Like I indicated earlier, the stimulus deal isn't going anywhere until the market has a sell off. The Trumpster is going to sign some executive orders over the weekend, and that will probably provide some passivation (seems like the right term here even though it is typically thought of in metallurgical terms). In the end however there will need to be a deal.

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

Slurry PumperSBR MVP

- 06-18-18

- 2811

#6931Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#6932Sold Tesla bought more appleComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#6934Btfd

ayxComment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6935TRVN approved.

Going to spike Monday.Cause Sleep is the Cousin of DeathComment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6936OLI might be worth 1 billionCause Sleep is the Cousin of DeathComment -

BigJaySBR MVP

- 01-14-12

- 3485

#6937TRVN still has a lot of upside I think.

I first learned about it here late 2018.

I’m averaged in at .68 it’s at $2.30 today up from .49 in March and up about 100% in the past six weeks.

PFDUA coming up on 8/7. Info below. Missed out by one vote in 2018.

https://www.trevena.com/pipeline/iv-oliceridine

I posted this a couple of weeks ago. FDA approval AH today. Spiked 50%.

This is the longest I’ve ever held a stock. Had to ride some insane SL raids but I didn’t sell a share pre-decision.

I think there’s still room for gains as TRVN has several other irons in the fire, including an upcoming COVID trial.Comment -

BigJaySBR MVP

- 01-14-12

- 3485

#6938I didn’t see your post before I posted.

I’m not afraid to admit I’m in uncharted waters here. Definitely want to make a nice profit with what I’ve held, but I’ve also seen bio stocks gain a lot after approved, only to see sharp drops a day or two later.

This stock has definitely been manipulated, especially the last few weeks.

Wondering if anyone who’s followed it had any sound advice. Should I be afraid of dilution if it gets bought out or merges? I’d hate to get out at 5ish Monday, even though that would be an incredible profit, only to see it boom to 10, 15 or even 20 in the next few weeks.

Thanks for anyone who has some adviceComment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6939I've been burned on a lot of biotechs for holding too long so I don't know. I've held TRVN for like 2 or 3 years, I bought at around 2 bucks, then bought again at around 60 cents. Don't even have many shares -- like 1500. Chump stuf compared to you I'm sure. But OLI has a big place imo in hospitals and I don't think the FDA would so easily approve an opiod during this climate (not referring to corona).I didn’t see your post before I posted.

I’m not afraid to admit I’m in uncharted waters here. Definitely want to make a nice profit with what I’ve held, but I’ve also seen bio stocks gain a lot after approved, only to see sharp drops a day or two later.

This stock has definitely been manipulated, especially the last few weeks.

Wondering if anyone who’s followed it had any sound advice. Should I be afraid of dilution if it gets bought out or merges? I’d hate to get out at 5ish Monday, even though that would be an incredible profit, only to see it boom to 10, 15 or even 20 in the next few weeks.

Thanks for anyone who has some advice

I'm also wondering if I should sell on maybe Monday night/Tuesdayish, and see if it drops and get back in. But I fear what you do. Could be 12 bucks or so within a few weeks/months.Cause Sleep is the Cousin of DeathComment -

BigJaySBR MVP

- 01-14-12

- 3485

#6940Goat, I went back and looked at the thread about penny stocks when I first started trading and you were the one who recommended it, along with a few others. I think TRVN and SIRI were the two I bought. Ended up with 11,800 shares of TRVN total, buying when the price dipped, and didn’t sell a single one through approval.I've been burned on a lot of biotechs for holding too long so I don't know. I've held TRVN for like 2 or 3 years, I bought at around 2 bucks, then bought again at around 60 cents. Don't even have many shares -- like 1500. Chump stuf compared to you I'm sure. But OLI has a big place imo in hospitals and I don't think the FDA would so easily approve an opiod during this climate (not referring to corona).

I'm also wondering if I should sell on maybe Monday night/Tuesdayish, and see if it drops and get back in. But I fear what you do. Could be 12 bucks or so within a few weeks/months.

