Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4586Comment -

IonaSBR MVP

- 01-08-10

- 4244

#4587Earnings after the close today:

Comment -

IonaSBR MVP

- 01-08-10

- 4244

#4588Fasten your seatbelt; I have a feeling the triple Q's will have a huge trading range over the next three (3) months.boughtQQQ Aug 21 2020 243.0 Put Limit 18.55

BOL with the position..

Full disclosure: I am short QQQ @ 225 1/2Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#4589Gilead dropped 10 bucks in a week after hcq was proved a dog.I have money in Moderna so hoping for good news. It honestly could go either way. Some are saying it could split up to 120 within the next week or so, which would be a 40% spike while others say it could drop back down to 50 or 60. So holding my chips hoping for good news.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4590look at MD and VA also, both over 1200 new cases today. is it because of more testing or is it because the virus is still spreading rapidly? there are two ways to spin it LOLComment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

-

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#4592What is the trend in the positivity rate there? If it's going down considerably then it's just a function of more testing.Comment -

IonaSBR MVP

- 01-08-10

- 4244

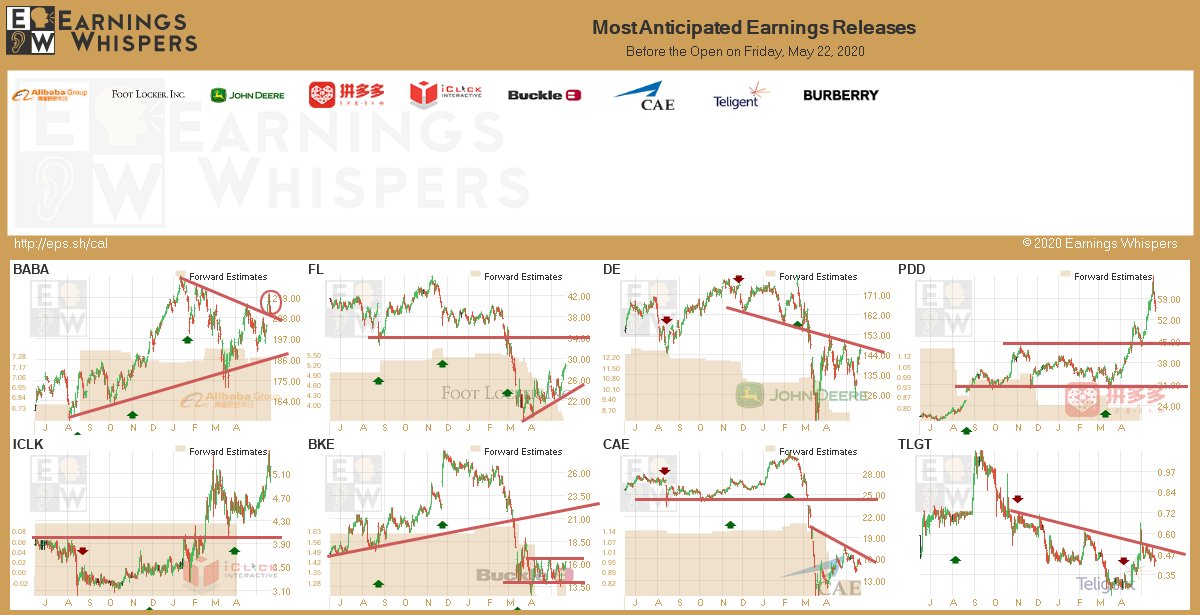

#4595Earning before the bell tomorrow:

Comment -

IonaSBR MVP

- 01-08-10

- 4244

#4596Nice going on the long QQQ @ 198; hat tip, Homie1975.

I sold a 121 Put (expires next Friday) today against my 100 share short position (pocketed a small premium). I just think this market is "Frothy" - just my 2 cents :-)

As always, BOL. More importantly, stay healthy.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4597Going to think outloud for a couple of posts...

News all excited because crude having its "best month ever"…lol.

WalMart is reporting great numbers. We were fortunate here that many smaller grocery and other stores stayed open and not much really shutdown even if people did.

But some parts of the country weren’t so fortunate and when the people needed something, some areas had WalMart, HomeDepot, Lowes, and Target while all others were for forced to close.

So the government handed money out to the people and they spent it at the above stores and online, buying stuff from them and on Amazon. Remember so much of this stuff made in China.

If those consumers spent some of the money they gave the people, then that money basically trickled its way back to the Chinese economy.

