anyone jumping into the humblepay etx?

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

allabout the $$$SBR Hall of Famer

- 04-17-10

- 9843

#9661Comment -

Legions36SBR MVP

Legions36SBR MVP- 12-17-10

- 3032

#9662Hello, this is the first year having to deal with stock taxes. Is there anything I need to know to put into turbotax? Some dividends and a few trades here and there. I have the forms from Merrill Edge and Robinhood. I'm pretty good when it comes to turbotax and inputting stuff, just figured I get some info from you guys in here who are pretty good at stocks. Thanks!!!Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#9663I used the Turbo Tax for the last time maybe 15 years ago, now I just have too much stuff going on from year to year to utilize it, but I'm pretty sure that the software will get all the info it needs from you're broker automatically.Originally posted by Legions36Hello, this is the first year having to deal with stock taxes. Is there anything I need to know to put into turbotax? Some dividends and a few trades here and there. I have the forms from Merrill Edge and Robinhood. I'm pretty good when it comes to turbotax and inputting stuff, just figured I get some info from you guys in here who are pretty good at stocks. Thanks!!!Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#9664Slurry, you seem to know a lot about Gold.

What do you think of NGD?

I can see from the chart that after it crashed in 2008, we saw a steady climb all the way to a high in 2011. I'm not sure if it had a reverse split or anything like that, I don't know how to check that.

But I do wonder what your favorite gold plays are considering inflation will be high the next couple years.Cause Sleep is the Cousin of DeathComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#9665i know you're asking Slurry not me but just know that any chart you look at it that is worth its weight in salt will have traditional splits or reverse splits already accounted for so the chart should be an accurate indicator of its trend lines either way, historically.Originally posted by Goat MilkSlurry, you seem to know a lot about Gold.

What do you think of NGD?

I can see from the chart that after it crashed in 2008, we saw a steady climb all the way to a high in 2011. I'm not sure if it had a reverse split or anything like that, I don't know how to check that.

But I do wonder what your favorite gold plays are considering inflation will be high the next couple years.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#9666Ok the end of the month happened this week and its time to share what all of my longer than a scalp trades are doing. Lets start with the stuff I plan on eventually holding for more than a year.

AQB AquaBounty Tecnologies

This company fish farms a North Atlantic Salmon Frankenfish they call AquaAdvantage Salmon which is a genetically modified fish that grows real quick as opposed to the natural version. They just got over a stock offering where they raised over 100 million bucks to build a state of the art facility in Kentucky. This facility will be able to pump out over 10000 metric tons of fish product every year. That's enough fish to satisfy any killer whale in the neighborhood, even Oprah. They are harvesting their first commercial small batch just this month at a different facility and soon we will be able to purchase the Frankenfish at stores. Here in the U.S. there is pushback from people who don't want to eat an environmentally friendlier version of a farmed fish and thus it may be a battle for acceptance for the American market.

This is a crucial time for Aquabounty as they must prove they can transition from a biotech company that has developed a safe Frankenfish to a meat producer in an efficient manner. In the upcoming year they will build their facility and it is still to be seen if that comes off without a hitch. If however they are able to build the fish farm and disassembly plant along with easing the concerns of the public's apprehension of choking down genetically modified food, they may have the beginnings of a food giant with many cost of the operation tightly controlled in the commodity of fresh salmon.

I'm going to get a hold of some of this stuff and do my own taste test against the real wild caught salmon. All in all however this company is in a wait and see mode for the next year or so.

A look at a 6 month chart with daily candles shows that this equity is in a trading range from $6.00 to $8.15, as shown with the yellow lines I drew on the picture. The descending wedge I drew in with the blue (dashed or "hidden") line proved to be resistance when the price ran up to tag the bell then pull back below the 20 DMA on Thursday to close just above the 9 DMA. The green arrow I drew in represents a break down candle so until and unless the price can move up and above the break down candle high of around $7.50ish, I would not advise buying this stock at this time for a trade. If however the price can move above the various resistance points on the way to the 50DMA and eventually above the $8.15 level, then the price may have room to run.

A look at the Yearly chart with weekly candles shows a few areas where I would be a buyer of more shares, $6.00 and $5.25 are prices I would support if the price came down to that level. I would also add at prices above $8.15.