I appreciate the advice. I’ll probably take some profits Monday.Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#6941Up to 268. A share deciding if I am going to ride to 300 or dump. I have sold some so down to 65 shares. I feel we are going to be into another mess. There is a thing called c.l.o. that shit is going to come to roost.Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#6942Tried a penny called haon. Big mistake.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#6943250 was last break out so projecting it’s the new support but we’ll see how this Instagram reels sentiment plays out. I still think possibly 300-350 a share by end of year but it’s gonna be bumpy.Comment -

IonaSBR MVP

- 01-08-10

- 4244

#6945Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#6946How will executive order to print money affect the market? Guessing we start seeing more all times highs this week if that happens. Calls on DIA and SPY?Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#6947He signed three, extending unemployment benefit of $400, but making tapped out states pay for 25% of it. He also declared a payroll tax holiday and moratoriums on evictions and student loans.

It might not exactly print money, but it certainly sets the stage.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#6948Alright I was on vacation last weekend so I didn't review all of my stock holdings. Sounds kind of wild saying I was on vacation because it isn't like I have a job or anything but whatever. Let's get into it.

Right now I only have 2 stocks that I am holding so just about all of these have been closed out.

AU: AngloGold Ashanti Limited

Well they reported Friday morning and I think they beat the estimate and the stock went down hit my stop price and now I'm out. With this stock it seems like a little more than a pullback so it may be a while before I jump back in this one.

I made a few changes to my spreadsheet and they just don't present well when translated to this format, but at the top of the page, I have the overall totals listed above the stock's totals for the same category, so for instance, for the IN PLAY section, I have a total of $13,880.25 in stock holdings, but the lower number of 0.00 represents that I currently have no AU stock holdings.TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK AU 0.00 0.00 0.00 1,896.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/17/20 11.59.56 AU 100 32.31 100 36.57 426.00 13.18% 426.00 13.18% 07/30/20 12.11.46 AU 200 32.71 200 30.83 -376.00 -5.75% -376.00 -5.75%

AUY: Yamana Gold Inc

I sold a little bit about a week ago, but then on Friday the stop price was triggered and I'm out with this one as well. Friday's close of 6.48 is just about on the 20 DMA and if it can hold 6.37 next week, I think I'll jump back in with 500 shares.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK AUY 0.00 0.00 0.00 789.90 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.16.25 AUY 500 5.11 144 6.51 201.60 27.40% 664.40 26.00% 356 6.41 462.80 25.44% 07/08/20 09.31.15 AUY 200 5.67 75 6.41 55.50 13.05% 69.25 6.11% 125 5.78 13.75 1.94% 07/31/20 9.30.02 AUY 450 6.46 450 6.51 22.50 0.77% 22.50 0.77%

AXP: American Excess

I've been short this on for the last month or so and it was looking like it was going to start working for me, but then on Friday, the Financials took off while the rest of the market floundered around, so the stop price was triggered with this on as well.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK axp 0.00 0.00 0.00 -723.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 10.55.15 AXP -100 96.93 100 97.99 -106.00 -1.09% -106.00 -1.09% 07/08/20 09.30.11 AXP -100 91.82 100 97.99 -617.00 -6.72% -617.00 -6.72%

AZN: AstraZeneca PLC

I bought this one on the rumor of their announcement for a vaccine, and it worked for that day then it has been in consolidation mode since. I'm gonna keep an eye out for this one and look for the right setup for me to jump back in.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK AZN 0.00 0.00 0.00 490.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/17/20 10.48.47 AZN 200 58.00 200 60.45 490.00 4.22% 490.00 4.22%

F: Ford Motor Company

I had this one for a couple of weeks before it reported and since then it has been holding up. I just don't like the stochastic chart and my chart shows that money is not going into the stock. I'll wait for the right stochastic signal along with confirmation of some new cash coming into the stock.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK F 0.00 0.00 0.00 440.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/15/20 09.30.07 F 2000 6.53 2000 6.75 440.00 3.37% 440.00 3.37%

