-

Kelly Re-Visited

Kelly Re-Visited

There have been some recent posts dealing with flat betting versus varying the bet size based on the expected returns (i.e. Kelly Criterion). I’d like to begin an intelligent discussion of the two alternatives. We all have opinions and I’d like for us to share those. But, please provide some documentary support for your opinions.

I really want to believe in Kelly and have used it in the past (and am currently using a variation). Unfortunately, my past experiences have cast doubt on my feelings. I’ve decided to put in a fair amount of effort to finally resolve the issue for me. I will be documenting this project in detail on my blog, ole44bill.blogspot.com. I really want to encourage discussion here on what I find, both supporting and non-supporting.

Since I think most people here are anti-flat betting, here is a link to an anti-Kelly discussion.

http://www.professionalgambler.com/debunking.html

If you have thoughts on this guys article, please share them.

-

Bsims, His "proof" is garbage. Yes, if you flat wagered the average Kelly bet over a series of wagers you would have made more profit. The problem is that you cannot go back in time to flat wager the average Kelly wager. The flat wager must be made at the same time as the Kelly wager.

Kelly is designed to maximize growth (e.g.). If you have accurate inputs (edge), Kelly will calculate the maximum you can wager for maximum bankroll growth. With +ev wagers, Kelly will compound your winnings and therefore your bankroll and average wager will continue to increase. Therefore, if you flat wager an amount greater than Kelly from the start, you are actually over betting your edge and run a much higher risk of going bankrupt. If you start out with the same wager amount, Kelly and/or increasing your wagers as your bankroll increases will always result in more profit than flat wagering. Kelly determines the amount of the wager upfront whereas the article's "proof" requires the Kelly wagers to have already taken place to determine the average wager. Now all one would have to do is to go back in time and wager accordingly.

I hope the above is clear. For the record, I have used Kelly successfully for decades for many different endeavors. Kelly on one hand is actually very simple and at the same time pure genius. It is amazing what Kelly can accomplish when one really understands it and can apply its concepts correctly. Kelly not only helps prevent me from over betting my edge, but it also helps me to determine which opportunities to select from a group of opportunities.

There is so much more that can be written but I will leave it here for now.

Joe.

-

It's not what they bring...

SBR PRO

SBR PRO

It really does depend on your goals and time frame but I agree that changing your bet size as least as possible is a solid strategy for sports betting.

Nobody survives going full kelly and those that say they do are really only fractional.

Changing your bet size changes your break even, and usually not for the better.

I've been making posts like that link since I came to SBR and you're right, it has been controversial.

Goals matter, you running a business that needs to draw income? Long term growth? For fun? Goals matter, as with any sound financial plan.

All the theoretical math in the world won't change that.

-

It's not what they bring...

SBR PRO

SBR PRO

Originally Posted by

u21c3f6

Bsims, His "proof" is garbage. Yes, if you flat wagered the average Kelly bet over a series of wagers you would have made more profit. The problem is that you cannot go back in time to flat wager the average Kelly wager. The flat wager must be made at the same time as the Kelly wager.

Kelly is designed to maximize growth (e.g.). If you have accurate inputs (edge), Kelly will calculate the maximum you can wager for maximum bankroll growth. With +ev wagers, Kelly will compound your winnings and therefore your bankroll and average wager will continue to increase. Therefore, if you flat wager an amount greater than Kelly from the start, you are actually over betting your edge and run a much higher risk of going bankrupt. If you start out with the same wager amount, Kelly and/or increasing your wagers as your bankroll increases will always result in more profit than flat wagering. Kelly determines the amount of the wager upfront whereas the article's "proof" requires the Kelly wagers to have already taken place to determine the average wager. Now all one would have to do is to go back in time and wager accordingly.

I hope the above is clear. For the record, I have used Kelly successfully for decades for many different endeavors. Kelly on one hand is actually very simple and at the same time pure genius. It is amazing what Kelly can accomplish when one really understands it and can apply its concepts correctly. Kelly not only helps prevent me from over betting my edge, but it also helps me to determine which opportunities to select from a group of opportunities.

There is so much more that can be written but I will leave it here for now.

Joe.

