-

Dummies guide to bitcoins please !

Dummies guide to bitcoins please !

In plain English

What is it ? How do you buy it ? How do you use it ? Is it safe ?

Thanks in advance

-

Go to the sportsbook forum and do a search and there's plenty of threads for information you need

-

Waste of time. Not safe at all. If your wallet gets stolen, there is nothing you can do.

Winklevoss twins control 5% of bitcoin. That should tell you all you need to know.

-

It's too late to get into it...you can buy them online or locally...put them in a bitcoin wallet. Check Coinbase. It's a cryptocurrency. It was mainly used on TOR for use in the Darknet. People were using it as a financial means to use without actually being traced back to them. It is very volatile and isn't regulated or FDIC insured. I have owned BTC when they were with <$100, and when they were worth $1,017$.

Most will then, after doing enough using of their BTC for "investing" will tumble them and cash them out. Or sell the coins for US Dollar's on a darknet market. That's one use. Another, things like Sportsbooks accept them as payment. Say you start out with one BTC, and end up with 5,000 in your wallet. You want to tumble them. This is an exchange of coins between a group, so that your original coins aren't linked back to you for tax reasons among being investigated. They go way beyond this, and people use them for other reasons, but i'm so tired i can't keep my eyes open and this is just the most basic run down of them and probably didn't come out right. In the morning ill write you a whole paper on it if u want to know details. Its 3:22am, i just saw the thread. I am not even going to check but BTC is worth i believe in the neighborhood of $190-$250/BTC at the moment, pure guess i haven't checked in months.

ps- There's newer crypto $ that is better than btc if you're in the know. Not Litecoin, but thats another.

Last edited by Evolved137; 03-18-15 at 02:26 AM.

-

Originally Posted by

goldengreek

In plain English

What is it ? How do you buy it ? How do you use it ? Is it safe ?

Thanks in advance

Don't bother with it Greek

Your smarter than this

-

You're about 3 years too late

-

Originally Posted by

goldengreek

In plain English

What is it ? How do you buy it ? How do you use it ? Is it safe ?

Thanks in advance

you are not alone either.

i have no clue what it is but it sounds like a scam.

-

Bitcoins is very complex

so many fraud places ..so many channels to go through linking bank accounts, storage places, safes, etc

-

SammyOdom can explain how it works but i think he is still trying to find his shirt

-

BitCoin Deposit Madness

Get in on the BitCoin buzz and load your account for the most exciting tournament in sports.

Make a minimum deposit of 2 BitCoin and receive a 25% cash bonus.

For example: Deposit 2 BitCoins and get ½ BitCoin *FREE.

This promotion is valid from Selection Sunday (March 15, 2015) to the date of the Championship Game (April 6th, 2015)

*8X rollover applies.

Remember, at Heritage Sports, Bitcoin payouts are ALWAYS FREE!

-

Story to those who care: BTC originating, the Silk Road Impact, and it's outcome.

The best time was before Mtgox was hacked. I purchased 1000 coins in October of 2007 for $13.74 per coin. I spent 955 of them on an online purchase that was successful. I left my 45 coins in my wallet because i just didn't want to transfer them out and see where they went. Waited until January, and found the price skyrocketed to over $1,000/coin...So i hung onto them. I sold them a few months later as the price was dropping very heavily and off'd the rest for $85X.XX (dont remember exactly) in change..was a nice come up, but wiped my hands of them and haven't touched them since.

Laws regarding them in the USA. Note it is illegal in several countries such as Russia, Vietnam, Indonesia, Bolivia, Ecuador and more..

Cited from wiki: (USA)

The U.S. Treasury classifies bitcoin as a convertible decentralized virtual currency.[116] Magistrate Judge Amos L. Mazzant of a Texas District Court classified bitcoin as a currency.[117] A June 2014 U.S. government auction of almost 30,000 bitcoins, which the U.S. Marshals Service seized in October 2013 from Silk Road, was said to increase legitimacy of the currency.[118]

The U.S. Government Accountability Office (GAO) reviewed virtual currencies upon the request of the Senate Finance Committee and in May 2013 recommended, that the Internal Revenue Service (IRS) formulate tax guidance for bitcoin businesses.[119] On 25 March 2014, in time for 2013 tax filing, the IRS issued a guidance that virtual currency is treated as property for U.S. federal tax purposes and that "an individual who 'mines' virtual currency as a trade or business [is] subject to self-employment tax".[120]

On 18 November 2013, the United States Senate held a committee hearing titled "Beyond Silk Road: Potential Risks, Threats and Promises of Virtual Currencies" to discuss virtual currencies.[121] At this hearing, held by senator Tom Carper, bitcoin and other currencies were received generally positively, with statements that bitcoin was a "legal means of exchange" and that "online payment systems, both centralized and decentralized, offer legitimate financial services" by US officials Peter Kadzik and Mythili Raman.[122][123]

