-

Major Stock Market Crash In January?

Major Stock Market Crash In January?

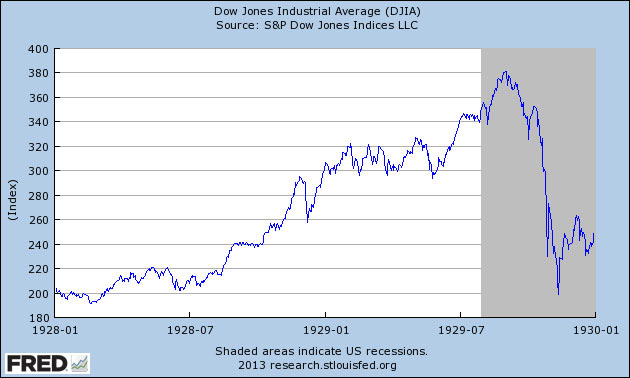

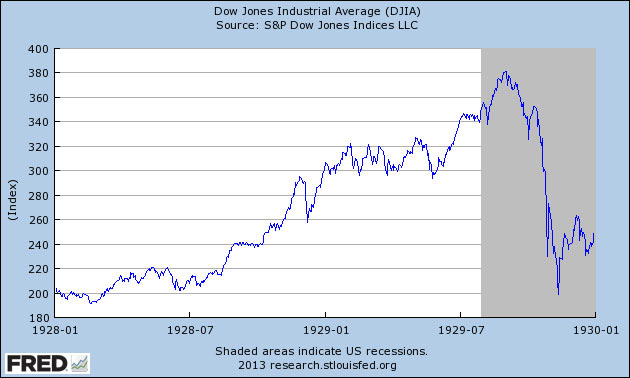

Is there a major financial crash in our near future? You must check out this stunning analogy (link above) between the current day Dow Jones Industrial Index compared with the time period 1928-1929 leading up to the memorable stock market crash…

The pattern of stock price movements looks VERY close to the lead-up to the 1929 top.

A lead-up to just any old top is one thing, but the 1929 top was followed by a memorable decline, which makes it all the more worthy of our attention…

http://modernsurvivalblog.com/the-ec...sh-in-january/

-

I have a few friends of mine who are brokers... live in $500,000 mansions. Practically born with a golden spoon in their mouths. Every rich cat needs to sweat a little. I hope it does crash.

-

SBR PRO

SBR PRO

I agree....the market does not make sense to me. Just too much fake money in it. Too much debt in our country..etc..etc. However since I have 95% of my money on the sideline, I'm sure it will go up 25% next year.

My company is at an all-time high and yet we've had 4 lay-offs this year (had 0 lay-offs the first 15 yrs I was there). Thank you sequestration. How does the stock price continue to rise when our business is drying up. It's not like anything else has changed (cost-cutting, improved outlook, etc).

-

If the market does selloff substantially early next year and the Fed/govt come to the rescue, I am going to add huge amounts to my already leveraged long position.

They will come in with more QE when people are crying in the street (as if they're not doing that already).

I am staying long and not selling - let's go MA DDD and PCLN!

-

Originally Posted by

TheMoneyShot

I have a few friends of mine who are brokers... live in $500,000 mansions. Practically born with a golden spoon in their mouths. Every rich cat needs to sweat a little. I hope it does crash.

-

Wall Street will be more ready for it this time around, so I don't think it will crash as hard. In '99 it was tech stocks with no real value behind it (think if there were 1000 Bitcoin-like stocks out there that everyone actually took seriously), and in 2007 it was extreme shadiness that got exposed. This time it won't be any one major thing except for the market is just too high and needs a good correction.

And your brokers will likely be savvy enough to short it all the way down and keep their mansions. I'm just hoping to get into a get into a nice USD position when the market starts to fall. Maybe a GBP/USD short. Not sure yet.

-

-

Originally Posted by

Ralphie Halves

Wall Street will be more ready for it this time around, so I don't think it will crash as hard. In '99 it was tech stocks with no real value behind it (think if there were 1000 Bitcoin-like stocks out there that everyone actually took seriously), and in 2007 it was extreme shadiness that got exposed. This time it won't be any one major thing except for the market is just too high and needs a good correction.

And your brokers will likely be savvy enough to short it all the way down and keep their mansions. I'm just hoping to get into a get into a nice USD position when the market starts to fall. Maybe a GBP/USD short. Not sure yet.

