-

Where's all the Smart Asses with their Stock Market threads???

Where's all the Smart Asses with their Stock Market threads???

Market up 4.24%.......almost 500 points today!! Largest single day gain in almost 5 years. Seventh largest of all time.

Can't believe all the genius sky is falling SBR guru's haven't made multiple threads about this?

....CAUSE THEY SURE AS SH*T SHOW UP ANYTIME WE HAVE A 100 POINT DROP.

Please allow me to be the first to say.......

-

Ah so thats why my Pops was in such a good mood

Makes sense now

-

People have a hard time with the "long term investment" everyone wants a get rich quick scheme.

-

Opie,

They are licking their wounds, cause they bought all the shorts. and just got their asses handed to them today.............

-

We live in volatile times!

Hang Seng up 6% today.

-

SBR PRO

SBR PRO

rich feeding the rich, take from the poor

-

Originally Posted by

ttwarrior1

rich feeding the rich, take from the poor

What?

-

Guys like Opie manipulate the market

These fukkin oil guys are in the old boys club

-

Originally Posted by

ttwarrior1

rich feeding the rich, take from the poor

-

Originally Posted by

ttwarrior1

rich feeding the rich, take from the poor

You really are a fukking muppet pal...Get a clue

-

-

Originally Posted by

ttwarrior1

rich feeding the rich, take from the poor

huh?

huh?

-

-

-

SBR PRO

SBR PRO

i have been saying to buy gold/silver for 10 years now, i think i'm happier being up 500% than flat in stocks over the last 10 years.

shit, even fishhead is happier being up a couple hundred % on corn/farmland

keep some fundamental facts in mind:

1) every paper currency in the history of the world has been devalued to zero

2) every ounce of gold and silver in the history of the world has kept its value

if your great-great grandparents took their paper money and hid it under their mattress in their house, and you just found it now, it would have almost no purchasing power vs. when they stored it. if they hid precious metals they would still have similar or greater purchasing power.

-

I know. I liken it to my buddies talking shit to me when my teams allows 3 field goals, but they don't have shit to say when my team comes back to score a touchdown.

-

who the fukk cares on a day to day basis. if you're a daily checker, get the fukk out if you can't handle this

-

SBR PRO

SBR PRO

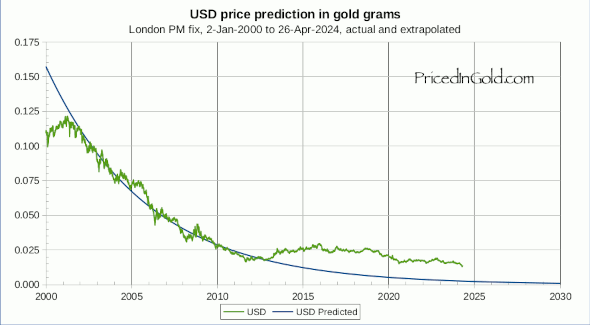

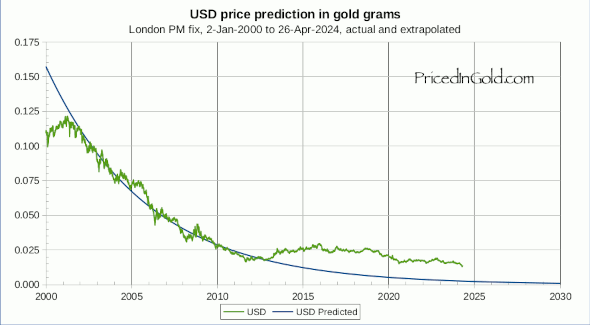

Back in March, I discussed the Half Life of the Dollar. In that article, I pointed out that the USD has been losing half of it's value every four years… and that trend remains solidly in place. But currency value decay, like radioactive decay, only appears smooth and steady when you stand back and look at the overall curve. Examined in fine detail, it comes in fits and starts, and with plenty of ups and downs!

-

SBR PRO

SBR PRO

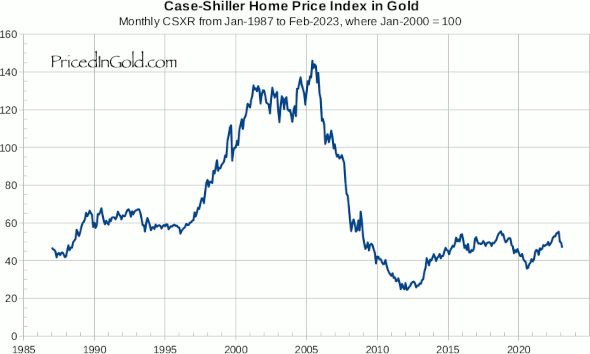

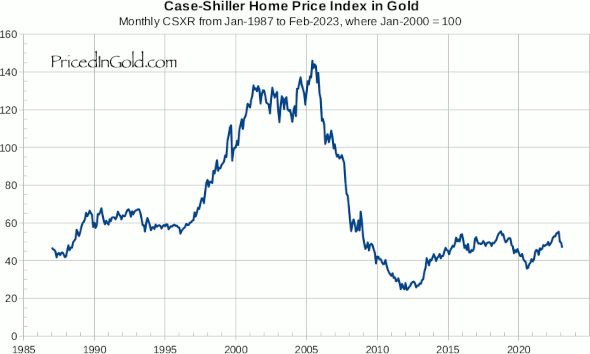

Case-Shiller Home Price Index

-

Today is a little bit of an anomaly. The Fed providing cheap dollar funding to the European Central Bank so they can lend cheaper to countries that are screwed so they don't take us down with them doesn't seem to be the wisest idea. That said, should be a good rest of the week, November jobs report should be much better than expected.