The Federal Election Commission (FEC) deadlocked on 21 November 2013 on whether to allow bitcoin in political campaigns. Their decision was split across party lines (three members Democrat voting nay, three Republicans voting yea).[124] Political bitcoin pioneers New Hampshire House member Mark Warden[125] and Southern California politician Michael B. Glenn[126] independently from each other accepted bitcoin in their campaigns, and paved the way for others to follow suit. On 8 May 2014, the U.S. Federal Election Commission issued draft guidance to U.S. politicians who want to receive bitcoin donations.[127] The Commission declined to declare bitcoins currency, stating they fit into its "anything of value" definition.[128]

In May 2014, Brett Stapper, co-founder of Falcon Global Capital, registered to lobby members of Congress and federal agencies on issues related to bitcoin.[129]

In January 2014, the U.S. Securities and Exchange Commission (SEC) was focused on whether bitcoin-denominated stock exchanges were illegal, per its enforcement administrator, and inquired into unregistered securities offerings of the gambling site SatoshiDICE and FeedZeBirds.[130] In May it warned investors that "both fraudsters and promoters of high-risk investment schemes may target bitcoin users".[131] The SEC charged and settled with the former owner of SatoshiDice and FeedZeBirds in June 2014 for selling unregistered securities.[132] In October 2014, former SEC Chair Arthur Levitt joined BitPay, a bitcoin payment processor, and Vaurum, a bitcoin exchange for institutional investors in advisory roles.[133]

The U.S. Commodity Futures Trading Commission stated in March 2014 it considered regulation of digital currencies[134] after TeraExchange announced to launch a swap. TeraExchange constructed an index for the value of bitcoin from six different exchanges. The dollar value of a given bitcoin amount is locked in the swap. The CFTC approved the financial product in September 2014, satisfied it "could not easily be manipulated".[135]

In June 2014 California Assemblyman Roger Dickinson (D–Sacramento) submitted draft legislation (Assembly Bill 129) to legalize bitcoin and all other forms of alternative and digital currency.[136] After the GAO had called for increased oversight of bitcoin, the Consumer Financial Protection Bureau warned consumers of bitcoin being risky.[137]

As of November 2014, there are no final rules at the U.S. state level yet. In March 2014, the New York State Department of Financial Services led by superintendent Benjamin Lawsky had officially invited bitcoin exchanges to apply with them,[138] and on 17 July it published draft regulations for virtual currency businesses.[139] Businesses would have to provide transaction receipts, disclosures about risks, policies to handle customer complaints, maintain a cybersecurity program, hire a compliance officer and verify details about their customers to follow anti-money-laundering rules, per FinCEN.[139]

CITED from darknet sources

Mainstream media have provided virtually zero coverage of this landmark case, so allow me to summarize some of the backstory for anyone who might be out of the loop. Near the end of 2013, the FBI seized the Silk Road and arrested Ross Ulbricht after a lengthy investigation. Law enforcement claimed that he was the black market’s lead operator, Ulbricht, known as Dread Pirate Roberts (DPR), and charged him with crimes like drug trafficking and computer hacking. For a time, he was also suspected of murder-for-hire, but those charges never came to fruition.

The other relevant storyline seemed completely unrelated until (edit--recently). During the first half of 2014, one of the most popular Bitcoin exchanges, MtGox, faced and caused all sorts of issues, costing Bitcoin users thousands of dollars. The truth behind the situation is still quite fuzzy, but the Bitcoin community generally blames MtGox’s CEO, Mark Karpeles. Either he made massive and entirely unnecessary mistakes that ran his company into the ground or he maliciously stole the coins in his exchange and tried to cover it up.

The new information is relatively simple: Ross Ulbricht and his defense team are claiming that Mark Karpeles is the real Dread Pirate Roberts. The moral issue that Krol describes in his article is that most liberty-minded people want to support DPR but we hate Karpeles. This creates a conflict if Karpeles is DPR. We also generally want to support Ross Ulbricht, but it would be wrong for him to blame an innocent man. This means there is conflict if Karpeles is not DPR.

edit---The Alphabet agencies claim that 144k coins were taken from Ulbricht's SR wallet, and the issue was that there was very solid backdoor safenet's that were given to "moderators" and "super-mods" such as a forum has, who oversee dealings and disputes in the market on a daily basis. They were paid very well, high 6 figures for their online watchdog hiring's. There were always job openings with 25k-100k payout's to IT guy's who could help close an open security loop in the system and help contain the guaranteed security SR bound on the TOR network, as well in TAILS.

