-

how much can i borrow for a house?

how much can i borrow for a house?

do i still need 20% down or can i do less? anyone know of any government loans? thanks

-

I was a licensed loan officer for 8 yrs

Send me a PM and elaborate in detail your situation and I will PM u back tomorrow with information for you

-

usda loan does 0 down no pmi

-

If you dont have $$ to put down then you might think of renting for longer...last thing the rest of us need is another foreclosure in the area bringing value down even more. Do a lease with option to buy on a house if anything.

-

SBR PRO

SBR PRO

What can you afford, are the key words. Add together ALL bills including food, utilities,

taxes and what you want to save per month. Whatever is left is what you can afford.

DO NOT let the bank say you can afford it!!!!! YOU have to do your own homework 1st.

They can care less what your bills are. They want paid or else they take your house.

I would recommend paying everything off before even considering a house. Cars and CC's

especially.

If you found a house that meets your financial requirement, jew 'em down and then some more.

-

Originally Posted by

rkelly110

What can you afford, are the key words. Add together ALL bills including food, utilities,

taxes and what you want to save per month. Whatever is left is what you can afford.

DO NOT let the bank say you can afford it!!!!! YOU have to do your own homework 1st.

They can care less what your bills are. They want paid or else they take your house.

I would recommend paying everything off before even considering a house. Cars and CC's

especially.

If you found a house that meets your financial requirement, jew 'em down and then some more.

I'm slightly offended Kelly

Correct on the overall expenses and keep in mind property insurance and homeowners insurance as well...they will bite you in the ass in many states/counties

-

-

USDA rural areas only Very alternative loan

FHA most likely best be and they allow either 3% or 5% down and the PMI is called MIP with FHA.

Again with subprime GONE... best bet is going to be to walk in to any bank or preferably the one that you do your banking with. They will sit you down with a Loan Officer who will take a 1003 Mortgage Application on you, pull your credit, submit online and pop ... out comes your yes or no and the reasons (stipulations)

Every loan is like a fingerprint or almost at least. You need insight on your personal situation and not a bunch of guessing from people. You need to work closely with a Loan Officer and maybe go to 2 different banks... i.e. State Employees Credit Union and Wells Fargo. Compare both of the Good Faith Estimates and the Truth and Lending form.

Capeesh ?

-

the less your mortgage is the better ha. the better your rate the better. i bought a foreclosed 4 bedroom house in sept in wi for 164000 at 4.25 for 30 yr fixed. payments are 1140 but i pay 1200 a month. between me and my fiance we make just under 50k but no car payments and minimal cc debt. our house needed work but everyone i talked to said MAYBE in 10-20 yrs it could be worth 225+ so thats always a good feeling knowing i shouldnt lose money on it.

-

sounds like you did very well Jhack704

4.25% fixed 30yr is awesome rate too!

-

thanks billy. ya im 26 almost 27. i lived w my fiances parents for 3 yrs so we saved up alot then and paid off our cars and what not. we looked for over 2 yrs til we found the house we wanted, we were picky but well worth teh wait

-

One of the biggest +'s of homeownership is that you get to itemize at tax time!!!

-

Can someone explain to me how credit score is determined. Like for instance whe i was struggling for work a few years back and living on my own I had up to a $3000 CC bill. Today it is down to only $120. About three to four times over the last eighteen months I have had it at zero balance and even a surplus.

Shouldn't I have a credit score above 700 as a result? I only settled once with a gym fitness membership once in which I could not make last 5 months payment as a high school senior back in 2002. But we settled. Since then no defaults and very few late monthly payments on my CC.

What should my score be?

-

Originally Posted by

NYSportsGuy210

Can someone explain to me how credit score is determined. Like for instance whe i was struggling for work a few years back and living on my own I had up to a $3000 CC bill. Today it is down to only $120. About three to four times over the last eighteen months I have had it at zero balance and even a surplus. Shouldn't I have a credit score above 700 as a result? I only settled once with a gym fitness membership once in which I could not make last 5 months payment as a high school senior back in 2002. But we settled. Since then no defaults and very few late monthly payments on my CC. What should my score be?

