Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#13441Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6474

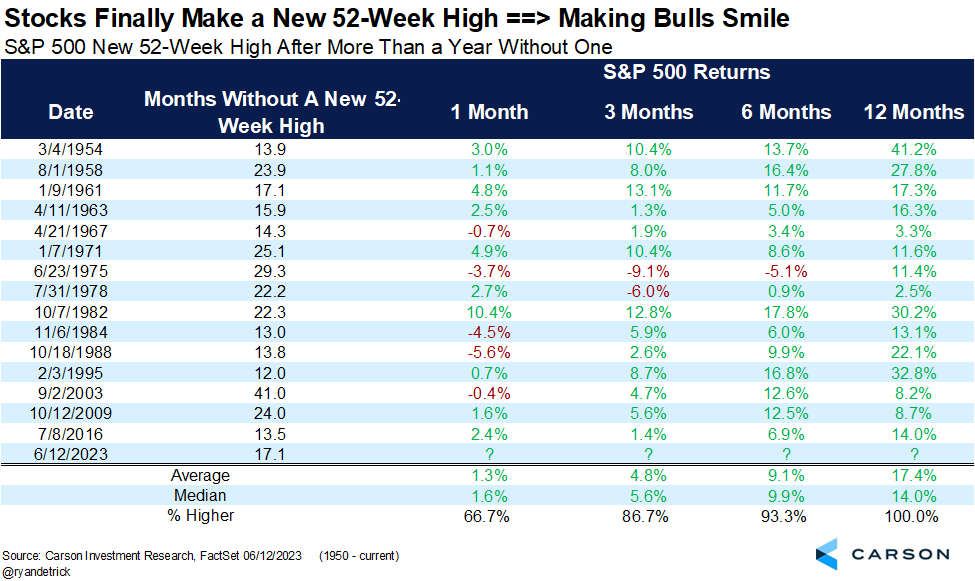

#13443Confessed market timer here. Right now my window is 0-60 days. I just did a relatively major downsizing of many of my positions. Let us see??The recent 52-week high on the S&P 500 took more than a year to reach. That has happened 15 times in the past. Out of the those 15 times, the market was higher a year later 15 times. 15 for 15. Averaging 17% higher. Everyone waiting for a crash that's probably not gonna happen. I'd be surprised if the ATH is not taken out next year, if not this year.Comment -

MadisonSBR Hall of Famer

- 09-16-11

- 6474

#13444In agreement!!Well you may have the stats on your side, but I just can't see how the markets keep up this BS. Things are slowing down and everything except for the markets is telling you so. Oil production is being slashed and prices are not spiking. That lets me know energy demand is going down. The yield curve has been super inverted for a while now, short term treasuries are filling up even my investment portfolio. The national truckload index has been steadily decreasing all year and is still getting lower.

unless there is something on the horizon that can keep this I-Beam of bullshyt going, I just can't see why the markets would be able to power up to the ATH. While I wait for the turn, I'll sit here with my finger on the sell button and enjoy the melt up, but I can't help but think there are some rough slides coming.Comment -

ChuckyTheGoatBARRELED IN @ SBR!

ChuckyTheGoatBARRELED IN @ SBR!- 04-04-11

- 37722

#13445In. Bought some. Thanks, Mike.Where's the fuckin power box, Carol?Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#13447way too frothy right now and still way too many headwinds.The recent 52-week high on the S&P 500 took more than a year to reach. That has happened 15 times in the past. Out of the those 15 times, the market was higher a year later 15 times. 15 for 15. Averaging 17% higher. Everyone waiting for a crash that's probably not gonna happen. I'd be surprised if the ATH is not taken out next year, if not this year.

15 for 15 and then Boom! the streak is broken.

that is how these trends work. LOLComment -

JIBBBYSBR Aristocracy

- 12-10-09

- 83686

#13448Stock market is gonna blow up soon. Can't hold. Pop goes the weasel with one more really bad financial report coming up.

Under this Biden Administration that is coming up on the horizon. I'd bet on that!Comment -

JIBBBYSBR Aristocracy

- 12-10-09

- 83686

#13449Invest in Government T-Bills at 5.45% for six months is the way to go right now.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#13450Yeah, even I am buying these things.

So will the slide continue today? Looks like a small level of support to start the day here at 434 on the SPY, but I'm looking at 431 for a short term scalp long trade if things get there today. Then we have a range of 426.50 to 429 that will provide more support today.