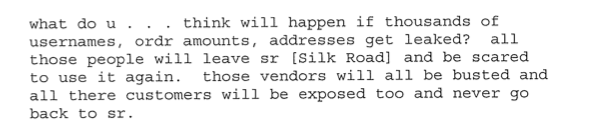

The downfall for EVERYONE was due to the fact that while the iron clad (and it was) PROTECTION PLAN put in place to protect all user's was masterfully planned, which was in a nutshell for those who care: take the serverr down and protect all coins of ALL USERS who kept their coins in their wallet's within SR. Sounds simple written out, but hundreds of thousands of hours were spent just keeping the safety and protection of user's and their money within, safe. DPR was a truly standup and honest man, I knew him very well for years.

How SR and DPR came to an end

Records obtained from Google showed Ulbricht had regularly logged into his Gmail account (wow) from the Internet cafe. He used VPN's and TOR to operate in this cafe, but also used gmail without encryption at the cafe the same day, which was just the first clue authorities came onto to capture SR's operator --

In July, Ross was visited in San Francisco by H.S. agents who had intercepted a package from Canada containing fake ID documents in nine different names, each bearing a photograph of Ulbricht. This is the ultimate irony. The site successfully without nearly any arrests made in hundreds of thousands of ships of anything imaginary, his package was. The connection was made. Once the agents seized the Silk Road website files, they could read the IP address for that VPN server. The hosting (why we never use VPN to trust anonymity, FYI!) provider gave up the access records for the VPN server to the FBI, which showed that it had been accessed from an address at a coffee shop near where Ulbricht was staying.

So, what happened to the billions of dollars lost on SR from over 2.5 million user's wallets?!

Ross made his ultimate mistake that led the the harm of not only himself, but other's, which i truly believe to be unintentional. The plan in place allowed for the "team" of those directly under him to close the server and pull all monies off of everyone and kept and held secretly and safely in the case of a DDOS attack. The issue was that Ross did not grant the physical authority of the hired protector's, operator's worldwide who were on duty 24/7, leaving Ross to be the only way for an operation shutdown safety net on notice. Unlucky for him, he was quietly and quickly arrested, and gave Alphabet boy's complete access to the SR's site.

ALL BTC were seized. Despite reports, nobody will ever know the total damages. Ross lost approximately $80m in coins IN his wallet, knowing how much he had stored in cash is of no doubt. FBI reports $1-$1.2 billion seized, however it is believed that number is extremely offbase and undermined. Some people were murdered later for using BTC to purchase cheap large quantities of narcot's, to repay fronts from local guy's they owed, or in a dozen or more cases, by those "local big guys" seeing the opportunity to lend their money to a friend, an addict, etc to use SR to get them 95%+ quality (fill it in) stuff for staggering cheap prices...You can imagine how many may people around the globe being in 5-figure transactions during the sweep with the BTC in currency not being their own. Vendor's lost millions, many alone.

I remember people pleading for their lives for help on the darknet forums post-shutdown. I remember ugly, sad, unfortunate stories. they weren't just stories either.

The only good new's is that basically no members/vendor's were indicted. (depending on i suppose who you look at the situation) User's were encrypted via TOR and if smart further encryption such as Tails to be protected from a end-node leak. 8 unlucky victims in Sweden, the USA, and i believe Britiain were taken into custody due to the links between the relations they had to Ross. Unclear exactly what testimony ross had against them.

Fun darknet secrets: Atlantis, a very underground and quiet market unheard of to anyone looking, quietly and publically shut down immediately after SR, citing "security concerns" after ensuring everyone's funds were cleared back to them immediately...SR 2.0 boldly opens months later...It's team of leader's were foolish. Not educated as close to SR 2.0, and an agent was involved in being of an employee. The leader's themselves were stealing user's money, and this was shutdown immediately. The name SR isn't even spoken of anymore, and is in disgust of darknet user's. Marketplace's are still thriving, with a half dozen in place. There is one which is by far the best, and you must be referred to be a member.

Last fun fact: I won't mention specifics, but Ross use to show his loyalty to member's if a vendor would scam them, whatever the cost be. He alway's would repay bad dealings. He would reimburse people $20k+ on a purchase that didn't go through. Under enough circumstance, he would even pay whatever amount needed to "guarantee" said scamming vendor could never do this...or heh, anything again. Example story, only because its public will share, was when "FriendlyChemist" SR vendor blackmailed DPR to release the IP's and addresses SR users..

DPR then contacted another use called "redandwhite," saying he'd like a "bounty" on "FriendlyChemist's" head, the complaint said. They allegedly agreed on a price of 1,670 Bitcoins. Redandwhite then wrote DPR back and said, "I received the payment ... We know where he is. He'll be grabbed tonight. I'll update you."

