Tossing on a short play with Netflix @ $483.00 for 25 shares.

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

Slurry PumperSBR MVP

- 06-18-18

- 2811

#6616Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#6617So much leverage and momentum play in this market. Retracement to around 3150 looks like bare minimum to me.Comment -

navyblue81SBR MVP

- 11-29-13

- 4143

#6618Can’t look at the market anymore. It’s a total bloodbath today. Getting sick to my stomach. The 40% gains I made earlier this week are all gone. Picked the wrong day to invest in Penn.Comment -

IonaSBR MVP

- 01-08-10

- 4244

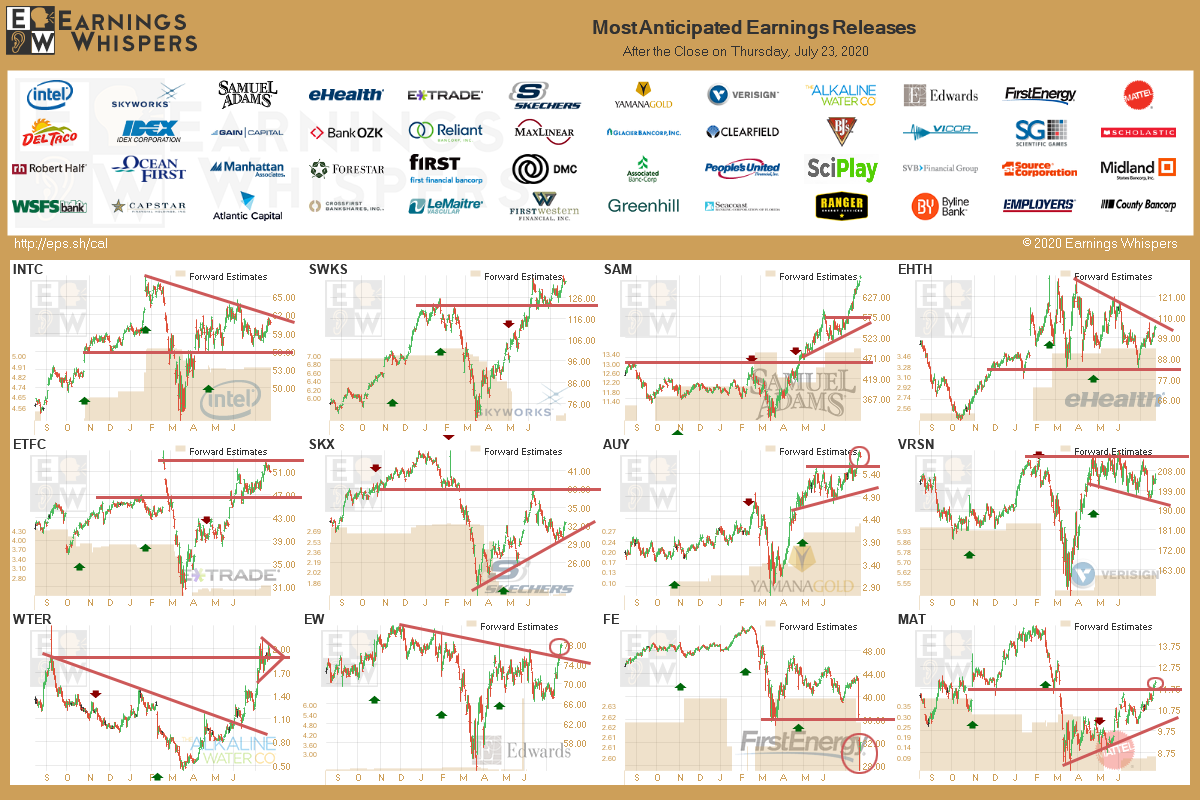

#6619Earning releases after the close today:

