-

-

SBR PRO

SBR PRO

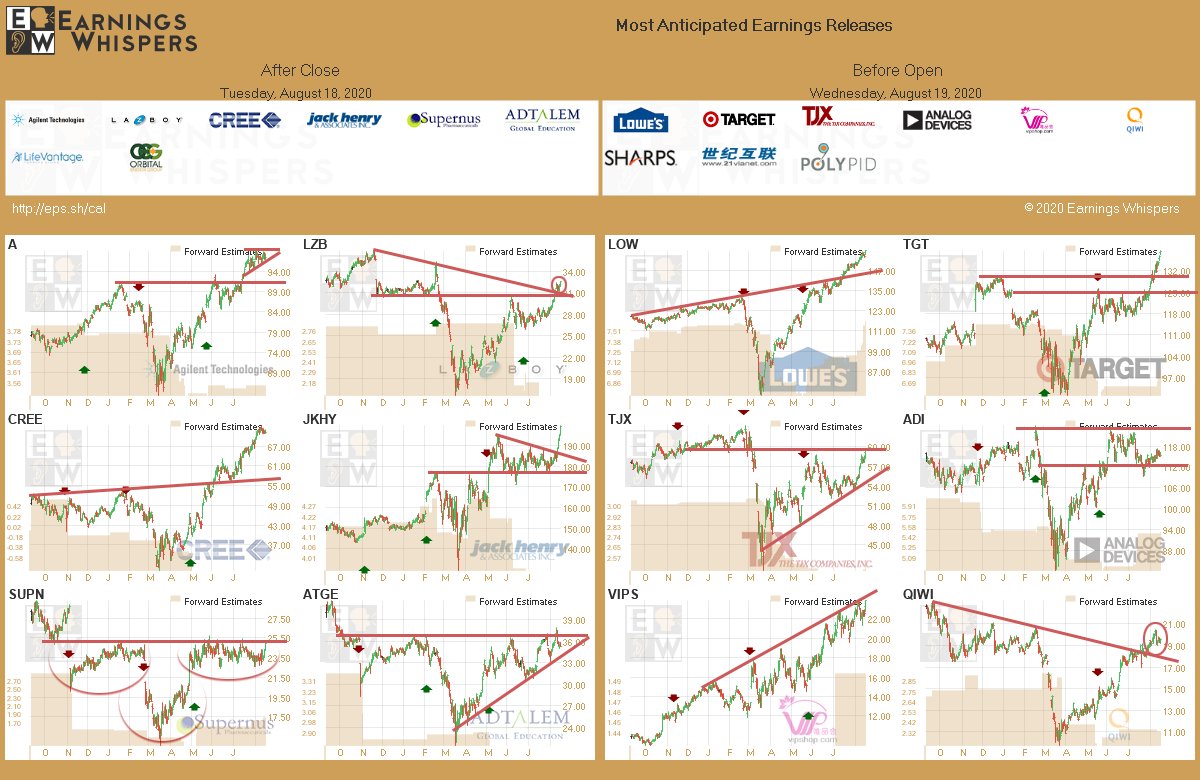

Earning announcements after the bell today and before the open tomorrow:

-

SE QoQ growth >40%, YoY > 100%, users, purchases and downloads exponential increases.

-

SBR PRO

SBR PRO

. I took 7000 cash out last week and think i will take 5000 out tomorrow. Going to sell p.g and fb this week. Will let apple go til 10th of sept. If trump loses this race he is going to sell all those c.l.o.'s that the govt has been buying. That way every one loses about at least a third of their portfolio's so he can say that you never should of elected a democrat.

-

SBR PRO

SBR PRO

gdp down 32% and yet the stock market hits record highs

lets all remember that the only reason target/lowes/etc are having blowout numbers is because everyone else was closed, and all those unemployed people were getting tons of free money to spend

i've been stock market bullish (when it was relatively super cheap) but not any more... the free money will run out and there is no fed buying everything at some point

would much rather hold gold for the next 5 years than stocks, unless you're cherry picking stuff that is still cheap

-

SBR PRO

SBR PRO

Originally Posted by

milwaukee mike

gdp down 32% and yet the stock market hits record highs

lets all remember that the only reason target/lowes/etc are having blowout numbers is because everyone else was closed, and all those unemployed people were getting tons of free money to spend

i've been stock market bullish (when it was relatively super cheap) but not any more... the free money will run out and there is no fed buying everything at some point

would much rather hold gold for the next 5 years than stocks, unless you're cherry picking stuff that is still cheap

But if you are liquid and can buy at bottom stock market will go back up if you have time.