Here was that update from "redandwhite": "Your problem has been taken care of ... Rest easy though, because he won't be blackmailing anyone again. Ever."

OUTCOME: Ross was arrested on all of his original charges, and while being known and in court records of shown 8 hired hits, he was not prosecuted for them. Unknown the extent of cooperation given to authorities. Many believe he helped aid in SR 2.0 and hate him, many belove him.

While BTC as a cryptocurrency lives on, it is without doubt that authorities do not like BTC or user's that buy them, and the use of BTC for obvious unregulated investing, the crytographic nature of them, and the use of the transactions occuring with them demean them in a way that they have leave a negative taste in L.E's mouth. As of recent, with hacking, nor L.E.'s influence, BTC user's are being robbed blind, cite what happened recently. The volatility is second to none. The only use of these as of now IMHO would be to purchase, put in wallet, and immediately unload them on whatever you have to use them for. DONT invest.

Figured id share the story for anyone who gives a shit, and had nothing to do for the last hour so i figured i would give a little bit of personal experience inside the market, owning coins before the meltdown, and my unbiased outlook on using them today.

GL on action today, gent's.

Last edited by Evolved137; 03-18-15 at 11:38 AM.

-

Originally Posted by

shady610

Waste of time. Not safe at all. If your wallet gets stolen, there is nothing you can do.

And if your regular wallet with cash gets stolen - you call the thief and get that back?

-

Originally Posted by

goldengreek

In plain English

What is it ? How do you buy it ? How do you use it ? Is it safe ?

Thanks in advance

It's a currency. It has no physical form. So think of it like Paypal - but in a currency different than the one you get paid in right now or use at 7-11.

You buy it through various methods using trade or another currency. There are sites that sell it directly. Sites that allow you to trade for it for fiat currency (localbitcoins where you can trade W-U/M-G/Bank Transfer or meet in person and exchange cash). There are bitcoin ATM's.

The bitcoin are stored in what is referred to as a wallet. Your wallet is a long code which only you are supposed to have control over. You can google "blockchain wallet" and have a wallet within seconds. You can set up an account at localbitcoin - and part of your account is they issue you wallet addresses. These addresses change with every incoming transaction (someone sending you bitcoin from outside localbitcoins) - but your account retains all the old addresses. Each new address is issued to add a level of privacy. If you get a blockchain wallet - your address remains the same (but you can add new addresses as often as you'd like and they all dump into the same account)

You spend them anywhere bitcoin is accepted. Sportsbooks, retailers, coffee shops, Vegas hotels.

If you have bitcoin in your "wallet" and you're signing up at a sportsbook, they might say "Send your bitcoin to this address" (they'll give you a long address similar looking to yours ...bunch of numbers and letters.).

The bitcoin travel across the internet on a network called "Block Chain". This is all the current bitcoin miners (computers who are trying to create bitcoin...that's for another thead). Each time enough computers have verified the transaction is legit (and not someone scamming) - blockchain issues a "confirmation" (usually 10-15 minutes)

Some sportsbooks (nitrogen) require no confirmations and will let you bet your bitcoin within seconds of the transaction occuring (since, if it's a scam, the confirmations should have come in by the end of the sports event and they could always negate the bets).

Other sites (retailers) may require 3+ confirmations to ensure they aren't being ripped off. This can take (on average) 15-45 minutes.

Been using it for a few years. It's volatile. So is gold. So the ruble. So is oil.

You don't expose anything by giving out your wallet address. If you give access to the wallet (passsword), you run the risk of being ripped off (no different than leaving a real wallet on a park bench). Same as your email or facebook.

If you're legit curious. Go grab a wallet at blockchain (google blockchain wallet). Post your wallet address here (not password) - if the mods are ok, I'll send you a very small amount of bitcoin. You can take it and throw it in nitrogen and get your feet wet. if it wins, you can withdraw it within seconds back to your block chain wallet.

Transaction costs to move bitcoin are usually in the range of 0.0001 bitcoin (around 2.5 cents).

Enough people and merchants consider bitcoin to be a currency. People can whine about how it's not real money or whatever. Money is only as useful as the people who are willing to accept it. There are hundreds of retailers, a handful of sportsbooks and hundreds of thousands (or millions) of people who happy to use it.

Bitcoin thefts or scandals are popular for the same reason it's news if a Tesla is in an accident...because it's new. Single car accidents rarely make the news. Just like thefts occur so often, we'd have 24/7 news coverage of ID theft and pickpockets. People leave their ATM pin stuck to their card all the time - yet ATM cards still remain popular.

Good luck.

Last edited by muldoon; 03-18-15 at 01:45 PM.