As the table shows I bought this stock back when it was $9.55, and if it goes below $3.75, I'm out. That seems like a too big of an allowance but when I first started with the stock, it rose to 4 times the original price I paid so the $2000 I have in it now represent previous profit gains I'm willing risk to give this company a chance to grow for the next year. Unless they totally collapse under the weight of the Environmentalist, GMO haters, or the Big Fish Lobbies, I will look the other way for a while waiting for the facilities to be built and re-access then.TOTALS ALL STOCKS 2021 89,259.70 -12,239.70 -2,950.70 2,284.00 MONTH MAR IN 10,623.70 ALLOWED -1,706.70 GAIN SO 392.30 TOTAL 19.25 TOTALS PER STOCK AQB PLAY 1,910.00 LOSS -1,160.00 FAR -562.00 GAIN 2,298.00 MONTH MAR 0.00 0.00 0.00 0.00 . DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSTOP LOSS/

BUY MORE

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS02/05/21 12.16.00 AQB 200 9.55 1,910.00 3.75 -1,160.00 -60.73% 6.74 -562.00

EVFM Evomfem

Evofem are the makers of Phexxi or better know as Magi-Lube which is a female birth control that is non-hormonal and as protects against some sexually transmitted diseases. Basically just squirt some just like a jizz shot in the snatch and she's ready to bang without all of that Maury Povich risk of being the father, or the bitchiness of birth control pills that she probably forgot to take anyways. I'm speculating here, but I hope is comes in AquaAdvantage Salmon, Cherry, Banana, and Bubble Gum flavors.

They just got done raising $30 million so an advertising campaign can get the word out. I'll be monitoring Maury, Springer, any Dateline ID show, and reality shows that feature skanks to see how often and effective the ads are for this one in the coming months. Its go time for this equity and if they don't get their shyt together in the next couple of months, we may have to move on and leave this idea for the trash heap of history.

OK I bought this stock right where I circled in yellow in mid February and the very next day the price moved up $1.50 to $5.53 so I sold it, and got back in just under the $4.00 mark. Ever since then they have been killing by falling like a rock right up until about a week ago when they decided to sell at a discount level of $1.75, 30 million shares, (Yellow arrow). I bought more the whole time with the anticipation of better days and a shyt load more when the stock had another offering. Thursday this stock showed a little life by gaining 15% before ending the week at or near the highs just under the 9DMA. It still has some work to do but I'm going to try and forget I own this for the next few months and check back to see how it is going mid summer. For the short term however it does look like a pretty decent trade opportunity with the stochastic lines (yellow circle at the bottom of the picture) crossing over in the oversold territory and resistance about $0.38 away which for a $2 stock is around almost 20% away.

So I got around $3300 bucks in this thing and considering the climb back down from Mt Everest in the last 45 days, I'm only down a little under $300. I place a stop loss right at $1.25 which will be set to execute after a daily close below and a subsequent opening as below that level.TOTALS ALL STOCKS 2021 89,259.70 -12,239.70 -2,950.70 2,284.00 MONTH MAR IN 10,623.70 ALLOWED -1,706.70 GAIN SO 392.30 TOTAL 19.25 TOTALS PER STOCK EVFM PLAY 3,316.00 LOSS -1,441.00 FAR -286.00 GAIN 324.00 MONTH MAR 2,552.00 -927.00 74.00 0.00 . DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSTOP LOSS/

BUY MORE

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS02/26/21 10.30.46 EVFM 200 3.82 764.00 1.25 -514.00 -67.28% 2.02 -360.00 03/04/21 15.03.30 EVFM 100 3.30 330.00 1.25 -205.00 -62.12% 2.02 -128.00 03/05/21 9.30.24 EVFM 100 2.41 241.00 1.25 -116.00 -48.13% 2.02 -39.00 03/05/21 10.13.00 EVFM 100 2.16 216.00 1.25 -91.00 -42.13% 2.02 -14.00 03/25/21 09.31.54 EVFM 500 1.80 900.00 1.25 -275.00 -30.56% 2.02 110.00 03/25/21 14.58.31 EVFM 500 1.73 865.00 1.25 -240.00 -27.75% 2.02 145.00

So how is gold and gold miners doing you ask?