Always go with the swiss francs my friend

-

Originally Posted by

Monitor-Tan

Always go with the swiss francs my friend

Switzerland pegged their currency to the Euro back in 2011. Since then, they've pretty much run together. Don't get me wrong, I'd still love to set my account to pay me in CHF, but I'm American and couldn't do much with it. It's definitely the coolest looking currency of the 8 majors.

On longer term charts, the GBP seems the most stretched out right now, but by the time the US stock market decides to turn, that could change.

-

SBR PRO

SBR PRO

-

Originally Posted by

sbrhedge

If the market does selloff substantially early next year and the Fed/govt come to the rescue, I am going to add huge amounts to my already leveraged long position.

They will come in with more QE when people are crying in the street (as if they're not doing that already).

I am staying long and not selling - let's go MA DDD and PCLN!

********** made an announcement overnight - stock is up $30 in Europe ... MA baby let's go!

-

Originally Posted by

TheMoneyShot

I have a few friends of mine who are brokers... live in $500,000 mansions. Practically born with a golden spoon in their mouths. Every rich cat needs to sweat a little. I hope it does crash.

500k mansion? You'd be hard pressed to find a decent house for so little where I live.

-

You can still buy Enanta Pharmaceuticals Inc. stocks. Pharmaceutical market is damn strong.

-

Wait till interest rates hit 6%-7% this jan-feb.

-

Economic collapse on it's way.

-

well, put your money on the line, you can be the next john paulson.

-

Don't see that. As long as interest rates are basically zero and the big companies are paying north of 3% in dividends then money has no where to go. The crack will come when inflation or over heating growth returns.

-

I saw some charts from guys way better at reading charts than me that show how we could keep going up for a few more years.

-

Originally Posted by

Ralphie Halves

I saw some charts from guys way better at reading charts than me that show how we could keep going up for a few more years.

+1

Too many bears - Yellen piloting a Stuka ... sounds like long-only.

-

I could definitely see a major crash early next year. Depending on who you read/listen, the holiday numbers haven't been as strong as hoped for. Many retailers do 60+% of their business during this crunch time. Throw on that more people really seeing how much more (as in THOUSANDS MORE) Barry Care costs them, their families, or their businesses.

The market begins and ends with private sector spending. Sure Barry has the rich getting richer in the markets by directing the Fed to keep money cheap. But when a great majority (working Joe's) stop/can't spend, it could easily trigger a bad mindset. That could trigger a collapse.

-

Originally Posted by

OTL

500k mansion? You'd be hard pressed to find a decent house for so little where I live.

Yup

Chicago is expensive

-

also

Starting the new year, along with other new laws/horseshit regulations......their are new federal restrictions being put on future home loans. You will only be allowed to purchase property according to certain income/assets guidelines. This sounds great in principle, but it may stunt housing sales. Sellers will have a smaller pool of perspective bidders. Buyers will have a more limited selection. ESPECIALLY if a good chunk of your income is CASH based.

Just a third hammer for the new year.

-

would be great for any investor, especially if you're not in the market(shame on you), if the market collapsed so you can buy-in. It's not going to happen tho. What will happen is a pullback, correction, whatever you want to call it is coming and it won't be different from what many say is going to be 5-15%. If you don't buy stocks when that happens, you don't like money. However, most people don't, half the country doesn't even own stocks and look what the market has done.

-

listening to Kudlow off the radio....

He says Barry is being told by a close confidant that there is a bubble. And this has him worried.

-

Originally Posted by

mpaschal34

I agree....the market does not make sense to me. Just too much fake money in it. Too much debt in our country..etc..etc. However since I have 95% of my money on the sideline, I'm sure it will go up 25% next year.

My company is at an all-time high and yet we've had 4 lay-offs this year (had 0 lay-offs the first 15 yrs I was there). Thank you sequestration. How does the stock price continue to rise when our business is drying up. It's not like anything else has changed (cost-cutting, improved outlook, etc).

What industry? Defense?

-

Facebook next two quarters.....Inovio Pharmaceuticals.....Boeing.....and Sodastream will make you rich.

-

Originally Posted by

sbrhedge

If the market does selloff substantially early next year and the Fed/govt come to the rescue, I am going to add huge amounts to my already leveraged long position.

They will come in with more QE when people are crying in the street (as if they're not doing that already).

I am staying long and not selling - let's go MA DDD and PCLN!

Gawd I really need MA and DDD to move up to make my year. Last Friday's move is great, and I like to see a lot more lifting up now.

-

I'm going to sell MA before the split and load it into V. AAPL is moving like crazy, should be a good year for aapl.

