NFL Stadium Funding and Naming Rights Analysis: Which Venues Cost (and Earn) the Most?

Last Updated: September 19, 2025 9:55 AM EDT • 13 minute read X Social Google News Link

SoFi may have reset the cost curve, but what’s really exploding in NFL stadium economics isn’t just the steel and glass – it’s the sponsorship money bolted to it.

Stadium naming rights have tripled since 2005. Sports betting partnerships are up more than 1,200% since PASPA got the axe. And if you're wondering what comes next, brace yourself: the estimated $2.1 billion spent on the Buffalo Bills and Tennessee Titans projects? Experts say that’s the floor now – not the ceiling.

(That's of particular interest to fans in Chicago and Washington, who will also see their beloved franchises build new state-of-the-art digs in the near future.)

The trends are loud, the money is louder, and taxpayers are still stuck somewhere in the echo chamber. Just six of the NFL’s 30 stadiums were built without public money. One (the Caesars Superdome) was entirely taxpayer-funded. And while franchises chase premium amenities and multi-use developments, cities are left negotiating against billionaires with lobbyists, lawyers, and leverage. It’s Monopoly, except the hotels come with PSLs and naming rights clauses.

In this deep dive, we break down exactly who’s paying for what, who’s naming what, and why the NFL’s stadium landscape looks like a real estate portfolio with end zones. We also spoke with two of the sharpest minds in stadium finance – including a guy who helped negotiate the Commanders sale and another who literally wrote the book on the subject – to help make sense of the numbers, the legal fine print, and the future of your favorite team’s home turf.

🏟️ NFL Stadium Sponsorship and Funding Key Trends

💰 Five of 30 NFL stadiums were built exclusively using private funds, while three were funded 100 percent by taxpayers

📈 NFL stadium naming rights sponsorships have increased by a whopping 200% over the past 20 years

🍊 EverBank Stadium, home of the Jacksonville Jaguars, is the earliest naming rights agreement set to expire; that deal runs out in 2027

🚀 Sports betting sponsorships and partnerships have seen a massive 1,233.3% jump since 2018

💬 Tax law expert: Future stadium projects will exceed $2.1 billion figure spent on Bills, Texans venues

How much did you pay for your stadium?

The construction costs for the league's 30 active venues vary wildly – and so, too, does the share of responsibility for paying those bills.

Here's a breakdown of the approximate funding split for every NFL stadium between taxpayer allocations and private funds:

NFL stadium funding split trends

📌 The raw average across all 30 NFL stadiums (treating each venue with equal weight) sees taxpayers funding 51.9% of construction costs, with private funding at 48.1%. (This does not include the ongoing Bills and Titans projects).

📌 Five venues were funded entirely with private money: SoFi Stadium (Inglewood), Hard Rock Stadium (Miami), MetLife Stadium (East Rutherford, N.J.), Gillette Stadium (Foxboro, Mass.) and Northwest Stadium (Landover, Md.)

📌 On the flip side, three stadiums (Caesars Superdome, New Orleans; Arrowhead Stadium, Kansas City; Highmark Stadium, Buffalo) were built exclusively with taxpayer money.

