don't see the upside??

Watch out for TESLA, I wouldn't buy that until after they report. Sure they will make probably $.50 a share and somehow spin that into people plucking out $1500 for another share for their portfolio. Crazy I know but this one stock has the ability to remain sky high and not really do anything with the underlying fundamentals. All hype and no substance will last a while, either they get their shyt together and justify the price, or the house of cards will come crashing down on day.Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#6538Dude tsla is going higher but too rich for meComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#6539I looked at numbers a while ago and think I got a something like Tesla having at least 50% market share globally in EV, with number of EV increasing exponentially Tesla is only company able to scale to meet demand and it’s already global. Their energy, autonomous & other services is more difficult to calculate but there likely to be several patents related to other companies to meet growing demand for their technology. I was surprised as anyone but found a good case for anywhere from 1-3 trillion in revenue by 2030Originally posted by MadisonHelp me understand what they could possibly report that would power this even further? Granted I've been a non-believer but this seems like a nice short play??

Just trying to understand the momentum. don't get it. Up 100% in a couple months??

Mr TRobin?? Help please.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#6540In the end you have to be a person believes that in 20 years we likely live in a world filled by zero emission resources and be willing too bet on the pioneers who get us thereComment -

IonaSBR MVP

- 01-08-10

- 4244

#6541Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6717

#6542Thank you for taking your time to reply, much appreciated.Originally posted by trobin31I looked at numbers a while ago and think I got a something like Tesla having at least 50% market share globally in EV, with number of EV increasing exponentially Tesla is only company able to scale to meet demand and it’s already global. Their energy, autonomous & other services is more difficult to calculate but there likely to be several patents related to other companies to meet growing demand for their technology. I was surprised as anyone but found a good case for anywhere from 1-3 trillion in revenue by 2030Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36993

#6543Bought tsla at 1500 and immediately drops.Originally posted by trobin31What are you looking at for earnings

keeping an eye on

Logitech, limelight

Intuitive Surgical-> I buy dips whenever possible

Tesla, Microsoft

Citrix

Probably loading up in Microsoft pre-market, between the software needed to do stuff from home and many businesses moving to Microsoft teams for video and instant messaging, I think Microsoft could be in for a ginormous run.

i think Tesla will beat earnings again, lots of talk of S&P could drive price to 1800-2k, battery day looking as well in September. I still have my monthly allotment to buy into Tesla and have hesitated waiting for pullback this month, so hard to time Tesla and this is why I’d rather just DCA without worrying about it, it’s gonna be irrelevant next year or a few years when it’s 3-5kComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9860

#6544Personally I have a hard time paying this current premium and I think it’s over-manipulated at the moment. I think there’s good support at 1200 and 1000, and who knows maybe below 1000 again before the year ends. I honestly wouldn’t be surprised if it jumped to 2k and dropped to 1k. I honestly would like it to sit and firm a nice base around 1k for at least 6 months but It’s one of the most volatile and manipulated stocks in history.Originally posted by chico2663Bought tsla at 1500 and immediately drops.Comment -

navyblue81SBR MVP

- 11-29-13

- 4142

#6545Good news on AZN vaccine. Not showing much in the way of the stock market yet, but should over time. I’d expect a slow rise as the week goes on.Comment

Search

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code