Have you ever applied for credit before because that will ding your score too.

-

if thats all the credit you have it probably wont be high. u need credit like car loans paid off and more than 1 major ************ with no settlements or late payments. it sounds like you really have 0 credit based on what u said

-

well with ************ if your balance is 50% or lower of your High Credit amount then it reflects on your credit score. If you have it paid down to around 30% it is optimum.

When you go to purchase something (house,car,etc) they pull a tri-merge credit report on you( not the same as a consumer credit report that you can pull on yourself via FreeCreditReport.com,etc) The Lender bases everything off your middle score. Everyone has 3 scores (Exquifax,Experian,Transunion) say you have a 681,702 and a 736. Then everything is based off the middle score...the 702. There are other factors that play (NO DOC,SIVA,SISA) loans are G O N E!!! Your job history, income (based off your last 2yrs of W2's and a most recent paystubb...if you are W2 employee) or ( last 2 yrs of tax returns looking at your bottom line figure and avg'd. i.e. you grossd 60k in 2010 but after all write offs on your schedule C you claimed to the gov't that you made 34k and in 2011 you made 57k but after all write offs you show only 32k. Then the lender will avg the 34k for 2010 and the 32k for 2011 giving you purchasing power of 33k. they then divide that by 12mos and you show to the world that you make around $2,888/mo.

Now here is where your credit and debt come in. say on your credit report it shows you have student loans that total $255/mo, a car payment of $350/mo and a couple ************ that total $175/mo.

Normally, if you are not over 50% DTI (debt to income) then you are good to go. In this case adding $255+$350+175=$780 mo in debt payments. Since you are able to document $2888/mo in income... you are running a DTI of 27% and banks(lenders) are going to love you

-

getting your credit report pulled will actually not hinder your scores ...unless you are habitual with it like appying for house, car, jewelry, etc,etc....then it can bring your score down but not much 8-10pts or something.

Yet and still it's good not to have a ton of pulls

-

Originally Posted by

jhack704

if thats all the credit you have it probably wont be high. u need credit like car loans paid off and more than 1 major ************ with no settlements or late payments. it sounds like you really have 0 credit based on what u said

How can I possibly have a credit score of 0? This makes no sense. I never defaulted on a loan or CC in my life. For just opening one up as a teenager and making minimal charges on it from your bank you start out with a score of 720.

-

your score is not 0 unless you have absolutely no active tradelines and no collections or anything

what do u want to do? why don't u just walk in a bank and apply for whatever it is you are wanting to do. Then you will have NEW insight on your situation!

Good luck

-

Jhack, i applaud you for making less than 50k together and paying 1200 on a house thats awesome! no sarcasm here!

-

Originally Posted by

NYSportsGuy210

Can someone explain to me how credit score is determined. Like for instance whe i was struggling for work a few years back and living on my own I had up to a $3000 CC bill. Today it is down to only $120. About three to four times over the last eighteen months I have had it at zero balance and even a surplus. Shouldn't I have a credit score above 700 as a result? I only settled once with a gym fitness membership once in which I could not make last 5 months payment as a high school senior back in 2002. But we settled. Since then no defaults and very few late monthly payments on my CC. What should my score be?

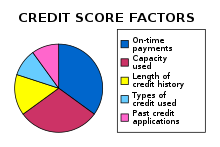

Makeup of the FICO score

The approximate makeup of the FICO score used by US lenders

Credit scores are designed to measure the risk of default by taking into account various factors in a person's financial history. Although the exact formulas for calculating credit scores are secret, FICO has disclosed the following components:[4][5]

- 35%: Payment history—Late payments on bills, such as a mortgage, CC or automobile loan, can cause a FICO score to drop. Bills paid on time will improve a FICO score.[6]

- 30%: Credit utilization—The ratio of current revolving debt (such as CC balances) to the total available revolving credit or credit limit. FICO scores can be improved by paying off debt and lowering the credit utilization ratio.[7] Alternatively, applications for and receiving the credit limit increase will also drive down the utilization ratio. The closing of existing revolving accounts will typically adversely affect this ratio and therefore have a negative impact on a FICO score.