-

Lumber stocks are like an ATM right now. Everything so green.

also GAN earnings tomorrow LFG

-

SBR PRO

SBR PRO

face book over 266. want to sell but have fomo

-

SBR PRO

SBR PRO

Originally Posted by

CanuckG

Lumber stocks are like an ATM right now. Everything so green.

also GAN earnings tomorrow LFG

sounds like they expect a catastrophic event soon.

-

SBR PRO

SBR PRO

-

SBR PRO

SBR PRO

sold fb now watch it go to 300

-

SBR PRO

SBR PRO

Originally Posted by

chico2663

sold fb now watch it go to 300

Is this a short or long term trade? I think you did the right thing. Needs to retrace to 250ish at least.

-

The market was sleep walking through another boring August day until the FED walked in and woke up the entire room with the meeting notes. We could see a pullback if things don't go well here in the next hour.

-

SBR PRO

SBR PRO

Originally Posted by

Slurry Pumper

The market was sleep walking through another boring August day until the FED walked in and woke up the entire room with the meeting notes. We could see a pullback if things don't go well here in the next hour.

And yet,m not much of a reaction. This market seems impossible to take down. Until it happens of course.

What do we see from Nvidia after the bell? It's going to be good, but the expectations have to be sky high.

-

I bought Intel for a swing trade, sitting at march lows...should see mid 50s soon enough

-

Originally Posted by

Goat Milk

My biggest gain this last month or so is CLSK

2 bucks to almost 10. Should I sell?

TRVN I'm averaged at 1.36. So let's see how that goes.

Looking for the next x10 boomer. F these little 5% gainers.

Thanks Goat. I took a look at CLSK after you mentioned it and took a position. Doing very well so far

-

-

SBR PRO

SBR PRO

Originally Posted by

d2bets

Is this a short or long term trade? I think you did the right thing. Needs to retrace to 250ish at least.

did it because when people start losing everything and the fed quits feeding the demon...shit will drop like it's hot.

-

Originally Posted by

chico2663

did it because when people start losing everything and the fed quits feeding the demon...shit will drop like it's hot.

I think the crash will happen after the vaccine is announced and everyone feels safe again. They want all that money sitting on sidelines to get back in first

-

SBR PRO

SBR PRO

-

Sold some RGR short today at the bell 09.30.03 for 20 shares @ 76.18.

Ruger has been on a mountain climbing expedition since the WuTang Flu hit, now I think it pulls back along the golden ration on the fibonacci retracement line to around $58.33 from this point. With all the unrest, it may only hit the 50% level which is around $64.55. I definitely see it going to the 38.2% level at $70.67. I'm stopped out just above the 50 DMA at $77.65 (2%)

-

GAN earnings disappointing. But good value here on the dip. Jumped on RKT and it's rocketing.

-

SBR PRO

SBR PRO

holy TSLA

trading at ~1000x earnings. unreal

-

SBR PRO

SBR PRO

Originally Posted by

homie1975

holy TSLA

trading at ~1000x earnings. unreal

took gains at 1600. before they told us of split. What a dumb ass move. on a good note apple is up 12 a share. sold out of pg. only aapl left and waiting til split to get rid of

-

SBR PRO

SBR PRO

Originally Posted by

homie1975

holy TSLA

trading at ~1000x earnings. unreal

Completely absurd. 383 billion cap.

5 years from now they will not be a 1 trillion company. But Nvidia will. Tesla just a more sexy name right now. I mean, you can't fight it. It could still move another 50% higher this year; anything is possible. I certainly wouldn't short. But you gotta find an exit at some point because it ain't justified.

-

SBR PRO

SBR PRO

Originally Posted by

d2bets

Completely absurd. 383 billion cap.

5 years from now they will not be a 1 trillion company. But Nvidia will. Tesla just a more sexy name right now. I mean, you can't fight it. It could still move another 50% higher this year; anything is possible. I certainly wouldn't short. But you gotta find an exit at some point because it ain't justified.

2er - i know you've been singing NVDA praises a long time. what a company, what a leader in Jensen. as you know, Jimmy Cramer loves them too. named his dog NVIDIA LOL

-

It's not what they bring...

