-

Kelly question; calculating the optimal Kelly fractional

Kelly question; calculating the optimal Kelly fractional

I've been told that calculating the ideal kelly fractional involves finding the ratio between assessed overlay, and actual long term edge.

For example:

assessed overlay = 10%

long term edge = 2%

ratio: 5:1

Thus the optimal kelly fractional is 5.

Is this true? I'm having my doubts about this, it just seems to simple/to good to be true.

-

Off the mark. Kelly is assessed as an optimal bankroll bet fraction as a function of your Bayesian Prior win% less expenses to make the bet (vig plus others costs to make bet). Google "Kelly criterion" both on the net and search here at SBR. This Q has been answered many, many times.

-

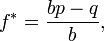

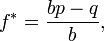

Are you wondering what the formula for Kelly is?

where:

where:

- f* is the fraction of the current bankroll to wager;

- b is the net odds received on the wager (that is, odds are usually quoted as "b to 1")

- p is the probability of winning;

- q is the probability of losing, which is 1 − p.

http://en.wikipedia.org/wiki/Kelly_criterion

-

Hey Wrecktangle I found the other thread on the Kelly Criterion. Great thread and it really did challenge some long held notions on Kelly.

I've got a question though, could one not Monte Carlo an analysis of Kelly?

I mean, you could create a Monte Carlo simulation of 1,000 runs of 10,000 bets each under different conditions, and then narrow down a kelly approach that was most in line to your own utility function.

It would even help in examining the correct bankroll size given the maximum expected drawdown with a strike rate of x%, an edge of y% and a betting run of z bets.

Is there any merit in this approach?

-

Hey roast, just saw your post. No, I'm conversant with the criterion, I just want to better understand its application. Cheers anyway for posting.

-

Originally Posted by

brettd

Hey Wrecktangle I found the other thread on the Kelly Criterion. Great thread and it really did challenge some long held notions on Kelly.

I've got a question though, could one not Monte Carlo an analysis of Kelly?

I mean, you could create a Monte Carlo simulation of 1,000 runs of 10,000 bets each under different conditions, and then narrow down a kelly approach that was most in line to your own utility function.

It would even help in examining the correct bankroll size given the maximum expected drawdown with a strike rate of x%, an edge of y% and a betting run of z bets.

Is there any merit in this approach?

I am not sure I fully understand what you are saying but let me add this piece of information for you:

Kelly is optimal as long as the inputs are perfect. So if you win 55% of your wagers at -110, your edge is 5% at odds of 100/110 and your optimal wager (edge/odds) is 5.5%. Now assume we take a sample of 500 wagers (10,000 is too many, however, the concept is the same regardless of how small or large the sample is).

If we start with a $1,000 bankroll and wager 5.5%, as long as we have 275 wins (275/500=55%) in that sample, we will always wind up with the exact same ending balance ($1,991.66) regardless of the order of the wins and losses (of course ignoring rounding issues).

In that same sample, if you wager more than or less than 5.5%, you will end up with less of an ending balance. The major significant difference between wagering more or less than 5.5% is that by wagering more than 5.5% you increase your risk of going bankrupt. The greater the wager over 5.5%, the greater the chance of going bankrupt and in any event, you will always end up with less of an ending balance as opposed to wagering the optimum 5.5%.

Just for fun I ran two sets of 500 wagers with very different patterns of 275 wins and 225 losses (I use excel).

I used 11% or 2x Kelly.

Sample 1:

Starting Bankroll: $1,000

Minimum Bankroll: $3.47

Maximum Bankroll: $13,068.91

Ending Bankroll: $990.24

Sample 2:

Starting Bankroll: $1,000

Minimum Bankroll: $626.93

Maximum Bankroll: $34,959.57

Ending Bankroll: $990.24

I hope in some way this was helpful to you.

Joe.

-

Using Half-Kelly (2.75%) in my two 500 wager samples from my post above with 275 (55%) winners:

Sample 1:

Starting Bankroll: $1,000

Minimum Bankroll: $364.76

Maximum Bankroll: $2,297.72

Ending Bankroll: $1,675.81

Sample 2:

Starting Bankroll: $1,000

Minimum Bankroll: $932.17

Maximum Bankroll: $3,111.98

Ending Bankroll: $1,675.81

and Full-Kelly (5.5%):

Sample 1:

Starting Bankroll: $1,000

Minimum Bankroll: $109.14

Maximum Bankroll: $4,654.36

Ending Bankroll: $1,991.66

Sample 2:

Starting Bankroll: $1,000

Minimum Bankroll: $842.68

Maximum Bankroll: $8,217.55

Ending Bankroll: $1,991.66

Joe.

-

Hey Joe, thanks for your input. I should have just said utility. I realize now that I'd rather not bet kelly optimally, but rather bet in a manner that maximises my 'utility'. Utility as in my satisfaction and contentment. I don't want to deal with the swings kelly (or half kelly for that matter) has on offer. Its volatility is an -EU proposition as far i'm concerned.

Therefore, I want to strike a balance between my tolerance of volatility and the pursuit of profit through monte carlo analysis, in order to come close to maximising my utility.

Possible? Or am I on the wrong track here?

Last edited by brettd; 09-08-10 at 01:39 AM.