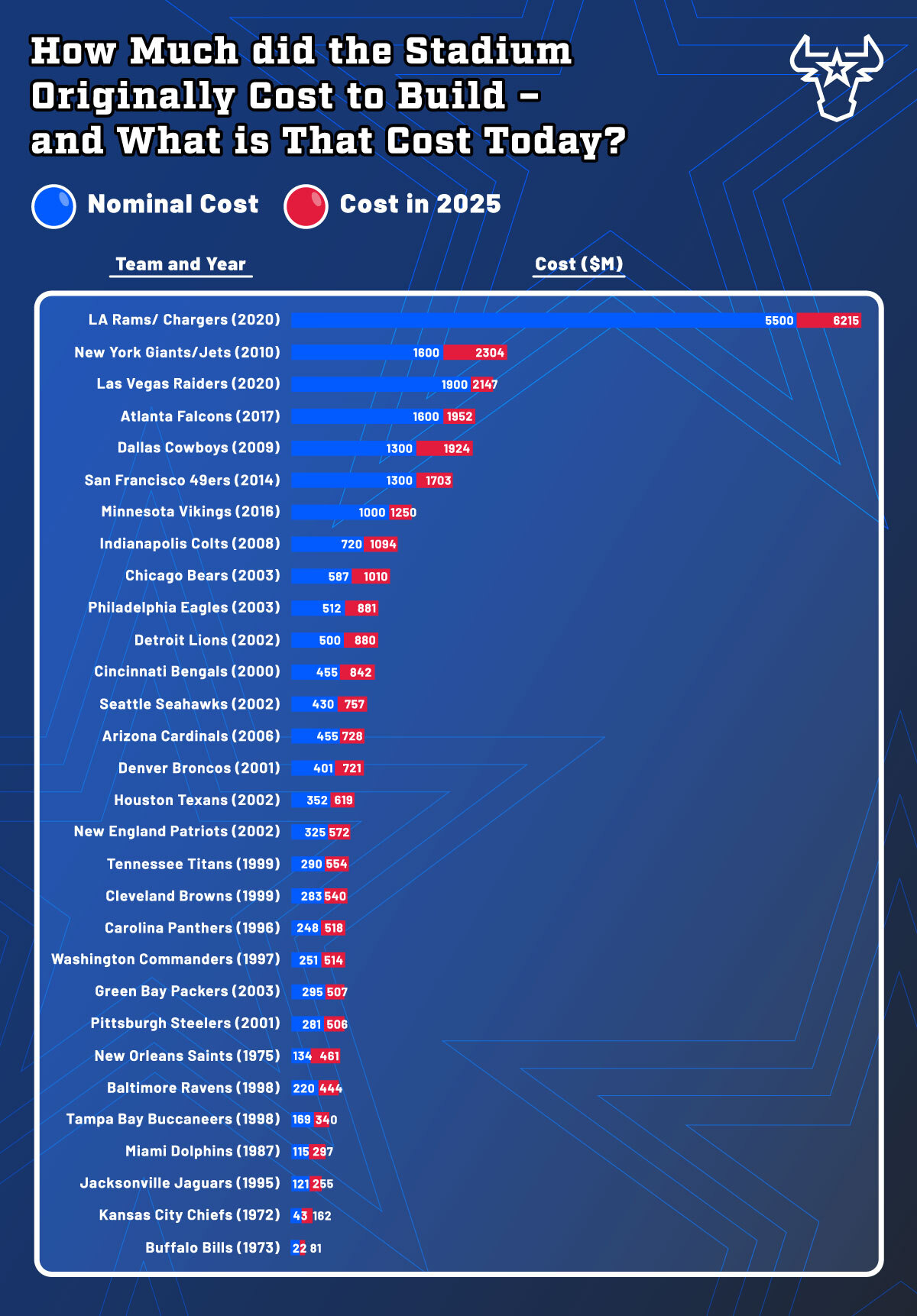

How much did your stadium cost?

One of the greatest parts of the NFL stadium experience is that no two venues are even close to being alike – and we're not just talking aesthetics.

All 30 stadiums (the Rams and Chargers share SoFi Stadium, while the Giants and Jets are co-tenants at MetLife Stadium) have their own stories and paths to construction, and the variety in cost alone is staggering. Here's a look at the total construction cost of each venue, along with the year they were built or renovated and what the overall cost would be as of 2025:

*The Bills are building a new 62,000-seat, state-of-the-art Highmark Stadium in Orchard Park, slated to open for the 2026 season with modern design features and substantial cost overruns now pushing the total to over $2.1 billion.

*Construction is underway on a 60,000-seat domed Nissan Stadium in Nashville, a $2.1 billion project (with over $1.2 billion in public funding) set to open in time for the 2027 NFL season.

NFL stadium cost trends

👑 There's a clear No. 1 on this list, and it might not be topped for a while. SoFi Stadium, located in the Los Angeles suburb of Inglewood, is home to both the Chargers and the Rams – and you probably could have built separate stadiums for both franchises and still not carry a price tag this large. At $5.5 billion upon its completion in 2020, this state-of-the-art venue comes in at a staggering $6.22 billion in present-day value, well ahead of the two current new stadium projects.