AU AngloGold Ashanti LTD.

OK AngloGold is a South African based gold miner that produces the 3rd most gold (3.047 million oz) with holdings on several continents. The primarily deal in gold, but like just about all mines they produce other commodities that just happen to come out of the ground. The last year or so they have been tightening up the business by selling off some less successful operations and focusing on building up capabilities and safety standards at the facilities they will continue to hold. I have done a shyt load of work for this company over the last decade and I can see with my own eyes how they have improved from a shyt hole operation to now a top notch facility focused on safety and production. The last earnings report knocked the ball out of the park as all gold miners did making $2.56 per share and paying out a $0.48 dividend. Compare that against Tesla (TSLA) which has a $0.64 per share earning and no dividend at a price that is over 27 times the share cost. Ok I know fundamentals don't mean shyt and this gold miner is proof. They will continue to pound the earnings out even it gold continues down and eventually maybe the investment community will give this sector the love it has earned.

Look at this nightmare of a chart for gold lovers. Since last August when AU put in a high of $38.50, it has been on a steady run down to a range from about $20.00 to $23.00. The $20.00 level represents the "Golden Ratio" number which is usually a real good spot for an expected support level when the Fibonacci retracement mapping is shown. The price has tagged that golden ratio level 2 times lately with the last time being a real boost to the upside. The price has bounced back in the last week to the top of the range. We'll see if there is enough energy to bust out and run a little bit. If so that may signal the consolidation period (Yellow square) to be over for the sector as a whole and time to pile back in for the train ride to higher prices. I don't have my hopes up however because I have seen this several times over the last 8 months only to be rejected just when I thought things are turning around.

Although I sold a little bit from shares I bought last September, I have around $7500 - $8000 invested here that I have been riding down for the last 8 months. Only just this week has the blood started to come back in and show that I am only losing around $300 for my efforts so far. Before that it was looking allot worse. Undoubtedly that is because I bought some more when the price approached the golden ratio level. I'm a buyer again at around the $20 level if it comes back again.TOTALS ALL STOCKS 2021 89,259.70 -12,239.70 -2,950.70 2,284.00 MONTH MAR IN 10,623.70 ALLOWED -1,706.70 GAIN SO 392.30 TOTAL 19.25 TOTALS PER STOCK AU PLAY 9,519.00 LOSS -1,519.00 FAR -327.00 GAIN 0.00 MONTH MAR 0.00 0.00 0.00 0.00 . DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSTOP LOSS/

BUY MORE

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS09/02/20 11.27.15 AU 300 28.01 2,801.00 20.00 -801.00 -28.60% 22.98 -503.00 85 28.51 42.50 1.79% 115 28.57 64.40 2.00% 10/22/20 15.39.11 AU 100 25.50 2,550.00 20.00 -550.00 -21.57% 22.98 -252.00 11/24/20 14.15.24 AU 200 20.84 4,168.00 20.00 -168.00 -4.03% 22.98 428.00

GDX Vaneck Vectors Gold Miners ETF

Vaneck is a basket of a shyt load of the biggest gold miners around. There are around 50 players jammed into this mash up of gold miners and is for the more established players. There is another GDXJ version that is for the juniors or companies are are more speculative or not as developed.

This chart action is best shown on a 1 year chart with daily candle sticks. Its been rough with the ETF making a high last august and since then its been trapped in a downtrend channel with a slow grind down the slurry hole. Take a look at the Fibonacci retracement lines and you can see that maybe things are leveling out at the 50% level. This last week the price moved about the 1st downtrend resistance line and even closed above the 50DMA for the first time in a while. As with the Au gold miner I'm not going to get too excited here just because it looks like there is a chance for a test of the upper down trending channel line and a cross over with the stochastic lines. I can only hope the charts turn around soon, but who knows all of the gold miners have been killing it fundamentally but no one cares. Eventually I think these stocks catch fire and when they do it should be a pretty robust move.