GDX: VanEck Vectors Gold Miners ETF

This gold mining ETF has been one of my favorites the last month but it is pulling back a little bit, I plan on buying a little if it comes back to $41.99 and holds that support level. It is way overbought, but then again it is related to gold so as all the miners have been killing it with the 2nd quarter numbers coming in when gold was at $1750, I would expect this ETF to continue the northward march in short order.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK GDX 0.00 0.00 0.00 1,733.20 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.57.34 GDX 70 34.70 70 42.65 556.50 22.91% 556.50 22.91% 07/07/20 11.54.02 GDX 100 37.57 100 42.65 508.00 13.52% 508.00 13.52% 07/08/20 09.30.25 GDX 100 38.44 30 43.08 139.20 12.07% 433.90 11.29% 70 42.65 294.70 10.95% 07/22/20 12.27.14 GDX 50 41.84 50 43.08 62.00 2.96% 62.00 2.96% 07/31/20 9.30.04 GDX 240 42.36 240 43.08 172.80 1.70% 172.80 1.70%

GLD: SDPR Gold Trust

This one has been on a rocket ride the last couple of weeks and on Friday, it finally started to pull back so my stop price was triggered. I have an advanced order in now at $185 were I think there is support, but somehow that seems like it may not get there now with the President signing a bunch of executive orders that keep the spending going for the foreseeable future. I want to be in this stock so I may have to buy right at the opening on Monday if the price of Gold is jumping up. Friday saw the gold price come down around $50 bucks. Is that enough of a pullback, yeah it might be, so the best scenario would be for the price of the stock to come back to $185 let me buy at support then shoot up to right around $193.80 and come back a little while making a higher low so I can get even more of it before we go for another ride up to $200+. We'll see either way I don't see the collapse of gold prices or silver for that matter until after the election at the least and probably well after the new year.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK GLD 0.00 0.00 0.00 1,172.13 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS06/24/20 15.23.14 GLD 15 166.09 15 182.47 245.70 9.86% 245.70 9.86% 07/08/20 09.54.37 GLD 10 170.11 10 182.47 123.60 7.27% 123.60 7.27% 07/17/20 10.00.00 GLD 10 169.84 10 182.47 126.30 7.44% 126.30 7.44% 07/21/20 10.31.20 GLD 15 172.73 1 190.50 17.77 10.29% 154.13 5.95% 14 182.47 136.36 5.64% 07/22/20 12.24.37 GLD 15 175.64 15 190.50 222.90 8.46% 222.90 8.46% 07/31/20 9.30.06 GLD 50 184.51 50 190.50 299.50 3.25% 299.50 3.25%

KL: Kirkland Lake Gold

This one reported so I sold a little, then bought it back and it went back up for a while, but now it too is pulling back. It is almost at support where I plan on jumping back on board with a few shares at $51.51. That level also represents the 20 DMA as well so that would be another entry point for me.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK KL 0.00 0.00 0.00 812.50 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/08/20 09.30.05 KL 100 45.05 50 49.25 210.00 9.32% 420.00 9.32% 50 49.25 210.00 9.32% 07/31/20 9.30.12 KL 100 51.96 100 53.70 174.00 3.35% 174.00 3.35%

LMT: Lockheed Martin

This is pretty much my entire portfolio now. I bought more on Friday and set the stop loss at $376.49 which will probably be re-examined after Monday's close.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK LMT 13,321.25 -144.10 175.45 1,830.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS08/06/20 14.11.46 LMT 25 378.27 9,456.75 376.49 -44.50 -0.47% 385.62 183.75 08/07/20 13.46.04 LMT 10 386.45 3,864.50 376.49 -99.60 -2.58% 385.62 -8.30

NFLX: NetFlix

This stock reminds me of the wife, everything is set up to go down, but it just refused to do so. The generous stop price was hit so I'll go elsewhere and put some money to work.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK NFLX 0.00 0.00 0.00 -638.75 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/23/20 12.08.11 NFLX -25 483.00 25 508.55 -638.75 -5.29% -638.75 -5.29%

RIG: Transocean Ltd.

