I think this is a solid comment.

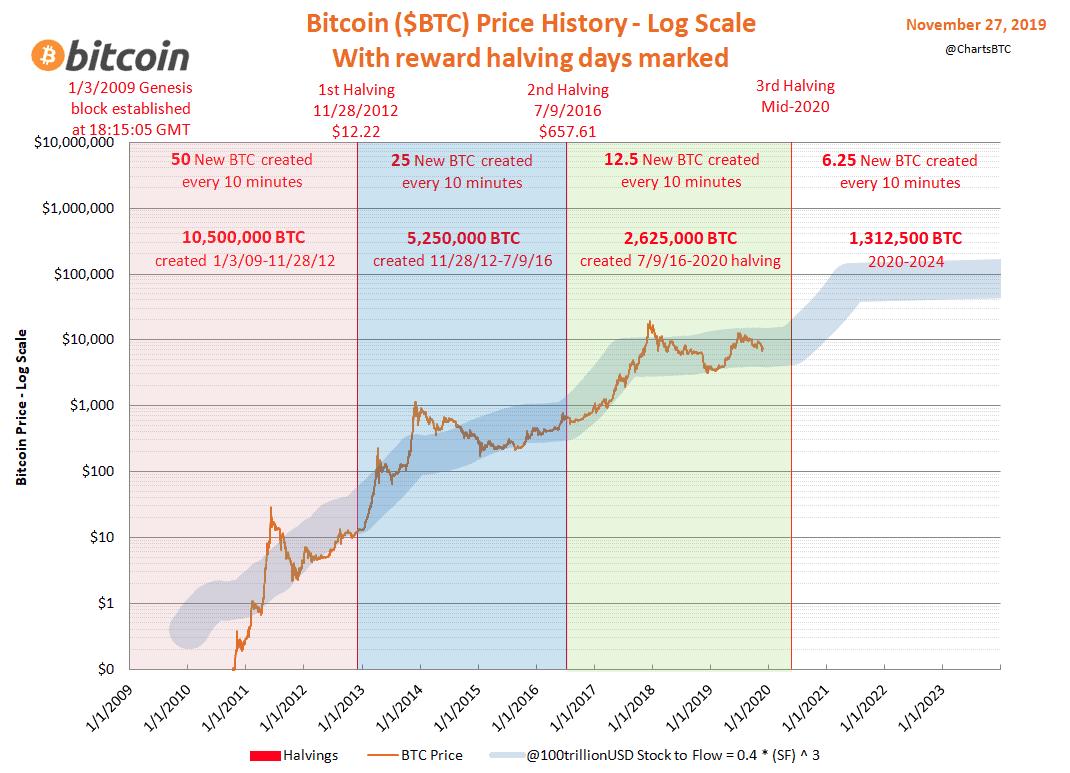

The HALVING has been talked about enuf. People have heard about it. I've seen some videos where the optimism is out of control. Markets don't get mis-priced by a factor of ??x.

I still think that Bitcoin investors should be concerned that it really hasn't gone mainstream. What does Bitcoin solve? Invariably, u still have to convert it to Fiat 99% of the time.

Reply With Quote

Reply With Quote MeanPeopleSuck gave mrpapageorgio 2 Betpoint(s) for this post.

MeanPeopleSuck gave mrpapageorgio 2 Betpoint(s) for this post.