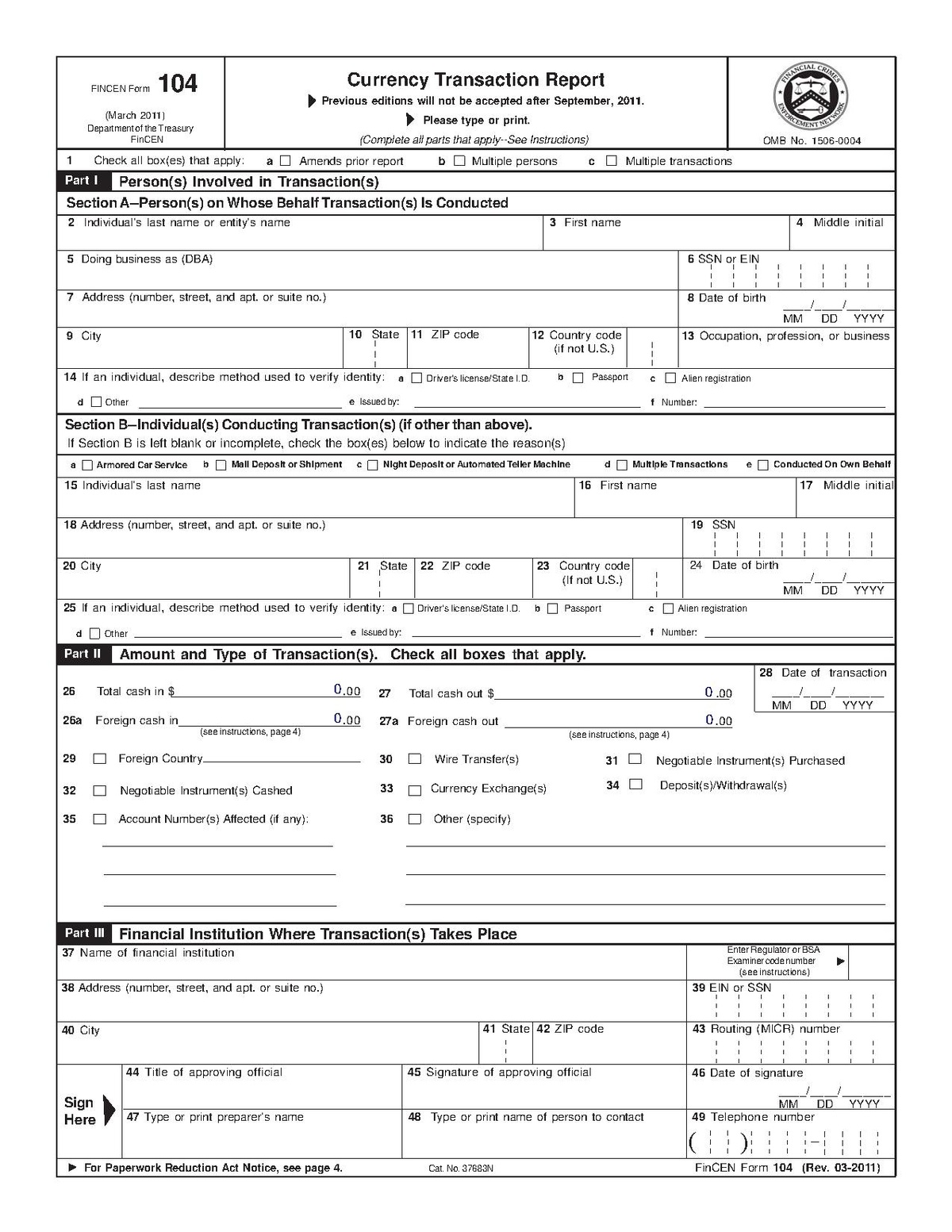

If you wager $5000 to win $4500 and are trying to avoid the CTR, you would have to cash your $9,500 ticket, walk away and come back again and cash the next $9,500. Any cash transaction over $10,000 for one stop at the sportsbook window will engage a CTR (IRS reporting).

As a foreigner you are ok to not only get the $9,500 if you don't have an SSN but you could also cash over $10,000 in tickets. They would file a CTR on you as well just using your passport or resident ID. If you cash over $10,000 they will ask for ID.

In the racebook if your bet pays over $600 and was at 300-1 odds or greater, you will have to show your ID but this time, you will have to pay taxes as well. Unlike a CTR which is just to track money laundering with no tax impliction. CTR is for transactions $10,000 or more. W-2G is for a payout of $600 or more if the odds were 300-1 or greater for the wager. It is possible to get a W-2G and a CTR in one transaction if say you won a superfecta that paid $10,001 for a $2 wager.

Just remember W2-G means TAXES. It is collected on a sports or race payout that hits at odds of 300-1 or more AND a payout of $600 or more. If only one of the criteria is met, no W2-G.

CTR means no tax implications, just tracking of a large cash transaction.

). I did not realize they made those changes in 2007. I can see why they would want the SARCs down to $5k. Too many games people were playing.

). I did not realize they made those changes in 2007. I can see why they would want the SARCs down to $5k. Too many games people were playing.