SBR PRO

SBR PRO

Originally Posted by

homie1975

holy TSLA

trading at ~1000x earnings. unreal

Wait, Tesla has earnings?

Is the 1000x earnings more or less than when they were a $450 stock with no earnings?

Of course I’m making jokes here.

-

I’d say Moderna is in a buy range 62-66 for me. Phase 3 data should start trickling in sometime in late September. This has been a rinse a repeat bump on results news.

-

SBR PRO

SBR PRO

Originally Posted by

trobin31

I’d say Moderna is in a buy range 62-66 for me. Phase 3 data should start trickling in sometime in late September. This has been a rinse a repeat bump on results news.

my dumb ass had options on moderna that expired today. i didnt sell when it was in the 90's like a fukkin idiot

-

Originally Posted by

allabout the $$$

my dumb ass had options on moderna that expired today. i didnt sell when it was in the 90's like a fukkin idiot

I donít usually trade biopharm but this one Iíve been accumulating as I think they have an advantage in the vaccine race #1 they are sponsored by NIH #2 itís likely to elicit the best immune response. If the phase 3 results are good, the climb is likely to stick longer term through when they actually deploy the vaccine. At which time you should sell. Donít forget, we are coming into the cold season and covid factors are going to start weighing more heavily once again. Right now not a major issue but if people start dying in the +3k per day all the covid stocks and vaccines will be at the forefront again.

-

In the arena of genomic editing I bought Pacific Bioscience PACB today. They have developed a system to perform long sequence genome reading which will eat into Illumina market share for genomic editing plus they are trading far below valuation @6.5 as this allows researchers to obtain more data for research and development

-

OK its time for the week that was, and how my positions are doing. The overall trend in the market is to chug along going up a little at a time with only about 6 people actually trading stocks everyday. Apple and the rest of the FANGMAN stocks are in super redickulous territory in terms of their near term overboughtness. Take a look at Apples monthly chart and tell me that is sustainable for a few more months.

Anyway lets get the stupid stuff out of the way first.

RIG: TransOcean

I've done several cutting edge pumping solutions for Transocean over the years, and truth be told, they are probably the single biggest reason for my successful career up to this point. The stuff they have developed over the years is right up there with all of the popular electric vehicle and software innovations, but since they are in dirty oil, and how to get at that oil in places that are hard to access, they don't get any fanfare. So as it is, the offshore drillers are getting pounded like a $10 smack whore down near the naval shipyard during a 4th of July weekend celebration. Its been bad for companies like Diamond Offshore, Valaris, Nobel, and others. Cheap oil and price wars between the Saudi and Russian countries haven't helped an industry that just 6 years was booming. Well that's the way it goes, you're a hero one day and a loser the next.

With all of that, then why am I buying RIG?? Who knows, I'm a stupid shyt for doing it , and I've been chasing it down for some reason all week after my initial buy. Just look at the chart, I have around 3 grand spent so far this week, and I'm going into a full 33% loss already. I knew I should have cut and run the day after I bought it at $2.13 and it tanked and closed at $1.91 but I didn't. I know on Monday the stock will move to my stop price and get me out at $1.04, which will be the $1000 point up in smoke and I can forget about the good time I've had.

, and I've been chasing it down for some reason all week after my initial buy. Just look at the chart, I have around 3 grand spent so far this week, and I'm going into a full 33% loss already. I knew I should have cut and run the day after I bought it at $2.13 and it tanked and closed at $1.91 but I didn't. I know on Monday the stock will move to my stop price and get me out at $1.04, which will be the $1000 point up in smoke and I can forget about the good time I've had.