Comment -

IonaSBR MVP

- 01-08-10

- 4244

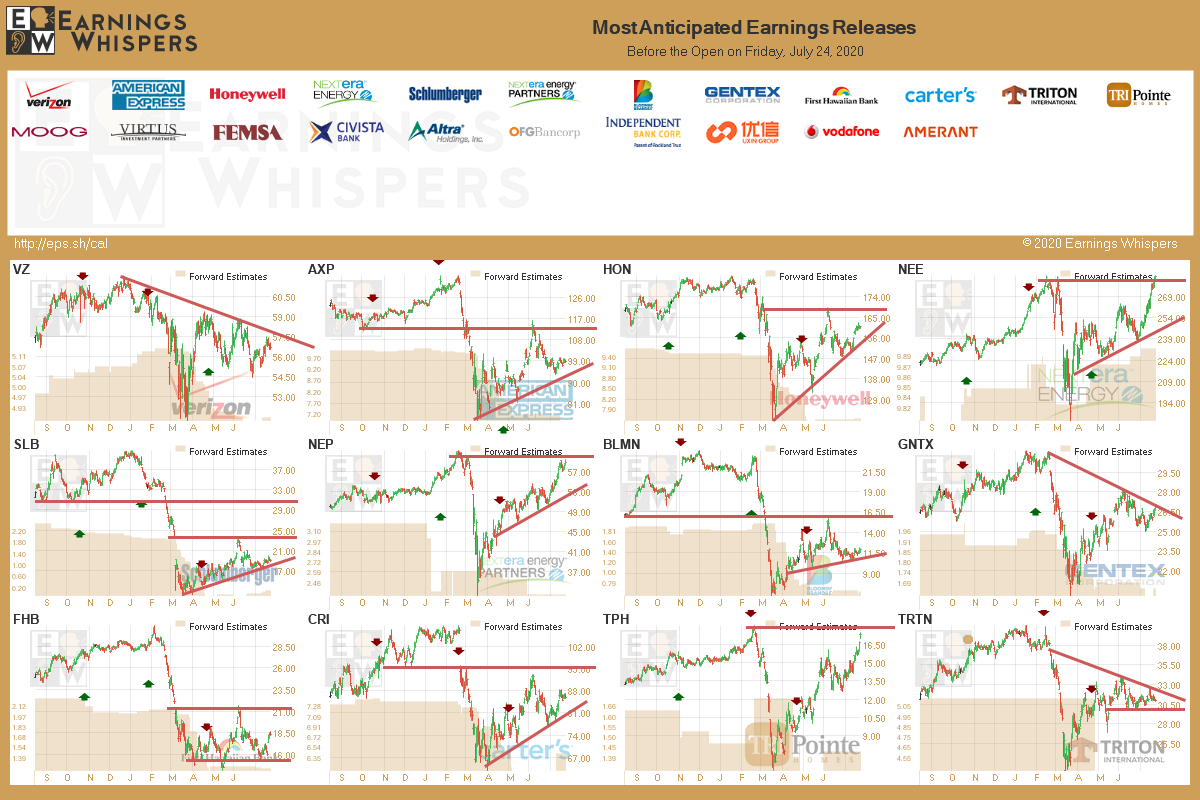

#6620Before the open tomorrow:

Comment -

CanuckGSBR Posting Legend

- 12-23-10

- 21978

#6621Major discount prices for gambling sector stocksComment -

zam77SBR MVP

- 11-03-10

- 3586

#6622I know a lot of you guys don't get into penny's here, but I thought this one would be a good one to share with ya's.

Ticker: MEDH

Med X Holding Inc is parent company for Lazy Daze coffee/head shop https://www.lazydazeco.com/. This is an already established cannabis/coffee shop franchise out of Austin TX since 04. There's also a branding company texasgreenrush.com that focuses on hemp/cbd/cannabis branding. They have 15 locations mostly Texas, but one in NC, OH and PA as well. Currently trading around .05 to .07/share with 80% growth over past week and climbing steadily.

New CEO took the reigns as of early June seems to be taking some big strides toward growth. Here is a you tube of CEO talking about what the biz is all about. https://www.youtube.com/watch?v=EuTr...ature=youtu.beComment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

-

homie1975SBR Posting Legend

- 12-24-13

- 15452

-

ERBtheGREATSBR Rookie

- 06-03-13

- 46

#6625Dude has been saying it for months while everyone else has been riding the money train. I'd be pissed too and hope it drops.Comment -

navyblue81SBR MVP

- 11-29-13

- 4143

#6626Last two weeks have been rough for my stocks. SE has dropped from 124 to 110. FSLY from 103 to 77. SQ from 135 to 122. PLUG from $10.20 to $8.50. NET from $42 to $36. Got a big rise from NOVN Tuesday only for it to shoot back down on Wednesday. And then yesterday I invested in sports casino stocks and they took a good ole dump on me, PENN and GAN being the worst. It's a Johnny Walker Blue night.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30064

#6627Great day for me. Cashed out of QLD and ZS puts for big gains.

Nasdaq weakness likely to continue but with August options I felt the need to clear out.

Now I'm in AMC long. All US theatres will be reopen by mid-late August.

weekly calls sell for solid income.