🗽 Here's a little perspective on the above trend. Just 10 years before SoFi Stadium, became a reality, the Giants and Jets christened their new home – MetLife Stadium in East Rutherford, N.J. – at a total construction cost of just $1.6 billion. Like SoFi, MetLife Stadium was completed using exclusively private funding, a rare example of two marquee sports venues requiring zero taxpayer money. MetLife Stadium comes with an estimated 2025 construction price tag of just over $2.3 billion.

🎰 Allegiant Stadium in Las Vegas carries the third-highest modern-day price tag of all NFL venues. The stadium was completed in 2020 for approximately $1.9 billion, with 39.5% of that total (~$750 million) generated via a hotel tax. The 2025 cost of $2.15 million makes this one of only three venues with a current expenditure north of $2 million – and the only one of the three to rely on taxpayer money to secure the necessary funds.

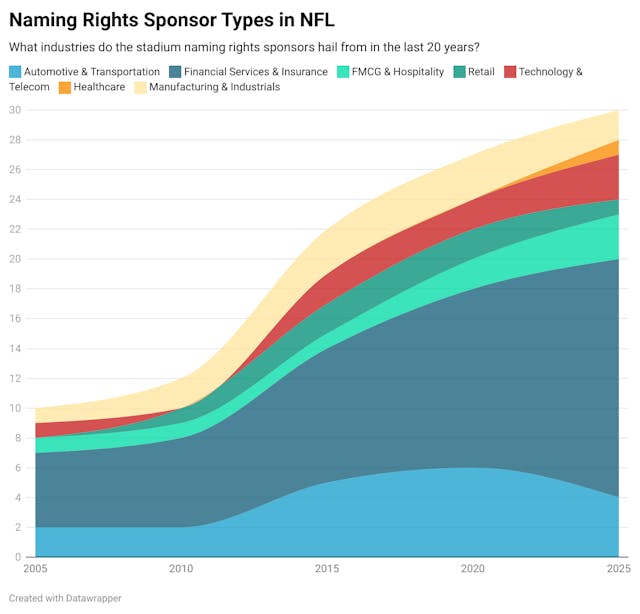

NFL naming rights sponsorships by industry, 2005-25

Interest in having brand names grace the front of NFL stadiums has skyrocketed over the past two decades – and three industries, in particular, have led the way

Here's a look at the evolution of NFL stadium naming rights over the past 20 years:

NFL naming rights sponsorship trends

➤ NFL stadium naming rights sponsorships have increased by a whopping 200% over the past 20 years, from just 10 in 2005 to 30 in 2025.

➤ Financial services & insurance (220%) have seen the highest growth rate in that span, and now sponsor half of the league's venues overall.

➤ Fast made consumer goods (FMCG) & hospitality (200%) and technology & telecom (200%) have also seen rapid expansion into the NFL naming rights universe.

Naming Rights Sponsorships by Team

Here's a breakdown of the current franchise values, stadium sponsors (if applicable) and sponsorship industries for all 32 NFL teams:

| Team | Value ($bn)* | Stadium Sponsor | Industry |

|---|---|---|---|

| Arizona Cardinals | 4.3 | State Farm | Financial Services & Insurance |

| Atlanta Falcons | 5.2 | Mercedes-Benz | Automotive & Transportation |

| Baltimore Ravens | 5 | M&T Bank | Financial Services & Insurance |

| Buffalo Bills | 4.2 | Highmark Blue Cross Blue Shield of Western New York | Health Care |

| Carolina Panthers | 4.5 | Bank of America | Financial Services & Insurance |

| Chicago Bears | 5.4 | No Sponsor | N/A |

| Cincinnati Bengals | 4.1 | Paycor | Technology & Telecom |

| Cleveland Browns | 5.1 | Huntington Bank Field | Financial Services & Insurance |