You're not wrong Joe, but edges come and go and for most that's too much to handle.

-

Originally Posted by

Bsims

This guy has absolutely no idea what he's talking about, from the very first words. Kelly is not a progressive staking strategy and this:

The Kelly criterion is essentially a progressive betting system wherein the higher your probability of winning, the more you’re supposed to risk; the less your probability of winning, the less you’re supposed to risk. (Sounds reasonable, all right.)

is just wrong, Kelly takes into account both probability and edge, a 40% bet with a >10% edge has a higher Kelly stake than a 70% bet with a 5% edge.

He compares it to the Martingale system later, he's absolutely clueless, there's no mention of the actual formula in the entire article. His test doesn't even include odds, so its literally impossible to even calculate the Kelly stake for it, its laughably bad, honestly one of the worst gambling articles I've read and thats saying something considering how useless most gamblers are.

The Kelly Criterion, given accurate inputs, will maximise logarithmic growth of bankroll, this is inarguable, there is a rigorous mathematical proof in the original 1956 paper, and if one can't follow that (which there is no shame in), it is easily demonstrated empirically by running simulations, I'll do so myself at the weekend if I get time.

If a gambler knows their edges to a sufficient degree of precision then there is no reason not to be using a Kelly based staking strategy, and if they don't, they probably shouldn't be staking anything at all.

-

Kelly works fine, as long as your predicted edge is roughly on target. You can have errors, but the average must be about correct.

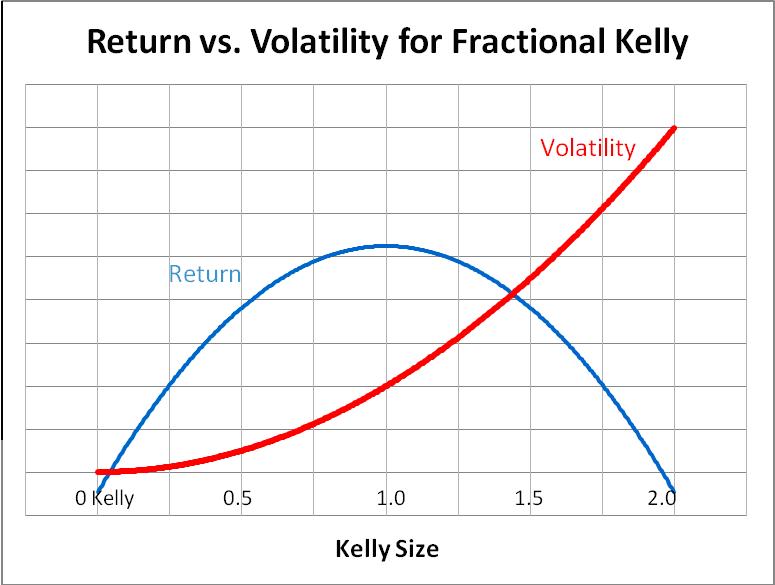

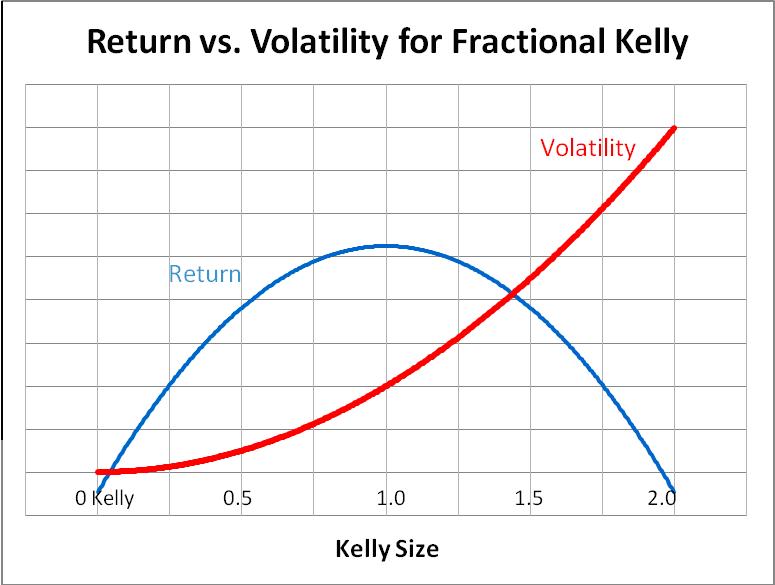

Most people fail at this stage, drastically over-estimate their edge, and end up past the peak of the EG curve .... which has the added negative of absolutely horrendous bankroll volatility, which few can handle.