UnrealComment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4598So in 2016 Trump's victory and Senate results were considered good for the markets and when he followed through with tax cuts, regulation easing, etc., the markets continued to respond, recovering from any large dips and even a boom.

It's largely believed that had Trump lost then the Democratic agenda would have tapered the markets or at the very least not been as successful for most of the equities.

Now though, the markets are have built in the idea of more stimulus coming, with Dems hoping to prop things up until metrics like unemployment get back to pre-pandemic levels and the Republicans on hold with it all.

Now we don’t how bad things will be, how many industries, companies, etc. just might disappear, and we know that Republicans do want to help businesses here with stimules, They are not just calling everything off. We also know that Dems will hand out stimulus with conditions that will rival restrictions, etc. that the 2016 election avoided.

Those conditions laid out, what about the markets?

With the markets counting in stimulus and future stimulus so much, just as Goldman, Is it possible that it might actually be good for the markets if the Dems win?

The promise of continued aid throughout and even after it’s declared “over” with a “vaccine” or whatever, would keep the markets afloat by itself. The republicans might fight that and not pass that kind of ongoing legislation.

If it all does catch up to us, and we have terrible employment and numbers heading into next year, and industries don’t recover, and unemployment stays way up there, then it seems that the market could have the exact opposite response to election results as it did in 2016.

That’s a bunch of “if’s” in a fluid situation, but will any of them be revealed by election time?

I’m just thinking out loud here.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30057

#4599KVB -I'm planning on sitting out next week altogether. It's all political now. McConnell and most Reps will not want to give most of the Heroes Act, but they will, eventually, give states aid, more corporate and probably some personal - but nobody knows how much or when.

The Senate won't decide this next week. They won't come back for real sessions until June 1. It is quite possible the market trades down next week. Still, any news of expectations or comments would keep it from going down under the trading range. So it could go down 1-3%.

Much better to wait for the Senate to have their debates and then announce the form of the stimulus. We know "opening" is NOT anything like before. The whole market has written off earnings and bad data for the next 6-9 months. It's ridiculous. What if the GOP wants to wait, and they just do state aid and some pet projects, but no more free gummint checks for some time ? I think Trump and McConnell know they have to save some powder for the fall when it counts more.Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#4600But the "powder" is endless, dontchaknow?KVB -I'm planning on sitting out next week altogether. It's all political now. McConnell and most Reps will not want to give most of the Heroes Act, but they will, eventually, give states aid, more corporate and probably some personal - but nobody knows how much or when.

The Senate won't decide this next week. They won't come back for real sessions until June 1. It is quite possible the market trades down next week. Still, any news of expectations or comments would keep it from going down under the trading range. So it could go down 1-3%.

Much better to wait for the Senate to have their debates and then announce the form of the stimulus. We know "opening" is NOT anything like before. The whole market has written off earnings and bad data for the next 6-9 months. It's ridiculous. What if the GOP wants to wait, and they just do state aid and some pet projects, but no more free gummint checks for some time ? I think Trump and McConnell know they have to save some powder for the fall when it counts more.Comment -

Slurry PumperSBR MVP

- 06-18-18

- 2811

#4601Yeah today was just a little drifting to the downside so they can bring it back tomorrow and go into the holiday right at the top of the trading range. Then on Tuesday next week watch for the I-beam of bullshit chart on the S&P to continue. At some point the market will break down, it has to. The earnings are shit, half of the small businesses aren't going to come back, shit loads of people on unemployment. With that said, it really looks like the FED will prop up the market until we at least break out of this trading range to the upside. Eventually, the Fed will give the money to the banks so that they can buy their own stock or make a profit somehow without doing anything. Then the industrial stocks will come to play and we will be off to the races for a little while and just when everybody gets into the market, the bottom will fall out and we'll drop like we did in March. Everybody thinks the China Syndrome was the cause of the downturn, and I say it was just the catalyst. The QE for the last 12 years was starting to catch up finally and the market needed to correct.Comment -

CanuckGSBR Posting Legend

- 12-23-10

- 21978

#4602In for 1000 shares on PENN (900 on this account) at around $16 a week ago. How long do we hold? Don't want to get greedy as I'm up almost 12k USD so far. Casinos are slowly reopening and sports will resume eventually. Also have $BYD (downtown vegas casinos should be okay) and $CHR.TO (really like them)

Comment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#4603Penn way overvalued, would get out asapCause Sleep is the Cousin of DeathComment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#4604Do some history. Markets always do better under dems. Beside Reagan who flooded his programs with surplus’s s.s.payments. Maybe also papa bushSo in 2016 Trump's victory and Senate results were considered good for the markets and when he followed through with tax cuts, regulation easing, etc., the markets continued to respond, recovering from any large dips and even a boom.