I broke the rules and bought this on before they reported and after they beat earnings estimates and made $.00 a share as opposed to -$.27 the rewarded me by dropping 10 percent the next day. So just like a miner, when they get in a hole, they dig deeper so I bought another round and it shot up to $2.50, which for you math guys, is almost 25% in 2 days. That is speculation stock rises and prices there which is weird for me to think of from a giant oil drilling company. As it turns out the stock price has been beaten down due to the fact that it takes allot of money to develop methods of drilling for oil in deep water environments, so they have more debt than most, and the price of oil is too low for them to make a killing. When oil prices start getting up to around $60 a barrel (if it ever gets back there), this will be a big mover. For now, they are relegated to near penny stock prices. It came back down, and I sold at $2.25, but I think this sector is about to see the rotational light and I'm back in it when it bounces off the 20 DMA at $2.15, and I'm piling on after it breaks $2.65.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK RIG 0.00 0.00 0.00 1,200.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/28/20 10.31.00 RIG 5000 2.21 5000 2.25 200.00 1.81% 200.00 1.81% 07/30/20 10.23.16 RIG 5000 2.05 5000 2.25 1,000.00 9.76% 1,000.00 9.76%

SQQQ: Proshares UltraPro Short QQQ

OK I started to collect this in small quantities due to its 3X relationship to the QQQs in the belief that the market will be moving down in short order, Primarily due to the stimulus bill being held up by congress. We all know the congress will bicker over the deal until the stock market chimes in. It is almost like a spoiled child, the market is addicted to free money and will scream if it doesn't come right quick. This weekend the Trumpster may have toss a wrench into the way things always work on wall street by granting the freebees outright by executive order. I'm not even sure he can do this, but either way it is a great political move to put Chupracabra and Crying Chuck in a little box. Since the White House tipped their hat and told us they were going to do this, I sold 2/3 rds of the position before the bell on Friday. Lets see how it plays out. If they dispute the free cash and don't get a stimulus bill, you can bet the market will head south just enough to scare the shyt out of the people in charge.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK SQQQ 559.00 -159.00 -5.00 -76.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/30/20 15.59.36 SQQQ 100 6.27 100 5.58 -69.00 -11.00% -69.00 -11.00% 08/03/20 15.50.29 SQQQ 100 5.69 100 5.62 -7.00 -1.23% -7.00 -1.23% 08/05/20 13.13.37 SQQQ 100 5.59 559.00 4.00 -159.00 -28.44% 5.54 -5.00

XLF: Financial Select Sector SPDR Fund

I've been waiting for this beaten down sector to pop for a few weeks. I think I was the only one who thought it would need to pop so that the rest of the market can follow but it moved down and stopped me out. Then on Friday while the rest of the market was wallowing in decline, the rotation finally started. I will probably jump back in once I see how things shake out on Monday.

TOTALS ALL STOCKS IN

PLAY13,880.25 ALLOWED

LOSS-303.10 GAIN

SO FAR170.45 TOTAL

GAIN-366.02 TOTALS PER STOCK XLF 0.00 0.00 0.00 -2,029.00 STOCKS DATE TIME STOCK

TICKERSHARES BEGIN

BUY/SELL

PRICETOTAL

IN PLAYSET

STOP LOSS

PRICEALLOWABLE

LOSS TOTALALLOW

LOSS

% TOTALTODAY'S

CLOSE/END

PRICEGAIN/LOSS

SO FAREND

SHARESEND

BUY/SELL

PRICEEND

GAIN/LOSSEND

%

GAIN/LOSSTOTAL

GAIN/LOSSTOTAL

%

GAIN/LOSSPARTIAL 1

SHARESPARTIAL 1

BUY/SELL

PRICEPARTIAL 1

GAIN/LOSSPARTIAL 1

%

GAIN/LOSSPARTIAL 2

SHARESPARTIAL 2

BUY/SELL

PRICEPARTIAL 2

GAIN/LOSSPARTIAL 2

%

GAIN/LOSSPARTIAL 3

SHARESPARTIAL 3

BUY/SELL

PRICEPARTIAL 3

GAIN/LOSSPARTIAL 3

%

GAIN/LOSS07/16/20 15.35.59 XLF 250 24.12 250 23.71 -102.50 -1.70% -102.50 -1.70%

That's it. Next week will be very interesting with the political haggling and the market about to reach the all time high. We've come to close for it not to happen, but then again I think we are in for a major collapse again of epic proportions. There are allot of indicators I can point to that agree with me but as usual it is difficult to pin point when it will happen and what the catalyst will be. I just know it will happen eventually, and the S&P will revisit the 2200 level at least and maybe even lower.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#6949This week looking at companies to buy the higher lows.