See below .....

-

It's not what they bring...

SBR PRO

SBR PRO

Originally Posted by

Larkman

...If a gambler knows their edges to a sufficient degree of precision then there is no reason not to be using a Kelly based staking strategy, and if they don't, they probably shouldn't be staking anything at all.

That's fair, but would you recommend Fully Kelly or a partial stake

So we adjust our bets accordingly but not to the extent the Kelly Criterion suggests?

-

It's not what they bring...

SBR PRO

SBR PRO

Originally Posted by

HeeeHAWWWW

Kelly works fine, as long as your predicted edge is roughly on target. You can have errors, but the average must be about correct.

Most people fail at this stage, drastically over-estimate their edge, and end up past the peak of the EG curve .... which has the added negative of absolutely horrendous bankroll volatility, which few can handle.

Pretty much.

-

Originally Posted by

KVB

That's fair, but would you recommend Fully Kelly or a partial stake

So we adjust our bets accordingly but not to the extent the Kelly Criterion suggests?

Depends entirely on how accurate and precise a gamblers model is, and how happy with risk they are. The Kelly Criterion is concerned purely with bankroll growth while invididual gamblers are going to have different opinions on the probability of losses they want to deal with. Certainly someone who's bankroll represents 100% of their liquid wealth should be using a lower fractional Kelly than someone who's bankroll represents 1%.

My recommendation would be pretty much the same as to every gambling question: test it empirically. I wanted a <5% chance of making a loss in an approximate 3 month period of betting and with my model that worked out at about 0.5 Kelly.

-

Originally Posted by

KVB

That's fair, but would you recommend Fully Kelly or a partial stake

So we adjust our bets accordingly but not to the extent the Kelly Criterion suggests?

I personally would recommend something closer to half Kelly. I have tried full Kelly a couple of times in the past but the volatility was too much for me even though in the end I would have reaped more profit. It is more important to me to be comfortable (not scared) with my wagers than the possible extra profit.

Joe.

-

flat bettors are clueless

simple as that

if you think betting the same amount on a 10% edge bet vs a 3% edge with different chances of completion then you are just a straight up retard

-

Originally Posted by

u21c3f6

I personally would recommend something closer to half Kelly. I have tried full Kelly a couple of times in the past but the volatility was too much for me even though in the end I would have reaped more profit. It is more important to me to be comfortable (not scared) with my wagers than the possible extra profit.

Originally Posted by

u21c3f6

You can quantify this:

Kelly fraction / EG

0.666 0.888

0.500 0.750

0.400 0.640

0.333 0.555

0.250 0.438

This is why half-Kelly is so popular: you only sacrifice 25% EG, but the bankroll rollercoaster drops from heart-attack inducing to just mildly scary.

You can also quantify that volatility. For example, I have some stats I did via 100k runs, edge 3% to 10%: the chance of being down 50% after 500 bets is 11% at full-Kelly, 1.9% at 1/2Kelly, 0.4% at 1/3Kelly. Of being down 66.66% respectively: 6.7%, 0.3%, and some very small 0.0x%(got rounded to zero!)

There are a pile of different volatility/drawdown measurements out there from the financial world that are worth looking at also.

Last edited by HeeeHAWWWW; 06-21-18 at 05:37 AM.

-

Originally Posted by

Larkman

This guy has absolutely no idea what he's talking about, from the very first words. Kelly is not a progressive staking strategy and this:

is just wrong, Kelly takes into account both probability and edge, a 40% bet with a >10% edge has a higher Kelly stake than a 70% bet with a 5% edge.

He compares it to the Martingale system later, he's absolutely clueless, there's no mention of the actual formula in the entire article. His test doesn't even include odds, so its literally impossible to even calculate the Kelly stake for it, its laughably bad, honestly one of the worst gambling articles I've read and thats saying something considering how useless most gamblers are.