It's largely believed that had Trump lost then the Democratic agenda would have tapered the markets or at the very least not been as successful for most of the equities.

Now though, the markets are have built in the idea of more stimulus coming, with Dems hoping to prop things up until metrics like unemployment get back to pre-pandemic levels and the Republicans on hold with it all.

Now we don’t how bad things will be, how many industries, companies, etc. just might disappear, and we know that Republicans do want to help businesses here with stimules, They are not just calling everything off. We also know that Dems will hand out stimulus with conditions that will rival restrictions, etc. that the 2016 election avoided.

Those conditions laid out, what about the markets?

With the markets counting in stimulus and future stimulus so much, just as Goldman, Is it possible that it might actually be good for the markets if the Dems win?

The promise of continued aid throughout and even after it’s declared “over” with a “vaccine” or whatever, would keep the markets afloat by itself. The republicans might fight that and not pass that kind of ongoing legislation.

If it all does catch up to us, and we have terrible employment and numbers heading into next year, and industries don’t recover, and unemployment stays way up there, then it seems that the market could have the exact opposite response to election results as it did in 2016.

That’s a bunch of “if’s” in a fluid situation, but will any of them be revealed by election time?

I’m just thinking out loud here.Comment -

ERBtheGREATSBR Rookie

- 06-03-13

- 46

-

ERBtheGREATSBR Rookie

- 06-03-13

- 46

#4606I'm long on...

DIA

XOM

SIX

CCL

CNK (the only one I'll contemplate selling)

PENN

SPGComment -

navyblue81SBR MVP

- 11-29-13

- 4143

#4607Anyone here on Stash? If so, curious your opinion of it.Comment -

CanuckGSBR Posting Legend

- 12-23-10

- 21978

#4608How do we not buy RRR or MGM?Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30057

#4609those are buys but it doesn't feel like a great rush to buy just now

questions like...

1) what happens when 2Q numbers reveal how bad the economy really is?

2) what happens when it dawns on the market that the new normal is NOT normal for hospitality and retail venues?

3) what happens IF the Senate disappoints on a second stimulus?Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4610KVB -I'm planning on sitting out next week altogether. It's all political now. McConnell and most Reps will not want to give most of the Heroes Act, but they will, eventually, give states aid, more corporate and probably some personal - but nobody knows how much or when.

The Senate won't decide this next week. They won't come back for real sessions until June 1. It is quite possible the market trades down next week. Still, any news of expectations or comments would keep it from going down under the trading range. So it could go down 1-3%.

Much better to wait for the Senate to have their debates and then announce the form of the stimulus. We know "opening" is NOT anything like before. The whole market has written off earnings and bad data for the next 6-9 months. It's ridiculous. What if the GOP wants to wait, and they just do state aid and some pet projects, but no more free gummint checks for some time ? I think Trump and McConnell know they have to save some powder for the fall when it counts more. Comment

Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4611That's really part of the point of the post. "Do some history" just doesn't cut it here. After the gernalization, you point out exceptions yourself...lol.

The only history we need is in really in my post, with the 2016 election. I think it's pretty clear we're in an exception time.

You can't possibly believe that the economy and markets, which are two different things, would have done better if Trump had lost. We're already in an exception to your generalization without even considering what happens going forward.

Crazy times.

Comment

Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4612^ There has been a Trump Bump since right after the election in 2016, there is simply no doubt about it. It cannot be ignored. The market was rising steadily under Obama from mid March 2009 until he left office, on the heels of the Great Recession, but it took a much steeper trajectory after trump was elected, there is no doubt about it. without the virus, we would have cont'd that tremendous upward pathComment -

ERBtheGREATSBR Rookie

- 06-03-13

- 46

#4613dow 40,000 during Trump's next 4 yearsComment -

CanuckGSBR Posting Legend

- 12-23-10

- 21978

#4614Hopped on 200 shares of $RRR at 12.83

PENN is still firingComment -

Fred The HammerSBR Posting Legend

- 08-13-13

- 11581

#4615I've made a nice chunk (for me) on MGM, but Penn has beat the shit out of MGM. I'd take the $ and run personally. If we do have some kind of 2nd corona wave then casinos are going to be fkd for some time. Of course Penn has horsetracks and they're getting huge handles now since nothing else to bet on.In for 1000 shares on PENN (900 on this account) at around $16 a week ago. How long do we hold? Don't want to get greedy as I'm up almost 12k USD so far. Casinos are slowly reopening and sports will resume eventually. Also have $BYD (downtown vegas casinos should be okay) and $CHR.TO (really like them)