As you can see I have a little under 20 dimes tied up in GDX and given the last couple of days, I'm only down around $750 for my efforts. I've been picking up more and more shares as the price goes down further and further and I will continue to pick up shares at an increasing rate when the price gets to around $27.50. This level would represent the Golden ratio number and the mathematics would tell me to load up so being a math related dude, I'll obey and do it if reached.TOTALS ALL STOCKS 2021 89,259.70 -12,239.70 -2,950.70 2,284.00 MONTH MAR IN 10,623.70 ALLOWED -1,706.70 GAIN SO 392.30 TOTAL 19.25 TOTALS PER STOCK GDX PLAY 19,242.00 LOSS -4,117.00 FAR -762.00 GAIN 0.00 MONTH MAR 4,620.00 -495.00 420.00 0.00 . DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSTOP LOSS/

BUY MORE

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS09/04/20 10.29.46 GDX 50 39.91 1,995.50 27.50 -620.50 -31.09% 33.60 -315.50 09/21/20 10.13.53 GDX 50 40.10 2,005.00 27.50 -630.00 -31.42% 33.60 -325.00 10/22/20 15.50.42 GDX 50 39.20 1,960.00 27.50 -585.00 -29.85% 33.60 -280.00 10/26/20 11.13.22 GDX 50 38.63 1,931.50 27.50 -556.50 -28.81% 33.60 -251.50 11/24/20 14.12.15 GDX 200 33.65 6,730.00 27.50 -1,230.00 -18.28% 33.60 -10.00 03/01/21 13.08.58 GDX 150 30.80 4,620.00 27.50 -495.00 -10.71% 33.60 420.00

NGD New Gold Inc.Originally posted by Goat MilkSlurry, you seem to know a lot about Gold.

What do you think of NGD?I can see from the chart that after it crashed in 2008, we saw a steady climb all the way to a high in 2011. I'm not sure if it had a reverse split or anything like that, I don't know how to check that.

But I do wonder what your favorite gold plays are considering inflation will be high the next couple years.

New gold has 2 mines located in Oh Canada which is one of the safest places to have a mine if you own one. They sold another mine but maintain a 8% claim on that mine from the buying company. Back in November when they reported a $0.12 per share earnings blow out when they where forecasted to remain flat, the stock took off to a recent high of $2.40 which is bucking the trend for gold miners during the same time. They followed that up in February with a $0.04 earning against a $0.02 estimate which relatively speaking is disappointing although they doubled the consensus number. Funny how fundamentals work right, but that is not actually that bad since all of Oh Canada was pretty much closed unless you play professional hockey. The company had to spend money to upgrade their facilities to be more China Virus un-friendly, and operations are cut back so the drop in earnings was easily explained away. Sure they shouldn't have to explain away a doubling of the earnings estimate. If Tesla doubled it earnings to a $1.20 when they report, it would be big news and the stock would go up another $200, but since this is a dirty mine that no one likes, it doesn't get shyt.

Looking at the yearly chart with daily candles it looks just like everything else gold miner related, and charts are typically adjusted for any stock splits. Its pretty much a mathematical thing so while a chart may list a different price for a stock than it actually was at the time, it will be adjusted on a per share basis. It has been consolidating bouncing off the $1.50 level a few times and now it is resting right on resistance of $1.63 with the 20 DMA, 50 DMA, and the 200 DMA just above it all before the $1.80 price. Just like all the other miners, the stochastic lines are oversold and have just crossed so there is hope here. This stock will move with the rest of the group but there is resistance to get through before I would buy it at around $1.90, but that would be a long term purchase. You can buy it here and get out if it goes below the $1.50 level. That's a 8% drop which explains why I don't usually get into a cheapy stock at these levels, but they have been making money just like all the other miners so I would expect good times eventually.

They may even be a can'tidate for a buy out since they are in a very friendly country for mining and the big boys are flushed with cash with the need to acquire more gold reserves. Don't be surprised if this company gets targeted this summer which would be a good thing for the price. I'll keep this one on my radar and if the sector moves up, this might be a good take over speculative play for me, but either way this is a decent miner in a friendly place.