The Kelly Criterion, given accurate inputs, will maximise logarithmic growth of bankroll, this is inarguable, there is a rigorous mathematical proof in the original 1956 paper, and if one can't follow that (which there is no shame in), it is easily demonstrated empirically by running simulations, I'll do so myself at the weekend if I get time.

If a gambler knows their edges to a sufficient degree of precision then there is no reason not to be using a Kelly based staking strategy, and if they don't, they probably shouldn't be staking anything at all.

The highlighted statement is the whole key to successful Kelly. How many people can accurately predict their edge? It is no easy task for probably 98% of bettors.

-

Originally Posted by

oilcountry99

The highlighted statement is the whole key to successful Kelly. How many people can accurately predict their edge? It is no easy task for probably 98% of bettors.

lol are you srs?

if you cant even do the basics then why are you betting?

you might as well go to the casino its the same thing

also on another note

kellys ror is 0

-

Thanks for your responses thus far. I've posted some of the discussion on my blog and added other comments. I'm working on a simulation model of wagering where the predicted edge is precisely accurate. Then I'll be able to look at various wagering schemes. I'll share this work with you and look forward to feedback to help guide me down the correct path.

-

As I begin work on my model, it’s important that we all agree on the formula. Following is the Kelly formula that I use for determining the percent of your stake that you should wager.

Kelly % = (Odds*Estimate-1)/(Odds-1)

Odds are expressed in European format. For instance, -110 American style odds are 1.90909… in European format. A $100 wager would return $190.91 thus risking $100 to win $90.91. Estimate is the probability of winning the wager.

Thus, if you feel there is a 55% chance of covering a point spread at -110, you should wager

Kelly% = (1.9091 * 0.55 - 1) / (1.9091 - 1) = 5.5% of your balance.

The model will use this formula. It will randomly vary the edge. This edge will be added to 0.50% to get the probability of winning. A random number will be generated and compared to the probability to determine if the wager won or lost. This will be repeated many times.

Last edited by Bsims; 06-21-18 at 10:18 AM.

Points Awarded:

MadTiger gave Bsims 1 Betpoint(s) for this post.

MadTiger gave Bsims 1 Betpoint(s) for this post.

|

-

Can't be arsed to work out if your formula works out as just a rearranged version of the traditional formula but its normally expressed as:

(pb - q) / b

Where p = probability of winning expressed as between 0-1, b = decimal odds - 1, and q = probability of losing: 1 - p. So expressing it purely using decimal odds and probability of winning its:

((p * (d - 1)) - (1 - p)) / (d - 1)

or as pseudocode

p = probability

b = odds - 1

q = 1 - p

kelly = (p * b - q) / b

Last edited by Larkman; 06-21-18 at 10:49 AM.

-

It's not what they bring...

SBR PRO

SBR PRO

Betting 5.5% of your bankroll is too much, but again I'll say that goals do matter.

I know this will come with a lot of disagreement but in the end this is an applied mathematics problem and it has been my experience and belief that for the vast majority of even successful sports bettors that they apply this math wrong.

Kelly isn't wrong, but the application, especially when it comes to sports markets in both North America and even worldwide, is subject to question.

Again, the math isn't wrong and can be theoretically applied but when it comes to the real world, there are compression factors in a running market that serve to undremine Kelly.

You will not see these factors with math alone, it takes an intimate knowledge of how the markets flow to get it right.

It was said earlier, just back test your betting, you'll see.

If it works for you, good, but I wouldn't begin a sport traders education with varying bet sizes...it will cost too much vig.

I've posted a great deal about this in the past including an example with two dice.

While 7 is the most likely number to come up on any given roll you have to remember that when you add up all the other possibilities other than a 7, the odds of actually getting a 7, while better than any single number, aren't that good.

The same goes for any edge you make in a any snapshot of them market...the other possibilities combined will serve to undermine your edge, something that is only slightly accounted for by the Nobel prize winner.

Remember, he wasn't formulating this for sports and the books love that players think they can get more of an edge by changing bet size.