How about the buy the dip crowd? On the upside 439.25 is a gap fill from Monday's opening price, then 440is the next spot. Above that and we have a full on rescue operation.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#13451good tip

i like the flexibility and i'm too lazy/private to move big money around, so i'm OK with the 4% at amex savings... do you have to buy these through that treasury direct website? that thing is horrible, i quit even buying the $10k/person of tips because it is so badComment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#13452Are you with CIT yet? They just bumped savings rate to 4.95%.good tip

i like the flexibility and i'm too lazy/private to move big money around, so i'm OK with the 4% at amex savings... do you have to buy these through that treasury direct website? that thing is horrible, i quit even buying the $10k/person of tips because it is so badComment -

MadisonSBR Hall of Famer

- 09-16-11

- 6474

#13453LOL , I've got some Ibonds there and it takes answering 6 questions and 10 minutes to get in. I'm all for security but ...good tip

i like the flexibility and i'm too lazy/private to move big money around, so i'm OK with the 4% at amex savings... do you have to buy these through that treasury direct website? that thing is horrible, i quit even buying the $10k/person of tips because it is so badComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#13454if you want to be able to move in and out of equities and BTC/ETH and a handful of altcoins, you can consider Robinhood. they are giving 4.65% though you have to pay $5 a month to get that rate. $1300 is obviously the minimum amount in order to break even and get your $60 back at the end of one year. anything you keep in there above $1300, you are making a free 4.65% annually and can move in and out of equities/btc/eth very quickly.good tip

i like the flexibility and i'm too lazy/private to move big money around, so i'm OK with the 4% at amex savings... do you have to buy these through that treasury direct website? that thing is horrible, i quit even buying the $10k/person of tips because it is so bad

I'd rather make interest in a brokerage account so i can invest quickly, than keep it in CIT or AMEX what have you.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#13455if you want to be able to move in and out of equities and BTC/ETH and a handful of altcoins, you can consider Robinhood. they are giving 4.65% though you have to pay $5 a month to get that rate. $1300 is obviously the minimum amount in order to break even and get your $60 back at the end of one year. anything you keep in there above $1300, you are making a free 4.65% annually and can move in and out of equities/btc/eth very quickly.

I'd rather make interest in a brokerage account so i can invest quickly, than keep it in CIT or AMEX what have you.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#13456Yesterday, I didn't get my $431 in the SPY that I was looking for, as the SPY spiked through the $434 support and took off from there to $436 for a quick morning trade opportunity. This morning it looks like the same play. The level of support right now is $434.50ish, with some resistance at $436. All of my numbers from yesterday are still in play, so we'll see if there is a trade this morning with the distinct probability of a floater situation off the morning pivot which should come right around 11ish. Might jump in off the bell with some couch change if it looks like the futures are going to turn positive, but would rather grab a $431 strike long daily scalp Call that expires later today if price gets there this morning on a buy the dipper. On the other side I would be looking at $440 as the prize for the close today. Not willing to take a short, but if I take a long trade, that would be one of my targets, we also have $439, and $437 as possible jumping off points.

Over in the GLD market, things have come back over the last 7 weeks and now find the price ($177.71) resting right on top of a weekly trend line spot of $177.40 that goes back about 3 years. I expect a bounce here and a rise back to $183ish spot over a few week's time. Doesn't sound like much, and it isn't, but a 3% possibility on some lunch money looking for a play isn't all that bad. I will also buy physical gold the further it goes down here during the summer as after buying a shyt load last year, I haven't bought any this year yet, but it looks like I may get my chance here oddly enough. I didn't think I would get the chance again at sub $1900 gold so if that happens I gotta get those 5 oz chunks for the kiddies once I take the dirt nap in a few years.Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#13457If you might wanna invest it, yeah. I have a Schwab (was Ameritrade) account for my investments. Keep basically no cash there.if you want to be able to move in and out of equities and BTC/ETH and a handful of altcoins, you can consider Robinhood. they are giving 4.65% though you have to pay $5 a month to get that rate. $1300 is obviously the minimum amount in order to break even and get your $60 back at the end of one year. anything you keep in there above $1300, you are making a free 4.65% annually and can move in and out of equities/btc/eth very quickly.

I'd rather make interest in a brokerage account so i can invest quickly, than keep it in CIT or AMEX what have you.Comment -

ChuckyTheGoatBARRELED IN @ SBR!

