You're right but it is a warning that things might turn south and leave a whole lotta people with losses. I have and still contend that the financials are not participating and the entire market is being held up with the FED and the FANG stocks. When facebook, apple, google and netflix turn over the entire market goes as well. The FED has been putting up braces and trying to control the downside. When that fails, it will be a big leg down and it usually happens quickly when it happens.

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

Slurry PumperSBR MVP

- 06-18-18

- 2811

#4341Comment -

IonaSBR MVP

- 01-08-10

- 4244

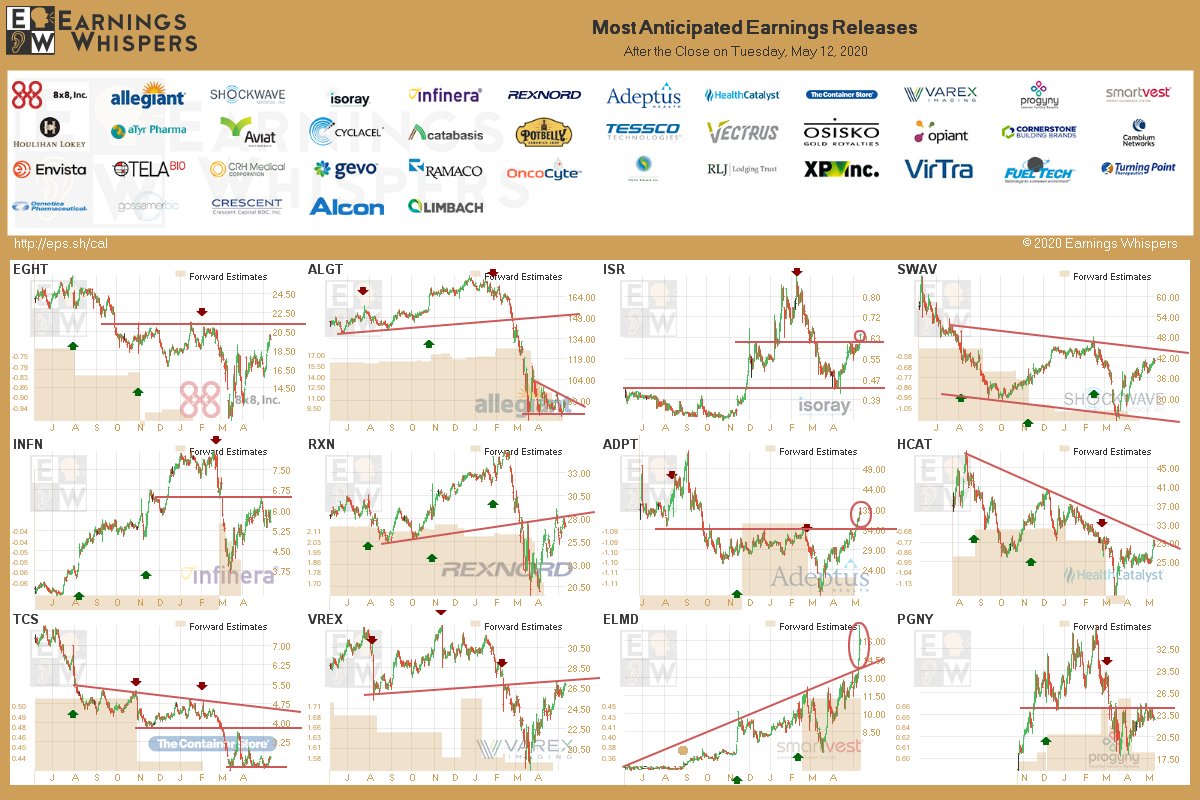

#4342Earning after the close today:

Comment -

IonaSBR MVP

- 01-08-10

- 4244

#4343Earnings before the open tomorrow:

Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30057

#4344I'm not accumulating silver. It will only go up more if there is another stimulus, but the link between currency debasement

and silver has been broken down in recent years due to program quants by the Fed. I'm actually looking at REITs now.

For example, Simon Properties is paying its full dividend and opening half its malls this week.

Can silver sustain a run over 20? probably but not until after the crushed normal stocks stage a recovery. In order for silver

to rally and stay up but the normal stocks fail, a rebound of Coronavirus would have to stop economic recovery.

CDE and EXK are two silver stocks on my watchlist but since the computers took over in 2010s it is hard to fight the Fed.Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#4345wouldn't invest a dime on reits if this shit doesn't recover you can expect them to cut dividend by 2021.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4346SlurryYou're right but it is a warning that things might turn south and leave a whole lotta people with losses. I have and still contend that the financials are not participating and the entire market is being held up with the FED and the FANG stocks. When facebook, apple, google and netflix turn over the entire market goes as well. The FED has been putting up braces and trying to control the downside. When that fails, it will be a big leg down and it usually happens quickly when it happens.