| TOTALS ALL STOCKS |

2020 |

|

IN

PLAY |

19,524.05 |

ALLOWED

LOSS |

-2,320.85 |

|

GAIN

SO FAR |

-534.25 |

|

|

|

TOTAL

GAIN |

-860.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MONTH |

AUG |

15,307.35 |

-2,163.35 |

-528.15 |

-501.07 |

| TOTALS PER STOCK |

RIG |

3,193.00 |

-1,009.00 |

-799.00 |

1,200.00 |

| MONTH |

AUG |

3,193.00 |

-1,009.00 |

-799.00 |

0.00 |

| STOCKS |

| DATE |

TIME |

STOCK

TICKER |

SHARES |

BEGIN

BUY/SELL

PRICE |

TOTAL

IN PLAY |

SET

STOP LOSS

PRICE |

ALLOWABLE

LOSS TOTAL |

ALLOW

LOSS

% TOTAL |

TODAY'S

CLOSE/END

PRICE |

GAIN/LOSS

SO FAR |

END

SHARES |

END

BUY/SELL

PRICE |

END

GAIN/LOSS |

END

%

GAIN/LOSS |

TOTAL

GAIN/LOSS |

TOTAL

%

GAIN/LOSS |

PARTIAL 1

SHARES |

PARTIAL 1

BUY/SELL

PRICE |

PARTIAL 1

GAIN/LOSS |

PARTIAL 1

%

GAIN/LOSS |

PARTIAL 2

SHARES |

PARTIAL 2

BUY/SELL

PRICE |

PARTIAL 2

GAIN/LOSS |

PARTIAL 2

%

GAIN/LOSS |

PARTIAL 3

SHARES |

PARTIAL 3

BUY/SELL

PRICE |

PARTIAL 3

GAIN/LOSS |

PARTIAL 3

%

GAIN/LOSS |

| 08/17/20 |

12.53.26 |

RIG |

300 |

2.13 |

639.00 |

1.04 |

-327.00 |

-51.17% |

1.14 |

-297.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 08/20/20 |

09.45.19 |

RIG |

400 |

1.73 |

692.00 |

1.04 |

-276.00 |

-39.88% |

1.14 |

-236.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 08/20/20 |

14.27.30 |

RIG |

400 |

1.53 |

612.00 |

1.04 |

-196.00 |

-32.03% |

1.14 |

-156.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 08/21/20 |

14.12.50 |

RIG |

1000 |

1.25 |

1,250.00 |

1.04 |

-210.00 |

-16.80% |

1.14 |

-110.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SQQQ: ProShares UltraPro Shares Short QQQ

I've been keeping this one around so I look at it everyday, and everyday the QQQs keep on going up. With $600 in play, it isn't as bad as the RIG play as of yet, and I do see a pullback coming in the next couple of weeks that will allow me to hit it hard. My chart isn't designed to allow for stock splits, so it may take a few weeks for me to figure it out so that the chart has the correct numbers.

| TOTALS ALL STOCKS |

2020 |

|

IN

PLAY |

19,524.05 |

ALLOWED

LOSS |

-2,320.85 |

|

GAIN

SO FAR |

-534.25 |

|

|

|

TOTAL

GAIN |

-860.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MONTH |

AUG |

15,307.35 |

-2,163.35 |

-528.15 |

-501.07 |

| TOTALS PER STOCK |

SQQQ |

111.80 |

-31.80 |

379.00 |

-76.00 |

| MONTH |

AUG |

111.80 |

-31.80 |

379.00 |

-7.00 |

| STOCKS |

| DATE |

TIME |

STOCK

TICKER |

SHARES |

BEGIN

BUY/SELL

PRICE |

TOTAL

IN PLAY |

SET

STOP LOSS

PRICE |

ALLOWABLE

LOSS TOTAL |

ALLOW

LOSS

% TOTAL |

TODAY'S

CLOSE/END

PRICE |

GAIN/LOSS

SO FAR |

END

SHARES |

END

BUY/SELL

PRICE |

END

GAIN/LOSS |

END

%

GAIN/LOSS |

TOTAL

GAIN/LOSS |

TOTAL

%

GAIN/LOSS |

PARTIAL 1

SHARES |

PARTIAL 1

BUY/SELL

PRICE |

PARTIAL 1

GAIN/LOSS |

PARTIAL 1

%

GAIN/LOSS |

PARTIAL 2

SHARES |

PARTIAL 2

BUY/SELL

PRICE |

PARTIAL 2

GAIN/LOSS |

PARTIAL 2

%

GAIN/LOSS |

PARTIAL 3

SHARES |

PARTIAL 3

BUY/SELL

PRICE |

PARTIAL 3

GAIN/LOSS |

PARTIAL 3

%

GAIN/LOSS |

| 08/05/20 |

13.13.37 |

SQQQ |

100 |

5.59 |

111.80 |

4.00 |

-31.80 |

-28.44% |

24.54 |

379.00 |

|

|

|

|

|

|

80 |

0.00 |

-447.20 |

-100.00% |

|

|

|

|

|

|

|

|

|

|

CHEF: Chef's Warehouse INC.