-

Not going to happen

Too many stops in place

We will have corrections but nothing major

Fed has too much power

In a way inflation will be good if you have cash in bank as rates will rise .

-

tsla going to get a boost soon, after ohio judge rules in their favor to allow sales.

-

Originally Posted by

NYSportsGuy210

Facebook next two quarters.....Inovio Pharmaceuticals.....Boeing.....and Sodastream will make you rich.

-

In all honesty and all seriousness... how do you truly calculate a stock market collapse? Again... I'm not even close to average in stocks. Don't understand them... never took a lesson. Never asked questions... but everyone "thinks" they 100% know. IMO... just from being in business 13 years of my life...

When we had the total collapse a few years back... what happened to all the people who filed bankruptcies? I'm sure they filed... and slowly started getting in debt again. Based upon my estimations of what some of my friends make, buy for their families, and their life styles... they are right back in debt. They say they are fine. But they aren't. You can just tell. Does this help the market knowing they can't file for bankruptcy the next 5-6 years? Remember... we had record breaking numbers of people who lost their homes and had 25k+ card debt.

Did you see facebook photos on Christmas Day? Some families showing 30-50 presents left side and right side of the tree? Unreal. Where does the money come from?

Some people never learn their lessons from being in debt. So... for the next 5 years... when people build the debt up again and can't file bankruptcy for 5-6 years... does this help the stock market?

As for number corrections etc... and the feds of a handle on everything... it's a crap shoot. Feds can't even get Obamacare straightened out... corrections will happen. But how do you have credit on top of credit on top of credit on top of credit? Loan on top of loan on top of loan on top of loan. With no money to pay for the loan to get your head above water? Some of you guys wouldn't know a "true business" and I'm not taking shots at anyone. You might think you know stocks... but not a true business. America is all about business. So as long as the fortune 500 businesses keep it going... then ride the wave... and hope you don't drown. Mom and pop businesses made this United States... and politics wanted them out. That's the honest to God truth.

But you will always have dishonesty in reporting numbers what's truly going on inside a heavy stock market business. Everyone lies. It's human nature. You will always have inflated numbers. The bubble will burst again... we just don't know when.

What we need to be discussing... why are we so naive thinking we're stable?

Last edited by TheMoneyShot; 12-27-13 at 01:45 AM.

-

Originally Posted by

TheMoneyShot

In all honesty and all seriousness... how do you truly calculate a stock market collapse? Again... I'm not even close to average in stocks. Don't understand them... never took a lesson. Never asked questions... but everyone "thinks" they 100% know. IMO... just from being in business 13 years of my life...

When we had the total collapse a few years back... what happened to all the people who filed bankruptcies? I'm sure they filed... and slowly started getting in debt again. Based upon my estimations of what some of my friends make, buy for their families, and their life styles... they are right back in debt. They say they are fine. But they aren't. You can just tell. Does this help the market knowing they can't file for bankruptcy the next 5-6 years? Remember... we had record breaking numbers of people who lost their homes and had 25k+ card debt.

Did you see facebook photos on Christmas Day? Some families showing 30-50 presents left side and right side of the tree? Unreal. Where does the money come from?

Some people never learn their lessons from being in debt. So... for the next 5 years... when people build the debt up again and can't file bankruptcy for 5-6 years... does this help the stock market?

As for number corrections etc... and the feds of a handle on everything... it's a crap shoot. Feds can't even get Obamacare straightened out... corrections will happen. But how do you have credit on top of credit on top of credit on top of credit? Loan on top of loan on top of loan on top of loan. With no money to pay for the loan to get your head above water? Some of you guys wouldn't know a "true business" and I'm not taking shots at anyone. You might think you know stocks... but not a true business. America is all about business. So as long as the fortune 500 businesses keep it going... then ride the wave... and hope you don't drown. Mom and pop businesses made this United States... and politics wanted them out. That's the honest to God truth.

But you will always have dishonesty in reporting numbers what's truly going on inside a heavy stock market business. Everyone lies. It's human nature. You will always have inflated numbers. The bubble will burst again... we just don't know when.

What we need to be discussing... why are we so naive thinking we're stable?

I agree.

This market is an obvious bubble. Anyone with half a brain sees it.

Only a matter of time before the balloon pops.

-

Of course you will see a correction but Fed will not let market collapse

-

Originally Posted by

jjgold

Of course you will see a correction but Fed will not let market collapse

How can the Fed stop it? What if there's a panic selloff?

Reply With Quote

Reply With Quote