-

SBR PRO

SBR PRO

home prices on that last chart are down almost 90% in real money terms (gold).

so if you wasted $300,000 on a house 5 years ago, that $300,000 is probably worth about $200,000. that same $300,000 in gold would be worth $1,500,000.

so if you listen to the mainstream media, economic "experts", etc etc you would've stuck your money in a terrific investment A HOUSE!

which keeps taking money every year in property taxes, interest, maintenance, etc etc.

the only ones that make money from you owning a house are THE BANKS, which is why they encourage it. if you stored your wealth in real money and rented over the last 10 years you would be fabulously rich instead of fabulously broke.

-

SBR PRO

SBR PRO

Originally Posted by

FuzzyDunlop

Today is a little bit of an anomaly. The Fed providing cheap dollar funding to the European Central Bank so they can lend cheaper to countries that are screwed so they don't take us down with them doesn't seem to be the wisest idea. That said, should be a good rest of the week, November jobs report should be much better than expected.

come on fuzzy you're way too smart to fall for this bullshit.

the fed is just stealing more wealth and building up more debt like they always do since jfk. last president to have the us treasury issue money instead of the federal reserve - we all know what happened after he made that decision.

why would a country like the u.s. - who was the wealthiest nation in the world with no federal income taxes - now owe $15 trillion over the last 10 years?

no reason for a country 200 years old to take on that kind of debt unless you're selling your soul to the devil to blow up sand.

it's not a matter of europe "taking us down with them" - we just keep printing money and spending since the dollar is the reserve currency (for now).

-

Originally Posted by

milwaukee mike

come on fuzzy you're way too smart to fall for this bullshit.

the fed is just stealing more wealth and building up more debt like they always do since jfk. last president to have the us treasury issue money instead of the federal reserve - we all know what happened after he made that decision.

why would a country like the u.s. - who was the wealthiest nation in the world with no federal income taxes - now owe $15 trillion over the last 10 years?

no reason for a country 200 years old to take on that kind of debt unless you're selling your soul to the devil to blow up sand.

it's not a matter of europe "taking us down with them" - we just keep printing money and spending since the dollar is the reserve currency (for now).

But your own logic is equally flawed. A yellow metal with little real use cannot act as a reserve in the long term either.

-

Originally Posted by

milwaukee mike

it's not a matter of europe "taking us down with them" - we just keep printing money and spending since the dollar is the reserve currency (for now).

I'm mainly referring to Greece and Italy, which we still won't know the level of how screwed we are until the Toronto Summit Dec. 7th.

-

Don't look now but the Dow is 12000 s&p 1200. Oops has been at those levels for the last fvcking 5 years. Rare has performed but it is controlled. I am thinking about wagering on sports. What do you think ?

-

Oh, I guess the economy is all recovered then. LOL.

-

SBR PRO

SBR PRO

yes i said rich feeding the rich and taking from the poor and being greedy. Greed is the reason why the stock market has been screwed. Its up because its the holiday season and people are spending money on it

-

Originally Posted by

ttwarrior1

yes i said rich feeding the rich and taking from the poor and being greedy. Greed is the reason why the stock market has been screwed. Its up because its the holiday season and people are spending money on it

-

-

Originally Posted by

milwaukee mike

i have been saying to buy gold/silver for 10 years now, i think i'm happier being up 500% than flat in stocks over the last 10 years. shit, even fishhead is happier being up a couple hundred % on corn/farmland

keep some fundamental facts in mind: 1) every paper currency in the history of the world has been devalued to zero 2) every ounce of gold and silver in the history of the world has kept its value if your great-great grandparents took their paper money and hid it under their mattress in their house, and you just found it now, it would have almost no purchasing power vs. when they stored it. if they hid precious metals they would still have similar or greater purchasing power.

When gold was trading around $300/ounce for a decade, the Milwaukee Mike's kept saying how investing in gold is for fools.

Now that gold is trading @ $1,700/ounce, they all come out of the woodwork saying what a great investment gold is and how its gone up 500% in the last 10 years. At $300/ounce, they hate it but at $1,700/ounce they love it.

Buying gold at $1,700/ounce is an act of insanity as you've already missed the boat.

-

until the ECB starts becoming the lender of last resort, europe can easily still drag down the world economy.

-

Originally Posted by

FourLengthsClear

But your own logic is equally flawed. A yellow metal with little real use cannot act as a reserve in the long term either.

^

As a start. Egad.

The technical "analysis" was my personal fave.

-

-

-

SBR PRO

SBR PRO

Originally Posted by

andywend

When gold was trading around $300/ounce for a decade, the Milwaukee Mike's kept saying how investing in gold is for fools.

Now that gold is trading @ $1,700/ounce, they all come out of the woodwork saying what a great investment gold is and how its gone up 500% in the last 10 years. At $300/ounce, they hate it but at $1,700/ounce they love it.

Buying gold at $1,700/ounce is an act of insanity as you've already missed the boat.

um no i have had gold for over 20 years. i never came close to hating it in the 260s/oz., that is in fact when i bought quite a bit. same with silver at $4-5/oz.

i'm pretty sure someone at eog/sbr could recover my old threads when gold was 300 or less that show i was very bullish.

quite a few people like jjgold here said buying gold at $700 was an act of insanity and quite a few more will say buying it at $2700 is an act of insanity...

Reply With Quote

Reply With Quote