I won't lie, I have some accounts using Kelly, but I wouldn't recommend it to any bettor without understanding their knowledge of sports betting and money management.

-

Following is an Excel spreadsheet which models the results of games with a known probability of winning, hence a known edge. It uses the random number function to assign an edge and again to determine if the game is won or lost. The odds are the standard -110 for spreads. The Kelly bet percentage is calculated from the probability and odds. Finally, there is a running balance that is updated based on Kelly bet size and the results of the game. The first 10 rows follow.

| Edge (3-7) |

Prob Win |

Random |

Win/Lose |

Odds |

Kelly % |

Balance |

Bet |

Net |

| 5 |

0.55 |

0.128 |

Win |

1.909 |

5.5% |

$1,000.00 |

$55.00 |

$55.00 |

| 4 |

0.54 |

0.185 |

Win |

1.909 |

3.4% |

$1,055.00 |

$35.87 |

$35.87 |

| 3 |

0.53 |

0.700 |

Lose |

1.909 |

1.3% |

$1,090.87 |

$14.18 |

-$14.18 |

| 7 |

0.57 |

0.976 |

Lose |

1.909 |

9.7% |

$1,076.69 |

$104.44 |

-$104.44 |

| 7 |

0.57 |

0.028 |

Win |

1.909 |

9.7% |

$972.25 |

$94.31 |

$94.31 |

| 4 |

0.54 |

0.908 |

Lose |

1.909 |

3.4% |

$1,066.56 |

$36.26 |

-$36.26 |

| 7 |

0.57 |

0.008 |

Win |

1.909 |

9.7% |

$1,030.30 |

$99.94 |

$99.94 |

| 4 |

0.54 |

0.172 |

Win |

1.909 |

3.4% |

$1,130.23 |

$38.43 |

$38.43 |

| 7 |

0.57 |

0.040 |

Win |

1.909 |

9.7% |

$1,168.66 |

$113.36 |

$113.36 |

| 4 |

0.54 |

0.292 |

Win |

1.909 |

3.4% |

$1,282.02 |

$43.59 |

$43.59 |

Following is a description of each entry by column.

| Column |

Heading |

Contents |

| A |

Edge (3-7) |

=(INT(5*RAND())+3) |

| B |

Prob Win |

=0.5+(L2/100) |

| C |

Random |

=RAND() |

| D |

Win/Lose |

=IF(L4

|

| E |

Odds |

=210/110 |

| F |

Kelly % |

=(L6*L3-1)/(L6-1) |

| G |

Balance |

1000 |

| H |

Bet |

=+L8*L7 |

| I |

Net |

=IF(L5="Win",+L9,-L9) |

This model is being built in a program, so I can easily run thousands of iterations and assess the results. If you have any questions or see a problem, let me know.

-

It's not what they bring...

SBR PRO

SBR PRO

Originally Posted by

Bsims

...It uses the random number function to assign an edge and again to determine if the game is won or lost...

There is great value to what you are doing in that post so don't get me wrong. But...

Even and especially over the long haul, the results of ATS bets are not random. They are driven by factors that develop both on the field with game stats, line originators, and market influences that shape each line and form a large picture.

Unfortunately, as with most modeling and broad large number studies, the market environment is not being taken into account. These numbers are theoretical and, when historical, are in a vacuum.

I would add constraints to the studies but know very few individuals that have access to or keep the results of the types of factors that become relevant to the outcome of spreads and even moneylines. It is something I do and every handicapper is different.

Each day is it's own docket that forms a season picture and those that think one game doesn't influence another miss a great deal. Only one of which is that the line can move based on public perception from the last game a team played. This can and will have an effect on the spread result.

The key is to be able to make final predicted score that is better than the bookmakers are able to hang in the environment.

The environment and even rotation order can constrain Kelly.

You don't have to understand all of this to be a winner, but it might make sense of how your bets are tracking.

You'll find it's not so random.

-

KVB I think Bsims is just trying to prove to himself if using Kelly staking is theoretically the optimum staking strategy, any differences between real world and simulated in this case are irrelevant. The assumption of the hypothesis is that we are given perfect inputs. Your concerns seem more to do with hypothetical gamblers inability to produce good probabilities and therefore accurate Kelly stakes than with the Kelly criterion itself.