Thought about EVRI, GAN, etc. but the uncertainties of college sports are weighing

and the general weakness in casinos. Big money doesn't seem to trust the revenues yet,

they want to see proof of how much these deals will pay and how safe sports are going to be

before laying down millions of dollars.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#6628Got SQQQ from 6.2 to 6.6

^ agree, this is the right moment to pile into Value stocks.

Main thing I’m looking at are companies without debt and plenty of cash on the sidelines. I like ABEV(buy <2.4) and LQDT (buy < 5.2) and just piling into those two for past month and foreseeable future.Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

#6629Buy the Fukin Dip

Roku< 150

MSFT <201

KingsofCloud <31

Crowdstrike <101Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#6630Reopen doesn't mean people will go and they will make money.Great day for me. Cashed out of QLD and ZS puts for big gains.

Nasdaq weakness likely to continue but with August options I felt the need to clear out.

Now I'm in AMC long. All US theatres will be reopen by mid-late August.

weekly calls sell for solid income.

Thought about EVRI, GAN, etc. but the uncertainties of college sports are weighing

and the general weakness in casinos. Big money doesn't seem to trust the revenues yet,

they want to see proof of how much these deals will pay and how safe sports are going to be

before laying down millions of dollars.Comment -

LinemanSBR MVP

- 11-21-09

- 2597

#6632

I put the election year chart on top of this year's DJ30. As you can see we moved quite the opposite direction till now. Unprecedented times.....We need to be flexible.

My stops are in place. We could always jump back in!Comment -

trobin31SBR Hall of Famer

- 01-09-14

- 9854

-

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#6634When they're valued at a multiple of earnings that is out of line with reality, sure. S&P 500 peaked mid-2000. In 2009 it was half that. Didn't return to 2000 level until 2014. A few years is nothing.Comment -

Shev2SBR Sharp

- 04-16-19

- 270

#6635

Cup and handle forming in $WSC? Pretty good short interest in this one, potential for a squeeze on a breakout past resistance.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#6636i kind of look at it through 10 year stuff that includes the "7-year business cycle"

so from 1990-1999 things went bonkers, stock market was great... then 2000-2009 it was god awful, with 2000-2002 and 2008-09 just so painful

then 2010-2019 fantastic stock market returns again... now 2020-2029 i agree will probably be god awful, once the free money runs out and the fed stops buying every asset

gonna be hard for companies to grow into these kinds of valuations when half the small businesses are totally gone and unemployment is through the roof, and foreclosures go crazy and people get evicted all over the placeComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#6637The bottomline is that probably 95% of people who try to time markets end up losing out on potential gains by staying out and waiting for "the perfect entry point".Comment -

navyblue81SBR MVP

- 11-29-13

- 4143

#6640Some of these low prices are incredible. But not sure to enter today or Monday. So far it’s a sea of red this morning.Comment -

LinemanSBR MVP

- 11-21-09

- 2597

#6641As humans, we just love to complicate things for some reason. What a perfect environment for that. Millions of questions you can ask to yourselves here and play the guessing game. But there is a system you can adapt and maneuver in the market and in life for that matter. It's called KISS....

Follow the trend and Keep It Simple Stupid!Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#6642So what is the supposed trend right now?As humans, we just love to complicate things for some reason. What a perfect environment for that. Millions of questions you can ask to yourselves here and play the guessing game. But there is a system you can adapt and maneuver in the market and in life for that matter. It's called KISS....

Follow the trend and Keep It Simple Stupid!Comment -

CanuckGSBR Posting Legend

- 12-23-10

- 21978

#6643Need J pow to make that printer go brrrComment -

LinemanSBR MVP

- 11-21-09

- 2597

#6646Van Tharp Back-To-Basics Series

by Van K. Tharp, Ph.D.

What Does Van Tharp Mean When He Says:

"We Only Trade our Beliefs About the Markets"?

If you are a regular student of Van Tharp's work or reader of this newsletter you hear this a lot: You can't trade the markets, you can only trade your beliefs about the market. Let's explore what this really means.

As a long time modeler of what makes great traders great, Van understands that to model effectively you have to find out what highly accomplished people do in common. Once you get the common tasks that produce excellent behavior, you need to get the ingredients of those tasks. Those ingredients include the beliefs, the mental states, and the mental strategies necessary to carry out those tasks.

Let’s look at some statements and see what you believe about them:

The market is a dangerous place to invest. (You are right.)

The market is a safe place to invest. (You are right.)

Wall Street controls the markets and it’s hard for the little guy. (You are right.)

You can easily make money in the markets. (You are right.)

It’s hard to make money in the markets. (You are right.)

You need to have lots of information before you can trade profitably. (You are right.)

