-

SBR PRO

SBR PRO

Originally Posted by

brooks85

There will be no options trading and ladder opening isn't even a real term so no idea what you mean.

O-M-G

-

Originally Posted by

Fishhead

O-M-G

No biggie, just stick to talking about things you know. This isn't one of them.

-

SBR PRO

SBR PRO

-

SBR PRO

SBR PRO

Ladder trading is a technique employed by traders across the globe.

On the "options" comment, was not speaking in terns of puts and calls.

-

I'm backing out of any LOCO IPO action. Never had el pollo loco, had a chance to see what their food was and not what I thought.

-

Ladder training is very good with futures and equities although not easy reading a price ladder and it looks simple with bids and offers

Good ladder readers know how the price is going to move and spots trends

-

SBR PRO

SBR PRO

Originally Posted by

jjgold

Ladder training is very good with futures and equities although not easy reading a price ladder and it looks simple with bids and offers

Good ladder readers know how the price is going to move and spots trends

Fair statement

Jim Cramer had a great show a few months back interviewing the best traders using equity to debt ladder techniques, great show, it was a combo of laddering and insider trading in which some made millions and millions.

-

Originally Posted by

jjgold

Ladder training is very good with futures and equities although not easy reading a price ladder and it looks simple with bids and offers

Good ladder readers know how the price is going to move and spots trends

Posts like this are how I know "jjgold" is not the fat bald moron in the videos.

-

Jim Cramer is such a damn hack

Guy is on all trading day then has his Gallagher type prop show

Must know someone (or some people)

-

SBR PRO

SBR PRO

Originally Posted by

TheCentaur

Jim Cramer is such a damn hack

Guy is on all trading day then has his Gallagher type prop show

Must know someone (or some people)

True, he is a master puppet, kind of like this JJgold character at SBR

-

Cramer is a fraud..he uses big audience to manipulate stock prices in his favor

for those reasons I believe 2 day delay on time he mentions stock on air before he can trade

He got into trouble a few times in past with price manipulation

-

lol he isn't a fraud, maybe a hype man but certainly not a fraud.

LOCO is open, if this stock opened yesterday or on monday it'd be up 50%

-

sob, whole plan this week was to liquidate and get into LOCO

-

typical friday sell off

dont be fooled that it is weakness

-

SBR PRO

SBR PRO

Originally Posted by

jjgold

typical friday sell off

dont be fooled that it is weakness

Sell offs in lower volume usually don't point to trouble.

-

definitely nothing to worry about, monday is going up. Next week is a huge IPO week. I pussed out with LOCO and only got a fraction of the gain I should have but won't make that mistake next week. Even thought there is nothing next week I felt quite as good as I did about LOCO.

-

Reminds me of sports bettors who think they found the secret by laying -500 and up college football games until the inevitable happens and a couple big dogs win straight up

-

-

Originally Posted by

Boner_18

The correct answer is infinity. Since the market is priced in dollars it will continue to soar as the fed devalues the usd. Think about it - if you suddenly have $2 where you used to have $1 then anything priced @ $10 should instantly be repriced @ $20 and a market @ $1240 would be $2480. The Fed is talking about slowing easing (not stopping or reversing), id expect the market to continue to march upward, though the slope should flatten... it isnt overvalued, your dollars are.

That is called inflation. We haven't seen it yet because the stock market is only being played by the wealthy. In terms of a correction its coming, but your guess is as good as mine.