- 15%: Length of credit history—As a credit history ages it can have a positive impact on its FICO score.[8]

- 10%: Types of credit used (installment, revolving, consumer finance, mortgage)—Consumers can benefit by having a history of managing different types of credit.[9]

- 10%: Recent searches for credit—Credit inquiries, which occur when consumers are seeking new credit, can hurt scores. Individuals shopping for a mortgage or auto loan over a short period will likely not experience a decrease in their scores as a result of these types of inquiries, however.[10] While all credit inquiries are recorded and displayed on credit reports for a period of time, credit inquiries that were made by the owner (self-check), by an employer (for employee verification) or by companies initiating pre-screened offers of credit or insurance do not have any impact on a credit score.

Getting a higher credit limit can help your credit score. The higher the credit limit on the CC, the lower the utilization ratio average for all of your CC accounts. The utilization ratio is the amount owed divided by the amount extended by the creditor and the lower it is the better your FICO rating, in general. So if you have one CC with a used balance of $500 and a limit of $1,000 as well as another with a used balance of $700 and $2,000 limit; the average ratio is 40 percent ($1,200 total used divided by $3,000 total limits). If the first CC company raises the limit to $2,000; the ratio lowers to 30 percent; which could boost the FICO rating.

There are other special factors which can weigh on the FICO score.

- Any money owed because of a court judgment, tax lien, etc. carry an additional negative penalty, especially when recent.

- Having one or more newly opened consumer finance credit accounts may also be a negative.[11]

-

FHA is 3.5% down, you'll need at least a 620 credit score to qualify. You can check to see if the home you are buying qualifies for a Homepath loan through Fannie Mae- no appraisal or mortgage insurance needed although the rate is about 1.5% higher than the current market rate. If you have questions, let me know. I'm a licensed LO.

-

Originally Posted by

RawBillyIce

getting your credit report pulled will actually not hinder your scores ...unless you are habitual with it like appying for house, car, jewelry, etc,etc....then it can bring your score down but not much 8-10pts or something. Yet and still it's good not to have a ton of pulls

This is true. You get a 14 day window to have your credit pulled as many times as you want as long its for the same type of transaction. If you have your report pulled by different industries (mortgage, car, furniture) it will affect your score right away on top of the letter of explaination you'll have to write stating that you didn't open up any new acccounts. The lending industry is black and white today.

Word of advice, if you get approved for a mortgage, don't move money around from account to account prior to closing. It will be a papertrail nightmare as every cent moved will have to be accounted for.

-

ha ha ... joey you are bringing back so many memories. I have not been an LO for last 2 yrs but was licensed in NC for 7-8yrs.

was an LO through all the Subprime era. That was fun. LO's got such a bad rep for the housing crisis, when really you can't blame them. They are simple salesmen in the end. The fault lies in Administration. If an Account Executive walks into your office and says, "Hey we can do 100% Stated with a 580 and 55% DTI, he LO is going to jump all over it. How can it be his/her fault in the least unless they are cutting and pasting,etc.

Subprime allowed 2 on front and 2.5 on back as long as u did not run into section 32(high cost)

I mean it was sick... u could take a 580 french fry cook at McDonalds (borrower) and 580 french fry cook at Burger King (co-borrower) and put the 100% Stated in a 210k home. The fault never was with the Loan Officers and always with regulation. As soon as the bubble bursted... how did they finally regulate the industry? They raised credit scores, zapped programs like stated,SIVA,SISA,etc,etc.... stiffened DTI (to below 40%, raised min FICO scores, from 620ish to 680 then to what??? 720,740?