GLD SPDR Gold Trust ETF

OK GLD is pretty much the paper version of gold but isn't actually owning gold itself. The price just very closely follows the gold price. Every year I keep around 50 grand worth in the paper gold, and at the end of the year, I extract $10000 from my account usually largely generated from the profits of owning GLD on the year, then I buy a 5 ounce chunk of gold. Then one day when I take the dirt nap, my kids will get the gold, immediately liquidate into cash and probably have a party and piss on my gravestone but who cares I think it is pretty much what I am required to do for the little fukking bastards. At this point it is the only reason I still look forward to living, just knowing it is keeping those assholes from cashing in on my life's savings gives me a extra boost in the morning right after my wake and bake.

Gold has been going down now for the last 8 months and has arrived at some very substantial support. Within the last 3 weeks the price bounced off of support and it may be that gold finally has found a bottom. Then again if the price of GLD dips below $155ish level, it could spark another selloff and at that point $140 would be on the table. The next few weeks will tell the tale of course. The good news is that it looks like the gold miners are starting to perk up which is normal market action. The miners typically front run the price of gold.

Look at the 3 year chart with monthly closes. The price tops out in August, puts in a doji candle which signals a directional change then falls back away in a down trending channel. The MACD has just turned negative for April after retreating as well but the last candle only represents 1 day so far, The stochastic indicator is declining with a pretty wide spread between the %k and %d lines. Also the lines themselves are still pretty far away from being oversold. The only good thing about this chart is that the price came back to the 20 Month Moving Average and close right at that magnetic level. Under normal market conditions the price should see a reaction when coming back to test the 20 period moving average on any chart the first time down. This chart also shows the price has quite a bit more to lose if the Fibonacci thing is going to get to the Golden Ratio I see touted about for this indicator. It looks like any gold buying around this time would be from trading on a short term basis on a monthly chart, so a couple of months time frame unless your a stacker like myself.

So from the table I am willing to buy around 200 more shares if and when the price gets down to the $153.27 level. I just keep doing this until I'm broke I guess, and since most of my position is still cash, I have a few more buys in me so I hear some people think the price will come back to the $1300 level this year, ouch. That would totally hurt, but then again I think of the kids and what a bargain it would be considering the country is plopping down a couple of trillion every other month and eventually things will go my way.TOTALS ALL STOCKS 2021 89,259.70 -12,239.70 -2,950.70 2,284.00 MONTH MAR IN 10,623.70 ALLOWED -1,706.70 GAIN SO 392.30 TOTAL 19.25 TOTALS PER STOCK GLD PLAY 49,460.00 LOSS -3,479.00 FAR -866.00 GAIN -357.25 MONTH MAR 0.00 0.00 0.00 0.00 . DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSTOP LOSS/

BUY MORE

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS11/24/20 13.39.32 GLD 100 169.60 16,960.00 153.27 -1,633.00 -9.63% 161.98 -762.00 02/26/21 3.58.22 GLD 200 162.50 32,500.00 153.27 -1,846.00 -5.68% 161.98 -104.00

SLV Ishares Silver Trust ETF

So SLV is pretty much the same thing as GLD except for silver. I think that the price of silver is a little misleading however, if you try actually buy a physical chunk of the stuff, the premiums are to the point where it just makes the whole thing a waste of time. Silver is going to be used more and more in the green energy field as the properties of this stuff is needed for batteries and other high end electrical storage needs so when you try and look at what companies are using it and how much of it they are using, things get murky to the point where my tin foil hat is sending a signal of some bullshyt stories.

So Silver ran on up to a multi year high and have been hanging out eating time of the clock just waiting to move higher. The yellow lines make a bull flag pattern and over the coming months I have more confidence that this metal will continue up.

A look at my table shows I only have a little less than $2500 in this, so over the coming weeks and months, I think I will just about triple my holdings and try to buy the dips. I just missed a chance last week so I'll have to wait and see if the price continues to move up from here, or gives me another chance at the $22 level.TOTALS ALL STOCKS 2021 89,259.70 -12,239.70 -2,950.70 2,284.00 MONTH MAR IN 10,623.70 ALLOWED -1,706.70 GAIN SO 392.30 TOTAL 19.25 TOTALS PER STOCK SLV PLAY 2,361.00 LOSS -239.00 FAR -46.00 GAIN 0.00 MONTH MAR 0.00 0.00 0.00 0.00 . DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSTOP LOSS/

BUY MORE

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS01/22/21 10.03.24 SLV 100 23.61 2,361.00 21.22 -239.00 -10.12% 23.15 -46.00

Next lets see how the short play in XLF is doing so far.