Bsims I'd suggest your simulation might be too narrow, all your probabilites are in the 50% range, all your odds are the same, and all your edges are integers. If you just want to see is how Kelly performs in what I assume is standard for American style spread betting its fine, but to see how it performs in general you'd want to model something closer to a match result market where you can have clear favourites and underdogs. I'll try to knock something up myself at some point.

-

Originally Posted by

KVB

Each day is it's own docket that forms a season picture and those that think one game doesn't influence another miss a great deal.

Correlated errors like this are a big danger indeed, but I'd suggest that's something a modeller should be well aware of. It's ultimately no different than over-estimating your edge in any other way.

-

https://www.sportsbookreview.com/for...conundrum.html

This guy referenced the same JR Miller post at one point, and was motivated to do this simulator.

-

KVB – I agree that ATS is not random. If it were random about 50-50 then no one could win in the long run. You site several factors that might influence the game. But in effect by assigning an edge, these are basically included. Take the first game in the spreadsheet. It has a 5% edge meaning that one side of the wager has a 55% chance of covering while the other only 45%. That’s why the “Prob Win” is assigned 0.55 and the random number determining the results is compared to that. It basically assumes there is an edge, and you know precisely what it is.

Larkman – I am initially picking simulations of betting against the spread because my understanding is that most of the wagers are on football and basketball. I also picked a relatively narrow edger range on the assumptions that the spreads are pretty accurate and the best one could hope for is a few percentage points in either direction. I will be able to modify the simulations to include other odds and ranges.

I am concerned about what metric to use to measure success. I use return per dollar wagered. Unfortunately, I’m sure that my early tests will support flat betting will be superior to Kelly using this metric. In my first million wager simulation, flat betting was better than Kelly about two-thirds of the time using this metric.

I want to consider the results using other metrics. I’m still working on the code that makes various counts on the simulated wagers. When I’ve included all the factors that I want, I’ll put the summary data in an Excel spreadsheet and share it with anyone who is interested in looking at it.

-

[QUOTE=Larkman;27868502]KVB I think Bsims is just trying to prove to himself if using Kelly staking is theoretically the optimum staking strategy, any differences between real world and simulated in this case are irrelevant./QUOTE]

It isn't theoretical. Every single person who has made REAL money from betting has used Kelly.

This isn't something that's up for debate. The only reason his "simulation" will show anything different is because he only uses one bet size and doesn't simulate it for at least 10k bets. Heck even 10k isn't enough. It should be at least 100k.

-

Originally Posted by

Miz

Yep, remember that post, forced me to rethink a lot. If you're downloading his spreadsheet, make sure to go down a few posts to get the later version.

Quoting him.....

"What you'll likely find is that when there is an equal chance of your estimated edge being either higher or lower than the actual edge, it tends to even out over time and Kelly remains far superior to flat betting. Only when flat betting approaches the average Kelly wager, does it come close to competing.

When the sample underperforms against the REAL win percentage, Kelly does moderately more poorly than flat betting. However, this is made up and then some when the win percentage regresses to the mean.

And finally, when you think you have an edge on the majority of your wagers but you don't, full Kelly does moderately poorer than flat betting

"

Last edited by HeeeHAWWWW; 06-22-18 at 07:31 AM.

-

Originally Posted by

tsty

It isn't theoretical. Every single person who has made REAL money from betting has used Kelly.

This isn't something that's up for debate. The only reason his "simulation" will show anything different is because he only uses one bet size and doesn't simulate it for at least 10k bets. Heck even 10k isn't enough. It should be at least 100k.

Theoretically optimum is the same thing as real world optimum, we know that, everyone who's ever tested Kelly's efficacy knows that, there is still no harm in someone proving it to themselves.

Its not true to say every profitable bettor uses Kelly, its perfectly possible to make money using other staking strategies they just won't make as much.