Comment -

Fred The HammerSBR Posting Legend

- 08-13-13

- 11581

#4616Let me ask a question for experienced traders if I can. I'm more of a day trader personality wise, but how does somebody go about becoming eligible to day trade? Some kind of a certification or something? Do you have to go to a different brokerage?

I bought USAC yesterday at $10.74 and I was ready to sell today at $11.28 and take my 5%, but Webull said my funds haven't settled yet and I could get a slap on the wrist. I did swing MGM the first time in 2 days. Thanks in advance for any help given!Comment -

IonaSBR MVP

- 01-08-10

- 4244

#4617I hope the below answers your question. In my case Schwab notified me that my account has been designated a Day Trading Account pursuant to SEC rules. Normally I do not day trade, but on one afternoon several years ago I made several round term trades on DIA. The following morning I received the alert from Schwab.Let me ask a question for experienced traders if I can. I'm more of a day trader personality wise, but how does somebody go about becoming eligible to day trade? Some kind of a certification or something? Do you have to go to a different brokerage?

I bought USAC yesterday at $10.74 and I was ready to sell today at $11.28 and take my 5%, but Webull said my funds haven't settled yet and I could get a slap on the wrist. I did swing MGM the first time in 2 days. Thanks in advance for any help given!

FINRA rules define a pattern day trader as any customer who executes four or more “day trades” within five business days, provided that the number of day trades represents more than six percent of the customer’s total trades in the margin account for that same five business day period. Customers should note that this rule is a minimum requirement, and that some broker-dealers use a slightly broader definition in determining whether a customer qualifies as a “pattern day trader.” We recommend that customers contact their brokerage firms to determine whether a broader definition applies to their trading activities.

When you meet the Day Trading thresholds, they (in my case Schwab) will designate your account as such.

Minimum Equity Requirement: The minimum equity requirement for a customer who is designated as a pattern day trader is $25,000. This $25,000 requirement must be deposited into the customer’s account prior to any day trading activities and must be maintained at all times. A customer cannot fulfill this $25,000 requirement by cross-guaranteeing separate accounts. Each day trading account is required to meet the $25,000 requirement independently, using only the financial resources avail- able in that account.

If a customer’s account falls below the $25,000 requirement, the customer will not be permitted to day trade until the customer deposits cash or securities into the account to restore the account to the $25,000 minimum equity level.

Day Trading Buying Power: A customer who is designated as a pattern day trader may trade up to four times the customer’s maintenance margin excess as of the close of business of the previous day for equity securities. If a customer exceeds this day trading buying power limitation, the customer’s broker-dealer will issue a day trading margin call. The customer has five business days to meet his or her margin call, during which the customer’s day trading buying power is restricted to two times the customer’s maintenance margin excess based on the customer’s daily total trading commitment for equity securities. If the customer does not meet the margin call by the fifth business day, the day trading account will be restricted to trading only on a cash available basis for 90 days or until the call is met.

Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4618canuck and others, i am in the same boat with penn although to a much larger extent, it has really been the greatest investment of my life

don't forget the tax advantages of holding something a year... the ability to buy puts as a hedge, or the ability to sell covered calls as a hedge

the options premiums on penn are still really elevated, great money to be had there because of the (imho unfounded) thought that it is way overvalued... the people saying that are just pissed that they didn't buy in the 3s instead of the 30sComment -

CanuckGSBR Posting Legend

- 12-23-10

- 21978

#4619Seems like PENN will only rise with sports and "normalcy" returning at some point. I get churchill down stock options from work and casino's seem to be gaining steam. I'll be holding long term.Comment -

milwaukee mikeBARRELED IN @ SBR!

- 08-22-07

- 26914

#4620good stuff canuck...50% capacity eventually turns into 100% capacity in these casinos... and just think of all these new people getting into horse racing/gambling instead of going to nba/nhl/mlb games

it's amazing how many people i've talked to in the past month that are into penn national and casino stocks, if i would've asked them a year ago those same guys would've said "wtf is that?"

Comment

Comment

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code