Bitcoin Price Tracking & Discussion -- 2025

Collapse

X

-

Accrued InterestSBR High Roller

- 04-02-22

- 145

#6476Comment -

cankidSBR Hall of Famer

cankidSBR Hall of Famer- 08-22-08

- 7239

#6477Lots going on right now, with 2 loose cannons in the world these world conflicts may get much worse with time.Comment -

shadymcgradySBR Posting Legend

- 02-27-12

- 10036

#6478I was wondering in here last yr around summer/fall during the last rise up to the top how correlated Bitcoin was to the stock market and all I got in response was a gaslit response from that clown robin talking about his own bullshit agenda and completely unrelated topic like a typical insecure narcissist.

Crypto is the fastest horse in the race but the dollar is still king for the foreseeable future and it's not close. I'm just curious when Bitcoin can become decoupled from the market and how long it would take since it's clear they are currently tied togetherComment -

Accrued InterestSBR High Roller

- 04-02-22

- 145

#6479Bitcoin is a social phenomenon that got going due to a huge asset bubble. The Fed is trying to take the air out of that bubble. There is no decoupling. It is an overt Ponzi Scheme. The largest in human history. The idea is now beginning to die. But it is very political in nature so there will be holdouts. So you will have an extended period of ups and downs at the bottom. It is going to stagger lower from here unless the Fed gets the stock market going again. Even then, it will continue lower from here over a period of years if it does not go right away.Comment -

Accrued InterestSBR High Roller

- 04-02-22

- 145

#6480What you are looking for here, is what is going to happen with inflation. It is probably going to come down very fast with the market going down. That is the Fed's goal. They don't want the market to go down very much, but they want to hit inflation. If they can just take the steam out of it, they feel like they can get control of things. If that happens then bitcoin can have a little relief rally and hold its own.

If the Fed can tank inflation altogether, then they can hit the gas pedal on the market again and bitcoin will go along for the ride but a lot of damage has been done and will be done in this process.

We are entering into uncharted territory. The economy has never been run before by the Federal Reserve and their worst nightmares have come to life. So they are experimenting.Comment -

allabout the $$$SBR Hall of Famer

- 04-17-10

- 9843

#6481i was in the bahamas during the crypto bahamas conference. the sentiment from the people who i was talking to there was btc would hit 27/28 for sure with a few guys thinking more in the 17/20k range before it rebounds. that was just shooting the shit at the bar i wasnt at the conferenceComment -

raiders72001Senior Member

- 08-10-05

- 11157

#6482It's the same thing over and over. There are periods of positive correlation, negative correlation and insignificant. The only reason why people see this correlation right now is that they are in lock step instead of a day or two apart.I was wondering in here last yr around summer/fall during the last rise up to the top how correlated Bitcoin was to the stock market and all I got in response was a gaslit response from that clown robin talking about his own bullshit agenda and completely unrelated topic like a typical insecure narcissist.

Crypto is the fastest horse in the race but the dollar is still king for the foreseeable future and it's not close. I'm just curious when Bitcoin can become decoupled from the market and how long it would take since it's clear they are currently tied togetherComment -

raiders72001Senior Member

- 08-10-05

- 11157

#6483Bitcoin is going to do it's own thing long term and follow it's 4 year cycle. If the stock market is moving the same way, then they will lock up short term. What's interesting is that last time bitcoin was the indicator for the major crashes.Comment -

ArkySBR MVP

- 12-09-11

- 1107

#6484Wow, LUNA and UST both taking it on the chin - LUNA @ $30.23 and UST at 70¢! Like Toby mentioned in the video above, the algorithms are being tested - severely!