| Dallas Cowboys | 10.1 | AT&T | Technology & Telecom |

| Denver Broncos | 5.5 | Empower | Financial Services & Insurance |

| Detroit Lions | 4.1 | Ford Motor Co. | Automotive & Transportation |

| Green Bay Packers | 5.6 | No Sponsor | N/A |

| Houston Texans | 6.1 | NRG Energy | Manufacturing & Industrials |

| Indianapolis Colts | 4.8 | Lucas Oil | Manufacturing & Industrials |

| Jacksonville Jaguars | 6.7 | EverBank | Financial Services & Insurance |

| Kansas City Chiefs | 4.8 | GEHA | Financial Services & Insurance |

| Las Vegas Raiders | 6.7 | Allegiant | Automotive & Transportation |

| Los Angeles Chargers | 5.1 | SoFi | Financial Services & Insurance |

| Los Angeles Rams | 7.6 | SoFi | Financial Services & Insurance |

| Miami Dolphins | 6.2 | Hard Rock | FMCG & Hospitality |

| Minnesota Vikings | 5 | U.S. Bank | Financial Services & Insurance |

| New England Patriots | 7.4 | Procter & Gamble | FMCG & Hospitality |

| New Orleans Saints | 4.4 | Caesars Entertainment | FMCG & Hospitality |

| New York Giants | 7.3 | MetLife | Financial Services & Insurance |

| New York Jets | 6.9 | MetLife | Financial Services & Insurance |

| Philadelphia Eagles | 6.6 | Lincoln Financial | Financial Services & Insurance |

| Pitsburgh Steelers | 5.3 | Acrisure | Financial Services & Insurance |

| San Francisco 49ers | 6.8 | Levi Strauss & Co. | Retail |

| Seattle Seahawks | 5.4 | CenturyLink, Inc. | Technology & Telecom |

| Tampa Bay Buccaneers | 5.4 | Raymond James Financial | Financial Services & Insurance |

| Tennessee Titans | 4.9 | Nissan | Automotive & Transportation |

| Washington Commanders | 6.3 | Northwest Federal | Financial Services & Insurance |

*Values provided by Forbes and are accurate as of 2024.

Only two stadiums in the NFL operate without naming rights sponsorships as of 2025:

- The Green Bay Packers play at historic Lambeau Field, re-named from City Stadium in 1965 after team founder and head coach Earl "Curly" Lambeau, who had passed away two months earlier. Packers president Mark Murphy has said "it will always be Lambeau Field," though the team has sold naming rights to several areas of the stadium.

- The Chicago Bears have remained faithful to the Soldier Field name, with their stadium serving to honor those who died in combat during World War I. But the Bears could be on the move to a different part of the metro area – and a relocation would almost certainly come with a naming rights agreement that would add hundreds of millions in revenue.

Naming Rights Sponsorship Values

Here's a look at the value of the NFL's 30 stadium naming rights deals (financial terms that were not made public have footnotes attached):

| Team | Sponsor | Start | End | Annual Value |

|---|---|---|---|---|

| Arizona Cardinals | State Farm | 2018 | 2036 | $8-9 million¹ |

| Atlanta Falcons | Mercedes-Benz | 2015 | 2042 | $12 million² |

| Baltimore Ravens | M&T Bank | 2017 | 2037 | $6 million |

| Buffalo Bills | Highmark Blue Cross Blue Shield of WNY | 2021 | 2031 | Unknown |