Do you notice the theme?

You are right about every one of these beliefs (whether you said yes or no to any of them). If you don’t believe in any of these statements, what do you believe instead? You are right about that too! However, there is no real right/wrong answer. Some people will have the same beliefs and agree with you and others won’t.

Therefore, whatever your beliefs about the markets are, they will direct your thinking and your subsequent actions.

What is a Belief?

Beliefs are a primary way to filter information from the world. Beliefs are judgments, categorizations, meanings or comparisons. They determine how we perceive reality and relationships in reality. What you expect (i.e. your reality) depends upon your beliefs and they are largely unconscious. Every sentence in this document represents one or two beliefs, including this one.

One of the beliefs that is most productive for good trading is the belief that you are totally responsible for your own results as a trader. When you adopt this belief, then you can learn from your mistakes. However, if you tend to blame someone else (your broker, your spouse, the person giving you tips) or even the market for the results that you get, then you will tend to repeat the same mistakes over and over again.

When traders “own their problems” and assume responsibility for the results produced, then they discover that their results come from some sort of mental state that either allowed them to 1) follow their rules, 2) not follow their rules, or 3) trade without having any rules.

When traders take the time to write down all their beliefs (about themselves, the markets, money, etc.), then they can establish a much better idea of what they want to trade, and how they want to trade. They can also see flaws in their thinking much easier. It is valuable to know which beliefs support you as a trader, and which ones hinder your progress.

What is a Mental State?

Every task has an optimal mental state that will allow you to accomplish it effortlessly. For example, to execute a trade you benefit from courage and total commitment. Fear, in contrast, is a big disadvantage as a mental state for executing trades.

Mental states are primarily what most people call discipline or emotional control. Examples include: being impatient with the markets, being afraid of the markets or being too optimistic about the markets.

Controlling your mental states is just part of the answer, but when you can see that you are the creator of your own results as a trader, then you can really make progress.

What is a Mental Strategy?

To understand mental strategies, you have to understand how people think. People think in their five sensory modalities (that is, in terms of visual images, sounds, feelings, taste and smell).

A mental strategy is the step by step way in which you use these modalities; it is the specific sequence of your thinking. For example, the most effective strategy for the action step of executing a trade is to 1) see the signal, 2) recognize internally that this is the signal you decided you should take, 3) feel good about it, and 4) take action. If you do anything else, you probably won’t be able to take action or it will be very slow.

The Psychology of Trading

Once you have a clear understanding of which beliefs, mental states and mental strategies are the core factors in top trading performance, you can then teach the same skills to others and have them perform well too. And when you can see this success duplicated in others, which we have been able to do in most aspects of trading, then you know you have a workable model.

The key psychological traits of top traders are

1. Personal Responsibility

2. Commitment

3. Their psychological “profile”

4. Working on personal issues (e.g., self sabotage)

Trading fundamentals include the Ten Tasks of Trading.

1. Self Analysis

2. Mental Rehearsal

3. Low-Risk Idea Development

4. Stalking

5. Action

6. Monitoring

7. Abort

8. Take Profits

9. Daily Debriefing

10.Periodic Review

Traders need to be reminded of these tasks and to eliminate any self-sabotage that keeps them from following the tasks. Van teaches all of these steps in detail in his various products and workshops.

Van Tharp believes that everything revolves around your beliefs, mental states and mental strategies, so with that in mind, everything about trading is 100% psychological, including why and how you trade and which system you will follow or build.

Many traders have a hard time “believing” this and it is almost the antithesis of what people learn in academic finance. So only you can decide whether it is worth the time to learn more about yourself and the psychological aspects of trading.

People get exactly what they want out of the markets. Most people are afraid of success or failure. As a result, they tend to resist change and continue to follow their natural biases and lose in the markets. When you get rid of the fear, you tend to get rid of the biases ~ Van K. Tharp, Ph.D.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#6647exactly, if you're long like i am, get in immediately and at least start a small position in all stocks you like. if it goes down, add to the position and lower your cost. if the stock runs away, well that's a nice problem to have, then you go open another position in a stock you like, rinse and repeat and check back in 5 years.

that's my recipeComment -

CanuckGSBR Posting Legend

- 12-23-10

- 21978

#6648Red/green there quick for gambling sectorComment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30064

#6650I covered yesterday when Nasdaq was around 10400s but now on the Intel and Apple bad news

that came very late yesterday, downside has accelerated. Tech is going to be on the outs for weeks.

Interesting to see the weakness spreading into all sectors now. I would write August/Weekly calls against any long positions.Comment

Search

Collapse

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code