-

Originally Posted by

Larkman

Its not true to say every profitable bettor uses Kelly, its perfectly possible to make money using other staking strategies they just won't make as much.

this a stupid statement

there is a big difference between someone who makes thousands in profit and someone who makes millions

nobody making millions will ever use non kelly unless it just becomes too difficult to calculate it ie high volume bettors who place at least a 100 bets per day

anyone with the ability to model markets that can lead to millions in edge will always know what strategy to use

if you honestly think someone that talented will opt for a sub optimal betting strategy...

-

It's not what they bring...

SBR PRO

SBR PRO

This is good discussion for sure.

Some of this is controversial and it's nice to see posters respecting and understanding each others' aim here and viewpoints. It's nice to have math to back things up but it's also nice that there experienced bettors that do know the real and theoretical world here.

Good job guys.

I also want to mention what I mentioned before...goals. Remember, Miller is trying to make a business of betting. That means he may have to take a salary and live off of earnings, which we all know can be inconsistent.

If it's your business, there's something to be said for at least taking a portion of the bankroll and trading with less volatility than full Kelly, or even no Kelly, and trying to minimize the vig.

-

It's an easy answer

Don't go pro if you can't handle it

If your bankroll doesn't go up and down 20% every day then you're doing it wrong

Going on long break even stretches is very normal

Like 5k bet stretches..very normal

-

another thing that people have confused is that the only reason to ever make a bet is for EG

everything else is irrelevant

everything should be done in order to maximise eg

There is a reason why bookies move their lines regardless if they think they have perfect lines or not. The same reason they accept bets with retards who go all in every bet regardless if the bet is +ev or not. They accept -eg bettors without a second thought.

-

So am I correct that the Kelly system takes into account that a bettor can correctly pick which bets have a better chance of winning than other ones? LOL

Maybe in BJ, But How the hell would somebody determine what chance they thought they had of winning a spread bet?

Every bet I bet, I "think" that it has a 100% chance to win or I wouldn't bet it! And we all know that it is really 50/50 on spread bets no matter what we "think"!

How in the world would anybody try to guess at the win chance? "I think the Ravens -6 bet has a better chance of winning than the Falcons -4 bet."

LOL From our experience, we'd probably have it BACKWARDS, and the one we thought would win would really lose!

And vice versa!

Last edited by JoeCool20; 06-23-18 at 04:00 AM.

-

Originally Posted by

JoeCool20

So am I correct that the Kelly system takes into account that a bettor can correctly pick which bets have a better chance of winning than other ones? LOL

Maybe in BJ, But How the hell would somebody determine what chance they thought they had of winning a spread bet?

Every bet I bet, I "think" that it has a 100% chance to win or I wouldn't bet it! And we all know that it is really 50/50 on spread bets no matter what we "think"!

How in the world would anybody try to guess at the win chance? "I think the Ravens -6 bet has a better chance of winning than the Falcons -4 bet."

LOL From our experience, we'd probably have it BACKWARDS, and the one we thought would win would really lose!

And vice versa!

3/5

-

Originally Posted by

tsty

lol are you srs?

if you cant even do the basics then why are you betting?

you might as well go to the casino its the same thing

also on another note

kellys ror is 0

Yes I'm serious......

-

A little 100k-run simulation might prove useful. 5k bets, 10k starting bankroll, half-Kelly, with estimated edges from 1% to 5%, and prices a range 10 cents either side of evens. Flat betting is the same average, ie 1.5% of current bankroll.

| Percentile |

Flat |

Kelly |

Kelly vs Flat |

| 1% |

4156 |

4564 |

+9.8% |

| 10% |

13328 |

15628 |

+17.3% |

| 25% |

25279 |

29924 |

+18.4% |

| 50% |

50883 |

63127 |

+24.1% |

| 75% |

104105 |

131332 |

+26.2% |

Note with fewer bets, say 1k, the gap between flat and Kelly isn't much at all, a few %. With more .... it's more.

The gap also increases _drastically_ with a wider range of estimated edges, eg increasing from 1-5% to 1-7% and the gap is more like +50/60%.

Last edited by HeeeHAWWWW; 06-23-18 at 07:43 AM.

Reply With Quote

Reply With Quote

MadTiger gave Bsims 1 Betpoint(s) for this post.

MadTiger gave Bsims 1 Betpoint(s) for this post.