-

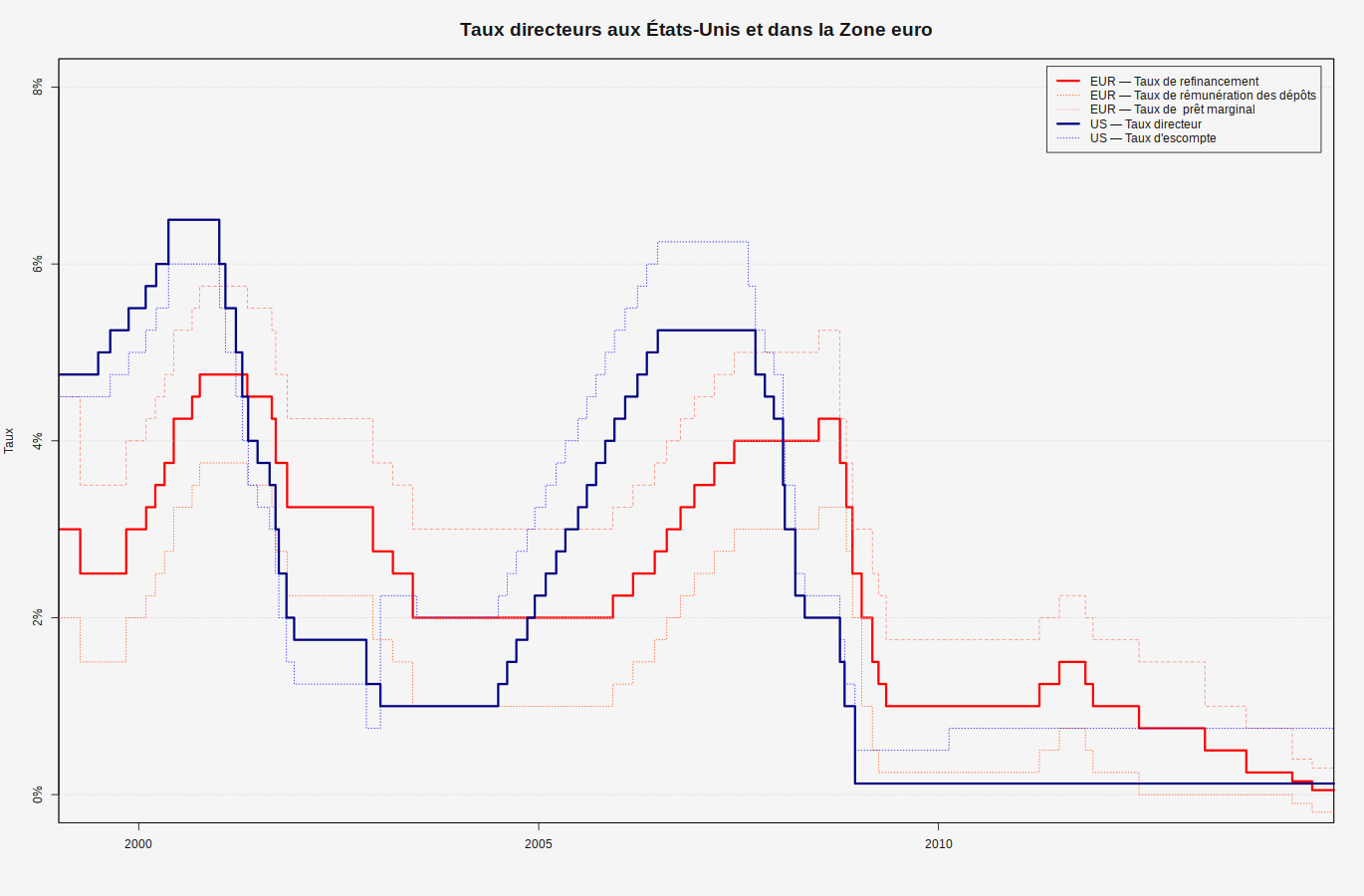

As long as the FED and the other Central Banks around the world keep interests rates at ZERO the market will continue to go up! Money has to flow and go somewhere and the fixed income market(stocks) is the only place to get YIELD ! You can debate and guess when the market will go down all you want but until the interest rate changes off of penetrating zero nothing will happen in the long run. If you have money in the bank you are actually losing money at zero percent because when you factor in inflation at 2% you are losing money.

-

Boomer that's what I don't understand the market should actually be going higher and that's what's scaring some economists

People are afraid to put money in the stock market

-

SBR PRO

SBR PRO

Farmland 10% appreciation yearly average last 20 years

4% leasing, 6% appreciation

-

-

also many people do not have the money to invest in market

-

There in lies the problem. No one knows what will happen,as we are in unprecedented territory. They are caught in a box and have to time things perfectly but we have a poor job market and have had a very slow recovery due to our stupid politicians lack of action on FiSCAL policies and stupid Obamas penetrating over regulations and anti growth policies. Will be very interesting how things play out.

-

Originally Posted by

RubberKettle

That is called inflation. We haven't seen it yet because the stock market is only being played by the wealthy. In terms of a correction its coming, but your guess is as good as mine.

Absolutely. In times of inflation you want to be in the inflating assets (the market) and not the underlying collateral (USD), otherwise you aren't even keeping pace with the status quo. Be nimble with your investments but I wouldn't stop buying, no REAL signs of this thing breaking yet.

A correction and a boom are coming, they're never ending cycles. It's like a subway train on a loop... there is always one coming, the precise timing of which is a mystery to most.

-

Originally Posted by

reddevil84

I agree with you but do you really think that interests rates can stay at zero any longer ? the previsions are the rates will go up mid-2015 or even earlier so why is it not now the right time to leave stock market ?

The market will correct and continue to climb higher. Even when or if they do raise interest rates it will be 1/4 or 1/2 of a %. This market is going up for years to come.

-

Corona on St. Pats... WTF!

SBR PRO

SBR PRO

LOCO leveling off today at around 29. Still a buy?

-

SBR PRO

SBR PRO

(AAPL) still up on a down day I see.

-

Originally Posted by

brooks85

The market will correct and continue to climb higher. Even when or if they do raise interest rates it will be 1/4 or 1/2 of a %. This market is going up for years to come.

best post of thread

shorting will bury you unless real short swing shorts

-

SBR PRO

SBR PRO

get Sodastream. They in advanced talks with British hedge fund to buy

company for $40. Trading at 30-31.

http://www.theflyonthewall.com/perma...list-reports--

-

SBR PRO

SBR PRO

Originally Posted by

jjgold

shorting will bury you unless real short swing shorts

"has buried you"........ past tense... market never about yesterday.

watch the tops we in for a new dynamic very soon.

-

weakness in mkt just cannot hold

too much internal strength

-

Markets can continue to grow.

01-02 happened because an asset class with PE over 30/1 with no earnings (internet technology) was overvalued, people recognized it, and sold off.

08-09 happened because an asset class with high PE and little earnings (MBS) was overvalued, people recognized it, and sold off.

Market can continue to rise all day long... the question is... and this is the only question... why would market collapse (which asset class is overvalued very badly and going to cause selloff?

Markets don't crash just because they go up. The expected value is positive, not negative. Corrections occur for a valid fundamental reason. What's the reason?

-

SBR PRO

SBR PRO

Originally Posted by

hockey216

Markets can continue to grow.

01-02 happened because an asset class with PE over 30/1 with no earnings (internet technology) was overvalued, people recognized it, and sold off.

08-09 happened because an asset class with high PE and little earnings (MBS) was overvalued, people recognized it, and sold off.

Market can continue to rise all day long... the question is... and this is the only question... why would market collapse (which asset class is overvalued very badly and going to cause selloff?

Markets don't crash just because they go up. The expected value is positive, not negative. Corrections occur for a valid fundamental reason. What's the reason?

S&P is trading at about 20 times pe. Nasdaq 23. Russell around 60 - 70

Reply With Quote

Reply With Quote