This one is my wife's pick, and ever since I bought it, it turn right the fuk around and has been heading down just like she doesn't. I'm allowing it to bleed me of a couple of hundred before I cut my losses, which is at $13.57. I can't say the same for the 'ole lady, she has been bleeding me for around 25 years now and it just wouldn't feel right if I had some happy days at this point.

| TOTALS ALL STOCKS |

2020 |

|

IN

PLAY |

19,524.05 |

ALLOWED

LOSS |

-2,320.85 |

|

GAIN

SO FAR |

-534.25 |

|

|

|

TOTAL

GAIN |

-860.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MONTH |

AUG |

15,307.35 |

-2,163.35 |

-528.15 |

-501.07 |

| TOTALS PER STOCK |

CHEF |

2,926.00 |

-212.00 |

-130.00 |

0.00 |

| MONTH |

AUG |

2,926.00 |

-212.00 |

-130.00 |

0.00 |

| STOCKS |

| DATE |

TIME |

STOCK

TICKER |

SHARES |

BEGIN

BUY/SELL

PRICE |

TOTAL

IN PLAY |

SET

STOP LOSS

PRICE |

ALLOWABLE

LOSS TOTAL |

ALLOW

LOSS

% TOTAL |

TODAY'S

CLOSE/END

PRICE |

GAIN/LOSS

SO FAR |

END

SHARES |

END

BUY/SELL

PRICE |

END

GAIN/LOSS |

END

%

GAIN/LOSS |

TOTAL

GAIN/LOSS |

TOTAL

%

GAIN/LOSS |

PARTIAL 1

SHARES |

PARTIAL 1

BUY/SELL

PRICE |

PARTIAL 1

GAIN/LOSS |

PARTIAL 1

%

GAIN/LOSS |

PARTIAL 2

SHARES |

PARTIAL 2

BUY/SELL

PRICE |

PARTIAL 2

GAIN/LOSS |

PARTIAL 2

%

GAIN/LOSS |

PARTIAL 3

SHARES |

PARTIAL 3

BUY/SELL

PRICE |

PARTIAL 3

GAIN/LOSS |

PARTIAL 3

%

GAIN/LOSS |

| 08/18/20 |

13.32.44 |

CHEF |

200 |

14.63 |

2,926.00 |

13.57 |

-212.00 |

-7.25% |

13.98 |

-130.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAT: Caterpillar INC.

This one was heading down until Friday when it shot up a couple of bucks and put me in the same position as the entry price when I shorted it at the top of a break up candle. Its sitting right below some resistance, so we will see if it turns back around or keeps moving up to my stop loss at $141.06.