-

Originally Posted by

brettd

Hey Wrecktangle I found the other thread on the Kelly Criterion. Great thread and it really did challenge some long held notions on Kelly.

I've got a question though, could one not Monte Carlo an analysis of Kelly?

I mean, you could create a Monte Carlo simulation of 1,000 runs of 10,000 bets each under different conditions, and then narrow down a kelly approach that was most in line to your own utility function.

It would even help in examining the correct bankroll size given the maximum expected drawdown with a strike rate of x%, an edge of y% and a betting run of z bets.

Is there any merit in this approach?

Sure you can. I use Monte Carlo in this fashion to examine a total system analysis (selection model with money management model). One word of caution: if you use Kelly with an over-fitted selection model, it will "wreck" your bankroll.

-

Originally Posted by

Wrecktangle

Sure you can. I use Monte Carlo in this fashion to examine a total system analysis (selection model with money management model).

Hey Wrecktangle, do you care to elaborate on this a little bit? I would love a simple example (if a simple example is possible).

I'm not exactly sure what you mean by the 'selection' model also.

I'm thinking of using Monte Carlo to understand whether a current run of bets is 'normal' compared to a distribution of simulated runs (i.e within 2 standard deviations, assuming a long term edge of x%). That way I can 'flag' performance as possibly abnormal (and in need of investigation) in reality, if the actual betting run is performing outside of those bounds.

Is this how you utilise Monte Carlo also?

Sorry for all questions, i'm probably becoming overenthusiastic of Monte Carlo as a predictive 'crystal ball'.

Cheers.

-

Originally Posted by

brettd

Hey Joe, thanks for your input. I should have just said utility. I realize now that I'd rather not bet kelly optimally, but rather bet in a manner that maximises my 'utility'. Utility as in my satisfaction and contentment. I don't want to deal with the swings kelly (or half kelly for that matter) has on offer. Its volatility is an -EU proposition as far i'm concerned.

Therefore, I want to strike a balance between my tolerance of volatility and the pursuit of profit through monte carlo analysis, in order to come close to maximising my utility.

Possible? Or am I on the wrong track here?

OK, utility. Of course utility is a personal thing. I am also not sure what a monte carlo analysis will do for you because it will just give you the range of bankroll swings for each fraction of Kelly. The lower the Kelly fraction, the less chance of losing half your bankroll before you double it. Even with the stats to show the possible swings of bankroll, you still have to decide how much drawdown risk you are willing to take.

Here is my personal experience for what it is worth. When I found out about Kelly, I tried to use full-Kelly. It wasn't so bad when my bankroll was relatively small but as my bankroll grew, the relative extreme swings of bankroll did not fit my personality. I then tried half-Kelly and found that more to my liking. Of course, when I looked at my half-Kelly data and plugged in what would have happened if I used full-Kelly instead, I realized that I left a good deal of money on the table so I went back to full-Kelly. It wasn't long before full-Kelly was making me uncomfortable again (which can also play havoc with your wagering and/or selection decisions) and so I went back to half-Kelly and rationalized it this way: Once I double my bankroll, at that point I would be wagering full-Kelly based on the original bankroll but with the added safety of another bankroll. This way of looking at it fits my personality perfectly and how I have conducted all my "investments" for many, many years.

One last note. I settled on half-Kelly from actual use. I think experience is a great teacher. You may need to settle on a different % but you won't really know until you try it. It is like paper trading/wagering, it seems like everything works great until you use real money. I will also tell you that when I am going through a "trying" period or things just don't seem to be going my way, I will ride it out by lowering my % to quarter-Kelly until I feel confident again that things are going my way.

If you truly have an edge (again, no edge, no any % of Kelly), pick a % and try it. And during your trial phase, you don't have to use your whole bankroll. IMO, gaining the experience of actually using Kelly %'s will help you determine what % may be right for you.

Joe.

Points Awarded:

MisterRodriguez gave u21c3f6 4 Betpoint(s) for this post.

MisterRodriguez gave u21c3f6 4 Betpoint(s) for this post.

|

-

Originally Posted by

u21c3f6

OK, utility. Of course utility is a personal thing. I am also not sure what a monte carlo analysis will do for you because it will just give you the range of bankroll swings for each fraction of Kelly. The lower the Kelly fraction, the less chance of losing half your bankroll before you double it. Even with the stats to show the possible swings of bankroll, you still have to decide how much drawdown risk you are willing to take.

Exactly, and then I can decide what comes to close to my own maximum utility. Or not?

I've never come close to full kelly. I consider a Kelly Fractional of 10 to be somewhat aggressive for my situation. This is considering that every sport that is bet on has access to a 'communal' bankroll.

I.E: a bankroll increase attributed to sport y, means sport z also now has access to a larger bankroll. As sport a to z is deemed to have long term edge of x%.

Looking at the results database, we've done 4687 bets in the last 3 months. Evaluating our use of Kelly is now a high priority.

BTW, cheers for another insightful post.

Reply With Quote

Reply With Quote

where:

where:

MisterRodriguez gave u21c3f6 4 Betpoint(s) for this post.

MisterRodriguez gave u21c3f6 4 Betpoint(s) for this post.