FAZ Direxion Shares ETF Trust Daily Financial Bear

OK so the FAZ is a 3x bear ETF of the financial group it closely but not exactly mirrors the XLF. I decided to short the XLF last week when it came down off the high of $35.29. I got a little boost when a hedge fund went belly up and retarded the uprising of the financials last week. The banks will fight back however and I suspect they will keep on buying their own stock over the coming month when the SLR waver that was given to them expires. I don't plan on having it that long so I'm kind of banking on the price to fall with the rest of the market here in the coming weeks.

So look at the last week and there is a bull flag type of thing going on with the price hanging out above the 20 DMA so when it does bounce up again probably on Monday, I'll plop down another portion of my short position on the FAZ. If the daily price closed above the high, I stop an sell the FAZ then move on but until then I'm keeping the faith.

TOTALS ALL STOCKS 2021 89,259.70 -12,239.70 -2,950.70 2,284.00 MONTH MAR IN 10,623.70 ALLOWED -1,706.70 GAIN SO 392.30 TOTAL 19.25 TOTALS PER STOCK FAZ PLAY 3,451.70 LOSS -284.70 FAR -101.70 GAIN 12.25 MONTH MAR 3,451.70 -284.70 -101.70 12.25 . DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSTOP LOSS/

BUY MORE

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSSTRADE

FINISHED03/26/21 9.38.00 FAZ 35 34.88 35 35.23 12.25 1.00% 12.25 1.00% Y 03/26/21 10.24.28 FAZ 35 34.30 686.00 31.67 -52.60 -7.67% 33.50 -16.00 15 35.23 13.95 2.71% N 03/26/21 12.32.51 FAZ 35 34.58 1,210.30 31.67 -101.85 -8.42% 33.50 -37.80 N 03/26/21 13.57.51 FAZ 35 34.76 1,216.60 31.67 -108.15 -8.89% 33.50 -44.10 N 03/26/21 15.58.59 FAZ 10 33.88 338.80 31.67 -22.10 -6.52% 33.50 -3.80 N

So I don't have too much into this play just yet, if it goes to plan I will probably have between $7500 and $10000 to work with before it is all over.

So this was my attempt at trying to make the longest post ever on SBR. I know your fingers are getting sore from hitting the scroll wheel when zooming by. The idea was to see just how much a single post could take and so far it looks like its gonna handle it. I might try to overload it next month again if this one works out for another attempt.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#9667Watch out the rally is showing signs of being real tired. I'm looking for turn around Tuesday to be in full effect here and it may spark a leg to the downside for awhile.Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#9668Has anyone invested in anything related to the metaverse?Cause Sleep is the Cousin of DeathComment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#9669Were you the one that mentioned this stock last year?Originally posted by allabout the $$$anyone jumping into the humblepay etx?

Quite the impressive winner. It was at a pre split price around .85 last I checked, last week. That's up from .15 last year.

Is their product for real??Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30064

#9670Tech and the S&P really wanted to go down yesterday AND today but were held in place by -- the Fed

in my opinion. It was an invisible bid. We have earnings coming, and another (likely dovish) Fed meeting.

The macro data is going to keep improving. This action was totally artificial but that makes it even more important.

With Coinbase and eventually Robinhood IPOs, they may hold this market up for 1-2 more months.