| Carolina Panthers | Bank of America | 2004 | NA | $7 million |

| Chicago Bears | Huntington Bank Field | 2024 | 2044 | Unknown |

| Cincinnati Bengals | Paycor | 2022 | 2038 | $8-12 million³ |

| Dallas Cowboys | AT&T | 2013 | NA | $17-19 million⁴ |

| Denver Broncos | Empower | 2019 | 2039 | $6 million⁵ |

| Detroit Lions | Ford Motor Co. | 2002 | 2036 | $2 million |

| Houston Texans | NRG Energy | 2000 | 2032 | $10 million |

| Indianapolis Colts | Lucas Oil | 2006 | 2028 | $6 million |

| Jacksonville Jaguars | EverBank | 2014 | 2027 | $4.3 million |

| Kansas City Chiefs | GEHA | 2021 | 2031 | Unknown |

| Las Vegas Raiders | Allegiant Travel Co. | 2019 | NA | $20-25 million⁶ |

| Los Angeles Chargers | SoFi | 2020 | 2040 | ~$15 million⁷ |

| Los Angeles Rams | SoFi | 2020 | 2040 | ~$15 million |

| Miami Dolphins | Hard Rock | 2016 | 2034 | $13.9 million |

| Minnesota Vikings | U.S. Bank | 2015 | 2040 | $8.8 million |

| New England Patriots | Procter & Gamble | 2010 | 2031 | ~$8 million⁸ |

| New Orleans Saints | Caesars Entertainment | 2021 | 2041 | $6.9 million |

| New York Giants | MetLife | 2011 | 2036 | $8 million |

| New York Jets | MetLife | 2011 | 2036 | $8 million |

| Philadelphia Eagles | Lincoln Financial | 2002 | 2033 | $12 million |

| Pittsburgh Steelers | Acrisure | 2022 | 2042 | >$10 million⁹ |

| San Francisco 49ers | Levi Strauss & Co. | 2013 | 2033 | $11 million |

| Seattle Seahawks | CenturyLink, Inc. | 2011 | 2034 | $4.2 million |

| Tampa Bay Buccaneers | Raymond James Financial | 1998 | 2028 | $3.2 million |

| Tennessee Titans | Nissan | 2015 | 2035 | $5 million |

| Washington Commanders | Northwest Federal | 2024 | 2031 | $8 million |

Naming rights sponsorship value trends

🟠 The Tampa Bay Buccaneers own the distinction of having the longest ongoing sponsorship agreement in place, having aligned with Raymond James Financial in 1998 (the only current sponsorship deal that dates back to the 20th Century). Their agreement is up in 2028, and it would surprise no one to see the two sides extend it further at that time.

🟠 EverBank Stadium, home of the Jacksonville Jaguars, is the earliest naming rights agreement set to expire. The Jags and EverBank signed a three-year extension in 2024 that moved the expiry to 2027, though there's nothing to suggest that the two sides will seek to end their partnership.

🟠 Allegiant Travel Co. might have the sweetest NFL naming rights gig in the league, providing the moniker for the sparkly new home of the Las Vegas Raiders. And like everything in Vegas these days, it's also the most expensive – costing the brand between $20-$25 million annually.

Sports betting sponsorships

While stadium naming rights get the bulk of the attention in the NFL advertising world, sports betting proliferation is garnering plenty of headlines, as well.

We've seen a huge jump in partnerships between NFL franchises and the industry's best sports betting apps from 2018 to 2025, as more states legalize online sports betting each year. And while just two teams jumped on the sportsbook partnership bandwagon the year PASPA was repealed, now more than two-thirds (22) of the league's franchises have aligned with NFL betting sites.

Here's a look at the evolution of sports betting operator sponsorships by team from 2018 to 2025:

Sports betting sponsorship trends

◾ bet365 is the runaway leader in sportsbook sponsorship deals in the NFL, now tethered to a dozen teams – four more than current runner-up FanDuel.

◾ Six different franchises (Denver, Detroit, Las Vegas, N.Y. Jets, Philadelphia, Pittsburgh) are each aligned with three sportsbooks for sponsorship purposes; all six teams are located within states that rank inside the top-10 all-time in sports betting handle.

◾ The Houston Texans are the only team with sports betting sponsorships in a state where sports wagering is illegal. (The Kansas City Chiefs are located in Missouri, where legal sports betting will be introduced later this year.)

◾ Of the 10 NFL teams that don't presently have a sports betting sponsorship in place, four (Cincinnati, Green Bay, Seattle, Tampa Bay) are located in states where sports wagering is legal.

The Future of NFL Stadiums and Financing: The Experts Weigh In

NFL stadium financing agreements are big business – and they have massive ramifications for fans, taxpayers and nearby communities.

We consulted a pair of experts to get their take on what future NFL stadium deals might look like:

⚖️ Robert Boland is a Partner at Shumaker's national sports law practice who has worked on several NFL stadium deals, and has served as a professor of sports management and business at NYU. He also wrote the stadium finance chapter in the book, "Sport Finance: Where the Money Comes From, and Where the Money Goes." with Dr. Karen Weaver.