| TOTALS ALL STOCKS |

2020 |

|

IN

PLAY |

19,524.05 |

ALLOWED

LOSS |

-2,320.85 |

|

GAIN

SO FAR |

-534.25 |

|

|

|

TOTAL

GAIN |

-860.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MONTH |

AUG |

15,307.35 |

-2,163.35 |

-528.15 |

-501.07 |

| TOTALS PER STOCK |

CAT |

2,730.50 |

-90.70 |

-38.10 |

0.00 |

| MONTH |

AUG |

0.00 |

0.00 |

0.00 |

0.00 |

| STOCKS |

| DATE |

TIME |

STOCK

TICKER |

SHARES |

BEGIN

BUY/SELL

PRICE |

TOTAL

IN PLAY |

SET

STOP LOSS

PRICE |

ALLOWABLE

LOSS TOTAL |

ALLOW

LOSS

% TOTAL |

TODAY'S

CLOSE/END

PRICE |

GAIN/LOSS

SO FAR |

END

SHARES |

END

BUY/SELL

PRICE |

END

GAIN/LOSS |

END

%

GAIN/LOSS |

TOTAL

GAIN/LOSS |

TOTAL

%

GAIN/LOSS |

PARTIAL 1

SHARES |

PARTIAL 1

BUY/SELL

PRICE |

PARTIAL 1

GAIN/LOSS |

PARTIAL 1

%

GAIN/LOSS |

PARTIAL 2

SHARES |

PARTIAL 2

BUY/SELL

PRICE |

PARTIAL 2

GAIN/LOSS |

PARTIAL 2

%

GAIN/LOSS |

PARTIAL 3

SHARES |

PARTIAL 3

BUY/SELL

PRICE |

PARTIAL 3

GAIN/LOSS |

PARTIAL 3

%

GAIN/LOSS |

| 08/21/90 |

09.30.01 |

CAT |

-10 |

136.80 |

1,368.00 |

141.06 |

-42.60 |

-3.11% |

138.43 |

-16.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 08/20/90 |

09.30.04 |

CAT |

-10 |

136.25 |

1,362.50 |

141.06 |

-48.10 |

-3.53% |

138.43 |

-21.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GDX: VanEck Vectors Gold Miners ETF

Gold got pounded all week after Warren Buffet's rally when he announced he was getting rid of the banking stocks and getting into gold. Its a real big deal that he is doing that, and it says allot about the future of the economy. I have a buy order for this stock when it gets down to $36.79, but I think I will also buy some more if it get down to $35.81. The stop loss is way down there at around $31 bucks. I just don't see it coming back that much, and this sector is just taking time off the clock before it moves up again.

| TOTALS ALL STOCKS |

2020 |

|

IN

PLAY |

19,524.05 |

ALLOWED

LOSS |

-2,320.85 |

|

GAIN

SO FAR |

-534.25 |

|

|

|

TOTAL

GAIN |

-860.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MONTH |

AUG |

15,307.35 |

-2,163.35 |

-528.15 |

-501.07 |

| TOTALS PER STOCK |

GDX |

2,046.75 |

-481.25 |

-2.25 |

1,733.20 |

| MONTH |

AUG |

2,046.75 |

-481.25 |

-2.25 |

0.00 |

| STOCKS |

| DATE |

TIME |

STOCK

TICKER |

SHARES |

BEGIN

BUY/SELL

PRICE |

TOTAL

IN PLAY |

SET

STOP LOSS

PRICE |

ALLOWABLE

LOSS TOTAL |

ALLOW

LOSS

% TOTAL |

TODAY'S

CLOSE/END

PRICE |

GAIN/LOSS

SO FAR |

END

SHARES |

END

BUY/SELL

PRICE |

END

GAIN/LOSS |

END

%

GAIN/LOSS |

TOTAL

GAIN/LOSS |

TOTAL

%

GAIN/LOSS |

PARTIAL 1

SHARES |

PARTIAL 1

BUY/SELL

PRICE |

PARTIAL 1

GAIN/LOSS |

PARTIAL 1

%

GAIN/LOSS |

PARTIAL 2

SHARES |

PARTIAL 2

BUY/SELL

PRICE |

PARTIAL 2

GAIN/LOSS |

PARTIAL 2

%

GAIN/LOSS |

PARTIAL 3

SHARES |

PARTIAL 3

BUY/SELL

PRICE |

PARTIAL 3

GAIN/LOSS |

PARTIAL 3

%

GAIN/LOSS |

| 08/10/20 |

14.23.05 |

GDX |

25 |

42.62 |

1,065.50 |

31.31 |

-282.75 |

-26.54% |

40.89 |

-43.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 08/11/20 |

13.17.50 |

GDX |

25 |

39.25 |

981.25 |

31.31 |

-198.50 |

-20.23% |

40.89 |

41.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GLD: SPDR Gold Trust

This one came back as gold plummeted this week, and flirted with my buy price of $180.35, but didn't trigger the order. I suspect that the gold will start moving back up next week again, but for the foreseeable future it is probably in a range until Congress shovels out a pile of cash to everyone. There hasn't been much news on the stimulus, and I keep saying we will hear nothing until the market steps in and has a mini crash of some sort.