Many argued it was overvalued on feb 19th before the COVID sell off started but it would've kept on climbing if not for the bioweapon so as that saying about "irrational markets" goes..... u know the rest of the storyComment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#4348Yesterday was double-top and now rolling over. Probably rest sideways for a few days around 2,850 before the next fall to low 2700's.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4349Here's the S&P with that same set of trendlines from before...

Comment

Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30057

#4350blood in the streets over at BXP

don't expect Mort Zuckerman to let this continue much longer.

Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4351KVer

sorry to ask, not trying to get spoonfed, but there are so many lines on that chart. what are we looking for? are we concerned about the parallels to the lines prior to the sell off? is this historically indicative of a second leg down, is that our concern here?Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4352Well, I initally posted this chart days ago asking the same questions.

The redlines were just a couple of trend, support, resistance lines I drew up days ago. Interesting to see how it stayed in that narrow pattern.

The others are moving averages, 20, 50, and 200.

Like I said, I posted this asking questions, maybe scenarios on what comes next. All I can say, now that we've seen a few days play out, that we are dipping below that diagonal trendline, and still bouncing off that top red resistance line.

If you notice, I made the trendline after the first top and and the subsequent turn upwards...shown in the circles below...

Once we seemed to have topped again, at the same top red resistance line, it makes me think I drew decent trendline here.

We have now broken through that diagonal and are in fact threateneing that lower support line.

As we fall through lines, I think it signals some kind of further drop. First the diagonal red line, then the acceleration towards the lower horizoantal red line.

It appears as though we are breaking out downward from this.

We are getting answers to the question I asked when I first posted .

In typing this, we have even gone further and just bounsed off of the lower support line...

And now, again as I type, we are back on that line...

Hopefully these last images aren't too small, but it looks like my lines show meaning. Let's see what's next.

Comment

Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4353We are ticking below the lower horizontal.

Might be time to draw new lines of support.

Comment

Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#4354Looks like some freefall action. Some good ol volatility coming back like a virus.Well, I initally posted this chart days ago asking the same questions.

The redlines were just a couple of trend, support, resistance lines I drew up days ago. Interesting to see how it stayed in that narrow pattern.

The others are moving averages, 20, 50, and 200.

Like I said, I posted this asking questions, maybe scenarios on what comes next. All I can say, now that we've seen a few days play out, that we are dipping below that diagonal trendline, and still bouncing off that top red resistance line.

If you notice, I made the trendline after the first top and and the subsequent turn upwards...shown in the circles below...

Once we seemed to have topped again, at the same top red resistance line, it makes me think I drew decent trendline here.

We have now broken through that diagonal and are in fact threateneing that lower support line.

As we fall through lines, I think it signals some kind of further drop. First the diagonal red line, then the acceleration towards the lower horizoantal red line.

It appears as though we are breaking out downward from this.

We are getting answers to the question I asked when I first posted .

In typing this, we have even gone further and just bounsed off of the lower support line...

And now, again as I type, we are back on that line...

Hopefully these last images aren't too small, but it looks like my lines show meaning. Let's see what's next.

Comment

Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#4355Wish I would of bought nvax up 55% today. My only ups are bmy and cydy.Comment -

chico2663BARRELED IN @ SBR!

- 09-02-10

- 36915

#4356I definitely wouldn’t invest in a company that does mortgages. There is going to be a shitload of defaults unless they decide to put the missed payments on the backend of mortgages. When we had the housing crises I made a fortune being a partner in hud company that did the clean outs and fixer on problems. My partner is still in business. I had to quit for heath reasons. When housing crises hit there were 2 countries that did it different. One was Netherlands? What they did is throw the top bankers in jail for allowing these fraudulent investments. The homeowners the govt. bought the underwater part of the loan so if you owed 150,000 on your house but it was valued at 120,000. They gave a marker for the 30,000 and no one walked away from loans. We allowed guys like mnuchin to make a fortune. Friend of mine lost her home. She never told me how desperate she was until it was to late.Thought since I was handling banks clean outs they would let me talk to them.I offered them the money to make it right. Banker told me he wouldn’t do it because they made too much money off it. House was worth 200,000. Govt figured 20% for total. So they got to write it down to 40000. They got to keep anything above that. Also the govt gave them tax break on 40000.They also got a grant for money. Everyone tries to blame the poor on this but many were 2nd homes to the rich. I was changing locks and winterizing homes on many homes appraised for half million or more. The stock brokers that caused the damage by putting these loans in a group to sell to investors made money. Bankers who sold homes at higher prices made money. The only ones that lost were the tax payers.Comment -

SnowballBARRELED IN @ SBR!

- 11-15-09

- 30057

#4357Dow chart is not in trouble at all.

Expect a rebound soon - not a true bearish reassignment.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4359Yeah, I'm not sold on a total freefall but we could see more negative before some positive.

Seem like angy profit taking in the big names driving the comeback will drop everything. If that is true, then things are generally pretty weak.