👔 Irwin Raij is the co-chair of Sidley Austin's Entertainment & Sports Group. Irwin has worked on some of the biggest and most complex sports deals in the country, including as lead counsel for the State of New York on the $850M deal for the Buffalo Bills and representing Investors in the Josh Harris-led consortium in their record-breaking US$6.05 billion acquisition the NFL’s Washington Commanders.

5 Key NFL Stadium Financing Themes Explored

NFL stadium costs are entering a new tier – and $2B is no longer top end

Both experts agree: the Titans’ and Bills’ projects – often cited as massive at an estimated cost of $2.1 billion apiece – are now middle-tier stadiums. The NFL’s vision post-SoFi and AT&T Stadiums is shifting toward mega-venues capable of hosting global events.

But these billion-dollar builds carry risks, and cities need airtight legal and financial strategies to avoid being left holding the bag.

🔹 Boland: “I see the baseline number for a new NFL stadium development as higher than the Titans and Bills projects. Those two teams are building comparatively low-cost buildings to some degree based on market size - for the Bills - and market position.”

Legal structure – not just the size of the deal – will define the future of stadium finance

Public outrage doesn’t always come from how much is spent, but how well the deal is built. Raij and Boland emphasize the need for cost caps, long-term liability protections, and robust non-relocation clauses to safeguard public interests.

They both point out that political short-termism is often exploited in these negotiations — and cities without deep legal support are vulnerable.

🔹 Boland: “Elected officials have a 4- or 8-year term but team owners and leagues have real staying power and know how to work the levers and knobs of the political process well.”

🔹 Raij: “Cities should not be on the hook for cost overruns. Stadium costs almost always escalate, and the public’s contribution needs to be boxed in from the start. A strong non-relocation agreement is the bedrock of protecting the public’s investment.”

Private equity will reshape the stadium ecosystem – but not in the way most people think

Since the NFL began allowing private equity to invest in franchises, many assumed this would lead to stadiums being privately funded. Both experts say: not quite.

Instead, private equity is expected to fuel mixed-use development around stadiums – a key revenue engine that can support stadium financing without breaching NFL debt limits.

🔹 Boland: “The development of residential and entertainment districts is probably the biggest trend going forward … a stadium or arena project that can solve a significant community problem – and housing is often a significant one – can be a big lever for growth.”

🔹 Raij: “While private equity may not be financing the actual stadium or owning it outright, it can play a key role in making the broader business model work.”

Hidden costs inflate stadium budgets far beyond construction headlines

While headlines focus on construction costs, both experts highlight soft costs, site development, late-stage technology implementation, and debt service as the real financial pressure points – especially in a high-interest-rate era.

🔹 Raij: “Every year of delay adds significant costs, especially in labor, which rarely decreases even if materials do. Technology integration – from Wi-Fi to smart ticketing – is often underestimated during early budgeting and becomes a big-ticket addition late in the process.”

🔹 Boland: “Owners and developers absolutely enjoy using the leverage they can create by being in demand.”

Suburban migration and site control are the new battlegrounds

With teams like the Bears and Commanders exploring suburban moves, both experts stress that stadium site selection isn’t just about real estate – it’s about long-term control over parking, food & beverage, and development rights.

Cities risk losing out on tax revenue, while suburbs stand to gain transformative economic districts.

🔹 Raij: “These projects are now anchors for broader mixed-use development that can transform a local economy and tax base. If the new stadium is just across city lines, the regional economy may still benefit – but the city may lose hotel, restaurant, and sales tax revenue.”

🔹 Boland: “It was the desire to control parking and grab a bigger share of food and beverage that supported the suburbanization movement of the 1970s and 1980s.”

¹ Sports Business Journal, Sept. 4, 2018; ² Sports Business Journal, Feb. 22, 2016; ³ Sportico, Aug. 9, 2022; ⁴ Dallas Morning News, July 25, 2013; ⁵ The Associated Press, Sept. 4, 2019; ⁶ Las Vegas Review-Journal, Aug. 5, 2019; ⁷ BNN Bloomberg, Sept. 15, 2019; ⁸ Yahoo! Finance, Nov. 4, 2013; ⁹ Andrew Fillipponi (Twitter/X), July 11, 2022.

James Bisson X social