So Bankroll if $10k:

NBA Total for this game is, UNDER 200 +100,

OVER 200 1/2 +110.

Odds to tie at 200 for this game is 2% ( which represent losing one side out right.)

How much should I wager?

Both side has +EV.

Thanks in advance.

NBA Total for this game is, UNDER 200 +100,

OVER 200 1/2 +110.

Odds to tie at 200 for this game is 2% ( which represent losing one side out right.)

How much should I wager?

Both side has +EV.

Thanks in advance.

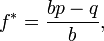

where:

where:

Maybe I'll calculate a fair line tomorrow and see what the true percentages should be and try part 1 again. It will still be profitable, though.

Maybe I'll calculate a fair line tomorrow and see what the true percentages should be and try part 1 again. It will still be profitable, though.