ChuckyTheGoatBARRELED IN @ SBR!- 04-04-11

- 37722

#13458What's up with these markets?

Painted red...except for some Bitcoin-related stocks.Where's the fuckin power box, Carol?Comment -

ChuckyTheGoatBARRELED IN @ SBR!

ChuckyTheGoatBARRELED IN @ SBR!- 04-04-11

- 37722

#13459Can someone give me context on one or two drivers on this market today?

*Is it the BRICS threat of a new currency? Is it a report that came out today?

Any info would be helpful. Thanks!Where's the fuckin power box, Carol?Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#13463Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#13464Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#13465Summer 2020.

I do not have a hundreds of shares, unfortunately. I do take diversity to a whole different level and my fam and friends laugh at me because I have my risk spread out across several sectors and many different stocks.

We have a poster here who was an "early adopter" of NVDA and is set up extremely nicely.

I will not say who it is. I will allow him to reveal himself, if he so chooses :-)Comment -

BeatTheJerkBARRELED IN @ SBR!

- 08-19-07

- 31794

#13466Well that should be interesting if he ever surfaces. I’m glad you have a position on this stock. I saw your portfolio’s they are very impressive thanks for giving us an inside scoop of your actual investments.Summer 2020.

I do not have a hundreds of shares, unfortunately. I do take diversity to a whole different level and my fam and friends laugh at me because I have my risk spread out across several sectors and many different stocks.

We have a poster here who was an "early adopter" of NVDA and is set up extremely nicely.

I will not say who it is. I will allow him to reveal himself, if he so chooses :-)Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

-

Slurry PumperSBR MVP

- 06-18-18

- 2811

#13470So as the rest of the world totally falls apart, news media make up stories they wish happened, and idiots build things they know nothing about to kill people, you have to wonder how is the market doing through all this. Pretty good actually and at the moment the SPY is just waiting for the 20 DMA to catch up to the price. Same thing is going on over in the QQQ camp. Only the IWM looks like it may have a little trouble. Then again the IWM is moving right into a full stack of support in the $179.50 - $170.00 area. Current price is $180.57 at last Friday's close. After not getting any trades last week, I'm going to patiently hang out and wait for the zone to come into play either today or sometime during the week. There should be a reaction in the other direction if only for an intra-day trade.

GLD is making that bounce I was expecting, and for a 1 to 2 week trade to start, we'll see how it goes.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#13471No dice yesterday for the IWM play, but by the end of the day the SPY and QQQs set up right on top of the 20 DMA. I bought some calls that expire Friday, and with the economic numbers coming out today, you just know they will be as fake as fake gets just like every thing else in today's world. Add in that it's turn around Tuesday, and the end of the month looming, and I can make a case for the long side going into the holiday.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#13472Well yesterday did indeed turn out to be turn around Tuesday. I like it when a play immediately moves pretty well in the direction I like. Now I can sit back and make sure the trade doesn't go negative on me while looking for some follow through.

The GLD trade is once again teetering on the trend line looking for a bounce. It's a wait and see, but if it does break down further, the slide could mean $1850 gold prices which I thought we were going to leave behind forever just a few months ago. I'm a jump in with the buying of physical gold under $1900 and certainly at the $1850 spot. Keep in mind we have that digital currency on the horizon from the FED and that will shake things up a bit.

While this has been going on, SLV is bouncing off of the 200 DMA, but if you missed the move as I did a few days ago, the metal stock is heading right into a pile of moving averages. I'll be a buyer above the $22.50 level which is still a far away spot. It may also be the spot where I short it depending on how the action looks if and when it gets there.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#13473My SPY and QQQ options are coming along nicely, and in all likelihood we will float into the holiday weekend.

GLD is right at a spot where it needs to bounce if my latest trade is to work out. If it breaks down further a gap fill on the weekly chart is on the schedule at around $174. At that level I'll be calling my physical gold dealer to load up.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#13475OK its time to get rid of those calls I got Tuesday. This play has worked pretty much as I thought it would. Today will get progressively less busy and just like in Gymnastics and porn movies, the finish can be all the difference between a good showing and a disastrous outcome. For the SPY, I'm first looking for a gap fill at $439.40 to begin with, that' 9 bucks worth of gain on a 4 dollar start. The QQQs are a little more muted but the exit starting point today is the $366.30 spot which is only about 6 bucks gain on a 4 dollar start. Either way, taking a more than 100 or 200 percent gain right before the holiday will have me celebrating.Comment

Search

Collapse

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code