I went from closing 5,6 loans a month to 1 a month and less... most of my peers through in the towel long before I did.

Out of curiosity Joey, How long have you been a Licensed LO and what state(s)?

Thanks!

-

Originally Posted by

Blissit02

Jhack, i applaud you for making less than 50k together and paying 1200 on a house thats awesome! no sarcasm here!

thanks. it isnt too hard, its well worth it, im not a renter or leasing kind of guy. im sure it might get a lil more tight when we have kids in a few yrs but for now it isnt too bad. its getting easier now too. at 1st i had to get a new furnace and about 5000 in fixes but i do construction so i probably saved over double that by doing the work myself

-

Originally Posted by

NYSportsGuy210

How can I possibly have a credit score of 0? This makes no sense. I never defaulted on a loan or CC in my life. For just opening one up as a teenager and making minimal charges on it from your bank you start out with a score of 720.

well i didnt actually mean 0, i meant they could say you dont have enough credit history to extend you credit but u wont know for sure unless you apply

-

Billy,

I'm licensed only in Illinois but can do 29 states or so though a interstate lending desk - 8 years now which seems like 80. Had some business in the subprime market back in the day but luckily, most of my clients continue to be vanilla type purchase borrowers. The industry sure has changed though. In the last refi boom we were making 260 bps on FHA plus covering closing costs - win-win for everyone. Now the comp plans are so screwed up, the only people making what they were before are the title companies. Even realtors are going on the skinny to get the listing. New HARP programs get released on March 1 - really hoping that they give everyone a chance to take advantage of the low rates and not just people who purchased prior to May 2009.

-

SBR PRO

SBR PRO

Take your money and stock up on some a1 and wait for the drought in your area.

-

@Joeythelip23 do u work for a full service coresponding lender/broker or a big bank?

I think the best avenue for the future is to get on with Wells or another BigBank. being a w2commissioned LO

may never reap what it used to. Those days are clearly seeya

I have went back to school and finished basically an associates degree about to transfer to an online private school like Phoenix to get Bachelors in IT I think. Wanted anything besides commission sales.

Do u have any thoughts on the future for computer programmers or software engineering? I was going to major in Mathmatics and look towards Acturial Science which has about 10 exams total and can top out Actuary Fellow at 200-300k / yr. Very goal oriented but most likely a pipe dream. would require a huge amount of self study and disipline but the financial reward is bar none the best !

-

I'm with a lender who is direct to Freddie, Fannie and Ginny- not a FDIC insured bank. Wells is a good bank with a big market share in my area but I refuse to do the big bank thing anymore as they kill any entrepreneurial spirit - I spent time with Wachovia and was severed when they closed retail lending nationwide, best thing that ever happened to me. I can make 2x more in pay with the same amount of volume as the big banks. Sure, I don't get leads but I've never needed them. My business model is 100% referral. You become a slave to their systems and unless you're banging out $70-$80 million a year in business, you're just another LO there.

I'm by far the wrong person to ask about the future of computer programmers/software engineering...I only use the stuff - don't understand how any of it works. Like any industry though, the market will soon become saturated with talent if that's what they are paying. You're smart to be specializing though. I have friends with 10+ years in the IT business and with outsourcing, they are always worried about the other shoe dropping.

Best of luck to ya man!

Last edited by joeythelip23; 02-29-12 at 11:24 AM.

Reason: grammar policing...

-

I am very familiar with the mtg biz being 100% referral. I always got my loans out of the air

Math is my passion. Do you have experience with math ?

-

No math experience besides the fancy stuff I can do on my mortgage calculator  I graduated college as a PR major... the money in the business is too much to pass up.

I graduated college as a PR major... the money in the business is too much to pass up.

-

I know that's right brother. Keep doing your thing