BABA; Alibaba: yeah I said it, buy the Chinese company. Not any company but the Chinese company with biggest market share in cloud and e-commerce. Expect it to get beat down further and anything below 240 I’m back in adding shares. You’re not gonna wanna hear this but Chinese economy is gonna dwarf US next 10 years so just follow the smart money.

QSR; restaurant brands: Popeyes chicken. nuff said. If that’s not enough it’s currently at the bottom of a beautiful box.

SHAK; Shake shack: just had a chance to try this burger after hearing about it for a few months. Spoiler....It’s pretty fukin good. Fries aren’t great, the shake is awight. But the convenience and ambience is on point and can see this one blossoming into a 5x as I believe people are fed up with Macdonald’s and prefer a more succulent burger. I also own jack in the box from the dip back in March and that’s been climbing nicely. When is in&out gonna ipo?

Alteryx; AYX; this dip is either very telling of an upcoming tech drop off or a retard hit the wrong button. Either way this is a buy the dip and 50% of my cash is going here.

CDN’s->Cloud flare; NET/Fastly; FSLY/Limelight;LLNW; Akamai; AKAM: take your pick, most of these that’s lagged but personally cloudflare and Limelight are undervalued. fastly is at at a good entry for swing trade.

Illumina; ILMN: I’m already long here & read they are trying to acquire long genome reading company as they currently only do short segment genome reading. But they are still the top dog in gene reading technology and will gladly add this dip on the long.

watchlist:

tesla: watching for <1300

fb: likely move down or up +20 points

SE: < 115

Msft: <205

overall hoping for a market crash response to stimulus posturing to catch some sales but I really see some rotations into beaten down sectors like energy and financials this week.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#6950Robin don't you worry about owning anything Chinese w the escalating tensions again?

Instead of QSR how about YUM where u get:

Taco bell

Pizza hut

KFC

The habit burger

MCD is so much more than burgers bro and has such a loyal following and zillions of locationsComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#6951Currently these are prices I like at brands I personally believe in. Personally I go to MCD to get a morning crappy coffee (IF I don’t have time to make my own or stop at Peet’s or SBUX) and occasional a breakfast sammich. So, I think I understand their offerings. I don’t like Taco Bell or Pizza Hut, but I live in dc and places like district taco, brick oven pizzas are plentiful and I haven’t been to either of those franchises in years. I guess I am just following my gut..so to speak.Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6952BurgerFi is a much better burger than Shake Shack, imo. Think Shake Shack is gonna get beat out by them in 2/3 years.This week looking at companies to buy the higher lows.

BABA; Alibaba: yeah I said it, buy the Chinese company. Not any company but the Chinese company with biggest market share in cloud and e-commerce. Expect it to get beat down further and anything below 240 I’m back in adding shares. You’re not gonna wanna hear this but Chinese economy is gonna dwarf US next 10 years so just follow the smart money.

QSR; restaurant brands: Popeyes chicken. nuff said. If that’s not enough it’s currently at the bottom of a beautiful box.

SHAK; Shake shack: just had a chance to try this burger after hearing about it for a few months. Spoiler....It’s pretty fukin good. Fries aren’t great, the shake is awight. But the convenience and ambience is on point and can see this one blossoming into a 5x as I believe people are fed up with Macdonald’s and prefer a more succulent burger. I also own jack in the box from the dip back in March and that’s been climbing nicely. When is in&out gonna ipo?

Alteryx; AYX; this dip is either very telling of an upcoming tech drop off or a retard hit the wrong button. Either way this is a buy the dip and 50% of my cash is going here.