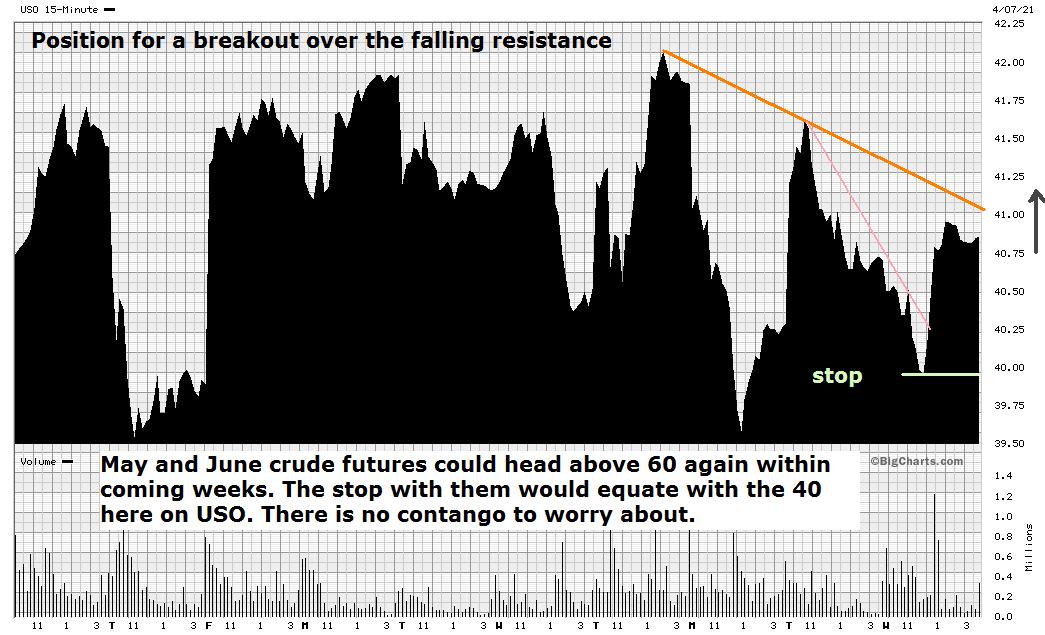

So I am currently in USO calls. I like crude at only 59/bbl going into May and more demand.

I was also considering MPC in the low 50's.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#9671not trying to be a dikk but has the sky fallen yet? i didn't think so. we still have room to run............

BULL FOR LIFE.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30064

#9672USO Comment

Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#9673Hmmmm.Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#9674I would not buy USO.

Crude is being manipulated and rather successfully for now. But it's a very fragile alliance. The Saudi's Russians and Mexicans are who you're betting on when you buy USO. You'll do better with PAA.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30064

#9675I'm only on May calls. Crude is down probably temporarily due to Covid news in India, France. That can change in a couple weeks. Plus the Iran talks. That is also fluid situation as is Ukraine battles. Long term you are right though if you were going to buy stock to hold. USO is a trading position only for a 2-3 dollar rise in crude.Originally posted by RoyBaconI would not buy USO.

Crude is being manipulated and rather successfully for now. But it's a very fragile alliance. The Saudi's Russians and Mexicans are who you're betting on when you buy USO. You'll do better with PAA.

Plus I think Ukriane blow up is highly likely.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#9676The volatility or lack of it, is killing me. I need some movement, any kind up or down. Something has to happened soon or I will go crazy waiting.Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#9677I invested in AZFL at half a cent. Did well today and past few. Mexico about to legalize weed federally. This will shoot up. Still under 1 cent. Think it can hit 50 cents in about a year.Cause Sleep is the Cousin of DeathComment -

packerd_00SBR Posting Legend

- 05-22-13

- 17827

#9678Anyone else buy into BCE Inc.?Comment -

CanuckGSBR Posting Legend

- 12-23-10

- 21978

#9679Lot of buzz around NY mobile wagering. Wont likely be a thing until 2022. So much red tape involved.

PENN feels undervalued to me at anything under $120

So many states going through their budgets and will be including sports betting/casino. Only a matter of time until PENN/Barstool enter 5-10 more states in the next 1-1.5 years.

Keep an eye on the SCR as well. It's dropped a lot since the reverse split but Canada should have single game betting by the fall and they will be first in line to offer wagering.Comment -

rm18SBR Posting Legend

- 09-20-05

- 22291

#9680I bought Roblox huge when it came out thought could get rich quick made 13% in 6 days and sold most though so not horrible.Originally posted by Goat MilkHas anyone invested in anything related to the metaverse?Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#9681What do you think about FUBO? Seems like there's so many options to choose from now.Originally posted by CanuckGLot of buzz around NY mobile wagering. Wont likely be a thing until 2022. So much red tape involved.

PENN feels undervalued to me at anything under $120

So many states going through their budgets and will be including sports betting/casino. Only a matter of time until PENN/Barstool enter 5-10 more states in the next 1-1.5 years.