Market cap at $1.3T after hanging around $1.8T to $2.0T for a good while. Hasn't been this low since the dip of July 2021....Comment -

jjgoldSBR Aristocracy

- 07-20-05

- 388179

#6485All dead

People losing their shirts

One of these times crypto’s not gonna come back and go all the way down to like 10,000Comment -

Yulia74SBR MVP

- 08-28-18

- 1907

#6487arrogant shit talker

Comment

Comment -

raiders72001Senior Member

- 08-10-05

- 11157

#6488One problem for BTC is that miner's are now being forced to sell because the rewards are declining.Comment -

raiders72001Senior Member

- 08-10-05

- 11157

#6489Luna Foundation Guard “sold” $ 750 million in Bitcoin to defend UST’s price tag

https://coinlive.me/luna-foundation-...ice-18531.html4/ As a result, the LFG Council has voted to execute the following:- Loan $750M worth of BTC to OTC trading firms to help protect the UST peg.- Loan 750M UST to accumulate BTC as market conditions normalize.Comment -

raiders72001Senior Member

- 08-10-05

- 11157

#6490Someone made a similar post about the liquidation earlier but I don't see it now.

https://cryptoslate.com/microstrateg...a-margin-call/MicroStrategy could defend $21k BTC to stop a margin call

MicrosStrategy's $205 million Bitcoin-backed loan would be subject to a margin call if Bitcoin dropped to $21,000Comment -

bigtymer56SBR MVP

- 07-31-12

- 4742

#6491Comment -

shadymcgradySBR Posting Legend

- 02-27-12

- 10036

#6492That argument has legs but you could turn around say the same thing for the dollar in that regardBitcoin is a social phenomenon that got going due to a huge asset bubble. The Fed is trying to take the air out of that bubble. There is no decoupling. It is an overt Ponzi Scheme. The largest in human history. The idea is now beginning to die. But it is very political in nature so there will be holdouts. So you will have an extended period of ups and downs at the bottom. It is going to stagger lower from here unless the Fed gets the stock market going again. Even then, it will continue lower from here over a period of years if it does not go right away.Comment -

shadymcgradySBR Posting Legend

- 02-27-12

- 10036

#6493Bitcoin seems in theory to be the perfect tool for wall street to manipulate since there are no laws regarding it compared to other assets at their disposal. Perhaps it's been happening for quite some time nowComment -

raiders72001Senior Member

- 08-10-05

- 11157

#6494They said the same around 2018. That bitcoin was coupled with stocks because of institutional investment. Then it decoupled.Bitcoin is a social phenomenon that got going due to a huge asset bubble. The Fed is trying to take the air out of that bubble. There is no decoupling. It is an overt Ponzi Scheme. The largest in human history. The idea is now beginning to die. But it is very political in nature so there will be holdouts. So you will have an extended period of ups and downs at the bottom. It is going to stagger lower from here unless the Fed gets the stock market going again. Even then, it will continue lower from here over a period of years if it does not go right away.Comment -

raiders72001Senior Member

- 08-10-05

- 11157

#6495Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

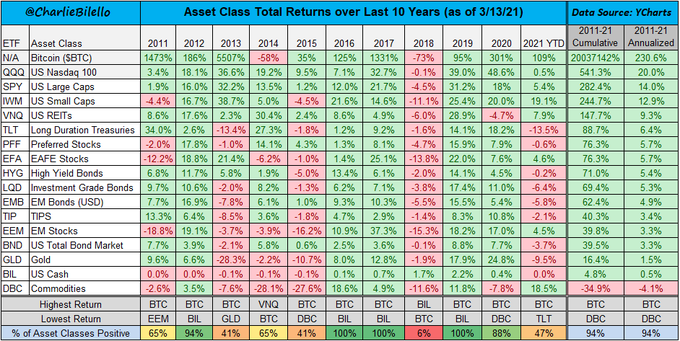

#6498Just chiming in to say this chart is vurtually meaningless to an investor and speculator.

I'll let you guys debate why. I will say this, it will be a more vigorous discussion in the stock or investment thread than it will amongst the BTC players.

Probably why this chart ended up in this thread.

Because from an investment perspective it's virtually meaningless.

Think about it.

A hint, it's trying to make a comparison between BTC gambling and Bond gambling.

The numbers in the chart are fine, but I could see the unspohisticated player coming away with this chart with a terrible misunderstanding of the factors at play here.Comment -

raiders72001Senior Member

- 08-10-05

- 11157

#6499I know that I post it ad nauseam but the same cycles happen over and over again and the same reasonings are stated every time.