| TOTALS ALL STOCKS |

2020 |

|

IN

PLAY |

19,524.05 |

ALLOWED

LOSS |

-2,320.85 |

|

GAIN

SO FAR |

-534.25 |

|

|

|

TOTAL

GAIN |

-860.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MONTH |

AUG |

15,307.35 |

-2,163.35 |

-528.15 |

-501.07 |

| TOTALS PER STOCK |

GDX |

2,046.75 |

-481.25 |

-2.25 |

1,733.20 |

| MONTH |

AUG |

2,046.75 |

-481.25 |

-2.25 |

0.00 |

| STOCKS |

| DATE |

TIME |

STOCK

TICKER |

SHARES |

BEGIN

BUY/SELL

PRICE |

TOTAL

IN PLAY |

SET

STOP LOSS

PRICE |

ALLOWABLE

LOSS TOTAL |

ALLOW

LOSS

% TOTAL |

TODAY'S

CLOSE/END

PRICE |

GAIN/LOSS

SO FAR |

END

SHARES |

END

BUY/SELL

PRICE |

END

GAIN/LOSS |

END

%

GAIN/LOSS |

TOTAL

GAIN/LOSS |

TOTAL

%

GAIN/LOSS |

PARTIAL 1

SHARES |

PARTIAL 1

BUY/SELL

PRICE |

PARTIAL 1

GAIN/LOSS |

PARTIAL 1

%

GAIN/LOSS |

PARTIAL 2

SHARES |

PARTIAL 2

BUY/SELL

PRICE |

PARTIAL 2

GAIN/LOSS |

PARTIAL 2

%

GAIN/LOSS |

PARTIAL 3

SHARES |

PARTIAL 3

BUY/SELL

PRICE |

PARTIAL 3

GAIN/LOSS |

PARTIAL 3

%

GAIN/LOSS |

| 08/10/20 |

14.23.05 |

GDX |

25 |

42.62 |

1,065.50 |

31.31 |

-282.75 |

-26.54% |

40.89 |

-43.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 08/11/20 |

13.17.50 |

GDX |

25 |

39.25 |

981.25 |

31.31 |

-198.50 |

-20.23% |

40.89 |

41.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RGR: Strurm Ruger & Company

This is pretty much the only stock I'm happy with this week. It has had a run up in the last couple of months and now it is pulling back a couple of bucks a day since I shorted it. I will add to the short play if this continues in a heavier way probably o Wednesday when it sinks a little more. I'm expecting a pretty good pullback down to the $59 dollar range eventually.| TOTALS ALL STOCKS |

2020 |

|

IN

PLAY |

19,524.05 |

ALLOWED

LOSS |

-2,320.85 |

|

GAIN

SO FAR |

-534.25 |

|

|

|

TOTAL

GAIN |

-860.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MONTH |

AUG |

15,307.35 |

-2,163.35 |

-528.15 |

-501.07 |

| TOTALS PER STOCK |

RGR |

3,009.80 |

-96.20 |

101.40 |

0.00 |

| MONTH |

AUG |

1,523.60 |

-29.40 |

69.40 |

0.00 |

| STOCKS |

| DATE |

TIME |

STOCK

TICKER |

SHARES |

BEGIN

BUY/SELL

PRICE |

TOTAL

IN PLAY |

SET

STOP LOSS

PRICE |

ALLOWABLE

LOSS TOTAL |

ALLOW

LOSS

% TOTAL |

TODAY'S

CLOSE/END

PRICE |

GAIN/LOSS

SO FAR |

END

SHARES |

END

BUY/SELL

PRICE |

END

GAIN/LOSS |

END

%

GAIN/LOSS |

TOTAL

GAIN/LOSS |

TOTAL

%

GAIN/LOSS |

PARTIAL 1

SHARES |

PARTIAL 1

BUY/SELL

PRICE |

PARTIAL 1

GAIN/LOSS |

PARTIAL 1

%

GAIN/LOSS |

PARTIAL 2

SHARES |

PARTIAL 2

BUY/SELL

PRICE |

PARTIAL 2

GAIN/LOSS |

PARTIAL 2

%

GAIN/LOSS |

PARTIAL 3

SHARES |

PARTIAL 3

BUY/SELL

PRICE |

PARTIAL 3

GAIN/LOSS |

PARTIAL 3

%

GAIN/LOSS |

| 08/20/20 |

09.30.03 |

RGR |

-20 |

76.18 |

1,523.60 |

77.65 |

-29.40 |

-1.93% |

72.71 |

69.40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 08/21/90 |

09.30.02 |

RGR |

-20 |

74.31 |

1,486.20 |

77.65 |

-66.80 |

-4.49% |

72.71 |

32.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

SBR PRO

SBR PRO

-

RNC this week, stocks will only go up...right?

-

SBR PRO

SBR PRO

Originally Posted by

homie1975

holy TSLA

trading at ~1000x earnings. unreal

that's not accurate based on upcoming earnings

can easily make $20/share next year so now we're at 100x earnings, not 1000x