Keep an eye on the SCR as well. It's dropped a lot since the reverse split but Canada should have single game betting by the fall and they will be first in line to offer wagering.Cause Sleep is the Cousin of DeathComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#9682We need Chico's take on that one. He's traded the shitt out of it the past year-plus.Originally posted by Goat MilkWhat do you think about FUBO? Seems like there's so many options to choose from now.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#9683enjoy the melt up, Brothers!Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#9684Going thru some stuff right, so not trading much except for alt coins given the bull market and less attention required.

Only thing I bought up recently is Tattooed Chef, TTCF, they make plant based frozen meals. Just building a position. Balance sheet is great, growth is great and food is great. Next earnings in June shld be blowout. Expanding products to veggies and fake meat, currently in Costco & Target, expanding to Walmart and grocery stores nationally. I am pretty judicious about food companies and really only have Jack in the Box and Cheesecake Factory bc I like their products. Buddha, Hemp and Burrito Bowls I tried were all delicious, and I usually hate frozen meals. I started position at $19 and hoping to add more between $15-$18.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#9685*almost* every household name in cyclicals, financials, tech, you-name-it, is 90%+ safe to open a small entry position in right now IMO. earnings are going to crush it across all sectors and lift the market substantially. and if this does not happen or some mini black swan swims in, AVERAGE DOWN on the small entry position incrementally.

just my opinion. if it's a new position for you that is within ~12% of the all time high, open very small. if it runs up from you, GREAT!! if it pulls back ~10% or more from your buy point, add some shares !!Comment -

RoyBaconBARRELED IN @ SBR!

- 09-21-05

- 37074

#9686You nailed that Nat gas trade late last year.Originally posted by SnowballI'm only on May calls. Crude is down probably temporarily due to Covid news in India, France. That can change in a couple weeks. Plus the Iran talks. That is also fluid situation as is Ukraine battles. Long term you are right though if you were going to buy stock to hold. USO is a trading position only for a 2-3 dollar rise in crude.

Plus I think Ukriane blow up is highly likely.

I've built a decent size position in PAA and ET. Flow has dramatically improved and price is up from $0 to $60. The pipes and midstreams should show big time increases compared to the covid quarters.Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#9687You guys ever heard of Clubhouse? Look out for that IPO. I think it's going to be a major player in the social media game.Cause Sleep is the Cousin of DeathComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#9688There’s talk of Twitter acquiring Clubhouse, Agora;API is the real time software platform that services clubhouse, so if you believe in clubhouse just start buying APIOriginally posted by Goat MilkYou guys ever heard of Clubhouse? Look out for that IPO. I think it's going to be a major player in the social media game.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#9689So the QQQ, and SMH have the look of just hanging around building up the stones to push to new highs. XLF has that look as well, IWM looks like the small pullback phase from a couple of days this week is over and it too has resumed upward. The SPY just creeps along ever so slowly up towards the 410 level. We are in full on melt up. We don't really even get small intraday pullbacks. Its hard to pick a loser in this phase. Of course there is no volume either but that the way it goes.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#9690So this morning with the entire market in slow mo melt up mode, I took another look at my XLF short trade and the chart is telling me to stop already. We have a bull flag situation with the price just hanging out right under the high gaining the stones to pop to new highs. Today, I'm going to completely switch my position on the FAZ to the FAS for upcoming week. The banks start to report next week and I'm sure they will be as good as expected or better. At least that is what the market chart is telling me.

So its a small loss in the XLF short trade and a switch to the long side for me.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#9691Anybody think they aren't playing with the numbers of employment this morning by delaying the numbers that are now 15 minutes late?Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30064

#9692Pot Stocks for 4/20 short squeeze: SNDL, OGI, CRON.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#9693That was an entire week of watching paint dry. So was last week by the way. Maybe the banks coming in with earnings next week will shake things up a little bit.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#9694nothing but sunny skies ahead, Boys. earnings season (overall) will be a smash but if you decide to "go away in May" you will very likely be selling into buying and will lose potential profits heading into June. there is simply too much money and credit out there waiting to buy your equities............Comment -

PlayzDontSBR High Roller

- 01-19-21

- 112

#9695the bulls are runnin' wild hope this trend continuesComment

Search

Collapse

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code