We're a long way until tomorrow but there is still some downward pressure on the equities...here's a futures heat map as of right about now (or last ten minutes or so)...

Comment

Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4360Yes out of the 3 indexes this has been the furthest down at around 17% from the ATH before today... .however....BA is a huge anchor No? (I added more shares at 126 to my position today)Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

-

Shafted69SBR Hall of Famer

- 07-04-08

- 6412

#4363Nasdaq being carried by FAANG stocks & only 10% from it's all time bubbly high. Financials didn't partake in the fake bear market rally. We need capitulation and blood on the streets.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

-

KVBSBR Aristocracy

- 05-29-14

- 74817

#4366I remember that all too well lol.I definitely wouldn’t invest in a company that does mortgages. There is going to be a shitload of defaults unless they decide to put the missed payments on the backend of mortgages. When we had the housing crises I made a fortune being a partner in hud company that did the clean outs and fixer on problems. My partner is still in business. I had to quit for heath reasons. When housing crises hit there were 2 countries that did it different. One was Netherlands? What they did is throw the top bankers in jail for allowing these fraudulent investments. The homeowners the govt. bought the underwater part of the loan so if you owed 150,000 on your house but it was valued at 120,000. They gave a marker for the 30,000 and no one walked away from loans. We allowed guys like mnuchin to make a fortune. Friend of mine lost her home. She never told me how desperate she was until it was to late.Thought since I was handling banks clean outs they would let me talk to them.I offered them the money to make it right. Banker told me he wouldn’t do it because they made too much money off it. House was worth 200,000. Govt figured 20% for total. So they got to write it down to 40000. They got to keep anything above that. Also the govt gave them tax break on 40000.They also got a grant for money. Everyone tries to blame the poor on this but many were 2nd homes to the rich. I was changing locks and winterizing homes on many homes appraised for half million or more. The stock brokers that caused the damage by putting these loans in a group to sell to investors made money. Bankers who sold homes at higher prices made money. The only ones that lost were the tax payers.

From the ground level, I always thought the loan officers and mortgage guys talking about what a great investment a house was, and how you can re fi next yr, etc, warranted oversight.

As a stock broker we were regulated when recommending speculative investments and here these guys at the bank were doing it and loaning the money to do so.

A lot of people lost their homes because the bank said they could afford it, lol, and they made money no matter what.

Comment

Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4367Yeah, we're still in that range but I have a feeling a lot of this sideways pattern isn't awaiting reopening, etc, but rather awaiting the next word of stimulus.

Perhaps the senate republicans have the market a little wary.

Even though we dropped just below my support line today, doesn't really mean we're out of the range. That was just a line I drew and you can see from the chart going back why.

But volatility might be picking up again and I don't see that S&P moving to the upside if it does.

Would like to see solid Russell 2000 stability, to be honest. I get a bad feeling about the broader markets when you remove some of those big tech guys.Comment -

d2betsBARRELED IN @ SBR!

- 08-10-05

- 39995

#4368So "reopening" is nothing and it's all based on endless stimulus? What a world. Nobody's spending the money though.Yeah, we're still in that range but I have a feeling a lot of this sideways pattern isn't awaiting reopening, etc, but rather awaiting the next word of stimulus.

Perhaps the senate republicans have the market a little wary.

Even though we dropped just below my support line today, doesn't really mean we're out of the range. That was just a line I drew and you can see from the chart going back why.

But volatility might be picking up again and I don't see that S&P moving to the upside if it does.

Would like to see solid Russell 2000 stability, to be honest. I get a bad feeling about the broader markets when you remove some of those big tech guys.Comment -

KVBSBR Aristocracy

- 05-29-14

- 74817

#4369Reopening may be nothing because there are huge longer term effects to the economy and markets.

But, as we discussed before, the big money may just be hanging in because what's the risk? As the stimulus bailouts in the news now are huge.

You're right, when stimulus is a memory and the consumer economy has no fuel what do we have?

Comment

Comment -

jjgoldSBR Aristocracy

- 07-20-05

- 388179

#4370We are hand-picked because were the bestComment -

Goat MilkBARRELED IN @ SBR!

Goat MilkBARRELED IN @ SBR!- 03-24-10

- 25850

#4371Think the majority of stocks still way overvalued. So many companies not making any money right now, losing millions, yet see their numbers jumping. Reality will set in soon.Cause Sleep is the Cousin of DeathComment -

guitarjoshSBR Hall of Famer

- 12-25-07

- 5797

#4373The Fed started buying corporate bond ETFs today. If the stock market starts to tank, Bazooka Jay will ride to the rescue and start buying stocks and ETFs.Comment -

homie1975SBR Posting Legend

- 12-24-13

- 15452

#4375Plunge protection team to the rescue in 3.....2.......1....

Learned about this team from Greaser.

Greaser check in buddy!Comment

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code