CDN’s->Cloud flare; NET/Fastly; FSLY/Limelight;LLNW; Akamai; AKAM: take your pick, most of these that’s lagged but personally cloudflare and Limelight are undervalued. fastly is at at a good entry for swing trade.

Illumina; ILMN: I’m already long here & read they are trying to acquire long genome reading company as they currently only do short segment genome reading. But they are still the top dog in gene reading technology and will gladly add this dip on the long.

watchlist:

tesla: watching for <1300

fb: likely move down or up +20 points

SE: < 115

Msft: <205

overall hoping for a market crash response to stimulus posturing to catch some sales but I really see some rotations into beaten down sectors like energy and financials this week.

I like CloudFare, but don't know enough about website building/tech. I believe it's one of the top though from what I've seen.

Fastly is overvalued. It's pretty obvious. That's why it keeps coming down after it crosses 100.

People were buying Nikola at like 70 a share, and they don't even have a product lol.

Volxwagon is partnering with Fisker. They are gonna be $SPAQ. Not sure if anyone into that sector.

ALIBABA is literally a gold mine but I won't touch a Chinese stock under Trump's watch.Cause Sleep is the Cousin of DeathComment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#6953Truth of the matter is...our economy relies on China for consumers. 120 billion dollars in consumer goods between our countries. Yes, there is an imbalance, but to think we will just pull Chinese IPOs or we will pull the rug from our distributors from the largest growing economy in the world is suicide.Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6954My biggest gain this last month or so is CLSK

2 bucks to almost 10. Should I sell?

TRVN I'm averaged at 1.36. So let's see how that goes.

Looking for the next x10 boomer. F these little 5% gainers.Cause Sleep is the Cousin of DeathComment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6955What did i say about GNUS stock?

Told ya'll it was a mickey mouse operation

Took one look at their website for literally 3 min and looked like it was made by TTWarior

Same with BOXL

These losers on Twitter just pump and dump these garbage brandsCause Sleep is the Cousin of DeathComment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#6956I'm looking this week for a rotation to start or continue to happens with my friends in the energy sector.

RIG at $2.13 if it comes back that far, and at $2.65 for a break out.

TNK at $15.87

UNG at $13.09

Still looking for the screaming child factor to enter the markets. Did the Trumpster's executive order do the trick? will it be challenged in the courts? who will challenge it? how long will it take to implement? Will Chupracabra lower her demands and negotiate with the Pres?

Think gold consolidates a little bit in the near future. Kind of on pause to a grind out some gains mode for a while until we know for sure how much money will be blown by the government.Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6474

#6957If you are referring to Collateral Loan Obligations I am in agreement. Does anyone know how to get a list of the most susceptible banks?Comment -

HockeyRocksSBR Hall of Famer

- 07-10-13

- 6069

#6958The payroll tax is all well and good, but wait until people realize they will have to pay those taxes back...Not sure this will go over very big...Comment -

BigJaySBR MVP

- 01-14-12

- 3485

#6959Surprised TRVN up only a buck today after FDA approval of Oli. Listened to the news conference this morning and I think this could be a great investment stock. Well funded company through at least 2021 and Oli patent lasts until 2032.

Figured it would be in the $5 range minimum with the huge volume today.Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6960Good point. I'm not selling for at least a year or so. Think they're gonna be moving quickly to get OLI in hospitals and I think Pfizer is manufacturing the drug and TRVN got cash on hand for that like you said.Surprised TRVN up only a buck today after FDA approval of Oli. Listened to the news conference this morning and I think this could be a great investment stock. Well funded company through at least 2021 and Oli patent lasts until 2032.

Figured it would be in the $5 range minimum with the huge volume today.Cause Sleep is the Cousin of DeathComment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#6961If you look at some of the energy stocks (solar specifically) 3 or 4 years ago, sickening what types of runs some of them have made. Could have retired by now. I love the stocks sitting at 2 bucks that are primed for big things in the next 3 years. My favorite kind of stocks.I'm looking this week for a rotation to start or continue to happens with my friends in the energy sector.