The 2018 cryptocurrency crash (also known as the Bitcoin crash and the Great crypto crash) was the sell-off of most cryptocurrencies from January 2018. After an unprecedented boom in 2017, the price of Bitcoin fell by about 65 percent during the month from 6 January to 6 February 2018.Comment -

raiders72001Senior Member

- 08-10-05

- 11157

#6500I was trying to show the best performing asset class for the past decade. Stocks and bitcoin are different animals. They should be in different forums.Just chiming in to say this chart is vurtually meaningless to an investor and speculator.

I'll let you guys debate why. I will say this, it will be a more vigorous discussion in the stock or investment thread than it will amongst the BTC players.

Probably why this chart ended up in this thread.

Because from an investment perspective it's virtually meaningless.

Think about it.

A hint, it's trying to make a comparison between BTC gambling and Bond gambling.

The numbers in the chart are fine, but I could see the unspohisticated player coming away with this chart with a terrible misunderstanding of the factors at play here.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#6501You can't have it both ways. You can't lump it into all those classes and then talk about how it's a different animal unless you don't understand what makes it a different animal.

There are a million things I could say here but I'll stick with one.

Could you imagine if every IPO of the last decade were able to start at .00000001 dollars?

What would equity returns look like then? How about bonds? Reits? Emerging market funds?

People can talk about how BTC and stocks are different animals, but do they really know what that means?

I don't think they do.Comment -

jjgoldSBR Aristocracy

- 07-20-05

- 388179

#6502Bitcoin is too high risk for most people

One of reasons the upside is limited nowComment -

raiders72001Senior Member

- 08-10-05

- 11157

#6503The chart was only to show the best performing assets over the past decade. You are trying to spin it as something else. This is why I say most stock people don't get bitcoin. Until you consider the 4 year cycle, whale wallets, miners, money moved off and on exchanges, OTC bitcoin movement and other on-chain analysis, you aren't going to understand bitcoin.You can't have it both ways. You can't lump it into all those classes and then talk about how it's a different animal unless you don't understand what makes it a different animal.

There are a million things I could say here but I'll stick with one.

Could you imagine if every IPO of the last decade were able to start at .00000001 dollars?

What would equity returns look like then? How about bonds? Reits? Emerging market funds?

People can talk about how BTC and stocks are different animals, but do they really know what that means?

I don't think they do.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#6504Here's another question I could ask, sine we're trying to compare returns over the last decade.

How many people here have made money shorting BTC?

Whether you sold what you don't own on credit with the promise to buy it back or whether you sold short while sitting on BTC in cold storage.

Who's the big winner there? What's the short positon on BTC right now?

A lot of "asseet classes" in that chart have had bids set by shortsellers the whole decade, and then some.

Who's short BTC right now, waiting to buy back?

See what I'm getting at here?Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#6505No spin here, just context.The chart was only to show the best performing assets over the past decade. You are trying to spin it as something else. This is why I say stock people don't get bitcoin. Until you consider the 4 year cycle, whale wallets, miners, and other on-chain analysis, you aren't going to understand bitcoin.

Don't worry about "stock people getting into btc", that's not the point and isn't what's happening in these posts. If anything, it looks like BTC gamblers are trying to compare to stocks, not the other way around.

Context and understanding of the trade are the point.Comment -

Accrued InterestSBR High Roller

- 04-02-22

- 145

#6506"Decoupling" is pure rationalization. When you point out that BTC moves in line with the stock market, when the stock market goes up, bitcoin goes up. Yeah, but bitcoin goes up a lot more!!! That is not decoupling.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#6507Raiders I'm not saying you don't understand, I'm just adding context to the chart.

Without it it sends the wrong message, or at least the wrong takeaway from a chart like that.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#6508This goes back to the short question I just asked.

Can somebody who does not own BTC create downward pressure on BTC by trading it?Comment -

raiders72001Senior Member

- 08-10-05

- 11157

#6509You keep posting about stocks, bonds etc. I don't care about any of that. You're looking way too deep into my reasoning for posting the chart. Institutions screwed up in 2021 because they don't understand crypto. It was just an awful time to invest.No spin here, just context.

Don't worry about "stock people getting into btc", that's not the point and isn't what's happening in these posts. If anything, it looks like BTC gamblers are trying to compare to stocks, not the other way around.

Context and understanding of the trade are the point.Comment

Search

Collapse

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code