RIG at $2.13 if it comes back that far, and at $2.65 for a break out.

TNK at $15.87

UNG at $13.09

Still looking for the screaming child factor to enter the markets. Did the Trumpster's executive order do the trick? will it be challenged in the courts? who will challenge it? how long will it take to implement? Will Chupracabra lower her demands and negotiate with the Pres?

Think gold consolidates a little bit in the near future. Kind of on pause to a grind out some gains mode for a while until we know for sure how much money will be blown by the government.Cause Sleep is the Cousin of DeathComment -

IonaSBR MVP

- 01-08-10

- 4244

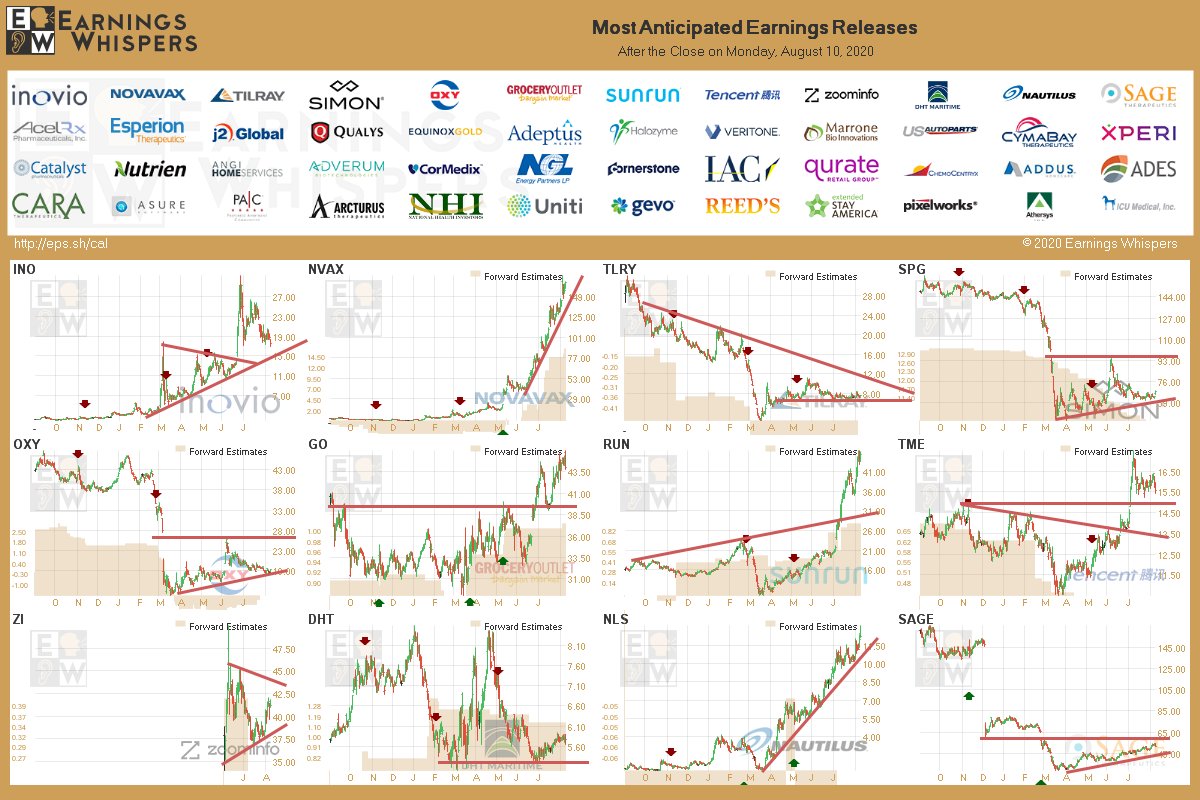

#6962Earning after the bell today:

Comment -

IonaSBR MVP

- 01-08-10

- 4244

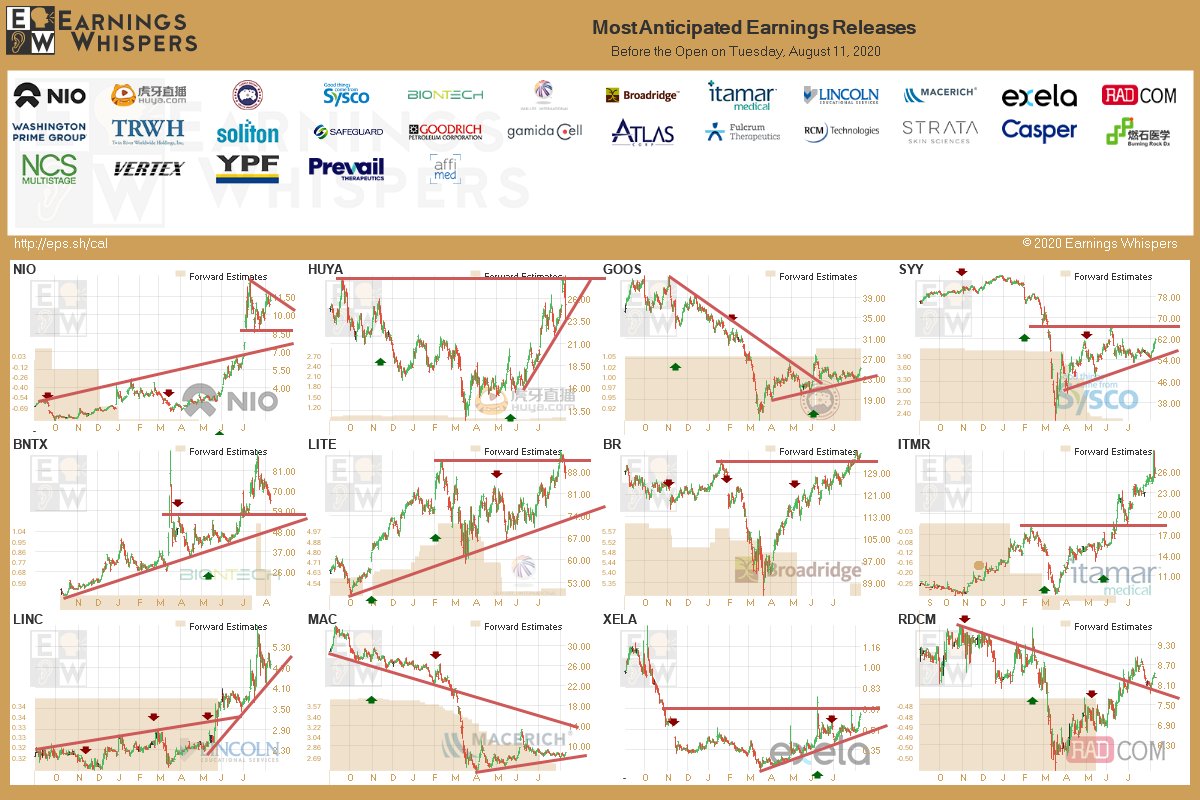

#6963Earning before the open tomorrow:

Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30064

#6964There is news today that Amazon is looking to buy the closed Sears and JCP stores --- turning them into "fulfillment centers" which has helped mall reits. Now, I'm on the JCP shareholder list to get updates during the bk. JCP has to make up their mind on which offer to take - there are 4 or 5 offers to buy the co. JCP reported a 500 million dollar better-than-expected cash position in the last month when shopping returned. The plan is to break JCP into 3 entities, a NewCo, A REIT, and a Distribution center.

They own billions in real estate and have a massive distribution center in the midwest. The stock is up today but still only 34 cents. JCPNQ. No guarantees... but it is, I dare say, better than a 50/50 shot that shareholders will get something in cash or new shares post-bk. I also have another new holding. OAS @ .71Comment -

SBR_Guest_ProSBR MVP

- 02-10-15

- 3955

#6965i'm thinking I want to jump into Alibaba. It's currently at $248, down 1.57% today. Been going down for the last month. Think this is the right time or hold and wait to buy?Comment

Search

Collapse

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code